Different Types of Blockchain Bridges: Features & Uses

- BLOG

- Blockchain

- October 16, 2025

Blockchain bridges are quickly changing the crypto world by linking separate blockchains and opening up a future where many networks work together.

In 2025, cross-chain transactions more than doubled, showing growing trust and use of these tools.

From fast and easy bridges to strong and secure ones, different types meet the specific needs of the growing decentralized finance space.

With the global decentralized finance market expected to pass $97 billion in 2025, understanding these bridges is key to success in a world of many connected blockchains.

Read our blog to see how different types of blockchain bridges are shaping the future of finance and driving new opportunities across crypto.

Contents

- 1 What Is A Blockchain Bridge?

- 2 What are the Different Types of Blockchain Bridges and How They Work?

- 3 Blockchain Bridge Types By Architecture

- 4 Blockchain Bridge Types By the Trust Model

- 5 Blockchain Bridge Types By Directionality

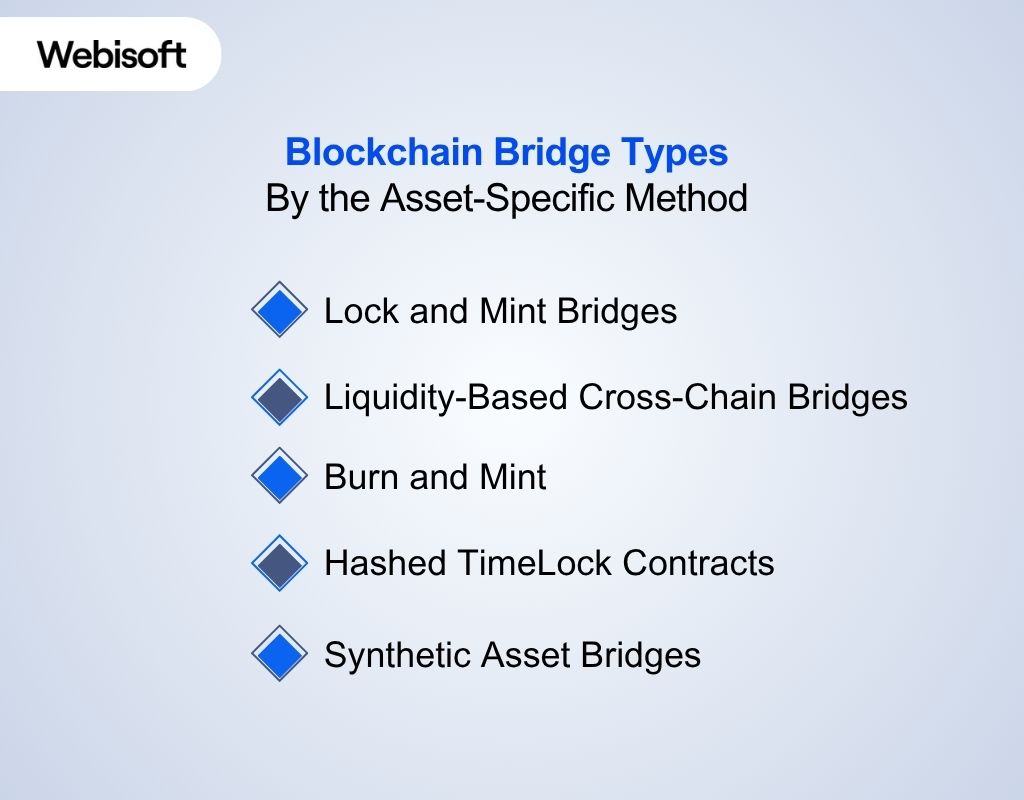

- 6 Blockchain Bridge Types By the Asset-Specific Method

- 7 How Can Webisoft Help With Your Blockchain Bridge Development?

- 8 Build your blockchain bridge with Webisoft!

- 9 In Closing

- 10 Frequently Asked Questions

What Is A Blockchain Bridge?

A blockchain bridge is a technology that enables the transfer of assets, tokens, or data between two distinct blockchain networks. By connecting different blockchains, it facilitates interoperability.

Users can move assets from one blockchain to another without needing a central exchange.

Blockchain bridges can be centralized, where a trusted third party manages the transfers. Or, it can be decentralized, where validation and asset management are handled by a network of independent validators.

These types of blockchain bridges play a key role in decentralized finance (DeFi), NFTs, and other decentralized applications (dApps) by expanding access to various blockchain ecosystems.

What are the Different Types of Blockchain Bridges and How They Work?

| Bridge Type | Description | Examples |

| Chain-to-Chain Bridges | Connects two blockchains for asset transfer | Polygon Bridge, Avalanche Bridge |

| Multichain Bridges | Connects multiple blockchains for simultaneous transfers | Stargate, Synapse |

| Sidechain Bridges | Links the main blockchain to a sidechain | Polygon, xDai Chain |

| Centralized (Custodial) Bridges | Managed by a central entity for asset transfers | Binance Bridge, WBTC |

| Decentralized (Non-Custodial) Bridges | Use smart contracts and validators for decentralized transfers | RenBridge, Cosmos IBC |

| Federated Bridges | Managed by a group of validators | Wormhole |

| Bidirectional Bridges | Assets move both ways between blockchains | Polygon Bridge, Wormhole |

| Unidirectional Bridges | Assets move in one direction only | Arbitrum, Wrapped Bitcoin |

| Lock and Mint Bridges | Lock assets on one chain, mint tokens on another | Polygon Bridge, Binance Bridge |

| Liquidity-Based Cross-Chain Bridges | Transfers use liquidity pools for fast movement | Synapse, Stargate |

| Burn and Mint Bridges | Burn tokens on the source chain and mint on the destination chain | CCTP, Circle |

| Hashed TimeLock Contracts (HTLCs) | Used in atomic swaps for trustless cross-chain transactions without minting or burning. | Bitcoin Lightning Network, Decred-Litecoin atomic swaps, Ethereum’s Atomic Swap Protocol |

| Synthetic Asset Bridges | Creates synthetic assets backed by collateral instead of transferring original tokens. | Synthetix, Mirror Protocol, Terra’s mAssets |

Here, we have listed different types of blockchain bridges and how they facilitate asset transfers and data exchange between various blockchain networks.

Blockchain Bridge Types By Architecture

1. Chain-to-Chain Bridges

Chain-to-Chain bridges or cross-chain bridges connect two specific blockchains to allow asset and data transfer between them. If you’re planning a bridge between chains, understanding their architecture is essential for security and performance.

They act as links so separate networks can interact, even if they use different rules or technologies.

Users move tokens from one chain to another without the need for a central exchange. This improves interoperability and gives access to new protocols and dApps on other chains.

Chain-to-Chain bridges focus on their paired networks and include specialized security.

Key Features

- Point-to-Point Connectivity: Directly links two blockchains for asset and data transfer.

- Consensus Compatibility: Supports the consensus mechanisms of both chains.

- Atomic Swaps: Enables secure token exchanges without intermediaries.

- Cross-Chain Communication: Facilitates message passing between smart contracts.

- Validator Set: Uses a defined group of validators to confirm transactions.

- Limited Scope: Operates only between the two connected blockchains.

Examples:

Polygon Bridge, Avalanche Bridge, Synapse Bridge, and Portal Bridge are examples of Chain-to-Chain bridges. They connect different blockchains to move tokens and data quickly and safely.

These types of blockchain bridges help users access multiple networks without hassle.

Companies like Webisoft, with their expertise in blockchain development, help design and implement these bridges to make operations more scalable.

Use-cases

You can move tokens between blockchains easily, giving you access to different networks and apps without hassle. If you use DeFi, these bridges let you join platforms on multiple chains without extra steps.

For NFT collectors, they help send your digital art across chains to reach more marketplaces.

If you provide liquidity, bridges let you share assets on several blockchains, which can boost your earnings.

These types of blockchain bridges also allow smart contracts on different chains to work together, opening new possibilities.

| Pros | Cons |

| Improve access to different blockchain appsIncrease liquidity by moving tokens across chainsFaster transactions within connected chainsExpand user options across blockchain networks | Transfers may take longer than expected.Comparatively costly transaction fees. |

2. Multichain Bridges

Multichain bridges connect multiple blockchain networks simultaneously, through which assets and data move freely across many chains.

They work by locking tokens on the source blockchain through smart contracts and minting wrapped tokens on the destination blockchains.

This mechanism supports broad interoperability and scalability across blockchains. Users can interact with various blockchain ecosystems without repeated conversions.

Wrapped tokens represent the original assets and are redeemable 1:1, depending on the bridge architecture.

Key Features

- Smart Contract Locking and Minting: Securely locks assets on one chain and issues wrapped tokens on others.

- Multi-Protocol Support: Works across different blockchain protocols for wide compatibility.

- Wrapped Token Representation: Maintains 1:1 backing of original assets with wrapped tokens.

- Decentralized Validation: Uses distributed validators to confirm transactions and maintain security.

- Cross-Chain Messaging: Facilitates communication between smart contracts on different chains.

- Scalable Connectivity: Connects many blockchains, expanding user options and network reach.

Examples

Stargate, Across, Celer Bridge, and Synapse Bridge are leading multichain bridges. They connect major blockchains like Ethereum, Binance Smart Chain, Solana, and Avalanche.

These bridges enable fast, secure transfers of tokens and NFTs, supporting diverse DeFi and NFT applications.

For instance, Stargate offers instant finality with a low, flat fee of 0.06% per transaction and uses unified liquidity pools to avoid fragmentation.

Use-cases

Multichain bridges let users move assets like tokens and NFTs across multiple blockchains in a single transaction.

For example, a user can transfer Ethereum tokens to Fantom, BNB Chain, or Avalanche at the same time using Multichain’s router.

These bridges also facilitate cross-chain contract calls where decentralized applications operate and interact across several blockchains simultaneously.

You can use Multichain’s NFT bridge to transfer ERC721 and ERC1155 tokens. It permits NFTs to move freely between chains, expanding access to marketplaces and gaming platforms.

| Pros | Cons |

| Connect many blockchains in one platformEnhance flexibility and user optionsEnable cross-chain dApps and messagingOffers arbitrage and liquidity benefits | Technical challenges in multi-chain coordination |

3. Sidechain Bridges

Sidechain bridges connect a main blockchain (mainchain) to a separate, independent blockchain called a sidechain.

They use a two-way peg mechanism, where assets are locked on the mainchain and represented by equivalent tokens on the sidechain.

This setup allows assets and data to move securely between the two chains while letting the sidechain operate independently with its own consensus and rules.

Sidechains help scale the mainchain by offloading transactions and enabling new features without compromising security.

Key Features

- Two-Way Peg: Locks assets on the mainchain and creates corresponding tokens on the sidechain. It offers more secure back-and-forth transfers.

- Independent Consensus: Sidechains run their own consensus mechanisms, allowing autonomy from the mainchain.

- Smart Contract Support: Sidechains can execute custom smart contracts to enable complex applications.

- Scalability: Offloads transactions from the mainchain to increase throughput and reduce congestion.

- Security Isolation: Sidechain issues do not directly affect the mainchain’s security.

- Customizable Parameters: Sidechains can have different block times, fees, and governance models tailored to specific needs.

Examples

Popular sidechains include Polygon (formerly Matic), xDai Chain, and Liquid Network. These sidechains connect to Ethereum or Bitcoin mainnets, providing faster transactions and lower fees while enabling DeFi, gaming, and NFT applications.

Use-cases

Sidechain bridges enable users to move assets from the mainchain to a faster, cheaper sidechain for activities like gaming, DeFi, or micropayments.

Developers use sidechains to deploy custom smart contracts and experiment with new features without risking the mainchain’s stability.

With expert consultation from Webisoft, businesses can create optimized sidechain environments that meet both performance and security standards.

| Pros | Cons |

| Enable faster and cheaper transactionsMaintain mainchain security isolationSupport custom features and governance | Assets must be locked, causing temporary illiquidity |

Blockchain Bridge Types By the Trust Model

4. Centralized (Custodial/Trusted) Bridges

Centralized bridges rely on a single trusted entity or custodian to manage asset transfers between blockchains.

This custodian holds the original tokens in custody on the source chain and issues equivalent wrapped tokens on the destination chain.

The mechanism depends on trust in the custodian to secure assets and process transfers correctly. While this approach offers simplicity and speed, it requires users to accept counterparty risk and reduced decentralization.

Key Features

- Single Custodian Control: One entity holds and manages locked assets.

- Wrapped Token Issuance: Custodian mints wrapped tokens representing locked assets on the destination chain.

- Fast Transaction Processing: Centralized control allows quicker confirmation and transfers.

- Simplified User Experience: Users interact with one trusted party rather than multiple validators.

- Custody and Security: Security depends entirely on the custodian’s practices and infrastructure.

- Limited Transparency: Users must trust the custodian’s honesty and operational integrity.

Examples

Binance Bridge and Coinbase Wrapped Bitcoin (WBTC) are prominent centralized bridges.

Binance Bridge locks assets on Ethereum and issues tokens on Binance Smart Chain, while WBTC involves BitGo as a custodian for Bitcoin-backed tokens on Ethereum.

Use-cases

Centralized bridges are suitable for users who prioritize speed and convenience over decentralization. Traders move assets quickly between popular chains for arbitrage or liquidity.

DeFi platforms use these bridges to access large pools of wrapped tokens. Enterprises choose custodial bridges for simpler regulatory compliance and asset management.

With Webisoft’s expertise in the blockchain world, businesses can integrate custodial bridges that meet their specific needs.

| Pros | Cons |

| Faster transactionsSimplified user experienceLow complexityHigh liquidityRegulatory compliance | Single point of failureCounterparty riskLack of full decentralization |

5. Decentralized (Non-Custodial/Trustless) Bridges

Decentralized bridges operate without even a single central authority or custodian, using smart contracts and decentralized validators. They help manage asset transfers between blockchains.

You’ll have full control of your funds every step of the way. The security of your assets is backed by the trusted blockchain protocols and the robust smart contracts in place.

This trustless design aligns with blockchain’s core principles of decentralization, transparency, and security.

Key Features

- Smart Contract Automation: Transfers and validations occur through self-executing contracts, eliminating the need for human intervention.

- Decentralized Validation: Multiple independent nodes or validators verify transactions collectively.

- User Custody: Users maintain full control of their assets at all times.

- Cross-Chain Compatibility: Supports asset transfers and data communication across different blockchains.

- Higher Fees: Transaction costs tend to be higher than centralized bridges due to complex validation processes.

- Bidirectional Transfers: Assets can move freely back and forth between chains.

Examples

RenBridge facilitates trustless transfers of assets like BTC and ETH across blockchains. Polkadot’s cross-chain communication model supports trustless interoperability.

Other notable projects include Cosmos IBC and deBridge, which provide decentralized cross-chain messaging and asset transfers.

Use-cases

Trustless bridges are ideal for users and developers who prioritize security and control over convenience. Traders can move assets across chains without exposing funds to custodians.

DeFi protocols use these bridges to access liquidity and services on multiple blockchains while preserving decentralization.

NFT platforms can transfer digital assets securely without centralized intermediaries.

| Pros | Cons |

| Full user control over assetsStrong security through decentralizationReduced counterparty riskAligns with blockchain’s decentralization ethos | Complex setup and slower transaction finality |

6. Federated Bridges

Federated Bridges operates through a group of pre-approved validators or a federation that jointly manages asset transfers between blockchains.

In this setup, the federation collectively validates transactions, locks assets on the source chain, and issues corresponding tokens on the destination chain.

While users still need to trust the validator group, you can expect reduced risks compared to single-party custodianship.

Federated bridges offer a middle ground between security and speed by distributing trust among multiple parties.

They’re even faster than trust-minimized bridges and more reliable than fully centralized ones, perfect for many cross-chain applications.

Key Features

- Validator Consortium: A group of trusted validators collectively manages and approves transfers.

- Asset Locking and Minting: Assets are locked on the source chain, and wrapped tokens are minted on the target chain.

- Faster Transaction Finality: Off-chain validation speeds up transfer confirmations.

- Partial Decentralization: More decentralized than single-custodian bridges, but trust is still placed in the validators.

- Simplified Management: Centralized control reduces technical complexity for users.

- Governance by Federation: Validator groups can add support for new assets or chains through consensus.

Examples

Wormhole is a notable federated bridge that uses a set of 19 validators, called “guardians,” to secure transfers across chains like Ethereum, Solana, and Binance Smart Chain.

Wrapped Bitcoin (WBTC) is another example where BitGo acts as a custodian, though it is more centralized than federated models.

Use-cases

Federated bridges make it easy to move assets quickly between well-known blockchains by using a trusted group of validators.

They are ideal for DeFi platforms that require quick, reliable access to liquidity across multiple chains without complicated infrastructure.

NFT marketplaces leverage these bridges to move digital assets seamlessly between chains.

It offers security and efficient transactions through the trusted validator network, which is crucial for maintaining the integrity of high-value digital art and collectibles.

Webisoft’s expertise in blockchain development can help build and maintain the infrastructure and maintain optimal security.

| Pros | Cons |

| Faster and simpler transfers More decentralized than single-custodian bridges Validators can quickly add new assets or chains Reduced technical complexity for users | Risk of validator mismanagement or hacks |

Blockchain Bridge Types By Directionality

7. Bidirectional Bridges

Bidirectional bridges allow assets and data to flow both ways between two or more blockchains. Users can send tokens from Chain A to Chain B and also return them from Chain B back to Chain A using the same bridge.

These bridges maintain synchronization between chains by using locking, minting, burning, and releasing mechanisms that operate in both directions.

Bidirectional bridges improve user flexibility and support complex DeFi, NFT, and cross-chain dApp workflows.

They typically involve smart contracts or validator networks to make the process secure and trust-minimized.

Key Features

- Two-Way Asset Transfer: Tokens can be sent and retrieved between chains.

- Token Lock-and-Mint/Burn-and-Release: Assets are locked on the source chain and minted on the target chain, with the reverse happening on return.

- Smart Contract Automation: Transfers are often governed by self-executing contracts.

- Validator or Oracles: Many use validator networks or oracles to verify and execute bidirectional operations.

- Cross-Chain Message Relay: Facilitates two-way communication between smart contracts on connected chains.

- User-Friendly Reversibility: Users can reclaim assets without needing multiple platforms.

Examples

Polygon Bridge, Wormhole, and Avalanche Bridge are examples of bidirectional bridges. They connect chains like Ethereum, Solana, and Avalanche, where users move tokens in both directions for smooth interaction with multiple blockchain environments.

Use Cases

Bidirectional bridges facilitate two-way token transfers for cross-chain trading, NFT movement, and DeFi liquidity sharing.

They power multi-blockchain dApps and hybrid enterprise solutions by syncing assets and data between chains.

| Pros | Cons |

| Full flexibility for users and developersSimplifies access to cross-chain dApps and assetsSupports reversible workflows and dApp logicReduces friction and enhances asset mobility | More complex infrastructure and validation mechanismsHigher risk of bugs due to increased logic |

8. Unidirectional Bridges

Unidirectional bridges facilitate asset or data transfer in only one direction, from a source chain to a destination chain. These bridges are designed for one-way migration.

They are used in scenarios like moving assets to a new blockchain, onboarding to Layer-2, or locking tokens permanently for staking or governance.

Unidirectional bridges are simpler to build and secure, but they lack the flexibility of reversible operations.

In some models, a reverse transfer requires a separate bridge or a centralized manual process.

Key Features

- One-Way Asset Flow: Assets are moved from Chain A to Chain B only.

- Token Locking and Minting: Tokens are locked on the source and minted or released on the destination.

- Simplified Logic: Less complex validation since only one direction is supported.

- Migration and Bootstrap: Often used for transitioning users or assets to a new chain.

- Limited Interoperability: Doesn’t support cross-chain communication or return flows.

Example:

Arbitrum’s initial token bridge let users send ETH to Arbitrum but included a waiting period and required a separate process for withdrawals.

Similarly, early token migrations like Wrapped Bitcoin, some staking systems, and governance models used unidirectional bridges

Use-Cases

Unidirectional bridges transfer tokens only from a source blockchain to a target blockchain. They are mainly used for token migration during network upgrades or moving assets to a new ecosystem.

Tokens are locked on the original chain and minted as wrapped tokens on the destination chain.

| Pros | Cons |

| Easier to develop and auditLower complexity and overheadFaster transaction confirmationsBetter suited for permanent or long-term migrations | No direct path to return tokensRequires additional mechanisms for reversibility |

Blockchain Bridge Types By the Asset-Specific Method

9. Lock and Mint Bridges

Lock and mint bridges work by locking original tokens on the source blockchain and minting an equivalent amount of tokens on the destination blockchain.

These minted tokens represent a 1:1 copy of the locked asset and are used for transactions or dApps on the target chain.

When users want to redeem their original assets, the minted tokens are burned, and the original tokens are released from the lock. This method makes the total supply remain consistent across chains.

Key Features

- Token Locking and Minting: Locks assets on the source chain and creates an equal amount on the destination chain.

- 1:1 Pegged Representation: Keeps the minted tokens equal in value to the original assets.

- Burn-to-Redeem Mechanism: Burns wrapped tokens to release original assets back on the source chain.

- Chain-Specific Contracts: Uses bridge-specific smart contracts tailored for each connected blockchain.

Basic Cross-Chain Compatibility: Makes interaction possible between EVM-compatible or integrated chains.

Examples

Polygon Bridge uses lock and mint to move ETH and ERC-20 tokens to the Polygon network. Avalanche Bridge and Binance Bridge follow similar mechanisms to bring tokens onto their respective chains.

Use-Cases

Lock and mint bridges are used to move popular tokens like ETH, USDC, or BTC onto faster or cheaper chains for DeFi participation. Users interact with dApps on Layer 2s while still holding value backed by original assets.

| Pros | Cons |

| Maintains 1:1 asset backingSimple and widely adopted mechanismOffers traceability and secure redemption | Can be slow due to locking/unlocking periods |

10. Liquidity-Based Cross-Chain Bridges

Liquidity-based cross-chain bridges operate by using pooled liquidity on both the source and destination chains. Instead of locking and minting tokens, these bridges use existing liquidity to fulfill transfer requests.

It makes transactions faster and often eliminates the need for wrapped tokens altogether.

Key Features

- Liquidity Pool-Based Transfers: Draws from token reserves on each side to handle user transfers.

Instant Settlement: Provides fast delivery of tokens without long confirmation times. - Dynamic Pricing Engine: Adjusts fees and token rates based on current liquidity availability.

- Cross-Chain Routing: Handles token transfers through multiple chains in a single operation.

- Non-Minting Model: Moves tokens across chains without creating new assets.

Examples

Synapse, Across Protocol, and Stargate use liquidity-based models for fast, low-slippage cross-chain transfers. These platforms focus on stablecoin movement and support multiple EVM-compatible chains.

Use-Cases

Liquidity bridges are best for users who want fast, cost-efficient transfers of popular tokens like USDC or USDT across chains. They’re widely used in DeFi for yield farming, arbitrage, and moving funds between chains without delays.

| Pros | Cons |

| Fast transfers with low latencyNo minting or redemption delaysUser-friendly and highly scalable | Dependent on available liquidity in pools |

11. Burn and Mint

Burn and mint bridging facilitates asset transfers between different blockchains by burning tokens on the source chain and minting equivalent tokens on the destination chain.

This method eliminates the need for locking assets and instead burns tokens on one blockchain to create new, equivalent tokens on another.

Burn and mint are typically used to ensure that assets are fully transferred across chains without creating duplicate tokens.

Key Features

- Burn Mechanism: Tokens are burned on the source chain to ensure the original asset is destroyed before minting a new equivalent token.

Minting Equivalent Tokens: New tokens are minted on the destination blockchain, representing the same value as the burned tokens. - No Wrapping or Custody: Direct minting and burning ensure that no intermediary assets or wrapped tokens are involved.

- Cross-Chain Interoperability: Facilitates asset transfer across different blockchain networks, ensuring seamless interaction between otherwise incompatible chains.

Examples

- CCTP (Cross-Chain Transfer Protocol) uses burn and mint mechanics to transfer assets between different blockchain ecosystems.

- Platforms such as Circle utilize this method for minting and burning native tokens between chains.

Use-Cases

Burn and mint bridges are ideal for moving assets like USDC or other tokens across different blockchains without relying on custodial methods.

Used in decentralized exchanges and protocols that require assets to be transferred between chains in a secure, trust-minimized manner.

| Pros | Cons |

| Trustless and direct, with no need for third parties.Eliminates the risk of creating duplicate tokens across chains.Provides seamless asset transfers without locking assets. | Technically complex to implement.Requires robust off-chain verification mechanisms for minting and burning. |

12. Hashed TimeLock Contracts (HTLCs)

HTLCs are often used in atomic swaps, providing a trustless mechanism for peer-to-peer cross-chain transactions. The primary benefit is that both parties involved in the transaction are assured that the exchange will either happen fully or not at all.

HTLCs make cross-chain trades simple, eliminating trust issues and reducing the need for third-party custodians.

They operate by using a cryptographic hash to secure the exchange and a timelock to ensure the transaction is completed within a specific time frame. This is a key element in enabling trustless atomic swaps.

Key Features

- Atomic Swap: Transactions occur only if both parties fulfill the contract terms, or they are reversed.

- Hash and Timelock: A secret hash is shared between parties, and a timelock ensures the transaction is completed within a specified timeframe.

- Trustless: No need for intermediaries or custodians, as the transaction is guaranteed by the contract’s logic.

Examples

Bitcoin Lightning Network, Decred-Litecoin atomic swaps, and Ethereum’s Atomic Swap Protocol are robust examples of HTLCs. They enable fast, secure, and trustless cross-chain transactions without intermediaries.

Use-Cases

- Atomic Swaps: Enabling cross-chain cryptocurrency exchanges without a centralized exchange.

- Cross-Chain Transactions: Allowing trustless transfers between different blockchains.

| Pros | Cons |

| Trustless transactionsSecurity via hash and time lockNo third-party involvement | Complex to implementPotential delays due to timelocksLimited to simple transaction types |

13. Synthetic Asset Bridges

Synthetic asset bridges enable the creation and use of synthetic assets that represent real-world assets on a blockchain. These assets are backed by collateral, typically locked in smart contracts.

They allow users to access the value of real-world assets like commodities, stocks, and fiat currencies, without having to transfer the underlying asset.

This opens up new possibilities for cross-chain trading and DeFi applications, making real-world asset exposure possible within decentralized ecosystems. Synthetic asset bridges enhance interoperability and provide a method to trade and use real-world assets across different blockchain networks without moving the original asset.

Key Features

- Collateralized Assets: Synthetic assets are backed by collateral that ensures their value matches the original asset.

- No Minting/Burning: Rather than transferring original tokens, synthetic versions are used, which helps in avoiding token wrapping or burning.

- Cross-Chain Compatibility: Synthetic assets can be used across different blockchain ecosystems, allowing for seamless transactions on multiple chains.

Examples

Synthetix, Mirror Protocol, and Terra’s mAssets are prime examples of synthetic asset bridges. They allow decentralized trading of synthetic assets like sBTC, sETH, and mTSLA across multiple blockchains.

Use-Cases

- Cross-Chain Trading: Enables trading of assets like stocks and commodities across blockchain networks.

- DeFi: Synthetic assets can be used for lending, staking, and trading in decentralized finance protocols.

| Pros | Cons |

| No direct asset transferProvides exposure to real-world assetsFacilitates cross-chain DeFi interactions | Collateralization riskComplex to manageMay require over-collateralization |

How Can Webisoft Help With Your Blockchain Bridge Development?

Webisoft specializes in creating seamless, secure, and scalable blockchain bridge solutions tailored to your business needs.

Whether you’re looking to integrate cross-chain DeFi services, launch an NFT platform, or facilitate efficient asset transfers across multiple networks, Webisoft has the expertise to guide you.

Here’s how:

- Custom Blockchain Bridge Development: We design and implement custom blockchain bridges for your specific use cases, whether for DeFi, NFTs, or enterprise solutions.

- Smart Contract Deployment: Our team handles the secure integration of smart contracts. This offers smooth cross-chain transactions and automated workflows.

- Robust Security Audits: We conduct in-depth security audits to identify vulnerabilities. This helps safeguard your assets during cross-chain transfers and minimizes the risk of compromise.

- Cross-Chain Interoperability: We integrate multiple blockchain networks, allowing seamless interaction. This makes the asset transfers across different ecosystems operate smoothly.

- Scalable Performance Optimization: We optimize your blockchain bridge for high transaction volumes. Your solution remains efficient as your business grows.

Webisoft helps you overcome the challenges of building and integrating blockchain bridges. We offer expert solutions that are secure, scalable, and aligned with your operational goals.

Build your blockchain bridge with Webisoft!

Secure your cross-chain solutions today.

In Closing

Different types of blockchain bridges play a crucial role in enhancing blockchain interoperability, allowing users to transfer assets and data across different networks.

Businesses, developers, and enterprises can leverage these bridges to enhance DeFi participation, NFT marketplaces, and cross-chain applications. Webisoft’s expertise can help implement the ideal blockchain bridge solution for your unique needs.

Contact Webisoft today to build your blockchain bridge and enhance your cross-chain capabilities!

Frequently Asked Questions

What makes decentralized bridges more secure than centralized bridges?

Decentralized bridges rely on distributed validators and smart contracts for transaction verification, ensuring that no single party has control over the assets. This reduces the risk of fraud or mismanagement compared to centralized bridges, which depend on a single custodian.

How do trust-minimized bridges reduce counterparty risk?

Trust-minimized bridges are specialized types of blockchain bridges that eliminate the need for intermediaries by using cryptographic proofs and decentralized validation. This confirms that users do not need to trust a single party, lowering the risk of fraud, theft, or mismanagement of assets.

Can businesses use blockchain bridging for both public and private blockchains?

Yes, all types of blockchain bridges can connect both public and private blockchains. Enterprises often use these solutions to enable secure and transparent transfers while meeting regulatory compliance needs, ensuring both privacy and interoperability across different blockchain networks.