There is nothing that can make you wonder, “Um… what’s happening in the digital world?” like a flood of blockchain news. That’s how most have felt while hearing about NFTs being sold or about Grimes receiving millions of dollars for them.

Things just keep coming up after NFT tokens took on the market like tens of millions of dollars have been paid for monkey images. Also, reports of million-dollar hacks of NFT projects are nonstop, and corporate cash grabs are just getting beyond our imagination.

NFTs are the future of blockchain technology, even though investors and collectors are thrilled with the early success of digital collectibles. They are likely to fundamentally alter how digital information is produced, shared, and used. Businesses will also be able to employ NFTs for Digital Rights Management (DRM) in a variety of ways.

NFTs are currently inundating the field of digital art and collectibles because they are seen as the virtual currency alternative to collectibles, just like everyone thought Bitcoin was. As a result of the enormous sales to a new crypto audience, digital artists are witnessing changes in their life.

To be more specific, the NFT buzz has caused a lot of enthusiasm but has also drawn criticism for being unstable, extremely speculative, and susceptible to fraud.

So, this is the time to crack the code about NFTs and generate a comprehensive idea about the whole system by going through the basics of NFTs, their benefits, the role of blockchain technology, their impact on various industries, how they work, and what the future holds for this exciting innovation.

This is where this article comes in to guide you through the whole NFT concept.

Let’s get started.

Contents

- 1 What Is an NFT Token?

- 2 A Little Bit of History: The Rise of NFT Tokens:

- 3 What Are the Key Features of NFTs?

- 4 What About NFT Standards?

- 5 The Benefits of NFT Tokens

- 5.1 1. Provable Ownership and Authenticity

- 5.2 2. Scarcity and Exclusivity

- 5.3 3. Royalties and Secondary Market Sales

- 5.4 4. Direct Engagement with Fans

- 5.5 5. Fractional Ownership and Investment Opportunities

- 5.6 Ease of Transfer and Global Accessibility

- 5.7 6. Versatility and Cross-Industry Applications

- 6 NFTs in the Art And Collectibles Market

- 7 What Are Other Use Cases of NFTs?

- 8 How Do NFTs Work? Investing And Trading Insights

- 9 Risks and Considerations for NFT Investors

- 10 The Future Outlook of NFTs

- 11 The Bottom Line

- 12 Frequently Asked Questions

What Is an NFT Token?

As you probably know by now, NFT stands for “non-fungible token.” However, to get a good grasp on NFTs, first, you need to learn about what fungibility and non-fungibility are as well as how they differ.

The definition of “fungible” in the Cambridge Dictionary is “easy to swap or barter for something else of the same sort and value. As a result, the fact that fungible tokens are interchangeable, fungible, and not unique is their primary property. The majority of digital currencies and tokens are fungible.

Non-fungible tokens are distinct, untransferable, indivisible, and irreplaceable, in contrast to fungible tokens. All NFTs of the same type are unique from one another. Each token is distinct, therefore exchanging them for one another would result in a loss of value.

In simple terms, NFT is a unique digital asset that represents ownership or proof of authenticity of a particular item or piece of content. While cryptocurrencies like Bitcoin and Ethereum are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and cannot be directly exchanged for one another. Each NFT possesses distinct properties that make it one-of-a-kind and irreplaceable.

At the core of NFTs is the use of blockchain, a decentralized digital ledger that ensures transparency, security, and immutability. Most NFTs are built on the Ethereum blockchain, utilizing smart contracts to establish and enforce ownership rights.

These smart contracts contain programmable instructions that dictate the behavior of the NFT, including details about the creator, ownership history, and any associated royalties.

NFTs can represent a wide range of digital assets, including but not limited to:

Artwork

Digital artists can tokenize their creations as NFTs, allowing collectors to purchase and own unique digital art pieces. The NFT serves as a digital certificate of authenticity and proof of ownership.

Collectibles

NFTs have breathed new life into the world of digital collectibles. Virtual trading cards, digital stamps, and even virtual pets (such as CryptoKitties) can be tokenized as NFTs, creating a market for rare and valuable digital items.

Virtual Real Estate

Virtual worlds and metaverses have started using NFTs to represent ownership of virtual land and properties. Users can buy, sell, and trade virtual real estate using NFTs, enabling the creation of immersive digital experiences.

Domain Names

NFTs can be used to tokenize domain names, making them unique digital assets that can be bought, sold, and transferred securely on the blockchain.

Music and Videos

Musicians and content creators can release their music, videos, or even limited-edition albums as NFTs. This allows them to maintain ownership rights, earn royalties from future sales, and engage directly with their fans.

The value of an NFT is driven by various factors, including scarcity, demand, the reputation of the creator, and the uniqueness of the digital asset. Collectors and enthusiasts are drawn to owning one-of-a-kind digital items, and NFTs provide a way to establish and prove ownership in the digital space.

A Little Bit of History: The Rise of NFT Tokens:

The history of Non-Fungible Tokens (NFTs) dates back to the early days of blockchain technology, but it wasn’t until recent years that they gained widespread attention and popularity. Let’s explore the fascinating journey of NFTs and their rise to prominence.

1. The Emergence of Blockchain Technology

The concept of NFTs can be traced back to the development of the Ethereum blockchain. Ethereum, launched in 2015 by Vitalik Buterin, introduced the concept of smart contracts, which are self-executing contracts with predefined conditions and outcomes.

Smart contracts paved the way for the creation of unique digital assets and laid the foundation for the NFT ecosystem.

2. CryptoKitties and Early Adoption

The breakthrough moment for NFTs came in 2017 with the launch of CryptoKitties, a blockchain-based virtual game that allowed users to buy, breed, and trade unique digital cats.

Each CryptoKitty was represented as an NFT, with distinct characteristics and traits that made them one-of-a-kind. The game became a viral sensation, causing a surge in transactions on the Ethereum network and highlighting the potential of NFTs in the mainstream.

3. Digital Art Breakthrough

It was in 2020 when NFTs truly started to make waves. The digital art world witnessed a pivotal moment with the sale of “Everydays: The First 5000 Days” by a digital artist Beeple.

The artwork, consisting of 5,000 individual pieces created over 13 years, was sold as an NFT for a staggering $69.3 million at a Christie’s auction. This groundbreaking sale captured global attention and catapulted NFTs into the mainstream media.

4. Explosive Growth and Mainstream Attention

In the first half of 2021, the NFT market experienced unprecedented growth. According to data from NonFungible.com, the total sales volume of NFTs reached $2.5 billion in the first six months of the year, surpassing the entire sales volume of 2020.

This surge in activity was fueled by a combination of factors, including increased adoption by artists, celebrities, and mainstream brands, as well as growing interest from collectors and investors.

5. Expansion into Music, Sports, and Virtual Realities

The music industry also embraced NFTs as a means of monetizing digital content. Musicians like Kings of Leon, Grimes, and Steve Aoki released exclusive music and merchandise as NFTs, creating new revenue streams and establishing direct connections with fans.

Additionally, sports leagues, including the NBA and the NFL, launched NFT collectibles and virtual experiences, further driving the mainstream adoption of NFTs.

6. Addressing Challenges and Advancements

The present condition of the NFT market continues to evolve rapidly. While there has been tremendous growth and enthusiasm, it’s worth noting that the market is not without its challenges.

Critics have raised concerns about the environmental impact of NFTs due to the energy consumption of blockchain networks, particularly those that rely on proof-of-work algorithms. Efforts are underway to explore more sustainable alternatives, such as the use of proof-of-stake blockchains.

What Are the Key Features of NFTs?

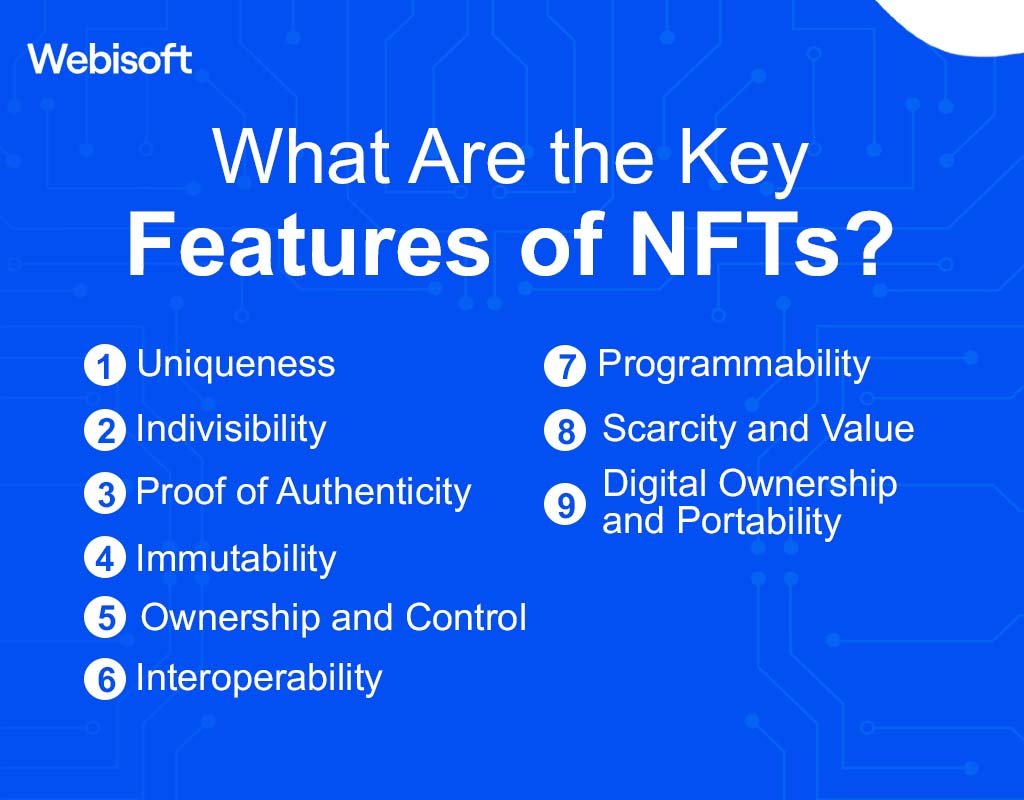

Non-Fungible Tokens (NFTs) possess several key features that distinguish them from other digital assets. Understanding these features is essential to grasp the uniqueness and value proposition of NFTs. Let’s explore the key characteristics of NFTs:

1. Uniqueness

Each NFT is distinct and unique, representing a specific digital item or piece of content. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are interchangeable, NFTs cannot be exchanged on a one-to-one basis due to their individual properties.

2. Indivisibility

NFTs are indivisible, meaning they cannot be divided into smaller units. Each NFT represents a whole item or piece of content, ensuring its uniqueness and integrity. This indivisibility contributes to the scarcity and value of NFTs.

3. Proof of Authenticity

NFTs serve as a digital certificate of authenticity, providing proof of ownership and validating the origin and uniqueness of a digital asset. The use of blockchain technology and smart contracts ensures the traceability and transparency of ownership records.

4. Immutability

NFTs are recorded on a blockchain, which is an immutable and decentralized ledger. Once an NFT is created and its ownership is established, it cannot be altered or tampered with, ensuring the integrity and authenticity of the digital asset.

5. Ownership and Control

NFTs enable creators and owners to maintain ownership rights and exert control over their digital assets. Through the use of smart contracts, creators can embed specific terms and conditions, such as royalties or resale rights, which are automatically enforced upon subsequent transactions.

6. Interoperability

NFTs can be created, bought, sold, and traded on various platforms and marketplaces, promoting interoperability within the NFT ecosystem. This allows for greater liquidity and accessibility, as NFTs can be seamlessly transferred between different platforms and wallets.

7. Programmability

Smart contracts associated with NFTs can include programmable instructions, enabling dynamic behaviors and functionalities. These instructions can govern aspects such as royalties, access control, and future developments related to the NFT.

8. Scarcity and Value

The scarcity of NFTs contributes to their value. The limited supply and uniqueness of each NFT make them desirable to collectors and enthusiasts, driving up their market value based on demand and perceived worth.

9. Digital Ownership and Portability

NFTs introduce the concept of digital ownership, allowing individuals to possess and transfer digital assets in a secure and decentralized manner. NFTs can be easily stored in digital wallets and transferred globally with ease.

What About NFT Standards?

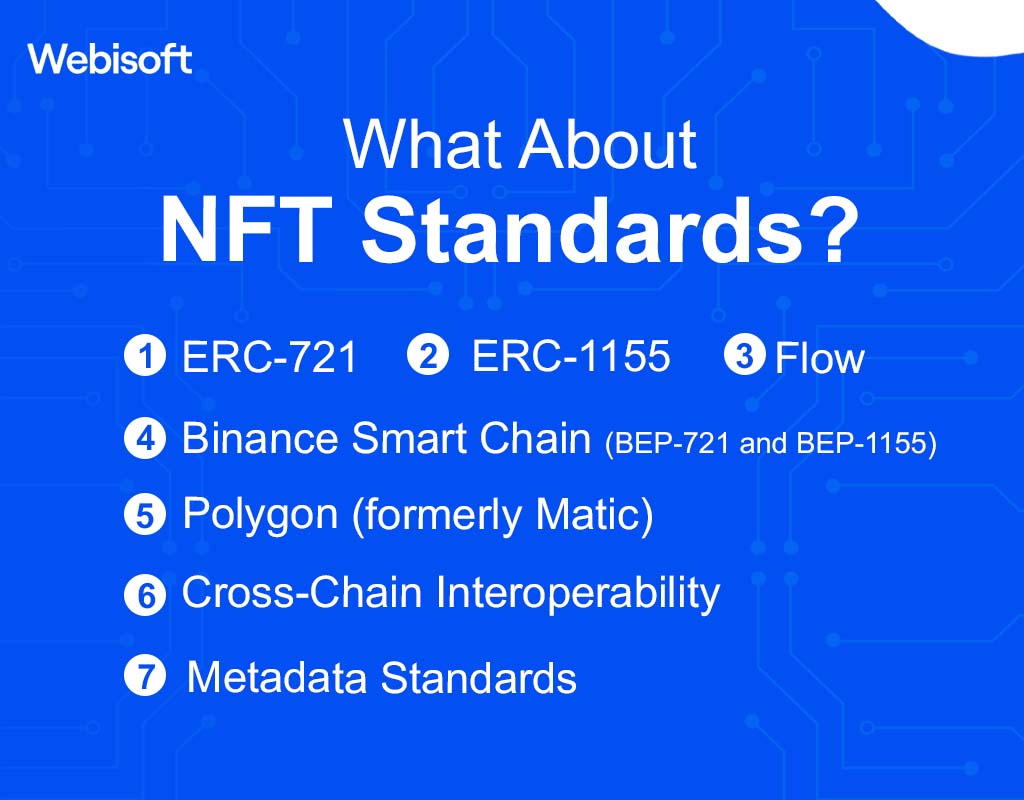

NFT standards play a crucial role in the development and adoption of Non-Fungible Tokens (NFTs).

These standards establish guidelines and specifications that ensure compatibility, interoperability, and consistency across different NFT platforms and marketplaces. Let’s explore the key NFT standards and their features:

ERC-721

The ERC-721 standard, introduced by Ethereum, was the first widely adopted NFT standard. It provides the foundation for the creation and management of unique tokens on the Ethereum blockchain.

Key features of ERC-721 include individual token ownership, non-fungibility, and the ability to store metadata associated with each token.

ERC-1155

The ERC-1155 standard is an evolution of the ERC-721 standard, introduced by Enjin. It allows for the creation of both fungible and non-fungible tokens on the Ethereum blockchain.

This standard enables more efficient token management by combining multiple token types within a single smart contract.

Flow

Flow is a blockchain platform designed for building decentralized applications and NFTs. It introduces its own NFT standard, providing a secure and scalable environment for creating, trading, and collecting digital assets.

Flow’s NFT standard supports unique ownership, metadata storage, and programmability.

Binance Smart Chain (BEP-721 and BEP-1155)

Binance Smart Chain, a blockchain platform compatible with the Ethereum Virtual Machine, offers its own NFT standards known as BEP-721 and BEP-1155.

These standards enable the creation and management of NFTs on the Binance Smart Chain, providing developers and users with alternative options for NFT creation and utilization.

Polygon (formerly Matic)

Polygon is a Layer 2 scaling solution for Ethereum that supports the creation and management of NFTs.

It leverages the existing Ethereum ecosystem while providing enhanced scalability and reduced transaction costs. NFT standards on Polygon are compatible with Ethereum, allowing for seamless interoperability.

Cross-Chain Interoperability

Various projects are working on achieving cross-chain interoperability for NFTs. These initiatives aim to enable the transfer and interaction of NFTs across different blockchain networks, expanding the possibilities for creators and collectors to engage in multi-chain ecosystems.

Metadata Standards

In addition to the core NFT standards, metadata standards are essential for describing and storing additional information about NFTs. Metadata can include details such as the title, description, image, video, audio, and other attributes associated with the NFT.

Common metadata standards include JSON (JavaScript Object Notation) and IPFS (InterPlanetary File System).

The Benefits of NFT Tokens

Non-fungible tokens (NFTs) have gained significant attention in recent years due to their unique characteristics and the opportunities they offer.

Let’s delve into the core benefits of NFT tokens and understand why they have become such a powerful tool in the digital world.

1. Provable Ownership and Authenticity

One of the primary benefits of NFTs is their ability to establish provable ownership and authenticity of digital assets. Using blockchain technology, NFTs provide a transparent and immutable record of ownership, ensuring that the creator or owner of the NFT is easily identifiable.

This feature is particularly valuable in the digital art world, where counterfeiting and plagiarism have been major challenges.

2. Scarcity and Exclusivity

NFTs introduce the concept of scarcity and exclusivity to the digital realm. Each NFT represents a unique item, making it distinguishable from other tokens. This uniqueness adds value to the NFT and creates a sense of exclusivity for collectors.

Artists and creators can leverage this scarcity to monetize their work effectively, as collectors are willing to pay a premium for limited-edition or one-of-a-kind items.

3. Royalties and Secondary Market Sales

NFTs allow creators to retain control over their work even after it is sold. Smart contracts embedded within NFTs enable artists to receive royalties whenever their NFT is resold in the secondary market.

This provides artists with a continuous revenue stream, incentivizing them to create more unique and valuable content.

4. Direct Engagement with Fans

NFTs offer a new way for creators to engage directly with their fans and build a community. By tokenizing their work, artists can offer special perks, access to exclusive content, or even physical experiences to their NFT holders.

This direct interaction fosters a deeper connection between creators and their audience, creating a sense of loyalty and support.

5. Fractional Ownership and Investment Opportunities

NFTs enable fractional ownership, allowing multiple individuals to own a percentage of a valuable asset. This fractional ownership model opens up investment opportunities for individuals who may not have the financial means to purchase an entire asset.

It also facilitates diversification, as investors can hold a stake in multiple NFTs across different categories.

Ease of Transfer and Global Accessibility

NFTs can be transferred quickly and securely across geographical boundaries. The digital nature of NFTs eliminates the need for intermediaries and reduces transaction costs. This ease of transfer and global accessibility make NFTs highly convenient for both buyers and sellers, regardless of their location.

6. Versatility and Cross-Industry Applications

While NFTs are commonly associated with art and collectibles, their applications extend to various industries.

They can be used in gaming, music, virtual real estate, fashion, and more. NFTs provide a versatile platform for innovation, allowing industries to explore new revenue streams and redefine traditional business models.

NFTs in the Art And Collectibles Market

Non-Fungible Tokens (NFTs) have revolutionized the art and collectibles market by introducing new use cases and opportunities for artists and collectors. For example,

1. Digital Art Collectibles

NFTs enable the ownership and trading of digital art collectibles, including digital paintings, illustrations, and animations. These digital artworks can be minted as NFTs, providing collectors with verifiable ownership and scarcity.

2. Sports Memorabilia

NFTs have been used to tokenize sports memorabilia, including digital trading cards, player autographs, and game highlights. Collectors can now own digital versions of their favorite sports collectibles, which can be bought, sold, and traded on various NFT marketplaces.

3. Virtual Assets in Gaming

NFTs are transforming the gaming industry by allowing players to own and trade virtual assets such as in-game items, characters, skins, and virtual real estate. This ownership gives players a sense of rarity and value in the virtual gaming world.

4. Limited-Edition Merchandise

Brands and artists are leveraging NFTs to release limited-edition digital merchandise and apparel. These digital collectibles can come with exclusive perks or experiences, creating a unique connection between fans and their favorite brands or artists.

5. Tokenized Artworks

Artists can mint their artwork as NFTs, allowing collectors to own digital copies of their creations. This opens up a new market for artists, enabling them to reach a global audience and sell their digital art directly to collectors.

6. Royalties and Secondary Sales

By embedding royalties into NFT smart contracts, artists can earn a percentage of future sales whenever their NFTs are resold. This provides artists with ongoing revenue streams even after the initial sale, creating a more sustainable model for artists to monetize their work.

7. Unlockable Content and Experiences

Artists can attach additional content or experiences to their NFTs, providing buyers with exclusive access to behind-the-scenes footage, artist collaborations, or VIP events. This enhances the value and uniqueness of the NFTs, attracting collectors who seek exclusive perks.

8. Crowdfunding and Patronage

NFTs enable artists to crowdfund their projects by selling NFTs representing future artworks or exclusive benefits. This allows artists to secure funding directly from their fans and supporters, bypassing traditional funding models.

What Are Other Use Cases of NFTs?

Aside from digital art, and collectibles, there are other prominent sectors where NFTs are being used. Let’s take a look at some of them.

1. NFTs in the Gaming Industry

NFTs provide unique ownership and verifiable scarcity, opening up new possibilities for gamers and game developers. For example, NFTs enable players to truly own their in-game items and assets.

Unlike traditional gaming, where players don’t have actual ownership and can’t transfer or sell their items, NFTs provide a decentralized mechanism for players to buy, sell, and trade virtual assets with the assurance of authenticity and uniqueness.

NFTs have introduced play-to-earn models, where players can earn real-world value by participating in games. By obtaining valuable NFTs through gameplay, players can sell them on NFT marketplaces or use them in other games, creating economic opportunities within virtual ecosystems.

Also, NFTs offer collectors the opportunity to acquire limited edition virtual collectibles, such as rare characters, skins, or digital trading cards. These digital collectibles have unique attributes, scarcity, and can be owned, displayed, or traded on NFT marketplaces. Collectors can showcase their valuable and exclusive digital collections within the gaming community.

2. Tokenizing real estate and assets with NFTs

Non-Fungible Tokens (NFTs) have extended beyond the realms of art and collectibles, finding innovative use cases in the world of real estate and asset tokenization. Tokenizing real estate and assets with NFTs opens up new opportunities for ownership, liquidity, and investment.

This allows for fractional ownership, dividing the property or asset into smaller, more affordable units. Each unit represents a specific percentage of ownership and is represented by an NFT. This enables a broader range of investors to participate in high-value assets that were previously out of reach.

NFTs built on blockchain technology provide transparent and secure ownership records. The decentralized nature of blockchain ensures that ownership information is immutable, reducing the risk of fraud or disputes.

Additionally, smart contracts associated with NFTs can automate processes such as rental income distribution, ensuring transparency and efficiency. In addition, Tokenization allows for fractionalized cash flows from rental income or asset appreciation.

Token holders can receive proportional cash flow distributions based on their ownership percentage, providing investors with regular income streams. This income-generating potential makes tokenized real estate and assets an attractive investment option.

3. NFTs and intellectual property rights

The emergence of Non-Fungible Tokens (NFTs) has sparked discussions around the intersection of NFTs and intellectual property rights (IPR). NFTs have introduced new possibilities for creators to protect and monetize their digital assets, while also raising questions about ownership and copyright. For example,

NFTs provide a digital certificate of authenticity, verifying the originality and ownership of a digital asset. This proof of authenticity can be particularly valuable for artists and creators, as it helps establish their ownership of the work and prevents unauthorized duplication or plagiarism.

Also, NFTs can be used to reinforce copyright protection for digital assets. By associating an NFT with a specific piece of content, creators can establish a public record of ownership and copyright. This makes it easier to enforce their rights and take legal action against infringement.

How Do NFTs Work? Investing And Trading Insights

To illustrate how NFTs work, let’s consider an example: an artist creates a digital artwork and decides to tokenize it as an NFT. The artist minted the NFT, attaching it to the artwork on a specific blockchain platform. The NFT contains the artwork’s metadata and verifies its uniqueness.

Once minted, the artist can list the NFT for sale on a marketplace. Collectors interested in the artwork can bid on or purchase the NFT. When a transaction occurs, the ownership of the NFT is transferred from the artist to the buyer, recorded on the blockchain.

The buyer now becomes the official owner of the NFT and gains the associated rights and benefits. It’s important to note that while the buyer owns the NFT, they do not necessarily gain ownership of the underlying content itself.

For instance, owning an NFT of a digital artwork does not grant the buyer the right to reproduce or distribute the artwork without the artist’s permission.

Exploring the NFT Marketplace

The NFT marketplace has emerged as a vibrant and dynamic space where artists, collectors, and investors come together to buy, sell, and trade digital assets. Let’s explore what’s happening in the NFT marketplace:

Growing Popularity The NFT marketplace has experienced explosive growth, attracting attention from various industries and individuals worldwide. High-profile sales and endorsements from celebrities and artists have contributed to the mainstream recognition of NFTs.

This increased popularity has resulted in a surge of participants, driving up demand and prices for NFTs. Diverse Range of Assets The NFT marketplace offers a diverse range of digital assets for sale.

These assets can include digital art, music, videos, virtual real estate, domain names, collectibles, and more. Artists and creators are utilizing NFTs to monetize their digital works, while collectors and investors are seeking unique and valuable assets to add to their collections.

Marketplace Platforms There are several prominent NFT marketplace platforms where users can buy, sell, and trade NFTs. These platforms provide a user-friendly interface and facilitate transactions using cryptocurrencies such as Ethereum.

Some popular NFT marketplaces include OpenSea, Rarible, SuperRare, and NBA Top Shot. Artists and Creators The NFT marketplace has provided a new avenue for artists and creators to showcase and monetize their digital creations.

Artists can mint their artworks as NFTs, retain ownership rights, and earn royalties when their NFTs are resold on the secondary market. This enables artists to directly engage with their audience and tap into a global market for digital art.

Challenges and Considerations While the NFT marketplace presents exciting opportunities, it also comes with challenges and considerations. These include concerns about copyright infringement, the environmental impact of blockchain technology, and the potential for market volatility and speculative pricing.

1. NFT Valuation And Price Determination

Valuing and determining the price of non-fungible tokens (NFTs) in the marketplace is a complex process that involves various factors. Here’s a breakdown of how NFT valuation and price determination happen:

2. Demand and Scarcity

The principle of supply and demand plays a significant role in NFT valuation. NFTs that are in high demand and have limited availability tend to command higher prices.

Factors such as the reputation and popularity of the artist or creator, the uniqueness of the asset, and the rarity of the edition or collection all contribute to the perceived value of an NFT.

3. Artistic and Cultural Significance

The artistic and cultural significance of an NFT can also influence its valuation. NFTs that are associated with renowned artists, historical moments, or cultural phenomena may be highly sought after by collectors, leading to higher prices.

The subjective appreciation of the artwork and its perceived cultural value can contribute to the overall valuation.

4. Scalability and Utility

NFTs that offer additional utility or functionality beyond their inherent value as digital assets can impact their valuation. For example, NFTs that grant access to exclusive content, virtual experiences, or special privileges within a platform or game may be valued higher due to their added utility and potential for future use.

5. Provenance and Authenticity

The traceability and authenticity of an NFT can influence its valuation. NFTs that can provide robust proof of ownership and a transparent record of their creation and transaction history are often more highly valued.

Verified editions or NFTs associated with well-known platforms or marketplaces may carry a higher degree of trust and therefore command higher prices.

6. Market Factors

The overall market conditions and investor sentiment can also impact NFT valuations. Market trends, the buying power of collectors and investors, and the perceived potential for future growth and returns can all influence the pricing of NFTs.

Fluctuations in the cryptocurrency market, which are often used for NFT transactions, can also indirectly affect NFT valuations.

7. Auction and Bidding

Auctions and bidding processes are common methods used to determine the price of NFTs. These events allow buyers to compete for an NFT, driving up the price based on the willingness of bidders to pay more.

Auction outcomes can be influenced by factors such as the reputation of the auction house, the scarcity of the NFT, and the level of interest generated among potential buyers.

Risks and Considerations for NFT Investors

Investing in non-fungible tokens (NFTs) can be an exciting opportunity, but investors need to be aware of the risks and considerations associated with this emerging market. Here are some key factors to consider:

1. Volatility and Speculation

NFT prices can be highly volatile, with significant price fluctuations occurring within short periods.

The market is driven by speculative interest, and prices can be influenced by trends, celebrity endorsements, and market sentiment. Investors should be prepared for the potential risk of price volatility and carefully assess their risk tolerance before entering the market.

2. Market Saturation and Bubble

The rapid growth of the NFT market has led to a saturation of projects and assets. Not all NFTs hold long-term value, and there is a risk of investing in overhyped or low-quality assets.

Investors should conduct thorough research, evaluate the reputation of artists and creators, and consider the long-term viability of the project before making investment decisions.

3. Lack of Regulation and Standards

The NFT market is relatively new and lacks comprehensive regulation. This absence of clear guidelines and standards can expose investors to potential scams, counterfeit NFTs, and legal issues.

Due diligence is crucial to verify the authenticity of the NFT, assess the credibility of the platform or marketplace, and ensure compliance with relevant laws and regulations.

4. Technical Risks

NFTs are digital assets that rely on blockchain technology. However, the technology is still evolving, and there are inherent technical risks associated with it, such as network congestion, scalability issues, and potential vulnerabilities in smart contracts.

Investors should be aware of these risks and consider the stability and security of the underlying blockchain infrastructure before investing.

5. Liquidity and Market Exit

While NFTs offer the potential for high returns, liquidity can be a concern. Selling an NFT may not always be easy, especially if there is limited demand for a particular asset.

Investors should be prepared for potential challenges in finding buyers and consider their ability to exit investments if needed.

6. Environmental Impact

NFT transactions are typically conducted using blockchain networks that consume significant amounts of energy. This has raised concerns about the environmental impact of NFTs.

Investors should consider the sustainability aspects of their investments and explore platforms or marketplaces that adopt environmentally friendly solutions.

NFT investors must conduct thorough research, diversify their portfolios, and consult with financial advisors if needed. By understanding the risks and making informed decisions, investors can navigate the NFT market more effectively and mitigate potential pitfalls.

The Future Outlook of NFTs

The future of non-fungible tokens (NFTs) holds great potential and exciting opportunities for investors. Here are some key aspects to consider when looking at the future outlook of NFTs:

1. Continued Growth and Adoption

The NFT market has experienced tremendous growth in recent years, and this upward trend is expected to continue. As more artists, creators, and industries embrace NFTs, the market is likely to expand further.

Increased adoption by mainstream companies, celebrities, and athletes will contribute to the broader acceptance and recognition of NFTs as a valuable asset class.

2. Evolution of NFT Standards

Currently, various NFT standards exist, such as ERC-721 and ERC-1155 on the Ethereum blockchain. However, the future is likely to witness the development of more advanced and interoperable standards.

These advancements will enhance the functionality and utility of NFTs, allowing for seamless integration across different platforms and ecosystems.

3. Integration with DeFi and Real-World Assets

NFTs have the potential to bridge the gap between digital and physical assets. We can expect to see more integration between NFTs and decentralized finance (DeFi) platforms, enabling features like fractional ownership, lending, and borrowing.

Additionally, the tokenization of real-world assets such as real estate, collectibles, and intellectual property will unlock new investment opportunities and increase the liquidity of these traditionally illiquid assets.

4. Enhanced User Experience and Interactivity

The future of NFTs will likely focus on enhancing the user experience and providing more interactive and immersive features.

This could include virtual reality (VR) and augmented reality (AR) integrations, gamification elements, and the ability to showcase NFT collections in virtual galleries or metaverses. These advancements will attract a wider audience and create engaging experiences for NFT enthusiasts.

5. Sustainability and Environmental Considerations

As the environmental impact of blockchain technology becomes more prominent, the future of NFTs will likely address sustainability concerns.

Efforts to reduce the carbon footprint associated with NFT transactions are already underway, with the exploration of eco-friendly blockchain alternatives and the adoption of energy-efficient protocols.

6. Regulatory Frameworks

As the NFT market matures, regulatory frameworks are likely to emerge to provide clarity and protection for investors. These regulations will aim to address issues such as fraud, intellectual property rights, consumer protection, and taxation.

Regulatory compliance will help foster trust and confidence in the market, and attracting institutional investors and further driving the growth of NFTs.

Overall, the future of NFTs looks promising, with ongoing advancements, increased adoption, and the potential for new use cases.

While the market may continue to evolve and face challenges along the way, early investors who stay informed, diversify their portfolios, and carefully assess opportunities will be well-positioned to benefit from the exciting possibilities that NFTs offer.

The Bottom Line

In conclusion, non-fungible tokens (NFTs) have emerged as a groundbreaking innovation in the digital world. They have revolutionized the way we perceive and trade unique digital assets. NFTs provide a way to prove ownership and authenticity of digital items, creating a new paradigm for artists, collectors, and investors.

However, it’s important to consider the risks associated with NFT investments. The market can be volatile, and there are concerns about scams, copyright infringement, and environmental impact.

Investors must conduct thorough research, understand the underlying value of the NFTs they are acquiring, and be mindful of the platforms they use for buying and selling. In the end, NFTs represent a paradigm shift in digital ownership and provide exciting possibilities for creators and investors.

By understanding the basics, exploring the various use cases, and considering the risks, individuals can navigate the world of NFTs and potentially benefit from this transformative technology.

So, are you ready to launch your own NFT marketplace? Partner with Webisoft and revolutionize the digital art and collectibles industry! Our expert team specializes in NFT marketplace development, delivering cutting-edge solutions tailored to your unique requirements.

Frequently Asked Questions

How Much Does 1 NFT Cost?

The cost of an NFT can vary greatly depending on several factors, such as the platform, artist’s reputation, scarcity, and demand for the specific digital asset. NFT prices can range from a few dollars to millions of dollars.

Is Bitcoin An NFT?

No, Bitcoin is not an NFT. Bitcoin is a cryptocurrency and a fungible digital asset, meaning each unit of Bitcoin is interchangeable with any other unit of Bitcoin. NFTs, on the other hand, are unique and non-interchangeable digital assets.

Can I Generate NFTs Free of Cost?

While there are platforms that allow users to mint or create NFTs for free, it is crucial to note that there may be associated fees for certain actions, such as gas fees on blockchain networks. Additionally, some platforms may charge fees for listing or selling NFTs. It’s advisable to research and understand the costs involved before generating NFTs.

Should You Buy NFTs?

Whether or not to buy NFTs depends on your personal interests, goals, and risk tolerance. For example, If you have a genuine interest in digital art, collectibles, or supporting artists, buying NFTs can be a way to engage with and own unique digital creations.

However, some NFTs have gained significant value over time, offering potential financial returns. However, the market can be volatile, so it’s important to do thorough research and understand the risks.