Welcome to the thrilling universe of Security Token Offerings (STO). This innovative development is reshaping the finance and technology sectors. STOs are a type of investment contract.

They represent the ownership information of an investment product recorded on a blockchain. For instance, when you invest in traditional stocks, ownership information is issued as a digital certificate. For STOs, it’s the same process but recorded on a blockchain and issued as a token.

STOs are regulated by the Securities and Exchange Commission (SEC). Hence, they are often referred to as SEC STOs. The SEC ensures that all transactions comply with its regulations. It provides a level of security and trust for investors.

It also means that STOs have the potential to bring new opportunities for businesses and investors alike. As we delve into the intricacies of STOs, we’ll explore how they are regulated by the Securities and Exchange Commission (SEC), hence the term “SEC STO”.

This guide will give you an understanding of SEC STOs, their types, their appeal to founders, and the process of launching and managing an STO.

Contents

Types Of Security Tokens

Security tokens are a transformative innovation in the world of digital assets. They represent a bridge between traditional finance and the emerging world of blockchain technology.

These tokens are a type of digital asset that encapsulates ownership rights in an underlying asset or entity. They are a critical element of Security Token Offerings (STOs), a novel fundraising form that harnesses blockchain technology’s power.

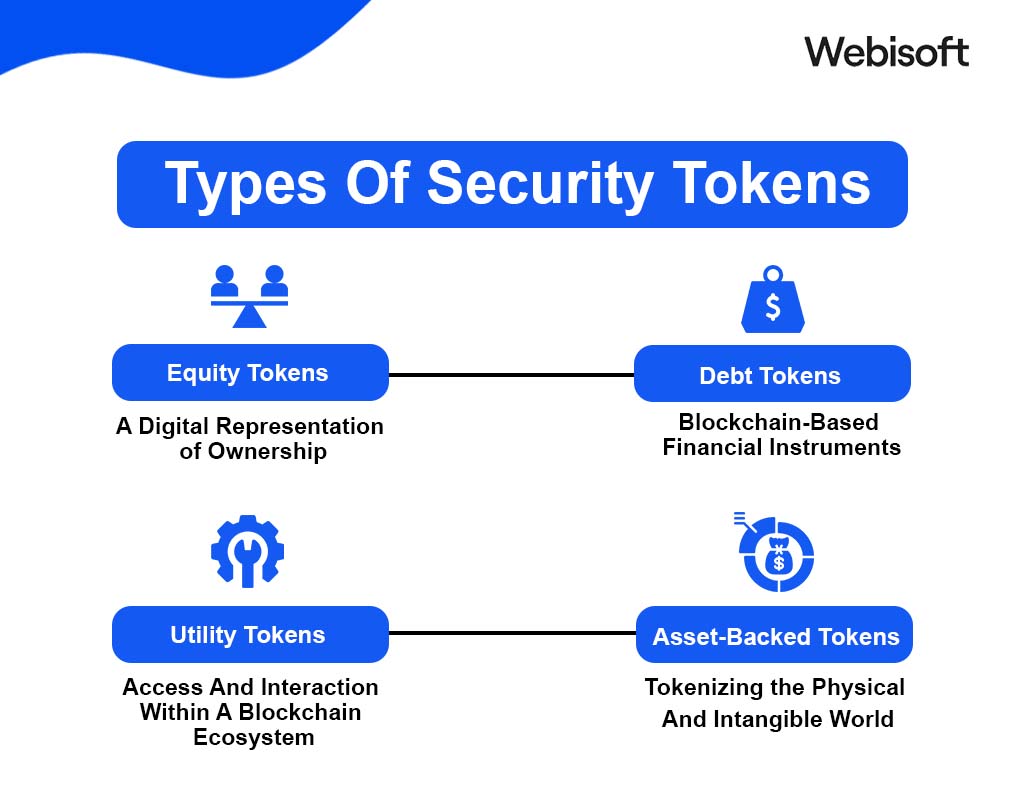

There are four primary types of security tokens: equity tokens, debt tokens, utility tokens, and asset-backed tokens. Each class has unique characteristics, advantages, and potential applications.

1. Equity Tokens: A Digital Representation of Ownership

Equity tokens are security token types that signify ownership in an underlying asset, typically a company or a business venture. They are the digital equivalent of traditional stocks, providing holders with a claim on a portion of the company’s profits and a voice in its strategic decisions.

This could encompass voting rights on significant company matters and a share of the company’s dividends. Equity tokens democratize access to investment opportunities. And can offer a more efficient, transparent, and inclusive method of managing ownership and distributing equity.

They can also facilitate liquidity and fractional ownership, opening up investment to a broader range of individuals.

2. Debt Tokens: Blockchain-Based Financial Instruments

Debt tokens represent another category of security tokens. They symbolize a loan made by an investor to a company or a government entity. In essence, they are akin to a bond in traditional finance.

The issuer of the debt token commits to paying back the loan with a predetermined interest over a specified timeframe. Debt tokens can offer companies a mechanism to raise capital without diluting ownership or control over the company.

For investors, they provide a fixed return on investment, making them a potentially stable and predictable investment option.

3. Utility Tokens: Access And Interaction Within A Blockchain Ecosystem

Utility tokens are unique tokens that give holders access to a product, service, or platform. They are typically used within a specific blockchain ecosystem, acting as a digital key.

For instance, a company might issue utility tokens that can be used to access a particular service on its platform, participate in a network, or interact with a protocol.

Utility tokens can foster a dynamic and engaged community around a product or service, incentivizing user participation, loyalty, and network effects.

4. Asset-Backed Tokens: Tokenizing the Physical And Intangible World

Asset-backed tokens represent ownership of a tangible or intangible object of value. This could range from real estate properties, artworks, and commodities to intellectual property rights.

By tokenizing the asset, it can be divided into smaller, more affordable units, making it accessible to a broader pool of investors.

Asset-backed tokens can also provide a mechanism to prove ownership, track the provenance of an asset, and facilitate peer-to-peer transactions, adding an extra layer of security, transparency, and efficiency.

Security tokens are a versatile and potent instrument in the blockchain and finance landscape. They offer a myriad of benefits, from democratizing access to capital. It enables fractional ownership and fosters vibrant ecosystems to enhance liquidity and market efficiency.

As the world of STOs continues to evolve and mature, we expect to see more innovative applications and use cases of these tokens, further blurring the boundaries between the traditional financial world and the digital asset space.

Why Security Tokens Appeal to Founders?

Security tokens have emerged as a compelling alternative to traditional fundraising methods for founders. They offer a unique blend of benefits that make them particularly appealing. Here’s why:

1. Low Barrier To Entry

One of the most significant advantages of Security Token Offerings (STOs) is their accessibility. Launching an STO is often less costly and complex than traditional fundraising methods, such as Initial Public Offerings (IPOs) or venture capital funding.

This lower barrier to entry opens up opportunities for smaller businesses and startups that may need more resources to navigate the traditional routes. In an STO, issuing tokens is streamlined and automated, reducing the need for intermediaries.

This can reduce the costs associated with fundraising. Furthermore, STOs are conducted on a blockchain platform. So they can be accessed by investors globally, expanding the potential investor base.

2. Accessibility To Institutional Capital

STOs can also attract investment from institutional investors. These are professional investors like banks, hedge funds, or mutual funds that manage large amounts of capital.

Institutional investors often seek investment opportunities that offer security, transparency, and the potential for high returns. STOs can provide all of these, making them an attractive option for these investors.

By attracting institutional capital, businesses can raise significant funds. This can provide them with the resources they need to grow and expand.

Furthermore, institutional investors can also add credibility to a business, making it more attractive to potential investors.

3. Get More For Less

With STOs, businesses can raise capital without giving up as much equity. In traditional fundraising methods, businesses often have to give up a significant portion of their equity in exchange for capital. This can dilute the founders’ ownership and control over their company.

However, with STOs, businesses can issue security tokens representing a claim on future profits or cash flows rather than equity. This allows founders to raise capital while retaining more control over their company.

It also provides investors a potential income stream, making it a win-win situation. Security tokens offer a range of benefits, making them a compelling option for founders.

From their low barrier to entry and accessibility to institutional capital to the ability to retain more control over their company, STOs represent a significant shift in how businesses can raise capital.

So, we can expect to see more and more founders turning to STOs to fund their ventures.

How to Launch A Security Token Offering

Launching a STO is a multi-step process. It requires careful planning and execution. Here’s a detailed guide on how to launch an STO:

Preparation: The Foundation of a Successful STO

The journey to launching a Security Token Offering (STO) begins with a crucial phase: preparation. This stage sets the foundation for the entire STO process and determines its success.

Here’s a detailed look at the critical components of the preparation stage.

1. Defining Clear and Measurable Goals

The first step in the preparation stage is to define your goals. They should clearly outline what you hope to achieve with your STO. This could include the amount of capital you aim to raise, the milestones you plan to reach with these funds, and the timeline for achieving these milestones.

Your goals will serve as a roadmap for your STO, guiding your decisions and actions. They will also provide a benchmark against which you can measure your progress and success.

2. Assembling A Diverse And Skilled Team

The next step is to assemble your team. Launching an STO is a multidisciplinary endeavor that requires expertise in various fields. Your team should include professionals with blockchain technology, finance, legal, and marketing expertise.

Each team member should have a clear role and responsibilities. For instance, your blockchain expert could be responsible for developing your token and ensuring it complies with all relevant regulations.

Your finance expert could handle financial planning and projections, while your legal expert could ensure your STO complies with all applicable laws and regulations. Your marketing expert could be responsible for promoting your STO and attracting investors.

3. Creating A Comprehensive Business Plan and Whitepaper

Building your business plan and whitepaper is another essential step. These documents will provide detailed information about your project to potential investors, helping them understand the value of your STO.

Your business plan should detail your business model, market analysis, marketing strategy, financial projections, and more. It should provide a clear and compelling case for why your project is a worthwhile investment.

Your whitepaper should provide detailed information about your project, including the problem it aims to solve, how it works, the tokenomics, and the details of the STO.

It should be written in clear and accessible language, making it easy for potential investors to understand. The preparation stage is a critical phase in the STO process.

It involves defining clear and measurable goals, assembling a diverse and skilled team, and creating a comprehensive business plan and whitepaper. You can set the foundation for a successful STO by carefully planning and executing this stage.

Pre-STO: Building and Marketing

The pre-STO stage is critical in the Security Token Offering (STO) process. During this stage, the groundwork laid in the preparation phase begins to take shape.

This stage involves three key steps: developing your token, building your platform, and marketing your STO.

1. Developing Your Token: The Heart of Your STO

The first step in the pre-STO stage is to develop your token. This involves deciding on the type of security token you will issue. It could be an equity token, a debt token, a utility token, or an asset-backed token.

Each type of token has unique characteristics and benefits. The choice will depend on your business model and goals. Once you’ve decided on the token type, you must choose the blockchain platform you will use.

This could be Ethereum, Algorand, Polymath, or any other medium that supports security tokens. The choice of platform will depend on various factors, such as its security features, scalability, and the level of support it provides for security tokens.

Ensuring your token complies with all relevant regulations is also crucial. This could involve complying with the rules of (SEC) or any other regulatory body in your jurisdiction. Compliance is not just a legal necessity—it also helps build trust with investors.

2. Building Your Platform: The Gateway to Your STO

The next step is to build your platform. This is where investors will participate in your STO. Your platform should be user-friendly and secure and provide all the information about your STO.

A user-friendly interface ensures investors can easily navigate your platform and participate in your STO. Security is also crucial—investors must trust that their funds and personal information will be safe.

Providing all the necessary information about your STO, such as the token’s details, the STO’s terms, and the timeline, is also essential. It helps investors make informed decisions.

3. Marketing Your STO: Attracting Investors

Marketing your STO is crucial to attract investors. This could involve various activities, such as social media marketing, email marketing, and more. Your marketing efforts should create awareness and excitement about your STO and its value to investors.

Content marketing could involve creating blog posts, infographics, videos, etc, providing valuable information about your STO. Social media marketing could involve promoting your STO on platforms like Twitter, LinkedIn, and Facebook.

Email marketing could involve sending regular updates to your email list. The pre-STO stage is a critical phase in the STO process. It involves developing your token, building your platform, and marketing your STO.

By carefully planning and executing this stage, you can set the stage for a successful STO.

STO: Raising Funds

The STO stage is when you launch your STO and start raising funds. This involves opening your STO to investors, managing the investment process, and ensuring everything runs smoothly.

You’ll need to provide regular updates to investors and respond to any queries or issues they may have.

Post-STO: Delivering On Promises

The post-STO stage is a critical phase that begins after your Security Token Offering (STO) has ended. During this stage, you start delivering on the promises made to your investors. This stage involves three key steps:

1. Distributing Tokens: Fulfilling Your Commitment

The first step in the post-STO stage is to distribute tokens to investors. This involves sending the tokens investors purchased during the STO to their digital wallets.

This process must be secure and efficient to ensure each investor receives the correct number of tokens.

Security is paramount during this process. You’ll need to ensure the distribution process is secure to prevent unauthorized access or manipulation. Efficiency is also crucial.

The process should be quick and seamless, ensuring investors receive their tokens promptly.

2. Listing Your Token: Providing Liquidity

The next step is to list your token on exchanges. Listing your token can provide liquidity for your token, allowing investors to buy and sell it. This can make your token more attractive to investors, giving them the flexibility to trade their tokens as needed.

You’ll need to work with exchanges that list security tokens and comply with their listing requirements. This could involve providing the exchange with detailed information about your token and your STO and paying any listing fees.

It’s essential to choose reputable exchanges with a large user base to ensure your token gets the visibility it needs.

3. Delivering on Your Promises: Building Trust and Confidence

Delivering your promises to investors is crucial for the success of your project. This involves using the funds raised during the STO to achieve the milestones outlined in your business plan and whitepaper.

Whether it’s developing your product, expanding your team, or entering new markets, showing progress and delivering on your commitments is important. Regular updates on your progress can help maintain investor trust and confidence.

These updates could involve sharing news about product developments, announcing new partnerships, or providing financial updates. Transparency is key during this process.

By being open and honest about your progress, you can build trust with your investors and show them that their investment is being put to good use.

Launching an STO is a complex process that requires careful planning and execution. Each step from the preparation stage to the post-STO location requires careful attention to detail and a commitment to delivering on your promises.

However, with the right approach and team, an STO can be a powerful way to raise capital for your project. It can give you the funds to bring your vision to life while providing investors with a unique and potentially lucrative investment opportunity.

How to Perform STO Properly?

Performing a Security Token Offering (STO) properly is a complex process that requires a deep understanding of regulatory requirements and a robust technology infrastructure.

Here’s a detailed look at the critical components of a successful STO.

1. Regulation: Navigating the Legal Landscape

The first step to performing an STO is to ensure compliance with all relevant regulations. In the United States, this means complying with the rules and regulations set forth by the Securities and Exchange Commission (SEC).

Compliance may involve registering your STO with the SEC, which requires providing detailed information about your company, token, and STO. This process can be complex and time-consuming, but ensuring your STO is legal and transparent is crucial.

Alternatively, you can apply for an exemption from registration. There are several exemptions available, each with its requirements and limitations.

Choosing the proper exemption requires a deep understanding of SEC regulations and carefully evaluating your STO’s characteristics and goals.

Regardless of your path, working with legal experts who specialize in STOs is crucial. They can guide you through the regulatory landscape and help ensure your STO complies with all relevant laws and regulations.

2. Technology Infrastructure: Building a Robust Platform

A robust technology infrastructure is another crucial component of a successful STO. This includes a platform for issuing tokens, managing investors, and conducting the STO.

Your platform should be secure, user-friendly, and capable of handling the technical demands of an STO. This includes issuing tokens, processing transactions, and managing investor data.

It should also provide tools for compliance, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

Building such a platform requires a deep understanding of blockchain technology and smart contracts. It also requires a team of skilled developers who can develop and maintain the platform.

3. Engaging an End-to-End STO Services Provider: A Partner in Your STO Journey

Given the complexity of STO launching, many companies engage an end-to-end STO services provider. These providers offer various services to guide you through launching an STO.

An end-to-end STO services provider can provide valuable expertise and resources, helping you navigate regulatory requirements and technical challenges. They can assist with everything from drafting your whitepaper and business plan to developing your token and platform.

In conclusion, performing an STO properly is a complex process that requires a deep understanding of regulatory requirements and a robust technology infrastructure.

You can increase your chances of a successful STO by ensuring compliance with regulations, building a robust platform, and engaging an end-to-end STO services provider.

Conclusion

SEC STOs mark a groundbreaking shift in finance and tech. They pave a fresh path for companies to gather funds, boasting several advantages over age-old fundraising techniques. Yet, initiating an STO demands meticulous strategizing and implementation.

Grasping the various security tokens, the allure of STOs for entrepreneurs, and the intricacies of starting and overseeing an STO can set your enterprise on the path to triumph in the STO realm. Ready to navigate the world of STOs? Let Webisoft guide you to success. Reach out to us today!