(Peer-to-peer) P2P lending through blockchain is revolutionizing the way we borrow and lend money. Imagine a world where lending is as simple and direct as sending a text message – that’s the convenience blockchain brings to P2P lending.

It’s not just about ease; it’s about efficiency and trust. Blockchain’s secure and transparent nature means every transaction is recorded, making it safer for borrowers and lenders.

This innovative approach has gained traction, with the global P2P lending market expected to reach $558.91 billion by 2027, highlighting its growing popularity.

However, this guide will dive into the details of P2P lending blockchain, its key benefits, and others. Let’s start:

Contents

- 1 Who are the Stakeholders Involved in the P2P Lending Blockchain Platform?

- 2 How Does P2P Lending Blockchain Work?

- 2.1 Step 1 – Lender Generates a Profile

- 2.2 Step 2 – Lender Eagerly Waits for Loan Requests

- 2.3 Step 3 – Borrower Generates an Account

- 2.4 Step 4 – Borrower Sends Loan Request

- 2.5 Step 5 – Lender Interviews the Borrower

- 2.6 Step 6 – Smart Contract Fixes the Interest Rate

- 2.7 Step 7 – Auto-Payments Using Smart Contracts

- 3 Webisoft’s Work on P2P Lending Blockchain Process

- 4 End Note

- 5 Frequently Asked Questions

- 5.1 What types of loans can be facilitated through P2P lending blockchain?

- 5.2 Are interest rates on P2P lending blockchain platforms competitive?

- 5.3 How is the repayment process managed on P2P lending blockchain platforms?

- 5.4 What happens if a borrower defaults on a blockchain P2P loan?

- 5.5 Can P2P lending blockchain platforms operate globally?

Who are the Stakeholders Involved in the P2P Lending Blockchain Platform?

P2P crypto lending blockchain platforms unite different players, each playing a vital role.

Lenders

Lenders are individuals or groups with extra money to invest. On P2P lending platforms, they offer loans to those in need.

Lenders look for good returns on their investments. Blockchain app creation helps them track their investments securely and transparently.

Borrowers

Borrowers are individuals or businesses seeking funds. They might need money for a new project, business expansion, or personal reasons.

On P2P lending technology platforms, they can get loans without going to a traditional bank. Blockchain ensures their transactions are safe and private.

Guarantor

Guarantors play a crucial role in adding trust to the system. They act as a safety net if a borrower fails to repay.

On blockchain platforms, guarantors assure lenders by backing loans. This increases confidence among lenders to invest.

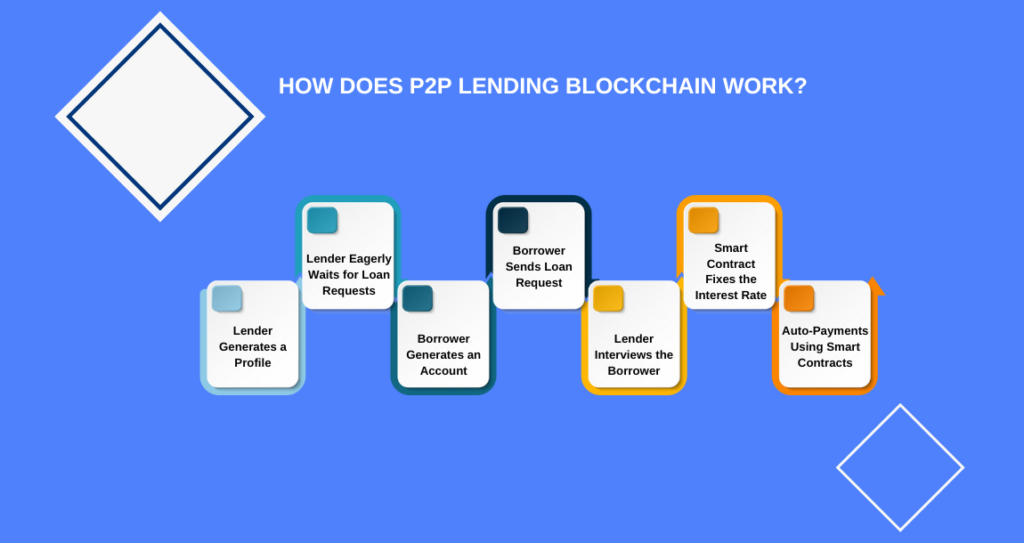

How Does P2P Lending Blockchain Work?

P2P lending on blockchain is a smart way to handle loans between people. Let’s break down each step of the process.

Step 1 – Lender Generates a Profile

Firstly, someone who wants to lend money, called a lender, makes a profile. They put in details like how much money they can lend. This helps people looking for a loan to find the right lender.

Step 2 – Lender Eagerly Waits for Loan Requests

After their profile is ready, the lender waits for people to ask for loans. They can look at different loan requests to find one they like. This part concerns finding a good match between the lender and the borrower.

Step 3 – Borrower Generates an Account

At the same time, a person who needs money, called a borrower, sets up their account. They share information about themselves and how much money they need. This helps lenders decide if they want to lend to them.

Step 4 – Borrower Sends Loan Request

Once their account is set up, the borrower asks for a loan. They can ask many lenders at once. This increases their chance of getting the money they need.

Step 5 – Lender Interviews the Borrower

Before saying yes to a loan, the lender might want to talk to the borrower. This chat helps the lender understand more about the borrower’s need for the loan and if they can pay it back.

Step 6 – Smart Contract Fixes the Interest Rate

When both sides agree, a smart contract sets up the interest rate. This is done using blockchain, so it’s fair and clear to both the lender and borrower. Everything about the loan is recorded safely.

Step 7 – Auto-Payments Using Smart Contracts

Lastly, paying back the loan is easy. The blockchain uses smart contracts to take care of payments automatically.

This means the borrower doesn’t have to remember to pay every time, and the lender gets their money back on time.

To sum up, international peer to peer lending on blockchain makes borrowing and lending money simple and safe.

It’s a great way for people to lend money to each other without worries. This method is all about being clear, fair, and easy for everyone.

Webisoft’s Work on P2P Lending Blockchain Process

P2P lending blockchain platforms like the one developed by Webisoft are transforming the lending and borrowing landscape.

These platforms create a more inclusive, secure, and efficient financial environment by involving key stakeholders like lenders, borrowers, and guarantors.

Webisoft’s innovations in streamlining loan approvals, enhancing security, and improving transparency are notable.

They are not only reducing costs and increasing accessibility but also facilitating global financial interactions and providing real-time updates. It makes peer to peer lending worldwide a viable alternative to traditional banking.

Streamlining Loan Approval

Webisoft’s platform simplifies the loan approval process. Borrowers can apply easily, and lenders can make quick decisions. The blockchain system reviews applications fast, saving everyone’s time.

Enhancing Security

Security is a top priority for Webisoft, the blockchain development company. Their blockchain technology ensures all transactions are encrypted. This means safer lending and borrowing for everyone involved.

Improving Transparency

Transparency is another benefit of Webisoft’s platform. Lenders and borrowers can see where their money is at all times. This transparency builds trust among users.

Reducing Costs

Webisoft’s platform cuts down on traditional banking fees. By eliminating middlemen, both borrowers and lenders save money. Lower costs make P2P lending more attractive than traditional loans.

Increasing Accessibility

Webisoft’s platform is open to a wide range of users. This inclusivity means more people can lend and borrow, expanding the financial market.

Facilitating Global Transactions

Webisoft’s technology breaks down geographical barriers. Lenders and borrowers from different parts of the world can connect. This global reach creates more opportunities for everyone.

End Note

P2P lending blockchain is a significant advancement in the financial sector, offering a more efficient, secure, and transparent way of lending and borrowing. Its rapid growth and adoption globally are testaments to its effectiveness and potential.

By using blockchain technology, P2P lending platforms can provide users with a trustworthy and streamlined process. This technology makes financial transactions easier and more accessible for everyone.

Webisoft stands ready to assist in navigating this new financial landscape. Our skilled team members are equipped with the knowledge and tools to help you leverage the full potential of P2P lending blockchain.

Reach out to Webisoft today and take the first step towards transforming your financial transactions with P2P lending blockchain. Let’s unlock new opportunities and drive growth together.

Frequently Asked Questions

What types of loans can be facilitated through P2P lending blockchain?

Various types, including personal loans, business loans, and debt consolidation loans, can be facilitated through these platforms.

Are interest rates on P2P lending blockchain platforms competitive?

Yes, often, they offer more competitive rates than traditional banks, as they have minimum overhead costs.

How is the repayment process managed on P2P lending blockchain platforms?

Repayments are made directly through the platform, with the blockchain ledger tracking all transactions for transparency and accuracy.

What happens if a borrower defaults on a blockchain P2P loan?

Platforms have different policies, but typically, they have measures in place like collateral or third-party guarantees to manage defaults.

Can P2P lending blockchain platforms operate globally?

These platforms can operate across borders, offering global access to lending and borrowing opportunities subject to local regulations.