Machine Learning in Banking: Real Use Cases & Benefits

- BLOG

- Artificial Intelligence

- January 26, 2026

Banking decisions no longer pause for manual review. Machine learning in banking now drives fraud alerts, credit approvals, and risk checks across core operations. Nearly 80 percent of global banks already rely on it in daily workflows. Inside banks, these systems work continuously.

They process transaction flows, detect irregular behavior, and manage volumes that traditional controls and static rulebooks were never built to handle. As this responsibility grows, understanding how machine learning functions within banking systems becomes important. The sections ahead explain how machine learning in banks operates, where it creates value, which risks need control, and how institutions design systems.

Contents

- 1 What Is Machine Learning in Banking?

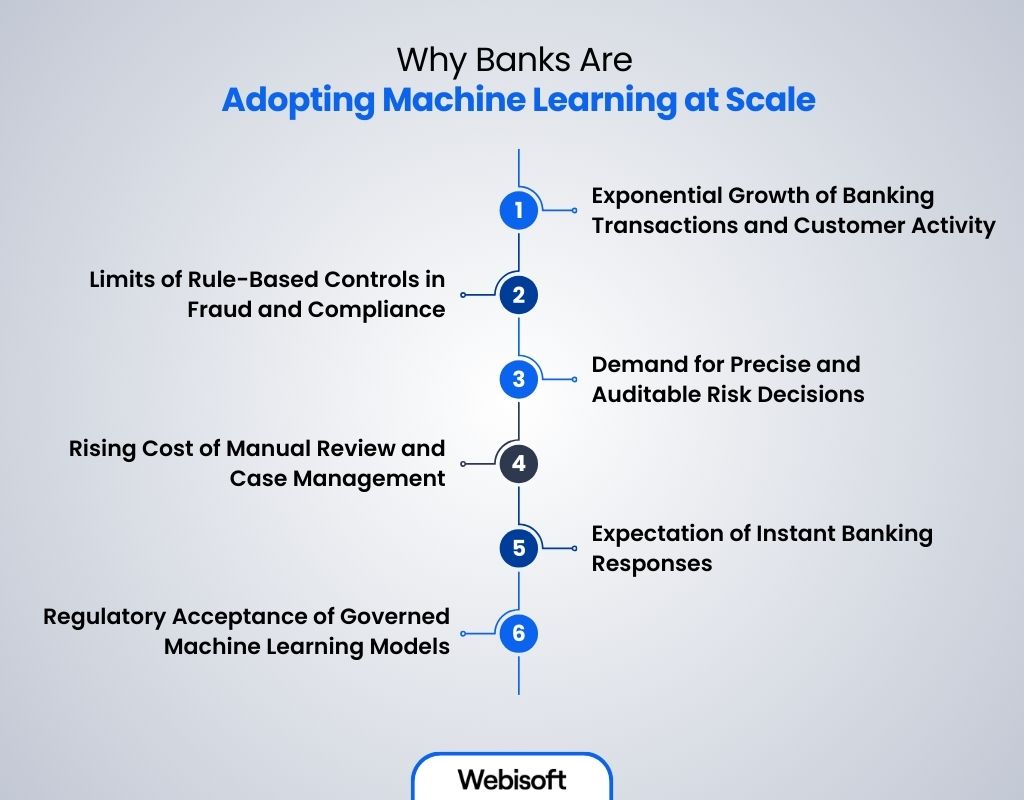

- 2 Why Banks Are Adopting Machine Learning at Scale

- 2.1 Exponential Growth of Banking Transactions and Customer Activity

- 2.2 Limits of Rule-Based Controls in Fraud and Compliance

- 2.3 Demand for Precise and Auditable Risk Decisions

- 2.4 Rising Cost of Manual Review and Case Management

- 2.5 Expectation of Instant Banking Responses

- 2.6 Regulatory Acceptance of Governed Machine Learning Models

- 3 Build compliant machine learning systems for modern banking.

- 4 Core Machine Learning Use Cases in Banking

- 5 How Machine Learning Systems Work Inside a Bank

- 6 Model Governance, Risk, and Compliance in Banking ML

- 7 Challenges Banks Face When Implementing Machine Learning

- 8 The Future of Machine Learning in Banking

- 8.1 Broader Mainstream Adoption Across Banking Functions

- 8.2 Growth of AI-Driven Operational Efficiency

- 8.3 Real-Time, Embedded Decision Intelligence

- 8.4 Explainable and Responsible AI as a Norm

- 8.5 Expansion of Personalized and Predictive Services

- 8.6 Integration with Generative and Advanced AI Capabilities

- 9 How Webisoft Helps Banks Implement Machine Learning Successfully

- 9.1 We start with feasibility, not assumptions

- 9.2 We design the data and system architecture banks can control

- 9.3 We build models that stay usable under governance and review

- 9.4 We handle deployment, monitoring, and retraining as a lifecycle

- 9.5 We integrate machine learning into real banking workflows

- 9.6 We work as an extension of your team, not a black box

- 10 Build compliant machine learning systems for modern banking.

- 11 Conclusion

- 12 Frequently Asked Question

What Is Machine Learning in Banking?

Machine learning in banking refers to the use of data-driven models that analyze large volumes of financial data to support decision-making. Rather than fixed rules, banks use machine learning models trained on historical and real-time data to detect patterns, predict outcomes, and automate operations.

In practical terms, machine learning helps banks make faster, more accurate decisions across risk assessment, transaction monitoring, customer interactions, and operational workflows. Machine learning in banking and finance enables systems to continuously adapt as customer behavior, market conditions, and regulatory expectations change. While still operating within strict governance and control frameworks.

Why Banks Are Adopting Machine Learning at Scale

Banks operate under constant pressure to make fast decisions without compromising risk controls or regulatory obligations. Machine learning helps banks move beyond rigid rule-based systems by improving decision accuracy, processing scale, and governance across transaction-heavy and risk-sensitive operations.

Banks operate under constant pressure to make fast decisions without compromising risk controls or regulatory obligations. Machine learning helps banks move beyond rigid rule-based systems by improving decision accuracy, processing scale, and governance across transaction-heavy and risk-sensitive operations.

Exponential Growth of Banking Transactions and Customer Activity

Retail and corporate banks process massive volumes of payments, transfers, and digital interactions daily. Machine learning enables banks to analyze transaction flows, behavioral signals, and channel activity at speeds manual systems cannot match.

Limits of Rule-Based Controls in Fraud and Compliance

Static rules struggle against evolving fraud patterns and laundering techniques. Machine learning detects subtle behavioral shifts across accounts and transactions, helping banks reduce false alerts while maintaining compliance thresholds.

Demand for Precise and Auditable Risk Decisions

Credit approvals, exposure limits, and operational risk decisions require accuracy and traceability. Machine learning improves prediction quality while supporting documentation and explainability needed for regulatory reviews.

Rising Cost of Manual Review and Case Management

Fraud investigations, AML reviews, and exception handling consume significant resources. Machine learning helps banks prioritize cases and route reviews more efficiently, allowing teams to focus on genuinely high-risk activity.

Expectation of Instant Banking Responses

Customers expect immediate transaction approvals and real-time service updates. Machine learning supports instant decisioning by evaluating risk and context during live interactions across digital banking channels.

Regulatory Acceptance of Governed Machine Learning Models

Supervisory bodies increasingly recognize validated and monitored models as alternatives to informal rule sets. Machine learning systems now support audit trails, version control, and performance monitoring required in regulated banking environments.

Build compliant machine learning systems for modern banking.

Discuss your banking data, risks, and implementation roadmap with Webisoft.

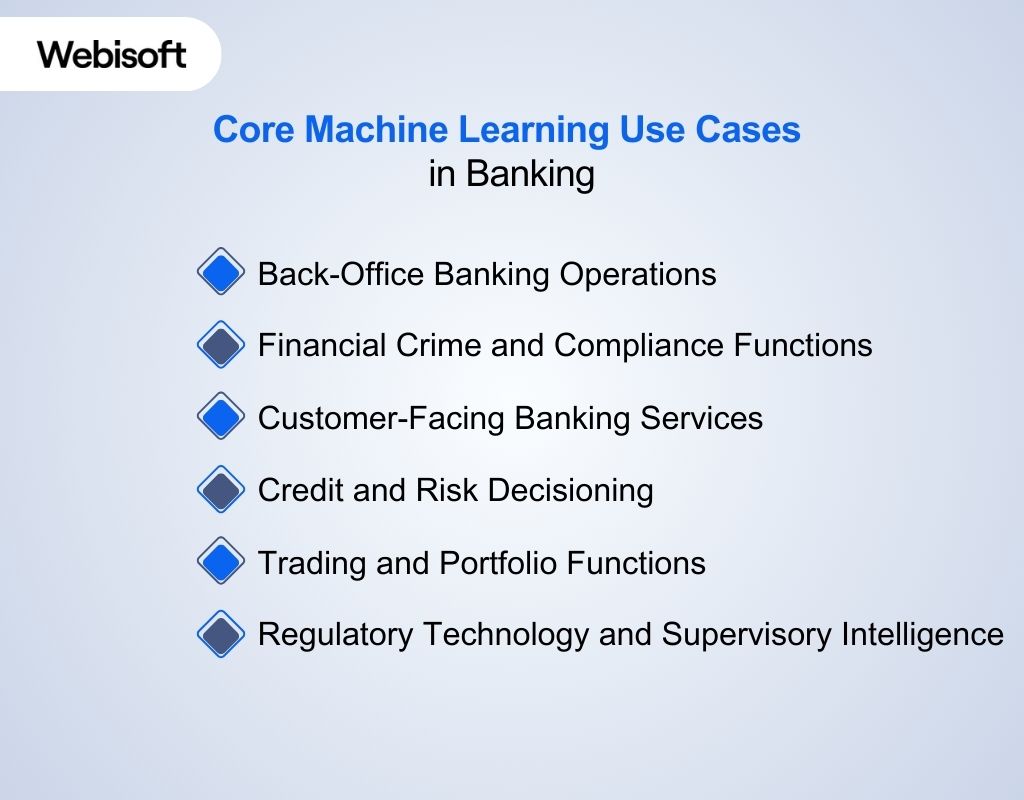

Core Machine Learning Use Cases in Banking

The use of machine learning in banking is centered on solving operational, risk, and customer-facing challenges where speed, accuracy, and scale matter. These use cases reflect where banks face the greatest pressure from scale, risk, and regulatory oversight.

The use of machine learning in banking is centered on solving operational, risk, and customer-facing challenges where speed, accuracy, and scale matter. These use cases reflect where banks face the greatest pressure from scale, risk, and regulatory oversight.

Back-Office Banking Operations

Back-office teams deal with high volumes of documents, exceptions, and reconciliation tasks. Machine learning helps reduce manual effort while improving accuracy and processing speed.

- Document Digitization and Processing: Banks handle large volumes of loan files, onboarding documents, and regulatory forms. Machine learning supports document digitization through OCR and data extraction, allowing systems to classify, validate, and route documents without manual intervention.

- Workflow Automation and Case Routing: Operational cases such as disputes, compliance reviews, and account exceptions can be automatically categorized and routed. This reduces processing delays and helps operations teams focus on complex or high-risk cases.

- Data Quality and Reconciliation: Machine learning models identify inconsistencies across internal systems, flag missing fields, and reconcile records. This improves data reliability for downstream risk, reporting, and audit processes.

Financial Crime and Compliance Functions

Compliance teams face constant pressure to detect suspicious activity without overwhelming reviewers. Machine learning improves signal quality while maintaining regulatory control.

- Transaction Monitoring for AML: Machine learning enhances AML programs by analyzing behavioral patterns across accounts and transactions. It helps detect suspicious activity that static rules often miss while reducing false positives that burden compliance teams.

- KYC and Customer Risk Profiling: Banks use machine learning to assess customer risk dynamically. Models monitor changes in behavior and documentation, supporting continuous due diligence rather than periodic manual reviews.

- Compliance Reporting and Alert Prioritization: Machine learning assists in prioritizing alerts and validating compliance data, helping banks meet regulatory timelines with greater accuracy and less manual effort.

Customer-Facing Banking Services

Customer interactions generate behavioral signals, and these applications of machine learning in banking industry help banks respond faster across digital channels.

- Intelligent Customer Support: Machine learning powers chat and voice systems that handle routine banking queries such as balance checks, transaction history, or payment status. Complex or sensitive cases are escalated to human agents.

- Personalized Banking Interactions: By analyzing transaction behavior and engagement history, machine learning enables banks to customize messages, product suggestions, and communication timing to individual customers.

- Customer Behavior Analysis: Banks apply machine learning to understand churn risk, service usage trends, and engagement patterns, supporting proactive retention and service improvements.

Credit and Risk Decisioning

Risk decisions must balance speed, accuracy, and explainability. Machine learning supports better assessments while remaining auditable.

- Credit Scoring and Loan Assessment: Machine learning models evaluate borrower risk using structured financial data and behavioral signals. These models support faster credit decisions while maintaining explainability required for audits.

- Early Warning Signals for Credit Deterioration: Banks monitor repayment behavior, account activity, and transaction trends to identify early signs of financial stress, allowing intervention before defaults occur.

- Operational and Enterprise Risk Analytics: Machine learning supports risk teams by identifying emerging exposure patterns across portfolios, operations, and counterparties.

Trading and Portfolio Functions

Market-facing teams rely on fast data interpretation and controlled execution. Machine learning supports these needs within defined risk limits.

- Market Data Analysis: Banks use machine learning to process large volumes of market data, news signals, and pricing movements to support trading and investment decisions.

- Algorithm-Supported Trading Strategies: Machine learning assists with trade execution, timing optimization, and strategy refinement, operating within defined risk limits and governance controls.

- Portfolio Risk and Optimization: Risk teams apply machine learning to assess portfolio exposures, correlations, and scenario impacts, supporting more responsive portfolio management.

Regulatory Technology and Supervisory Intelligence

Regulatory expectations continue to rise. Machine learning helps banks manage reporting volume and supervisory scrutiny more effectively.

- Regulatory Reporting Automation: Machine learning helps banks prepare regulatory reports by validating data, flagging anomalies, and ensuring consistency across submissions.

- Supervisory Risk Monitoring: Banks and regulators use machine learning to monitor systemic risk indicators, detect emerging vulnerabilities, and assess institutional health using large datasets.

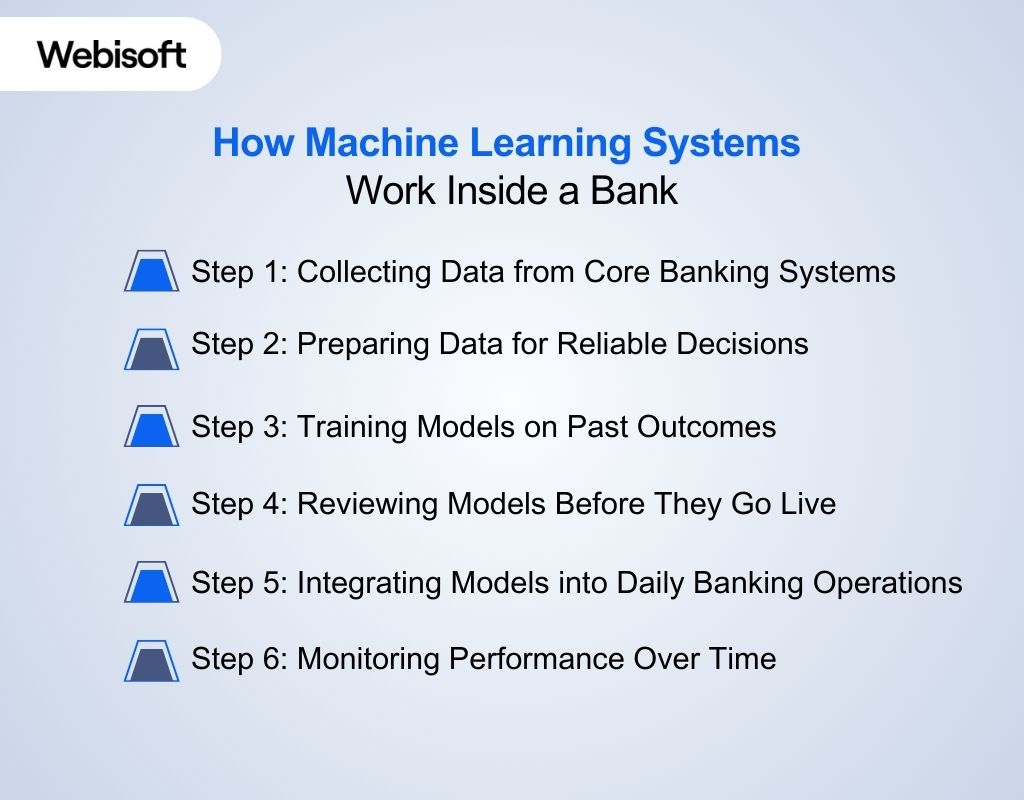

How Machine Learning Systems Work Inside a Bank

Machine learning systems in banks follow a controlled, step-by-step process designed to balance automation with security, accuracy, and regulatory oversight. Each step ensures models operate reliably within core banking environments.

Machine learning systems in banks follow a controlled, step-by-step process designed to balance automation with security, accuracy, and regulatory oversight. Each step ensures models operate reliably within core banking environments.

Step 1: Collecting Data from Core Banking Systems

Banks begin by pulling data from everyday operations such as transactions, account activity, customer interactions, and historical risk records. This data moves through secured pipelines where access, quality, and privacy are tightly controlled.

Step 2: Preparing Data for Reliable Decisions

Raw banking data is rarely usable as-is. Teams clean, standardize, and organize it into meaningful signals, such as spending patterns, repayment behavior, or unusual activity, while carefully checking for bias or data gaps.

Step 3: Training Models on Past Outcomes

Models learn by analyzing historical examples, including past fraud cases, loan performance, or compliance decisions. Banks test these models against separate datasets to confirm they behave consistently under different conditions.

Step 4: Reviewing Models Before They Go Live

Before deployment, models are reviewed by risk and compliance teams. This step focuses on transparency, fairness, documentation, and the ability to explain why a decision was made.

Step 5: Integrating Models into Daily Banking Operations

Once approved, models are connected to core systems through secure integrations. They support real-time decisions, such as transaction approvals, or scheduled processes, such as risk scoring and reporting.

Step 6: Monitoring Performance Over Time

After launch, banks continuously track how models perform. Changes in data patterns or outcomes trigger reviews, ensuring decisions remain accurate and aligned with business and regulatory expectations.

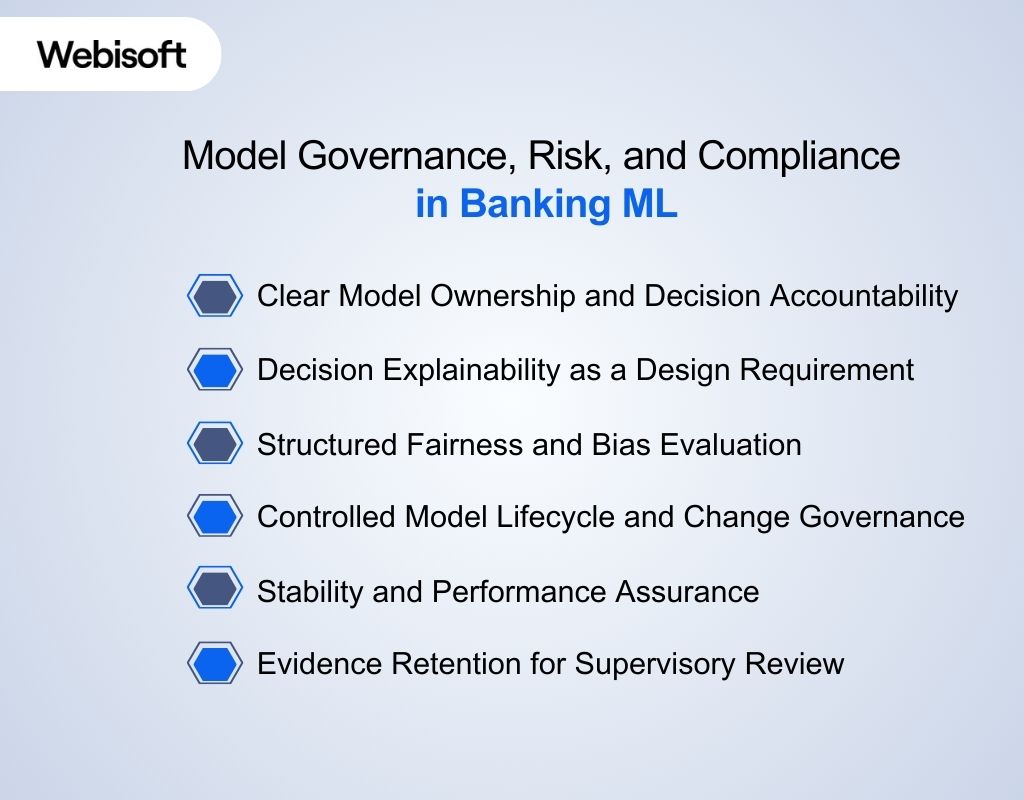

Model Governance, Risk, and Compliance in Banking ML

In banking, machine learning must follow governance frameworks protecting customers, data integrity, and regulatory obligations, as outlined by Bank for International Settlements guidance. These controls ensure models remain explainable, auditable, and stable as they influence high-impact financial decisions across banking operations.

In banking, machine learning must follow governance frameworks protecting customers, data integrity, and regulatory obligations, as outlined by Bank for International Settlements guidance. These controls ensure models remain explainable, auditable, and stable as they influence high-impact financial decisions across banking operations.

Clear Model Ownership and Decision Accountability

Banks assign explicit responsibility for each model across development, validation, approval, and ongoing oversight. This structure ensures accountability when automated decisions affect customers, balance sheets, or regulatory exposure.

Decision Explainability as a Design Requirement

Models are built to provide understandable reasoning for their outputs. Explainability supports internal reviews, customer inquiries, and supervisory assessments without relying on opaque or untraceable logic.

Structured Fairness and Bias Evaluation

Banks establish regular testing to detect bias across protected attributes and decision outcomes. These reviews focus on preventing unintended discrimination rather than reacting to issues after deployment.

Controlled Model Lifecycle and Change Governance

Any modification to a model follows a defined approval and revalidation process. This prevents silent behavior changes and ensures consistency across versions and environments.

Stability and Performance Assurance

Banks monitor model behavior to confirm decisions remain consistent as data patterns evolve. This oversight focuses on stability and reliability rather than application-specific performance metrics.

Evidence Retention for Supervisory Review

Governed machine learning systems maintain clear records of model versions, approvals, and decision logic. These artifacts support supervisory reviews without exposing operational details or business logic.

Challenges Banks Face When Implementing Machine Learning

Despite its potential, implementing machine learning in banking sector is complex. Institutions must balance innovation with regulatory pressure, legacy systems, and operational risk while ensuring models remain reliable in real-world banking environments.

- Fragmented and siloed data environments: Banking data often sits across disconnected systems with inconsistent formats. This makes it difficult to create unified datasets suitable for training reliable machine learning models.

- Legacy infrastructure and integration constraints: Many banks rely on older core systems not designed for real-time model integration. Connecting machine learning outputs to these platforms requires careful architectural planning.

- Regulatory uncertainty during early adoption: While regulators accept model-driven systems, expectations can vary by region and use case. Banks must interpret evolving guidance while avoiding compliance exposure.

- Limited internal expertise and operational readiness: Successful machine learning initiatives require coordination between data teams, risk, compliance, and business units. Skill gaps or misalignment can delay deployment.

- Difficulty scaling from pilot to production: Models that perform well in controlled tests often struggle at scale. Production environments introduce data drift, performance pressure, and monitoring requirements that are hard to manage.

Many of these challenges require more than experimentation to resolve. Learn how at Webisoft, we implement regulated machine learning that integrates cleanly with existing systems, data controls, and compliance processes.

The Future of Machine Learning in Banking

As banks move past early implementation challenges, machine learning adoption continues to evolve in structured ways. This section explains how future banking systems will apply machine learning at scale, balance regulatory expectations, and support more reliable decision-making across core operations.

As banks move past early implementation challenges, machine learning adoption continues to evolve in structured ways. This section explains how future banking systems will apply machine learning at scale, balance regulatory expectations, and support more reliable decision-making across core operations.

Broader Mainstream Adoption Across Banking Functions

Nearly 8 in 10 banks now use AI and machine learning in banking functions such as fraud detection, lending, or risk management. This trend is expected to continue as institutions expand deployments beyond isolated pilots.

Growth of AI-Driven Operational Efficiency

Banks that fully embrace AI and machine learning could see major improvements in efficiency ratios. Industry studies show 92 percent of global banks use AI in core functions, while large institutions report efficiency gains up to 15 percent.

Real-Time, Embedded Decision Intelligence

The future will see more machine learning embedded directly into core systems, enabling real-time analytics and decisions across channels, rather than treating insights as offline reports. This shift supports faster and more contextual responses to customer behavior and risk signals.

Explainable and Responsible AI as a Norm

As regulators emphasize transparency and accountability, demand for explainable machine learning models will rise. Future systems will be expected to surface understandable reasoning behind decisions, making compliance and risk control fundamental design features.

Expansion of Personalized and Predictive Services

Machine learning will increasingly drive customized experiences, from personalized product offers to predictive financial guidance. Thus transforming customer engagement and creating new competitive differentiation in digital banking.

Integration with Generative and Advanced AI Capabilities

Banks are beginning to combine traditional machine learning with generative AI for internal analysis and support workflows. Recent reports note that more than 50 percent of large banks are piloting generative AI use cases in reporting, documentation, and knowledge access.

How Webisoft Helps Banks Implement Machine Learning Successfully

You have seen what machine learning can do in banking, and what makes implementation hard. Our team at Webisoft helps you turn those ideas into systems that fit your data, security, and compliance needs, without rewriting your stack.

You have seen what machine learning can do in banking, and what makes implementation hard. Our team at Webisoft helps you turn those ideas into systems that fit your data, security, and compliance needs, without rewriting your stack.

We start with feasibility, not assumptions

Before any model work begins, we help you define the business outcome, assess data readiness, and confirm what can be delivered reliably in production. This keeps initiatives tied to measurable value and prevents pilots that cannot scale.

We design the data and system architecture banks can control

Banks do not fail because the model is “wrong.” They fail when data pipelines, access rules, and system boundaries are unclear. We architect the end-to-end flow, including pipelines and integration points, so the solution stays manageable under real operational constraints.

We build models that stay usable under governance and review

In banking, a model must be defensible, not just accurate. We validate models for performance and interpretability, and we document decisions so your teams can support audits, internal reviews, and risk sign-off with confidence.

We handle deployment, monitoring, and retraining as a lifecycle

Model performance changes when customer behavior and data patterns shift. We support the full lifecycle with monitoring and controlled retraining so systems keep producing reliable decisions after launch, not just on day one.

We integrate machine learning into real banking workflows

A model is only useful when it fits the way your teams operate. We integrate ML into existing platforms and operational processes so predictions become decisions that your staff can act on, without creating parallel tools that get ignored.

We work as an extension of your team, not a black box

Some banks need targeted support, others need an end-to-end delivery team. We offer flexible engagement models and structured delivery so your internal stakeholders stay in control while we move implementation forward with clear communication.

Webisoft supports banks through every stage of machine learning delivery, from feasibility and architecture to governed deployment and long-term operation. Start a conversation with our team to explore how this approach can fit your data landscape, compliance requirements, and business priorities.

Build compliant machine learning systems for modern banking.

Discuss your banking data, risks, and implementation roadmap with Webisoft.

Conclusion

Wrapping up, machine learning in banking is less about flashy innovation and more about dependable outcomes. It quietly reduces friction, sharpens risk judgment, and helps banks operate at scale without losing control, even as expectations and oversight continue to intensify.

Reaching that state takes deliberate engineering, not trial and error. Webisoft helps banks build machine learning systems meant to be lived with, audited, and trusted, so results remain steady long after deployment pressure fades.

Frequently Asked Question

Can small or regional banks use machine learning effectively?

Small and regional banks can use machine learning by starting with focused use cases that rely on existing data. Applications such as transaction categorization or fraud scoring deliver value without requiring large teams or complex infrastructure.

Is customer consent required for machine learning in banking?

Customer consent requirements depend on the type of data used and local regulations. Banks must follow privacy laws and existing customer agreements, especially when using personal or behavioral data. Clear disclosure and lawful processing remain essential for compliance.

Does machine learning replace human decision-making in banks?

No. Machine learning does not replace human decision-making in banking. Instead, it supports analysts and reviewers by prioritizing cases, providing risk insights, and improving consistency. While humans remain responsible for final decisions that carry regulatory or customer impact.