The Howey Test comes from a decision made by the Supreme Court in 1946. It’s a way to figure out if something is an investment contract and needs to follow specific laws.

However, people like the Howey Test because it’s straightforward and flexible. This test makes it easier to understand different kinds of investments. Nowadays, with cryptocurrencies becoming more popular, the Howey Test is crucial.

It helps to make clear if digital money, like Bitcoin or Ethereum, should follow the same rules as traditional investments. This is important for keeping investors safe and making sure the market plays fair.

In this article, we’re going to explore what the Howey Test is all about and see if cryptocurrencies pass this important test. So, read the article till the end!

Contents

- 1 What is the Howey Test?

- 2 4 Key Howey Test Elements

- 3 Howey Test and Cryptocurrencies

- 4 Does Crypto Pass the Howey Test?

- 5 Examples of What Has and Hasn’t Passed the Howey Test

- 6 Howey Test Criteria: Different Interpretations

- 7 How to Pass the Howey Test?

- 8 Recent Developments and Regulatory Actions

- 9 What Are the Alternatives to the Howey Test for Evaluating Currencies?

- 10 Final Note

- 11 Frequently Asked Questions

What is the Howey Test?

The Howey Test got its name from a Supreme Court decision in 1946. This decision was about figuring out if an investment contract counts as a security under federal law. The story started with orange groves in Florida. The W.J. Howey Co. was selling pieces of land, promising buyers a share of the profits from the oranges grown there.

This situation led to the creation of the Howey Test. It outlines four criteria to decide if something is an investment contract and therefore a security. These criteria are now also used to see if digital assets, like cryptocurrencies, are securities.

Howey test 4 prongs

The Howey Test has four main points to check:

- Does the investment involve spending money or other assets?

- Do investors expect to make money from their investment?

- Are these expected profits mainly from the work of others?

- Is there a shared venture between the investors and the people offering the investment?

In the below segment, we’ll discuss them in proper detail.

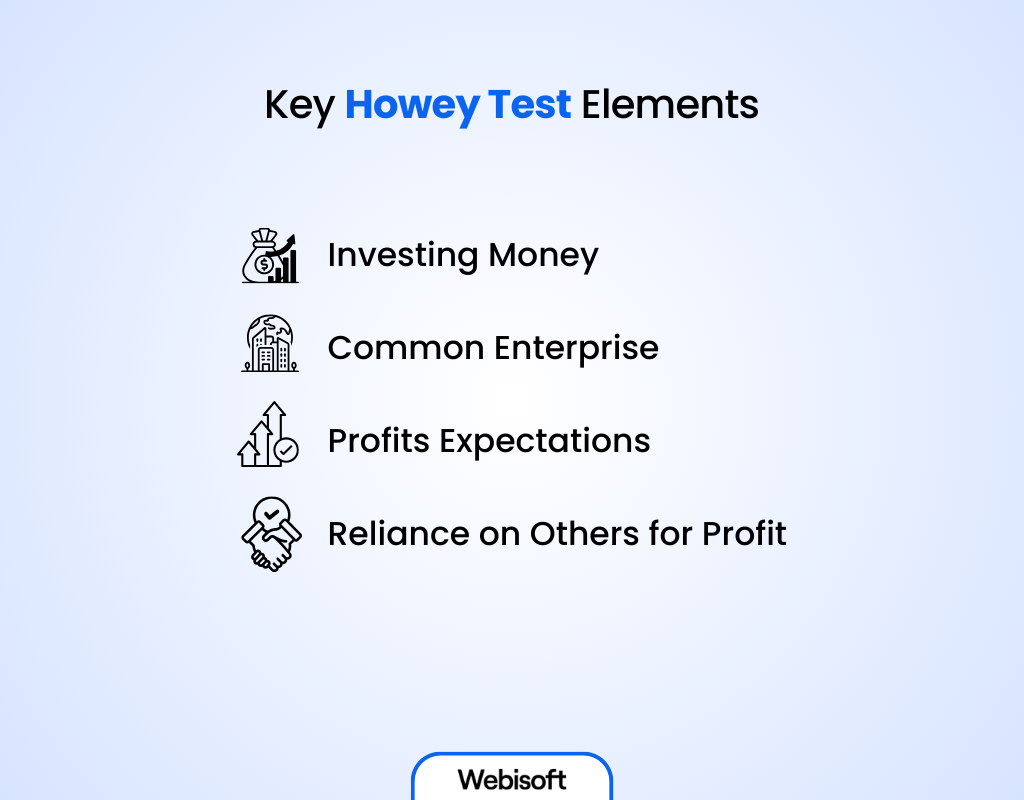

4 Key Howey Test Elements

The Howey Test is important for anyone investing in cryptocurrencies or similar assets. It helps determine if your investment is considered a security and thus needs to adhere to specific regulations. However, the key Howey test elements are:

Investing Money

The first part is about whether you’re putting money or assets (like cryptocurrencies) into something with the hope of making more money. This is about expecting to get more out than you put in.

Common Enterprise

This looks at whether you and other investors are pooling your resources for a common goal. If you’re all investing in a crypto project and share in its ups and downs, your investment might be viewed as a security.

Different Views on Common Enterprise

There are a few ways to look at this:

- Broad Vertical Commonality: Here, your success isn’t directly tied to the success of the people running the project. This often doesn’t meet the common enterprise requirement of the Howey Test.

- Horizontal Commonality: This is about the connection among investors. If all investors are looking to profit together, it’s likely considered a common enterprise.

- Narrow Vertical Commonality: This focuses on the link between your profits and the actions of the project’s organizers. Decentralized projects usually don’t match this idea because the connection is too indirect.

Profits Expectations

The test checks if you’re relying on someone else’s efforts to make money from your investment. If you’re counting on a company or project team to make your investment profitable, it could be a security.

Reliance on Others for Profit

If your investment’s success depends on the work of others, the Howey Test might label it as a security. This is crucial because:

Why This Matters:

- Not knowing who’s in charge of your investment can lead to a lack of control.

- Scams often promise high returns with no effort on your part, which is risky.

- Securities are regulated more strictly than other types of investments, such as gold or real estate.

- If your investment is deemed a security, it falls under the jurisdiction of regulatory bodies like the SEC.

Being aware of these factors is essential for anyone investing in digital assets like cryptocurrencies. It helps you understand the legal implications and ensures you make informed decisions.

Howey Test and Cryptocurrencies

This test is crucial for determining if your cryptocurrency investments are considered securities and thus subject to specific legal requirements. The Howey Test examines four main areas to make this determination.

The relevance of the Howey Test to cryptocurrencies is significant. It dictates whether your investment must adhere to certain regulatory standards. The “common enterprise” aspect of the test, in particular, evaluates if your potential profits are linked with those of other investors. It often depends on your project’s overall performance.

How the Howey Test’s four criteria apply to cryptocurrencies is an ongoing discussion. As the digital currency market expands, so does the conversation about how these investments fit within existing laws.

This test serves as a crucial guideline for regulators and investors exploring the relatively new terrain of digital assets.

Does Crypto Pass the Howey Test?

Figuring out if digital assets like cryptocurrencies are considered securities by the Howey Test is a bit complex. You might question whether something like Bitcoin falls under this category. It’s not as straightforward as a simple yes or no answer.

To put it plainly, Jay Clayton, who was the SEC chair in 2018, mentioned that cryptocurrencies such as Bitcoin don’t count as securities. They act more like digital currencies, similar to dollars or euros.

So, when we ask if Bitcoin passes the Howey Test, the answer leans towards no because Bitcoin doesn’t rely on a collective effort. Or it doesn’t depend on a specific promoter for its value to increase. It behaves more like an asset, akin to gold.

However, Initial Coin Offerings (ICOs) tell a different tale. Clayton pointed out that every ICO he came across acted as a security. With ICOs, you invest money to receive a digital token, hoping that it will increase in value thanks to the efforts of others. This scenario fits right into the Howey Test criteria. It labels them as securities that must adhere to certain regulations.

Tokens that don’t meet the Howey Test criteria are often called utility tokens. These are essentially digital vouchers for future services. Yet, even these can sometimes be seen as securities, depending on the details.

Examples of What Has and Hasn’t Passed the Howey Test

To get a clearer picture, let’s explore some examples that describe how the Howey Test is applied. This test is crucial because it determines whether deals are considered investment contracts.

Now, let’s check out what has and hasn’t passed the Howey test:

| Investment Type | Howey Test Outcome | Explanation |

| Common Stock | Pass | Expecting profits from others’ efforts in the enterprise. |

| Condominium Units | Fail | Typically fails for personal use or control without profit expectations. |

| Real Estate Limited Partnerships | Pass | Passes with profits expected from the managing partner’s efforts. |

| Whiskey Warehouse Receipts | Fail | Fails due to the lack of a common enterprise and primary profits source. |

| Multi Level Marketing Schemes | Pass | Passes when earnings are primarily from recruiting others, meeting investment criteria. |

| Merchandise Accounts | Fail | Fails as purchasing for discounts lacks the expectation of profits from others’ efforts. |

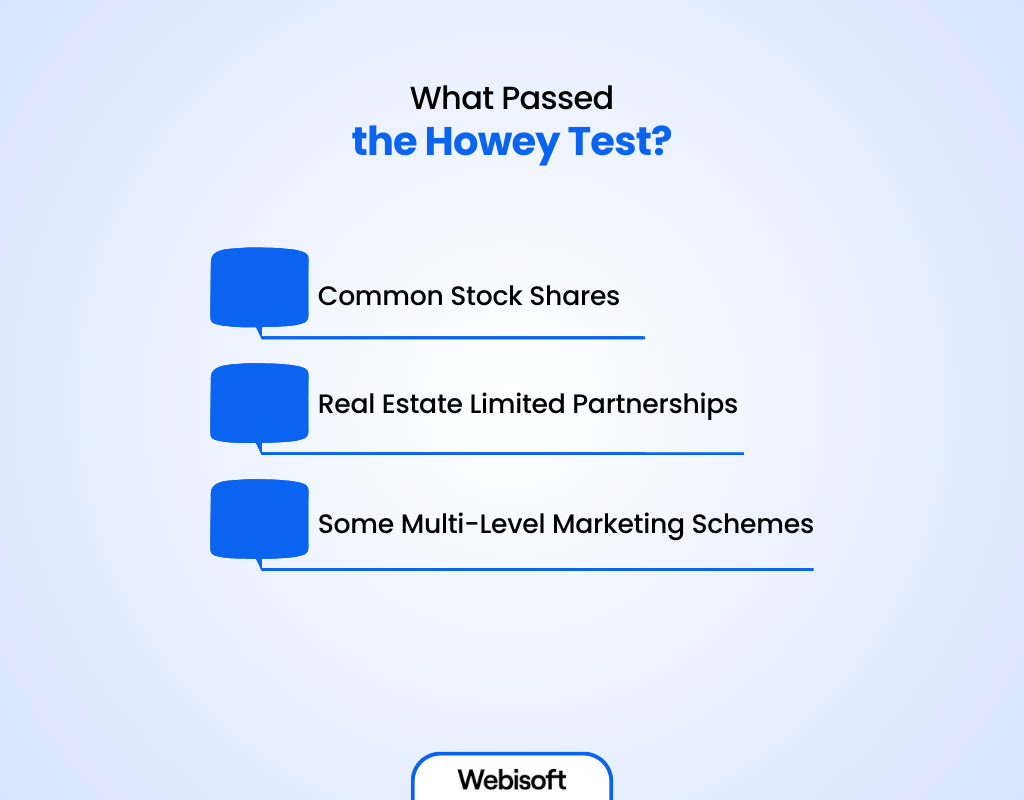

What Passed the Howey Test?

The Howey Test helps decide if an investment is legally considered a security. Here’s what made the cut:

- Common Stock Shares: Investing in company shares usually passes. You’re putting your money into a business, hoping to make money from what others do.

- Real Estate Limited Partnerships: This is another pass. By investing in real estate through partnerships, you expect to make money from the managing partner’s efforts.

- Some Multi-Level Marketing Schemes: These schemes pass because you earn money by recruiting others. The Supreme Court has recognized these as investment contracts since your profits largely depend on recruiting efforts.

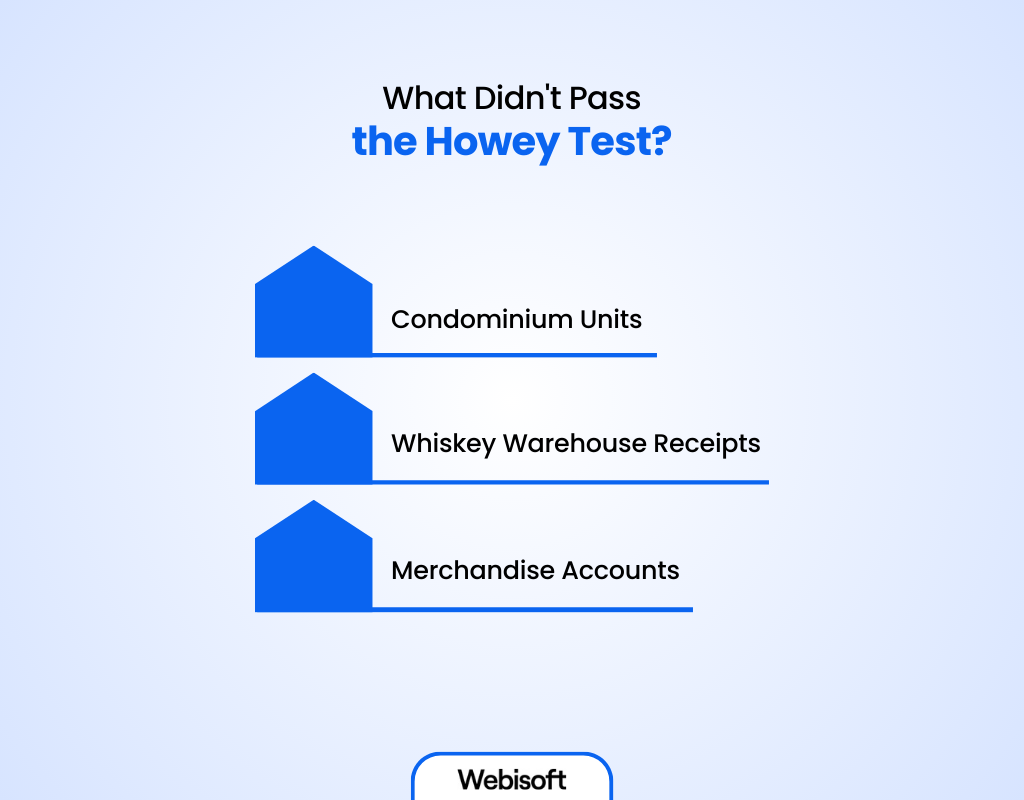

What Didn’t Pass the Howey Test?

Not everything meets the criteria. Here’s what failed:

- Condominium Units: Buying a condo for personal use or control doesn’t pass. You’re not expecting to profit from the work of others.

- Whiskey Warehouse Receipts: Trading these as collateral doesn’t meet the test. There’s no joint business effort aimed at making profits from others’ work.

- Merchandise Accounts: Buying these for discounts on goods fails the test. You’re not looking to make a profit from someone else’s efforts.

Howey Test Criteria: Different Interpretations

Since the Howey test was introduced, different courts have not always agreed on how to apply it. This disagreement has made it harder to understand exactly what the test’s criteria mean. Let’s clarify some of these different views:

What Counts as a Common Enterprise?

Usually, courts look at something called “horizontal commonality.” Thus, they consider a setup where investors all put their money into the same pot. And, how much money each person makes depends on how well the whole investment does.

But there’s another perspective known as “vertical commonality.” It zeroes in on the relationship between the money of an investor. However, it hopes to make the effort the person or company asking for the investment puts in.

What Does ‘Expectation of Profits’ Mean?

There’s debate over what “expectation of profits” really means. Some courts look for a promise of dividends or value increase. Others might consider different forms of return, like just avoiding a loss. So, what counts as expecting a profit can vary.

How Much Effort Should Come from the Promoter?

There’s also a debate about how important the promoter’s work is to the chance of making a profit. Most courts pay attention to whether the promoter controls the business decisions that affect the investment’s success.

However, some also look at how vital the promoter’s role is in the overall success of the investment. Overall, the Howey test is crucial for deciding whether an investment needs to be regulated.

Nonetheless, how it’s used can vary widely based on where you are, the details of the case, and what kind of financial product is being offered. This variability makes it somewhat challenging to get a clear grasp of how the test is applied.

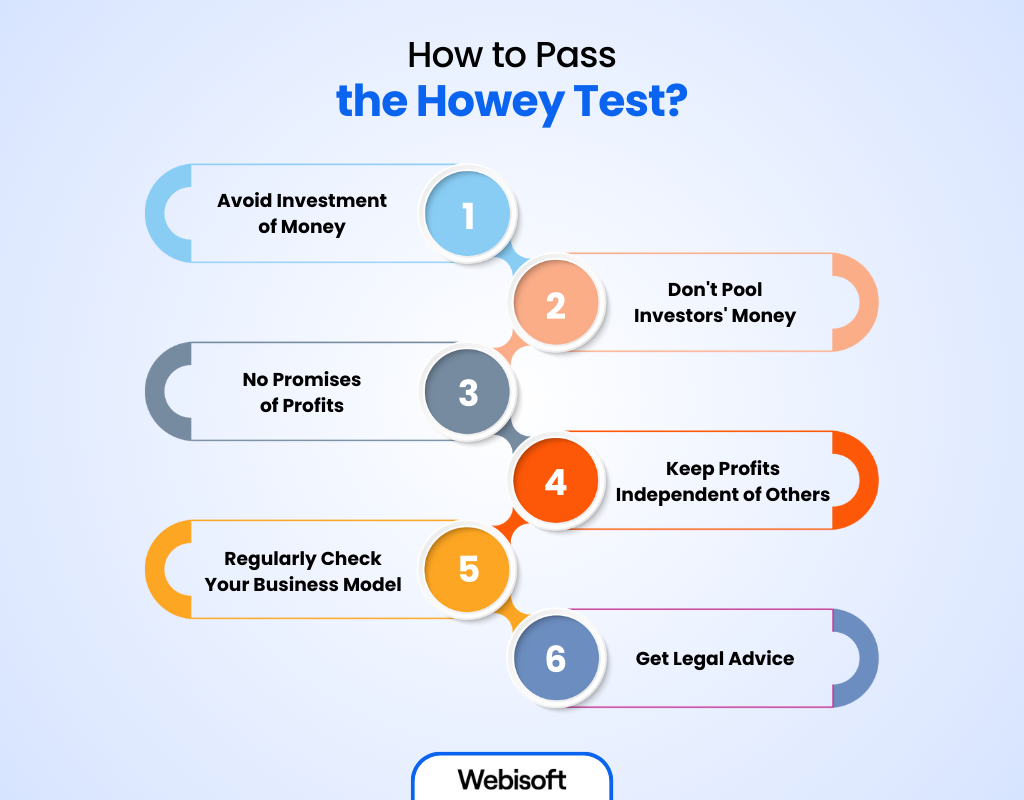

How to Pass the Howey Test?

Dealing with the Howey Test and Howey rule can be tricky if you’re in a business that might be seen as offering investments.

In short, to pass the Howey Test, your business should not look like an investment opportunity. It’s about making sure you’re selling a product or service, not a chance to make money. With careful planning and legal help, you can navigate this challenge successfully.

Here’s a straightforward guide to help you stay clear of being labeled as an investment under this test.

Step 1: Avoid Investment of Money

Make sure your business model doesn’t revolve around collecting money from people with the promise of financial returns. Focus on selling your products or services directly.

However, this approach keeps you on the safe side. It emphasizes that you’re offering a real value proposition, not an investment opportunity.

Step 2: Don’t Pool Investors’ Money

Ensure your business operations do not involve combining funds from various investors. Your business’s success should not dictate the financial outcomes for your investors.

This distinction is crucial to demonstrate that your operation does not constitute a common enterprise, a key element the Howey Test evaluates.

Step 3: No Promises of Profits

Be explicit that your offering does not include the promise of profits. Any potential gains should result from the customer’s own endeavors. It clearly distancing your proposition from investment opportunities where returns are expected from the efforts of those managing the investment.

Step 4: Keep Profits Independent of Others

Your business should encourage active participation from clients or users. It should ensure any profits are not primarily derived from the efforts of others.

This emphasizes the non-investment nature of your business. In business success depends on individual engagement rather than passive expectation of profits.

Step 5: Regularly Check Your Business Model

Always keep an eye on how your business matches up with the Howey Test. The financial world changes often and so does the way this test is applied. Be ready to adjust your business if needed.

Step 6: Get Legal Advice

With all the legal complexities, talking to a lawyer is a smart move. They can give specific advice for your situation. Moreover, they can help you stay clear of legal issues related to the Howey Test.

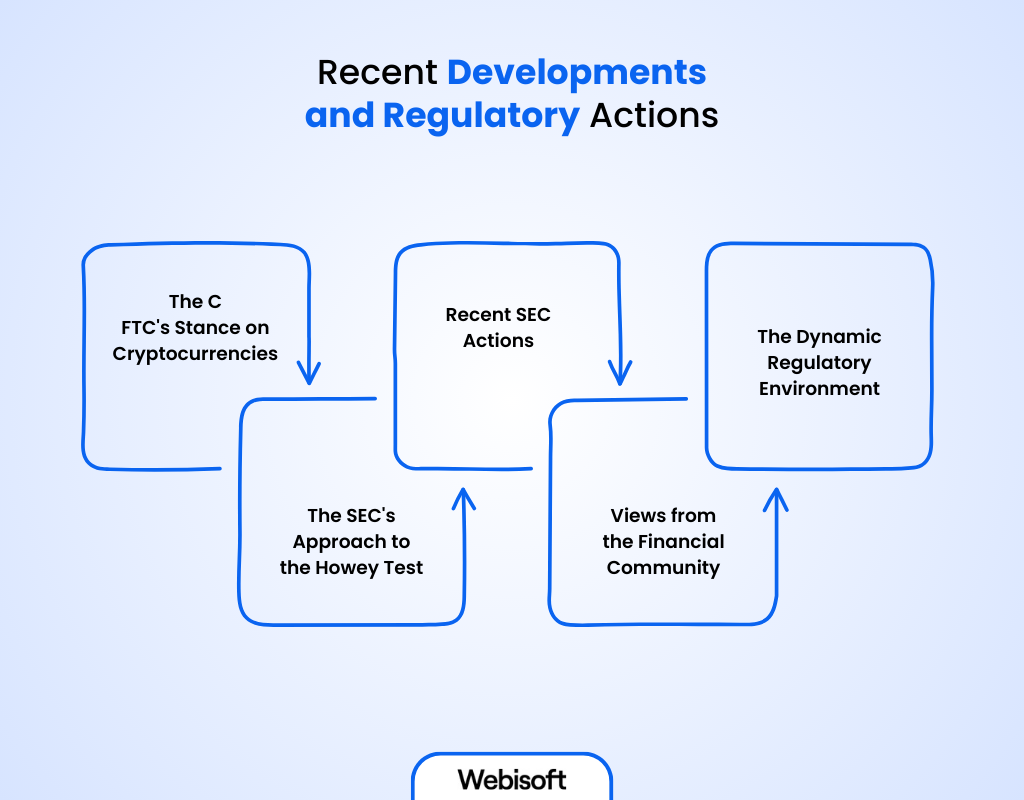

Recent Developments and Regulatory Actions

The cryptocurrency scene is always changing, particularly with rules and regulations. Two key regulators in this space are the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission).

Here’s a simple look at what they do and how they see things.

The C FTC’s Stance on Cryptocurrencies

The CFTC started getting involved back in 2015, treating virtual currencies like commodities. This viewpoint matters because it affects how cryptocurrencies are traded and the rules they follow.

The SEC’s Approach to the Howey Test

The SEC, on the other hand, often views many cryptocurrencies as unregistered securities. They use something called the Howey Test to decide this. Basically, if you buy cryptocurrency expecting to make money mainly from other people’s work, the SEC considers it a security.

Recent SEC Actions

Lately, the SEC has been really active in applying these rules. For example, they’ve gone after companies like Ripple Labs, showing they’re serious about seeing certain cryptocurrencies as securities.

Views from the Financial Community

Organizations like the Independent Community Bankers of America agree with the SEC that many cryptocurrencies should be seen as securities according to the Howey Test. This shows more and more people in finance are paying attention to how cryptocurrencies fit into existing laws.

The Dynamic Regulatory Environment

What we’re watching is a changing situation with how cryptocurrencies are regulated. The SEC and CFTC are both trying to figure out the best way to handle these digital assets.

But, there’s not yet a clear agreement on how everything should work. The SEC uses the Howey Test to classify some cryptocurrencies as securities. It can differ from the CFTC’s approach.

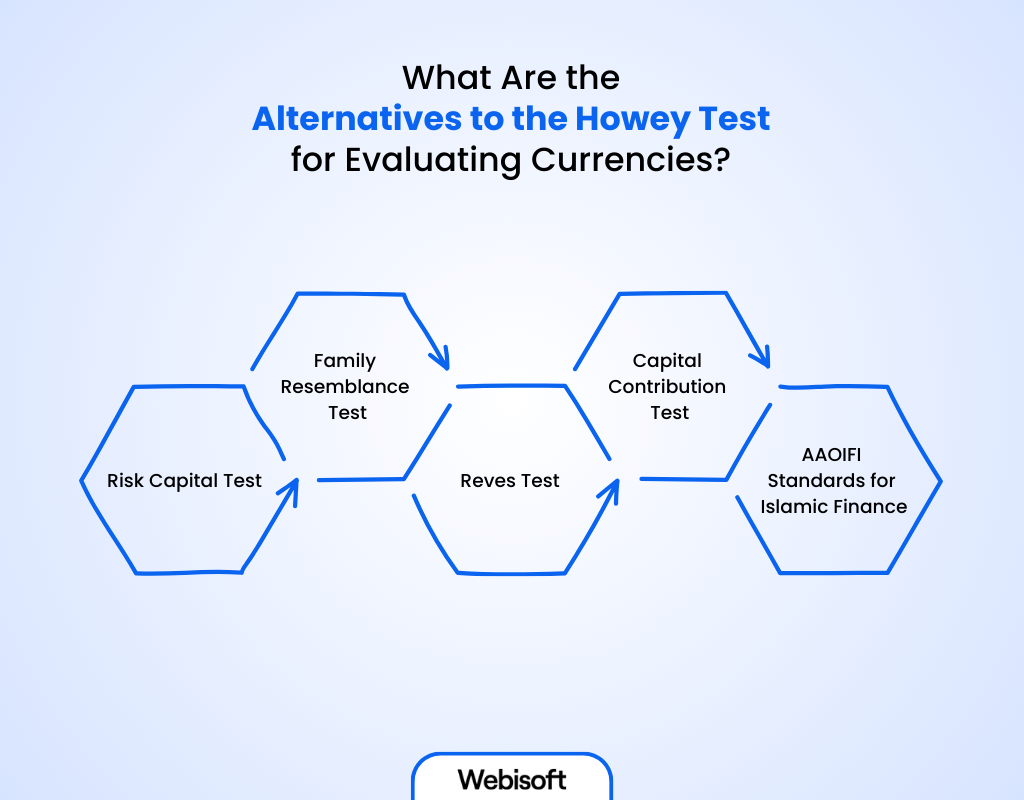

What Are the Alternatives to the Howey Test for Evaluating Currencies?

Looking into whether a cryptocurrency is more like a standard investment? You don’t only have to use the Howey Test. There are other ways to check.

Let’s take a look at some different ways to evaluate cryptocurrencies.

| Method | Key Focus |

| Howey Test | Investment with expectation of profit from others’ efforts. |

| Risk Capital Test | Risk of losing capital in a venture beyond control. |

| Family Resemblance Test | Compares transaction to typical securities. |

| Reves Test | Similarity to traditional securities in motivation and distribution. |

| Capital Contribution Test | Investor’s control or effort’s impact on success. |

| AAOIFI Standards | Compliance with Sharia law for cryptocurrencies. |

Risk Capital Test

This test sees how risky your investment is. It checks if you might lose your money on something you can’t control. Moreover, it’s helpful when it’s unclear if someone else’s hard work might make you profit, a big part of the Howey Test.

Family Resemblance Test

Started in 1990, this test compares your deal to common securities deals. It looks at why you’re investing, how people sell the investment, what you hope to get, and if any other rules might fit. Moreover, it suits new, tricky investments like some cryptos.

Reves Test

This test comes from a Supreme Court case. It checks if your investment is like typical securities by looking at your investment reasons, your profit hopes, and how they sell the investment. Also, it’s quite like the Family Resemblance Test.

Capital Contribution Test

This test works well for things like Ethereum’s decentralized system. It looks at how much control you have over your money. Moreover, it’s good when the Howey Test doesn’t quite work out, checking if your own effort could help your investment succeed.

AAOIFI Standards for Islamic Finance

For a crypto investment to be okay under Islamic finance, it must meet AAOIFI standards. These standards check if the investment is acceptable under Sharia law, avoiding things like interest, too much uncertainty, and gambling.

Final Note

In conclusion, understanding the Howey Test is essential if you’re involved in cryptocurrency investing. It helps you figure out if your crypto investments are considered securities and if they need to follow strict rules set by the SEC.

If the crypto assets are securities, the companies offering them must give out detailed information to investors and register with the SEC. Not doing this can lead to legal trouble.

However, exploring cryptocurrency and its regulations doesn’t have to be overwhelming. With Webisoft’s support, diving into the complexities of cryptocurrency is made easier. We provide the insights and expert advice you need to explore the crypto market confidently.

Frequently Asked Questions

How Does the Howey Test Apply to Cryptocurrencies?

The Howey Test is used to see if cryptocurrencies are considered securities. It’s important for following the law and protecting investors in the fast-changing world of digital assets.

Can the Howey Test Affect My Investments?

Absolutely, the Howey Test can impact your investments. If your investment is considered a security under this test, it has to meet certain legal and regulatory standards. It affects how legal it is and what rights you have.

How is the Howey Test Used Today?

Today, the Howey Test is still a critical method for regulators and courts to check different investment opportunities against the law. This helps make sure they follow the rules of securities laws.