How Does Cryptocurrency Work? A Detailed Guide

- BLOG

- Crypto

- October 18, 2025

The rapid rise of digital currencies has introduced both opportunity and confusion. Yet a fundamental question remains: how does cryptocurrency work? Cryptocurrency operates through decentralized, cryptographic networks that eliminate the need for intermediaries while enhancing transaction transparency. This guide offers a comprehensive explanation to help investors understand cryptocurrency’s core mechanisms and practical implications.

Contents

- 1 What is Cryptocurrency?

- 2 How Does Cryptocurrency Work?

- 3 How Cryptocurrency Addresses Are Used?

- 4 Common Cryptocurrency Examples and How They Work?

- 5 Country-based Regulations on Cryptocurrency

- 6 What Are the Advantages And Limitations of Cryptocurrency?

- 7 Ready to launch your crypto project? Contact Webisoft today!

- 8 Real World Use Cases of Cryptocurrencies

- 9 How Webisoft Helps in Your Next Cryptocurrency Development

- 10 In Closing

- 11 Frequently Asked Questions

What is Cryptocurrency?

Cryptocurrency is a digital form of money that uses cryptographic techniques to secure transactions. It control the creation of new units, and verify the transfer of assets on a decentralized network, typically a blockchain. Unlike traditional currencies issued by governments (fiat), cryptocurrencies operate without a central authority. It rely on distributed consensus mechanisms, such as proof of work or proof of stake to maintain their integrity and transparency. The foundation of cryptocurrency lies in blockchain technology, a distributed ledger system that records every transaction across a network. This ensures transparency, prevents tampering, and removes the need for third-party verification. Each cryptocurrency functions through a set of protocols that govern its supply, issuance, and security. Most are decentralized, meaning no single entity has control over the network.

How Does Cryptocurrency Work?

Cryptocurrency transactions move digital assets between wallets. Each wallet has a unique address. Transactions are signed with private keys. The network verifies and records them on the blockchain.

Cryptocurrency transactions move digital assets between wallets. Each wallet has a unique address. Transactions are signed with private keys. The network verifies and records them on the blockchain.

i) Wallets and Addresses

Cryptocurrency wallets are digital tools that allow users to store and manage their crypto assets securely. They come in several types based on their connectivity and storage method:

- Software Wallets: These are applications installed on desktops or mobile devices, connected to the internet. They enable quick access to cryptocurrencies and facilitate transactions, but are more vulnerable to online threats. Examples include Electrum and Mycelium.

- Hardware Wallets: Physical USB-like devices that store private keys offline (cold wallets). They provide enhanced security by isolating keys from internet exposure. Mostly, they are considered the safest option for storing large amounts of cryptocurrency.

- Paper Wallets: Physical printouts or handwritten notes containing public and private keys. Since they are offline, they are immune to hacking but require careful handling to avoid physical loss or damage.

ii) A Technical Perspective on Wallet Types

While software, hardware, and paper wallets are commonly used categories, technically, all cryptocurrency wallets fall into two broader types based on how they connect to the internet:

- Hot Wallets: These are always connected to the internet, making them convenient for frequent transactions but more vulnerable to cyber threats. Software wallets, such as mobile apps, desktop wallets, and web-based wallets, are all examples of hot wallets.

- Cold Wallets: These are offline wallets that store private keys away from internet exposure, offering higher security. Both hardware wallets and paper wallets fall into this category, as they operate without continuous internet access.

Understanding this distinction helps clarify how does cryptocurrency work. Users managing large holdings often prefer cold wallets for long-term storage, while hot wallets are ideal for quick, daily use. If you are still confused about where to get started, take advantage of our advanced crypto development service and grow in the industry.

How Cryptocurrency Addresses Are Used?

Every cryptocurrency wallet is built on a pair of cryptographic keys: a public key and a private key. These two keys work together to enable secure transactions. The public key is mathematically linked to the private key and is used to generate your cryptocurrency address. They are likely the unique identifier that others can use to send you funds. Think of the public key as your “email address”: it’s safe to share, and it’s how people know where to send money. The private key, on the other hand, is like your password or signature. It gives you full control over the funds in your wallet. When you want to send cryptocurrency, your wallet uses the private key to sign the transaction. You will get the rightful ownership without revealing the key itself. The blockchain network verifies the digital signature using your public key, ensuring the transaction is legitimate. Importantly, whoever holds the private key controls the funds, which is why private key security is critical. In essence, a cryptocurrency address is a simplified form of your public key. It allows others to send you crypto, while the private key ensures only you can spend it.

Every cryptocurrency wallet is built on a pair of cryptographic keys: a public key and a private key. These two keys work together to enable secure transactions. The public key is mathematically linked to the private key and is used to generate your cryptocurrency address. They are likely the unique identifier that others can use to send you funds. Think of the public key as your “email address”: it’s safe to share, and it’s how people know where to send money. The private key, on the other hand, is like your password or signature. It gives you full control over the funds in your wallet. When you want to send cryptocurrency, your wallet uses the private key to sign the transaction. You will get the rightful ownership without revealing the key itself. The blockchain network verifies the digital signature using your public key, ensuring the transaction is legitimate. Importantly, whoever holds the private key controls the funds, which is why private key security is critical. In essence, a cryptocurrency address is a simplified form of your public key. It allows others to send you crypto, while the private key ensures only you can spend it.

i) Making a Transaction

To send cryptocurrency, the sender inputs the recipient’s wallet address and the amount to transfer. The sender’s wallet software uses their private key to digitally sign the transaction, proving ownership of the funds. This signed transaction is broadcast to the blockchain network, where it awaits verification. The recipient receives the cryptocurrency once the transaction is confirmed and recorded on the blockchain ledger.

ii) Transaction Verification Process

Once broadcast, the transaction is verified by network participants (miners or validators). They check that the sender has sufficient balance and that the digital signature is valid. Verified transactions are grouped into blocks, which are added to the blockchain through consensus mechanisms like proof-of-work or proof-of-stake. This process ensures transaction authenticity and prevents double-spending.

iii) Transaction Fees

Transaction fees are paid by the sender to incentivize miners or validators to prioritize and process their transactions. Fees vary based on network congestion and transaction size. Higher fees generally lead to faster confirmations, as miners prioritize transactions offering greater rewards

Common Cryptocurrency Examples and How They Work?

At thai stage of learning how does cryptocurrency work, we will know about its usabilitres. The crypto market includes thousands of coins, but only a few dominate in terms of usage, market value, and influence. Below are the key cryptocurrencies worth knowing:

At thai stage of learning how does cryptocurrency work, we will know about its usabilitres. The crypto market includes thousands of coins, but only a few dominate in terms of usage, market value, and influence. Below are the key cryptocurrencies worth knowing:

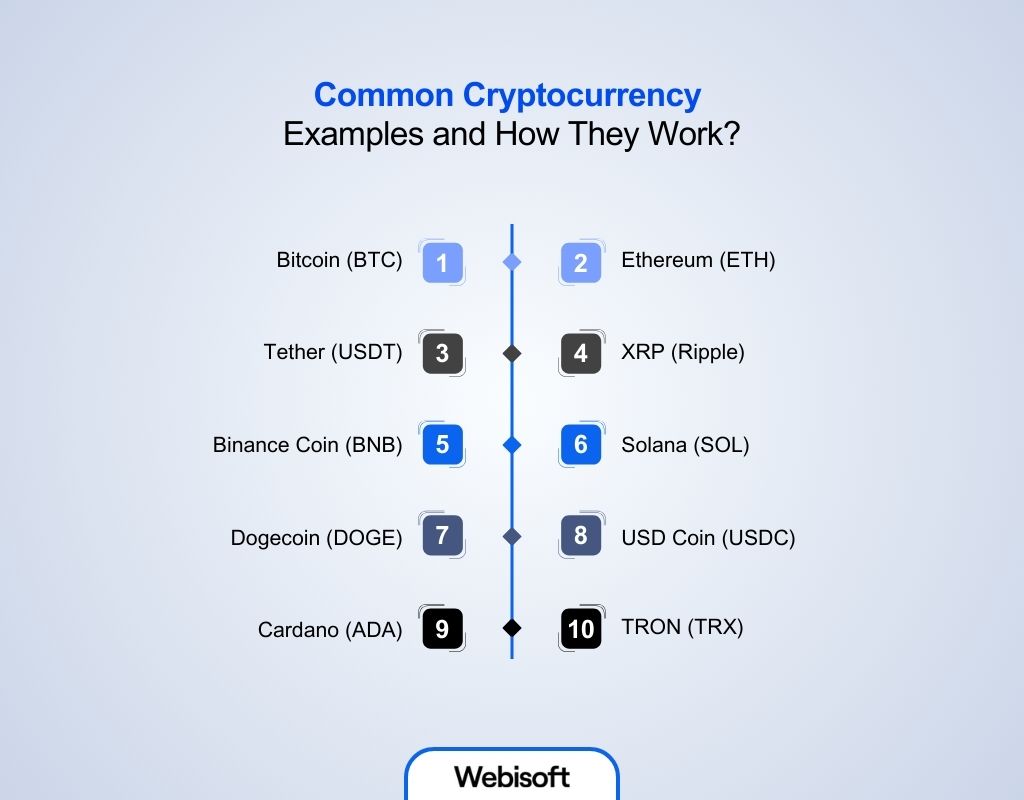

i) Bitcoin (BTC)

Bitcoin is the first cryptocurrency, operating on a proof-of-work blockchain with a capped supply of 21 million coins. It functions as digital gold, primarily used as a store of value and peer-to-peer digital cash. Transactions are verified by miners solving complex puzzles to add blocks to the blockchain134.

ii) Ethereum (ETH)

Ethereum introduced smart contracts, enabling decentralized applications (dApps). It is transitioning from proof-of-work to proof-of-stake consensus, which reduces energy consumption. Ethereum powers much of the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems137.

iii) Tether (USDT)

Tether is a stablecoin pegged 1:1 to the U.S. dollar, designed to minimize volatility. It is widely used for trading and liquidity on exchanges, allowing users to move value without exposure to crypto price fluctuations13.

iv) XRP (Ripple)

XRP is designed for fast, low-cost cross-border payments. Ripple Labs helps banks and financial institutions improve global money transfers and settlements using the XRP ledger for fast transactions.

v) Binance Coin (BNB)

BNB was initially created to reduce trading fees on the Binance exchange. It now powers various applications on Binance Smart Chain. Such as decentralized exchanges, NFTs, and transaction fees, using a proof-of-stake authority consensus13.

vi) Solana (SOL)

Solana is known for high throughput and low transaction costs. It uses a unique hybrid consensus combining proof-of-history and proof-of-stake to enable fast, scalable smart contracts and DeFi applications13.

vii) Dogecoin (DOGE)

Dogecoin started as a meme coin and uses proof-of-work like Bitcoin. Despite its origins, it is popular for tipping, microtransactions, and has a strong community backing. It operates on a decentralized blockchain with fast block times13.

viii) USD Coin (USDC)

USDC is a regulated, dollar-backed stablecoin issued by Circle.It focuses on transparency and regulatory compliance, making it popular in DeFi and payment systems as a stable value.

viii) Cardano (ADA)

It’s a blockchain platform built for creating secure, scalable apps and smart contracts. What makes it different is its use of a proof-of-stake system, which is much more energy-efficient compared to the traditional proof-of-work. Cardano focuses on security, sustainability, and scalability, aiming to provide a long-term solution for the crypto world. The ADA token is used for staking, voting, and paying fees, offering a more eco-friendly and efficient alternative to many other blockchains.

ix) TRON (TRX)

TRON is built to decentralize content sharing and entertainment platforms. Instead of big platforms owning your content and profits, TRON allows you to share directly with users using blockchain. TRON can handle lots of transactions very quickly, which is important for things like gaming or streaming. It is cheap to use, making it attractive for developers and users.

Country-based Regulations on Cryptocurrency

Cryptocurrency regulations vary widely across regions. While some governments embrace digital assets, others impose restrictions or outright bans.

Cryptocurrency regulations vary widely across regions. While some governments embrace digital assets, others impose restrictions or outright bans.

i) United States

The U.S. lacks a unified federal crypto framework. Instead, agencies like the SEC, CFTC, and FinCEN regulate based on securities, commodities, or money services. Some states, like New York, require a BitLicense for crypto businesses. Tax reporting is required by the IRS, and KYC rules are enforced nationally.

ii) Asia

Regulation across Asia is mixed. Japan recognizes cryptocurrencies as legal property and regulates exchanges through its Financial Services Agency. In contrast, China has banned crypto trading and mining entirely. Singapore promotes a balanced approach via the Monetary Authority of Singapore. It focuses on innovation with strong anti-money laundering (AML) oversight.

iii) Europe

The European Union is implementing MiCA (Markets in Crypto-Assets Regulation) to standardize rules across member states. MiCA focuses on consumer protection, stablecoin oversight, and AML enforcement. Countries like Germany have integrated crypto into existing financial laws, while others await EU-wide clarity. The European Central Bank is also studying digital euro frameworks.

iv) Latin America

Argentina has no outright crypto ban but restricts banking services related to crypto. It applies taxation and is exploring regulatory frameworks. In 2023, Brazil officially allowed people and businesses to use cryptocurrencies (like Bitcoin, Ethereum) to pay for goods and services. The Central Bank is developing a digital real CBDC.

v) Oceania

Australia classifies cryptocurrencies as legal property subject to capital gains tax. Crypto businesses must register with AUSTRAC and comply with AML/CTF laws. ASIC regulates ICOs and crypto exchanges, with plans for a licensing framework and a potential CBDC

What Are the Advantages And Limitations of Cryptocurrency?

Cryptocurrency has reshaped the financial landscape with new efficiencies, but it also introduces distinct risks. A clear view of both its strengths and drawbacks is essential to fully understand how does cryptocurrency works and to make informed decisions.

| Advantages | Limitations |

| Decentralization reduces single points of failure | Regulatory uncertainty creates compliance risks |

| Borderless transactions enable global financial access | High volatility undermines its use as a stable currency |

| Lower fees for cross-border payments | Scalability issues limit transaction throughput |

| 24/7 trading availability with no market close | Lack of consumer protections for lost or stolen assets |

| Transparent blockchain records improve audibility | Cybersecurity threats, including exchange hacks |

| Ownership of private keys ensures user-controlled assets | Complex interfaces hinder adoption by non-technical users |

| Tokenization allows new asset classes to emerge | Environmental concerns tied to energy-intensive blockchains |

Building a cryptocurrency requires expert skills, which can be complex and costly. However, with Webisoft, you gain access to top-tier expertise at a cost-effective price, ensuring quality without breaking the bank.

Ready to launch your crypto project? Contact Webisoft today!

Let’s build your crypto success together.

Real World Use Cases of Cryptocurrencies

Get to know practical cryptocurrency use cases that are powering the industries:

Get to know practical cryptocurrency use cases that are powering the industries:

1. Payments and Transactions

When you use cryptocurrency for payments, you can send money quickly and securely, whether it’s for online shopping or sending funds across the world. There are no middlemen, which means you pay lower fees and your transactions happen faster. For example, platforms like Ripple make it easy for you to transfer money internationally almost instantly, saving you time and money.

2. Decentralized Finance (DeFi)

With DeFi, you don’t need a bank to lend, borrow, or earn interest on your money. You can use decentralized platforms to manage your crypto assets directly. Smart contracts automate these processes, so you can participate in activities like yield farming or lending without complicated paperwork or approvals. It’s a way for you to access financial services anytime, anywhere, with more control and transparency.

3. Non-Fungible Tokens (NFTs)

If you’re into digital art, music, or collectibles, NFTs let you own unique digital items that no one else has. Each NFT is stored on the blockchain, proving that you truly own that digital asset. This gives you a new way to support creators and even make money by buying, selling, or trading these one-of-a-kind items securely.

4. Smart Contracts and Decentralized Applications (DApps)

Smart contracts work like digital agreements that automatically execute when conditions are met middleman. This means you can use decentralized apps (DApps) for things like finance, gaming, or even tracking products in a supply chain. All with more trust and less hassle. It’s a way for you to interact with services that are transparent and efficient.

5. Crypto Derivatives

Advanced traders use crypto futures, options, or perpetual contracts to speculate on price movements or hedge risk. These tools are offered on specialized exchanges and involve leverage, making them high-risk and not suitable for beginners.

How Webisoft Helps in Your Next Cryptocurrency Development

At Webisoft, we transform your cryptocurrency ideas into reality with tailored solutions that are efficient, secure, and built for growth. Our expert team provides a comprehensive range of services designed to guide you at every stage of your cryptocurrency journey.

1. Custom Blockchain Development

We understand that every business is unique, and your blockchain should reflect that. Webisoft creates custom blockchains tailored to your specific needs, ensuring security and high performance. Our goal is to build a blockchain that supports your vision, whether you are launching a new cryptocurrency or building an entire ecosystem around it.

2. Smart Contract Development & Auditing

Webisoft develops robust, flawless smart contracts tailored to your use case and then audits them for safety and efficiency. Our rigorous testing ensures that your smart contracts work seamlessly in real-world scenarios.

3. Secure and Scalable Solutions

Webisoft’s crypto solutions are designed for scalability and high performance. As your platform grows, we ensure that your systems can handle an increasing number of users without compromising security or speed.

4. User-Friendly Wallet Integration

A great user experience starts with a seamless wallet. Webisoft offers smooth wallet integration for your crypto platform. You can store, send, and receive digital currency with ease. We ensure that your wallet system is intuitive, secure, and packed with the features your users need.

5. End-to-End Crypto Exchange Platforms

Whether you’re looking for a centralized exchange, a decentralized exchange, or a hybrid model, Webisoft builds platforms that support the full range of trading needs. From peer-to-peer systems to fiat-to-crypto platforms, you will experience easy cash-to-crypto transactions.

6. Advanced Token Standards Compliance

Stay ahead of the curve with Webisoft’s advanced token development services. We design and create tokens that meet the latest global standards. We ensure your project is compliant with regulatory frameworks. This gives your crypto project instant trust and reliability in the market.

In Closing

To sum up, how does cryptocurrency work? It is more than a financial trend. It represents a shift in how digital systems handle value, trust, and ownership. As adoption accelerates, so does the need for reliable, secure, and scalable blockchain solutions. If your business is exploring crypto integration or blockchain infrastructure, Webisoft provides expert development services. From custom wallets to full-scale platforms and payment gateways, they help to build secure, future-ready solutions tailored to your digital asset strategy.

Frequently Asked Questions

Can cryptocurrency be used for everyday purchases?

Yes, some retailers and service providers accept cryptocurrency, especially Bitcoin. However, adoption varies by region, and transaction speed or volatility may affect its practicality.

Is cryptocurrency legal worldwide?

Legality varies. Some countries permit regulated use, others restrict it, and a few have banned it entirely. Always review local regulations before investing or transacting in crypto.

What is a smart contract in cryptocurrency?

A smart contract is a self-executing program stored on a blockchain. It automatically enforces conditions agreed upon by both parties, eliminating the need for intermediaries.

Are crypto transactions anonymous?

Not entirely. Most blockchains are pseudonymous. Transactions are public but not directly linked to personal identities. Privacy-focused coins offer more anonymity but raise regulatory concerns.

How is cryptocurrency taxed?

Taxation depends on jurisdiction. In many countries, cryptocurrencies are treated as property, meaning gains are subject to capital gains tax. Always consult with a tax advisor.