Imagine a realm where banking and investments are not as alien as they seem. It’s a world you’re already part of, even if you’re unaware.

Now, let’s introduce a game-changer: blockchain. Yes, you’ve heard it right!

Blockchain is not just a buzzword. It’s a revolutionary distributed ledger technology. It’s making a significant impact on numerous industries globally. Why is it so influential? The answer lies in its core features. Blockchain is transparent, immutable, and decentralized.

Transparency ensures that all transactions are open for verification. Immutability means that it cannot be altered once a transaction is recorded. Decentralization implies that the control of the network is not in the hands of a single entity. Instead, it’s distributed across multiple nodes or participants.

These features are causing a stir, a positive disruption. They transform how we conduct business, manage data, and build trust. And one of the sectors where blockchain is making substantial waves is banking.

Are you ready to harness the power of blockchain in banking? Webisoft is here to guide you through the process. So, let’s embark on this journey to explore how blockchain is transforming banking.

Contents

- 1 Blockchain: Beyond Cryptocurrency

- 2 Addressing Banking Challenges with Blockchain

- 3 Blockchain Applications in Banking: A Deep Dive

- 4 What Are the Different Blockchain in Banking Case Studies?

- 4.1 1. Cross-Border Payments: Ripple and Santander

- 4.2 2. Trade Finance: HSBC and R3 Corda

- 4.3 3. Identity Verification: SecureKey and Canadian Banks

- 4.4 4. Syndicated Loans: BNP Paribas, Credit Suisse, and Synaps Loans

- 4.5 5. Asset Tokenization: Société Générale

- 4.6 6. Smart Contracts for Derivatives: JPMorgan Chase and Quorum

- 4.7 7. Supply Chain Financing: IBM and We.Trade

- 5 How Blockchain Technology Will Change the Future of the Banking System

- 5.1 1. Enhanced Security

- 5.2 2. Faster Cross-Border Payments

- 5.3 3. Improved Transparency and Trust

- 5.4 4. Streamlined Trade Finance

- 5.5 5. Smart Contracts

- 5.6 6. Asset Tokenization

- 5.7 7. Enhanced Identity Verification

- 5.8 8. Decentralized Finance (DeFi)

- 5.9 9. Sustainability and Environmental Considerations

- 6 Webisoft Blockchain Devleopment Service

- 7 Frequently asked questions

- 8 Conclusion

Blockchain: Beyond Cryptocurrency

Blockchain technology, the backbone of cryptocurrencies, has grown beyond fueling Bitcoin or ether transactions.

Its secure and transparent nature has led to its adoption across various industries, promoting growth and development. The banking sector is no exception to this trend. Blockchain can revolutionize banking by enhancing security, efficiency, and flexibility.

This article will explore blockchain technology’s growing challenges and potential applications in the banking sector. So, let’s see how blockchain can transform this field!

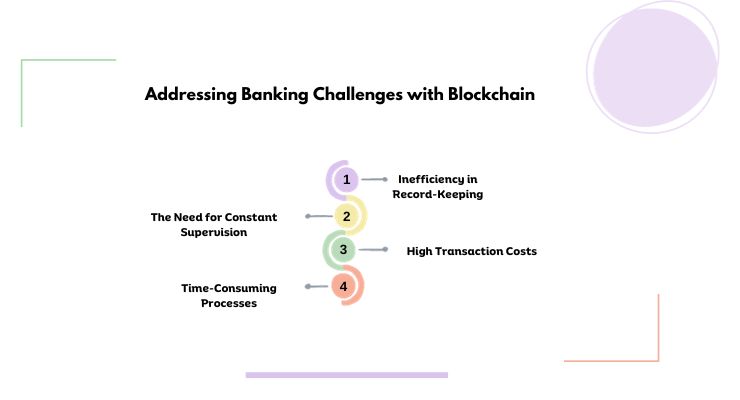

Addressing Banking Challenges with Blockchain

The banking industry, despite its ubiquity, grapples with numerous hurdles. With its secure, transparent, decentralized, and cost-effective attributes, blockchain can address these challenges. Let’s delve into how:

Challenge 1: Inefficiency in Record-Keeping

Traditional banking works on managing transaction records due to a growing user base. This leads to extended payment processing times. Blockchain can revolutionize this aspect by making data management efficient, quick, and secure.

In traditional banking, each transaction must be recorded. As the user base expands, this task becomes increasingly complex. It leads to delays in payment processing and potential errors. Blockchain, however, can streamline this process.

Blockchain’s distributed ledger for finance allows for efficient and secure record-keeping. Each transaction is recorded on the blockchain and visible to all network participants. This transparency ensures accuracy and prevents fraudulent activities.

Challenge 2: The Need for Constant Supervision

The rise of digital banking has significantly increased the need for constant monitoring and recording. Services like loans have inherent risks, such as trust in intermediaries, counterparty failures, and credit risks.

In a blockchain-enabled banking sector, every participant is a node. This reduces the need for intermediaries. Transactions are recorded on the network, minimizing fund management risk. Smart contracts expedite transactions, further enhancing efficiency.

Challenge 3: High Transaction Costs

Third parties, central databases, intermediaries, bookkeeping, and value transfer systems often inflate transaction costs. They also extend execution times for transactions. Blockchain can substantially reduce these costs.

Blockchain eliminates the need for third parties in transactions. It also negates the need for central databases and intermediaries. This reduces the costs associated with these elements.

Blockchain also simplifies bookkeeping and value transfers, further reducing transaction costs.

Challenge 4: Time-Consuming Processes

Traditional banking processes can take days or even weeks to clear payments. This is mainly due to the involvement of intermediaries. With its peer-to-peer transactions and smart contracts, blockchain accelerates the settlement process, enabling instant payments.

Blockchain’s peer-to-peer transactions eliminate the need for intermediaries. This speeds up the payment process. Smart contracts, which are self-executing contracts, further expedite transactions.

They automatically execute when the conditions in the agreement are met, facilitating instant payments. Blockchain presents a promising solution to the current challenges in the banking sector.

With its speed, accuracy, and transparency, blockchain has the potential to reshape banking for the better. It can streamline processes, enhance security, and improve efficiency, making banking more user-friendly and reliable.

Blockchain Applications in Banking: A Deep Dive

Interested in how blockchain technology can rejuvenate the banking sector? Let’s delve into five promising blockchain applications in banking.

Blockchain: The Clearance and Settlement Process

Cross-border payments often pose a challenge for banks. They need help to process these payments swiftly and cost-effectively.

The delay primarily stems from the complex system involving numerous intermediaries like fund networks, asset managers, and traders.

Blockchain technology, however, can eradicate these inefficiencies. Blockchain allows banks to monitor and settle transactions directly as a decentralized ledger technology. It eliminates the need for intermediaries and regulatory custodians, streamlining the process.

Blockchain’s Benefits in Lending & Borrowing

Lending and borrowing are fundamental services provided by banks. The traditional process involves lenders, borrowers, and guarantors.

Blockchain can simplify this process by reducing delays and enhancing transparency.

- Streamlining Operations: Blockchain technology can streamline lending and borrowing, making the process more efficient.

- Reducing Delays: Blockchain can significantly reduce delays, accelerating the loan approval and disbursement process.

- Enhancing Transparency: Every transaction is recorded and visible with blockchain, promoting transparency in lending and borrowing.

- Eliminating Middlemen: Blockchain can eliminate the need for guarantors or intermediaries, simplifying the loan process.

- Trustworthy System: Blockchain’s decentralized nature ensures a secure and trustworthy system for lenders and borrowers.

- Cost-Effective: By reducing the need for physical documentation and intermediaries, blockchain can make lending and borrowing more cost-effective.

- Real-Time Updates: Blockchain provides real-time updates on loan status, providing both lenders and borrowers with up-to-date information.

- Fraud Prevention: The immutable nature of blockchain records helps prevent fraud in lending and borrowing.

- Global Access: Blockchain technology can enable global access to lending and borrowing services, breaking geographical barriers.

- Future of Banking: With its numerous benefits, blockchain has the potential to revolutionize the traditional lending and borrowing process, paving the way for the future of banking.

Blockchain’s Impact on Accounting & Bookkeeping

Accounting in banking has traditionally needed to be faster to digitize. This is due to the need to comply with strict regulatory requirements for data integrity and validation.

Blockchain can revolutionize this by simplifying compliance and streamlining conventional double-entry bookkeeping methods

Blockchain’s Influence on Trade Finance

Trade finance revolves around financial activities related to international trade and commerce.

These activities are often hampered by excess paperwork, such as letters of credit and invoices. This results in time-consuming and often inefficient processes.

Blockchain’s Role in Credit Report Generation

Traditional lenders often find it challenging to assess borrowers’ creditworthiness accurately. They heavily rely on third-party credit report agencies. And these reports are only sometimes accurate or available for small business owners.

Blockchain technology is revolutionizing the banking sector. It streamlines processes, enhances security and transparency, and is set to make banking more efficient and user-friendly.

As a result, both banks and customers stand to benefit from its implementation.

What Are the Different Blockchain in Banking Case Studies?

Blockchain technology is revolutionizing various industries, and the banking sector is no exception.

By offering a decentralized and transparent way to record transactions, blockchain has the potential to enhance efficiency, security, and trust.

Here are some notable case studies that illustrate how blockchain is being utilized in banking:

1. Cross-Border Payments: Ripple and Santander

- Overview: Ripple partnered with Santander to facilitate cross-border payments using blockchain technology.

- Outcome: The partnership resulted in faster, more transparent, and cost-effective international transactions, enhancing customer experience.

2. Trade Finance: HSBC and R3 Corda

- Overview: HSBC utilized R3’s Corda blockchain platform to digitize and streamline trade finance processes.

- Outcome: The implementation led to reduced processing times, increased transparency, and minimized risks of fraud.

3. Identity Verification: SecureKey and Canadian Banks

- Overview: SecureKey collaborated with major Canadian banks to create a blockchain-based identity verification system.

- Outcome: The system improved the efficiency and security of identity verification, providing a seamless experience for customers.

4. Syndicated Loans: BNP Paribas, Credit Suisse, and Synaps Loans

- Overview: These financial institutions worked together to explore the use of blockchain in managing syndicated loans.

- Outcome: The collaboration resulted in reduced administrative burdens and increased transparency in the syndicated loan market.

5. Asset Tokenization: Société Générale

- Overview: Société Générale issued a bond as a security token on the Ethereum blockchain.

- Outcome: This innovative approach demonstrated the potential for blockchain to simplify and enhance the issuance and management of financial securities.

6. Smart Contracts for Derivatives: JPMorgan Chase and Quorum

- Overview: JPMorgan Chase utilized Quorum, an enterprise-focused version of Ethereum, to develop smart contracts for derivatives.

- Outcome: The use of smart contracts automated complex processes, reducing the potential for errors and enhancing efficiency.

7. Supply Chain Financing: IBM and We.Trade

- Overview: IBM partnered with We.Trade to offer a blockchain-based platform for supply chain financing.

- Outcome: The platform provided real-time visibility into transactions, improving trust and collaboration among trading partners.

These case studies showcase the diverse applications of blockchain technology within the banking sector. From facilitating international payments to automating complex financial contracts, blockchain is proving to be a transformative force.

As the technology continues to mature and adoption grows, the potential for blockchain to reshape the banking landscape is immense. These real-world examples offer valuable insights into the practical benefits and challenges of implementing blockchain.

How Blockchain Technology Will Change the Future of the Banking System

Blockchain technology, known for its decentralized and transparent nature, is poised to revolutionize the banking system.

By offering a secure and efficient way to record transactions, blockchain has the potential to transform various aspects of banking. Here’s how:

1. Enhanced Security

Blockchain’s cryptographic nature ensures that once a transaction is recorded, it cannot be altered.

This immutable characteristic enhances the security of financial transactions, reducing the risk of fraud and unauthorized access.

2. Faster Cross-Border Payments

Traditional international money transfers can be slow and expensive. Blockchain enables real-time or near-real-time cross-border payments, cutting down processing times from days to minutes and reducing costs.

3. Improved Transparency and Trust

With blockchain, all transactions are recorded on a public or private ledger that all parties can access. This transparency fosters trust among participants and allows for easier auditing and compliance.

4. Streamlined Trade Finance

Trade finance involves complex and paperwork-heavy processes. Blockchain can digitize and automate these processes, reducing administrative burdens and enhancing efficiency.

5. Smart Contracts

Smart contracts are self-executing contracts with the terms directly written into code. In banking, they can be used to automate complex financial agreements, ensuring accuracy and reducing the potential for disputes.

6. Asset Tokenization

Blockchain enables the conversion of physical assets into digital tokens. This can simplify the trading and management of financial assets, making them more accessible and liquid.

7. Enhanced Identity Verification

Blockchain can provide a secure and unchangeable record of customers’ identity information, streamlining the identity verification process and enhancing security.

8. Decentralized Finance (DeFi)

DeFi leverages blockchain to create decentralized financial systems outside traditional banking. This can democratize finance, providing access to financial services to those who might be excluded from traditional banking.

9. Sustainability and Environmental Considerations

Blockchain’s transparency can be leveraged to track and verify the sustainability credentials of financial products, aligning banking with growing environmental and social responsibility trends.

Webisoft Blockchain Devleopment Service

Ready to revolutionize your banking operations with blockchain technology? At Webisoft, we’re experts in integrating blockchain into banking systems for improved security, efficiency, and transparency.

Don’t get left behind in the financial revolution. Contact us today to learn how blockchain can transform your banking services!”

Frequently asked questions

What are the advantages of using blockchain in inter-bank trade?

Blockchain technology offers several benefits for interbank trade. It eliminates the need for intermediaries, reducing time-consuming manual processes. Providing a tamper-proof record of transactions enhances security and reduces costs associated with intermediaries

Real-time visibility into asset movement and simplified cross-border transactions are additional advantages, ensuring efficient and trustworthy inter-bank trade.

Is blockchain technology secure for storing and sharing sensitive client information?

Yes, blockchain technology provides robust security for storing and sharing client information. Its advanced encryption algorithms, decentralized storage, and consensus mechanisms make it highly resistant to data breaches.

Blockchain also enables controlled access and permissions, ensuring only authorized parties can view and update sensitive client information, enhancing data security and privacy.

How does blockchain contribute to the transition toward a cashless society in banking?

Blockchain technology has played a great role in the move toward a cashless society. Blockchain enables seamless digital transactions by providing secure, transparent, and efficient payment systems.

It reduces reliance on physical currency, lowers transaction costs, and offers faster settlement times. Embracing blockchain allows individuals and businesses to enjoy the convenience and benefits of digital payments, furthering the global shift away from cash-based economies.

Conclusion

In the dynamic world of finance, the integration of blockchain in banking is more than a technological advancement; it’s a paradigm shift that promises to redefine trust, efficiency, and innovation.

From securing transactions to democratizing access to financial services, blockchain is weaving a new fabric of transparency and integrity within the banking landscape.

As we stand on the brink of this transformative era, the opportunities are as vast as the challenges are complex. Are you ready to explore the potential of blockchain in your banking operations?

At Webisoft, we specialize in tailoring blockchain solutions that align with your unique needs and goals. Let’s embark on this exciting journey together and shape the future of banking with cutting-edge technology that empowers and inspires.Contact Webisoft today and take the first step towards a more secure, transparent, and innovative banking experience.