Have you ever wondered why international money transfers can be so expensive and slow? Did you know that the average cost of sending remittances globally is still above 6%? These are just some of the challenges faced by individuals and businesses when it comes to cross-border payments. But don’t worry!

Blockchain cross-border payments offer a ray of hope in international finance. With lower transaction costs, lightning-fast transfer times, enhanced accessibility, and increased transparency, they promise to make global money movement easier and more efficient.

In this comprehensive guide, we will delve deep into blockchain cross border payments, exploring their benefits, real-world examples, regulatory considerations, and future trends. Get ready for a journey into the future of finance!

Contents

- 1 What is a Blockchain Payment?

- 2 What is Cross Border Payment?

- 3 Benefits of Cross Border Payments

- 4 Cross Border Payments vs Traditional Banking Services

- 5 How to Add Blockchain to Cross-Border Payments

- 6 Real-World Examples and Use Cases

- 7 Challenges of Blockchain Cross Border Payments

- 8 Future Trends of Blockchain Cross Border Payments

- 9 Conclusion

- 10 FAQs

- 10.1 Can individuals use blockchain for cross-border payments, or is it primarily for businesses?

- 10.2 Are blockchain cross-border payments completely free from fraud?

- 10.3 Can blockchain cross-border payments be reversed if there’s an error?

- 10.4 How do I convert cryptocurrency received in cross-border payments into my local currency?

What is a Blockchain Payment?

A blockchain payment is a digital transaction that uses blockchain technology. Blockchain acts as a decentralized digital ledger that records and verifies transactions on a network of computers. When it comes to payments, blockchain allows for secure and transparent money or asset transfers between parties, no matter where they are in the world.

In contrast to conventional payment systems that depend on large institutions like banks. However, blockchain payments function autonomously removing the need for intermediaries.

Transactions are instead verified and recorded on a transparent ledger accessible to all network participants. This improves security and reduces dependence on external entities and their associated fees.

What is Cross Border Payment?

A cross-border payment is a transaction where the sender and the recipient are based in different countries.

This type of payment typically involves converting currency and navigating through various banking systems or payment networks to transfer money from one country to another. Cross-border payments are essential for international trade, remittances, and global business operations.

Benefits of Cross Border Payments

Blockchain cross border payments offer a multitude of benefits that are transforming international finance. Let’s explore some of the key benefits:

Cost-Efficiency

Blockchain cross-border payments often come with significantly lower transaction fees compared to traditional methods. By eliminating intermediaries and reducing currency conversion costs, businesses and individuals can save money on cross-border transactions, as explained in this detailed blockchain pricing overview.

Speed

Traditional international bank transfers can take several days to complete. In contrast, blockchain payments are processed swiftly, often within minutes, irrespective of the geographical locations of the sender and recipient. This rapid transaction speed is crucial for businesses that require timely payments.

Accessibility

Blockchain payments are accessible to anyone with an internet connection, regardless of their location. This integration is particularly important for people in regions with limited access to traditional banking services. It provides them with a means to participate in the global economy.

Transparency

Blockchain’s decentralized ledger ensures transparency and consistency. Every transaction is recorded and can be verified by anyone on the network, reducing the risk of fraud and enhancing trust in the payment process.

Reduced Risk of Errors

The transparent and decentralized nature of blockchain minimizes the chances of errors or discrepancies in transactions. Smart contracts, often used in blockchain payments, automate processes and ensure that payments are executed precisely as agreed upon.

Enhanced Security

Blockchain employs cryptographic techniques to secure transactions, making them highly resistant to unauthorized alterations or hacking. This upgraded security is particularly valuable for large-value cross-border transactions.

Financial Inclusion

Blockchain cross border payments open financial services to unbanked and underbanked populations worldwide. Individuals who were previously excluded from the traditional banking system can now access affordable and efficient cross-border payment solutions.

Competitive Advantage

Businesses that adopt blockchain cross-border payments can gain a competitive edge. This advantage stems from reducing operational costs, improving cash flow, and providing faster and more reliable payment options to customers and partners.

Global Trade Facilitation

Cross-border payments are essential for international trade. Blockchain simplifies this process, reducing the time and costs associated with conducting business across borders. It also helps in the efficient management of supply chains and trade finance.

Future-Proofing

As blockchain technology continues to develop, businesses that accept blockchain cross-border payments are setting themselves up for future growth and adaptability. They can easily incorporate upcoming trends such as Central Bank Digital Currencies (CBDCs) and other blockchain innovations.

Cross Border Payments vs Traditional Banking Services

Here’s a comparison table highlighting the key differences between blockchain cross border payments and traditional banking services:

| Aspect | Blockchain Cross-Border Payments | Traditional Banking Services |

| Speed and Efficiency | Rapid, often within minutes | Slower, can take days |

| Cost | Lower fees or no intermediaries | Higher fees |

| Transparency | Transparent and immutable ledger | Limited transparency |

| Accessibility | Available globally | Subject to banking hours |

| Reliance on Intermediaries | Reduced reliance or none | Multiple intermediary banks |

| Security | Highly secure with cryptography | Security measures in place |

| Cross-Border Transactions | Facilitated with ease | Often require correspondent banks |

How to Add Blockchain to Cross-Border Payments

Integrating blockchain into cross-border payments is a strategic move that can revolutionize the way money moves across borders. Here’s the step-by-step process of adding blockchain to cross-border transactions:

Choose a Blockchain Platform

The first step is to carefully select a blockchain platform that aligns with the specific requirements of your cross-border payment system. Popular blockchain platforms for this purpose include Ethereum, Ripple, Stellar, and others.

Each platform offers its own set of features and capabilities, so the choice should be based on factors such as transaction speed, scalability, and compatibility with existing financial infrastructure.

Develop a Smart Contract

A crucial element in blockchain cross-border payments is the creation of a smart contract. Smart contracts are self-executing contracts with predefined rules and conditions.

They automate and facilitate the payment process, ensuring that transactions are secure, transparent, and executed precisely as agreed upon. This eliminates the need for intermediaries and minimizes the risk of errors or disputes.

Integration with Financial Institutions

To bridge the gap between blockchain technology and the traditional banking system, collaboration with financial institutions is essential. Integrating blockchain into established banking systems ensures that cross-border transactions can smoothly interact with existing financial infrastructure.

This may involve partnerships with banks, payment processors, and other financial entities to create a seamless interface between blockchain and traditional financial networks.

User-Friendly Interface

The success of blockchain-based cross-border payments also relies on providing a user-friendly experience. Developing an intuitive user interface is critical to encourage individuals and businesses to adopt this innovative payment method.

A well-designed interface should make it easy for users to initiate, track, and manage blockchain-based cross-border transactions. User education and support are also key components of ensuring a smooth transition to this technology.

Real-World Examples and Use Cases

Let’s explore some blockchain cross border payments example and use cases:

Ripple (XRP)

Ripple is a prime example of blockchain’s impact on cross-border payments. Its native cryptocurrency, XRP, is used to enable fast and low-cost international money transfers.

Ripple’s network connects banks and financial institutions worldwide, allowing for near-instantaneous settlement of cross-border transactions.

By eliminating the need for correspondent banks and reducing transaction fees, Ripple has gained traction as a solution for efficient cross-border payments.

Stellar (XLM)

Stellar is another blockchain platform designed to simplify cross-border transactions. It focuses on enabling financial inclusion by providing affordable and accessible cross-border payment services.

Stellar’s native cryptocurrency, XLM, is used to bridge different currencies, making it easier for individuals and businesses to send money across borders. Projects like IBM World Wire have adopted Stellar’s technology to facilitate cross-border payments.

IBM World Wire

IBM World Wire is a real-world use case that utilizes blockchain for cross-border payments. It aims to transform the way businesses and financial institutions conduct global transactions.

IBM World Wire offers a secure and transparent platform for cross-border payments, including digital assets and stablecoins trading. This initiative showcases how blockchain can simplify cross-border transactions for many participants.

Digital Remittances

Blockchain technology has also made significant inroads into digital remittances. Companies like BitPesa (now known as BitPesa) and Coins.ph provide platforms that allow individuals to send money across borders using cryptocurrencies.

These services often offer lower fees and faster transfer times compared to traditional remittance methods, benefiting migrant workers and their families.

Trade Finance

Blockchain has found applications in trade finance, where cross border payments play a crucial role. Platforms like we.trade and Marco Polo use blockchain to simplify and secure trade financing processes.

These solutions enable businesses to conduct international trade with reduced administrative overhead and improved trust among participants.

Cross-Border E-commerce

In e-commerce, cross-border payments are integral to global sales. Blockchain-based payment gateways and cryptocurrencies like Bitcoin are being adopted by online retailers to facilitate international transactions.

These solutions offer consumers and businesses a seamless way to buy and sell products and services across borders without the hassle of traditional payment methods.

Challenges of Blockchain Cross Border Payments

Implementing blockchain technology in cross border payments brings about several challenges that need to be addressed for successful adoption. Here are some of the key challenges:

Regulatory Compliance

Complying with various regulatory requirements across different jurisdictions is a significant challenge. Anti-Money Laundering (AML), Know Your Customer blockchain (KYC), taxation, and data privacy regulations must all be carefully navigated to ensure legal compliance.

Scalability

Blockchain networks, particularly public ones, face scalability issues when handling a high volume of cross-border transactions. To address this growing demand, we require scaling solutions like layer 2 protocols.

Interoperability

The lack of consistent rules and compatibility among diverse blockchain systems and networks creates a challenge. Smooth communication and transactions across various blockchain environments are crucial to ensure that cross-border payments are effective and available to all.

Volatility

Cryptocurrencies, which are commonly employed in cross-border blockchain payments, can experience significant price fluctuations. This instability can create uncertainty regarding the value of transferred funds and may impact the cost-efficiency of transactions.

Network Congestion

During times of heavy usage, public blockchain networks may become congested, resulting in delays and higher transaction fees. It’s crucial to implement solutions that can ease this congestion to maintain reliable network performance.

Future Trends of Blockchain Cross Border Payments

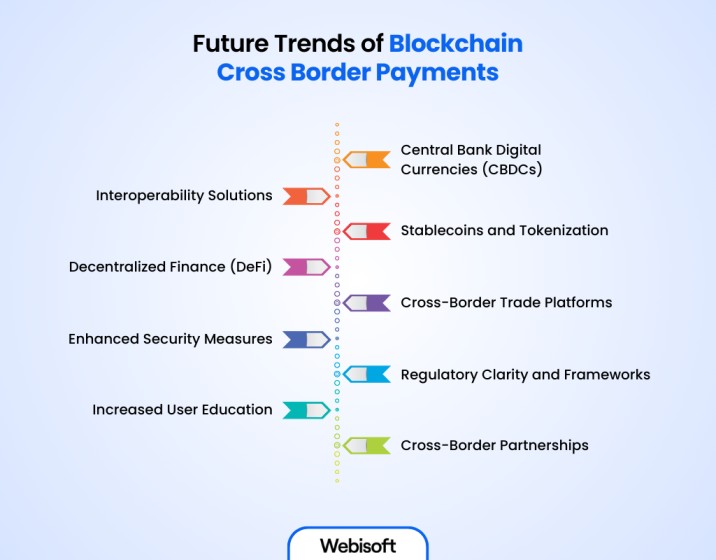

The future of blockchain cross border payments holds exciting opportunities. Let’s look at some of the future trends:

Central Bank Digital Currencies (CBDCs)

Many central banks are exploring the development of CBDCs, which are digital representations of their respective national currencies. These digital currencies are expected to become a cornerstone of cross-border payments, offering efficiency and transparency while maintaining regulatory control.

Interoperability Solutions

As the number of blockchain networks and platforms continues to grow, interoperability solutions will become increasingly important. Projects like Polkadot and Cosmos aim to bridge different blockchains, enabling seamless cross-border transactions between various networks.

Stablecoins and Tokenization

Stablecoins, which are cryptocurrencies pegged to stable assets like fiat currencies, are gaining popularity for cross-border payments. They offer the benefits of blockchain technology while mitigating the volatility associated with cryptocurrencies like Bitcoin.

Tokenization of assets, including real estate and commodities, will also play a role in cross-border trade.

Decentralized Finance (DeFi)

DeFi platforms are expanding to include cross-border payment solutions, enabling users to send and receive funds globally without relying on traditional banks. These platforms offer financial services like lending, borrowing, and trading, all powered by blockchain technology.

Cross-Border Trade Platforms

Blockchain-based platforms specifically designed for cross-border trade are growing. These platforms facilitate end-to-end trade finance, including documentation, payment, and tracking, streamlining international commerce.

Enhanced Security Measures

Blockchain’s inherent security features will continue to develop. Zero-knowledge proofs and advanced encryption techniques will be employed to ensure the utmost security of cross-border transactions.

Regulatory Clarity and Frameworks

As governments and regulatory bodies gain a deeper understanding of blockchain, more comprehensive regulatory frameworks will emerge. These frameworks will create a conducive environment for blockchain-based cross-border payments while maintaining regulatory oversight.

Increased User Education

User education and awareness campaigns will become crucial to drive adoption. As blockchain cross-border payment solutions become more user-friendly, educating individuals and businesses about their advantages will be a priority.

Cross-Border Partnerships

Collaborations between blockchain companies, traditional financial institutions, and global payment networks will grow. These partnerships will lead to the development of innovative cross-border payment solutions with wider reach and acceptance.

Conclusion

In conclusion, blockchain cross border payments represent a promising growth in global finance. Throughout this article, we’ve uncovered their potential to transform the way we send money across borders. We’ve discussed their significant advantages, from reducing costs and speeding up transactions to improving accessibility and transparency.

While there are challenges to overcome, such as regulatory compliance and adoption hurdles, the future looks bright. Innovations like Central Bank Digital Currencies (CBDCs) and improved interoperability are on the horizon.

To stay ahead in this changing sector of cross-border payments, it’s worth considering the expertise of Webisoft, a leader in blockchain technology and financial solutions. Contact Webisoft today and explore the exciting future in global finance.

FAQs

Can individuals use blockchain for cross-border payments, or is it primarily for businesses?

Yes, individuals can use blockchain for cross-border payments, not just businesses. It offers a fast, secure, and often cheaper way to send money internationally compared to traditional banking methods.

Are blockchain cross-border payments completely free from fraud?

No, while blockchain cross-border payments greatly reduce the risk of fraud due to their secure and transparent nature, they’re not completely immune. It’s important to implement strong security practices to protect against potential vulnerabilities.

Can blockchain cross-border payments be reversed if there’s an error?

No, once a blockchain cross-border payment is made, it can’t be reversed if there’s an error. It’s permanent, so it’s important to double-check all details before sending.

How do I convert cryptocurrency received in cross-border payments into my local currency?

Cryptocurrency exchanges and peer-to-peer platforms can be used to convert received cryptocurrencies into local fiat currency.