If you’ve found yourself tangled up in the fascinating web of cryptocurrency, you’ve probably heard of Uniswap. As one of the leading decentralized trading platforms, the Uniswap exchange is becoming a cornerstone of the DeFi space.

It’s a fresh take on the traditional crypto trading paradigm, offering a uniquely democratic and user-empowering experience. The platform’s trailblazing features are what sets it apart in a crowded crypto landscape, and it’s high time we explore them.

So, let’s embark on a journey into the world of Uniswap, as we unpack its standout features and understand why it’s causing such a buzz in the crypto-verse.

Contents

- 1 Embracing a Decentralized Approach to Finance

- 2 Meet Uniswap: A New Wave in Decentralized Exchanges

- 3 Dive into the world of Uniswap and Its Unique Token – UNI

- 4 A Peek into Uniswap: Understanding its Mechanisms

- 5 Deconstructing the Operation: Uniswap at Work

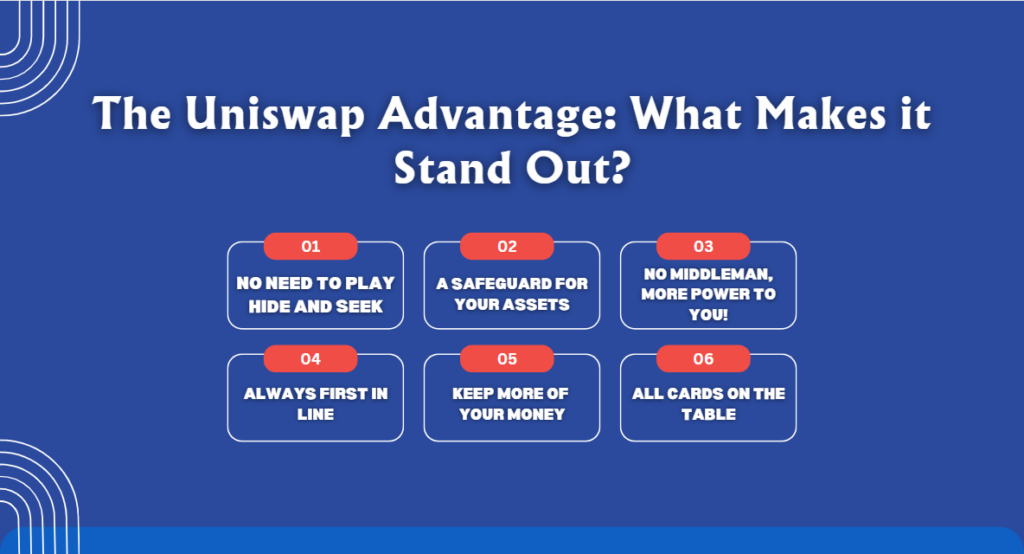

- 6 The Uniswap Advantage: What Makes it Stand Out?

- 7 The Hidden Truth of Temporary Losses

- 8 The Friendly Guide to Launching Your DeFi Token on Uniswap

- 9 How to Add Liquidity?

- 10 Wrapping Up

Embracing a Decentralized Approach to Finance

For countless years, the financial sector has been heavily dependent on centralized systems, encompassing even the domain of digital currencies. While these systems have served their purpose, they’ve not been without their fair share of shortcomings. It’s these flaws that have caused many to seek out an alternative where their financial affairs aren’t reliant on a go-between.

Enter the arena of Decentralized Finance, better known by its shorthand, DeFi. As its name implies, DeFi is all about orchestrating financial transactions in a decentralized fashion, free from any governing bodies. Numerous efforts have been made to actualize this concept, one prominent form being decentralized exchanges.

Imagine decentralized exchange platforms as arenas for crypto trading that forgo the need for traders to first deposit funds. Instead, they transact straight from their personal crypto wallets, fostering a one-on-one (P2P) trading ecosystem.

These platforms, colloquially known as DEXs, are springing up left and right, each vying to deliver the most secure and efficient DeFi services. Standing out among them is Uniswap. Getting your tokens listed on Uniswap doesn’t require a Herculean effort, but it does demand some degree of technical expertise.

Meet Uniswap: A New Wave in Decentralized Exchanges

Are you familiar with Uniswap? It’s an ingenious piece of work crafted by Hayden Adams that revolutionizes the way we exchange tokens on the Ethereum platform.

Picture it as a decentralized, automated supermarket for swapping ERC20 tokens, but without the traditional “order book” model.

Uniswap stands tall in its field by ensuring a high level of decentralization, effectively skipping the middleman in transactions and providing its users with an autonomous trading environment.

In the world of centralized exchanges, platforms are notorious for their exorbitant fees, especially when it comes to listing new tokens. The more traditional exchanges even profit from these transactions.

But Uniswap? It marches to a different drum. It hands the reins of control back to its users, championing the notion of self-sovereignty over your own funds.

Just imagine: no more surrendering of your private keys to place orders on an internal database, no more worrying about the safety of your assets if the exchange’s security is breached. That’s the peace of mind Uniswap provides by ensuring you always hold your private keys.

Uniswap: The Jewel of DeFi Projects

Uniswap isn’t just making waves. It’s one of the most triumphant projects in the DeFi space. It prides itself on its unique open-source platform model, which uses token pools to dictate prices. And the best part? No platform fees or listing fees in sight.

In the realm of Uniswap, the possibilities are endless. Any ERC-20 token can launch on this platform as long as there’s a liquid pool to back it up.

The Evolution of Uniswap: From V1 to V3

Uniswap is always evolving, currently boasting three versions of its protocol. V1 and V2 are open-source and licensed under GPL, embodying the spirit of open collaboration.

On the other hand, V3, although still open-source, comes with some tweaks. V3, which was unleashed in May 2021, flaunts features such as multiple fee tiers and concentrated liquidity, making it a game-changer in the DeFi space, similar to innovations highlighted in Innovations in DeFi Staking.

The Simple Magic of Uniswap

Breaking it down to its essence, Uniswap is an innovative protocol that allows you to perform direct token swaps from your wallets.

There’s no need for any third-party involvement or giving up custody of your assets. Uniswap’s smart contracts empower you to not only swap tokens but also add or remove liquidity from pools as per your requirements.

Next up, let’s take a dive into understanding Uniswap’s native token, shall we?

Dive into the world of Uniswap and Its Unique Token – UNI

Hello there! Today, we’re going to delve into the fascinating realm of Uniswap, and specifically, we’ll be talking about their star player – the UNI token. The best part? If you own UNI, you get to call the shots!

That’s right; being a UNI owner comes with the privilege of having a say in the changes that should be made to the protocol. It’s all about creating a democratic, community-driven platform, and UNI is the key to that.

Ever wonder how the UNI supply is distributed? Well, here’s the scoop. The majority of the UNI supply (that’s about 60%!) is designated directly for the people who make Uniswap great – its community members.

The other 40%? That’s set aside to be released over a span of four years, reserved for the dedicated team, passionate investors, and savvy advisors who help Uniswap thrive.

UNI in Action – The Liquidity Mining Pools

Now, let’s talk about where you can find this fantastic UNI token. It’s actively available in four liquidity mining pools. They are:

- ETH and USDT combo

- The ETH and USDC pair

- The duo of ETH and DAI

- And, the team of ETH and WBTC

Each of these pools has a unique blend of tokens to meet diverse trader needs. But that’s not all!

Once you’ve been a UNI holder for 30 days, you have the power to vote for the introduction of even more pools. It’s a sort of ‘grace period’ to allow you to settle into the Uniswap governance model.

Hold on, our journey doesn’t end here. Stay tuned as we dive deeper into how Uniswap operates.

A Peek into Uniswap: Understanding its Mechanisms

Ever pondered over the intricate operations of Uniswap? It’s a unique blend of ingenuity and state-of-the-art technology, steering clear from the customary “order book” blueprint commonly adopted by crypto trading platforms. Let’s delve into the dual elements that provide momentum to this pioneering setup:

Amassing Liquidity: Uniswap’s Fuel

Visualize a vast reservoir teeming with tokens, all securely housed within a smart contract. There you have it – a liquidity pool. Its chief function?

To supply the critical liquidity that keeps trading activities humming. Gathering tokens in this manner is a widely-used technique by many decentralized exchange platforms.

Constant Product Market Maker Protocol: Uniswap’s Heavy Lifter

Seems like a complex term, right? But don’t be discouraged. This protocol is essentially an adaptation of the popular automated market maker (AMM) model.

Fundamentally, an AMM is a smart contract that controls a liquidity pool. In addition to liquidity providers, this pool forms a substantial reserve of tokens that traders can use.

Here’s where the magic happens: traders need to pay a fee to engage with these pools. This fee is then proportionally shared among the liquidity providers, based on their stakes in the pool.

This protocol’s winning feature is its openness. It extends a warm welcome to any token to join the Uniswap ecosystem, as long as it is paired with a matching value of ERC20 or the corresponding ETH token.

Deconstructing the Operation: Uniswap at Work

With the key elements explained, let’s turn the spotlight onto Uniswap’s operation.

Also known as LPs, Liquidity Providers are the unsung heroes that keep Uniswap ticking. They create a trading environment by placing two tokens of equal value.

These tokens could either be an ERC-20 and an ETH token or a pair of ERC20. Frequently, such pools are overflowing with stablecoins such as DAI.

In acknowledgment of their contribution, liquidity providers get liquidity tokens which:

- The share of liquidity they hold should be indicated.

- Can be exchanged for their represented share.

One of Uniswap’s core principles is the invariability of the total liquidity in the pool. But how does this come into play in real-world operations?

Imagine this situation: there’s a liquidity pool specifically for ETH/USDT. We’ll designate the ETH portion as ‘x’ and the USDT portion as ‘y’. Uniswap calculates the pool’s total liquidity (let’s call this ‘k’) by multiplying ‘x’ and ‘y’.

x x y = k

Now, imagine you purchase 1 ETH for 300 USDT from the ETH/USDT liquidity pool. This transaction increases the USDT portion while reducing the ETH portion of the pool.

As a result, the price of ETH rises because ‘k’ must remain fixed. Therefore, the price of ETH is influenced by how much a transaction disrupts the harmony between ‘x’ and ‘y’.

This forms the basis of Uniswap’s pricing mechanism. This means that large liquidity pools can better accommodate hefty transactions since they result in a lesser disturbance between ‘x’ and ‘y’ compared to smaller pools.

This process introduces us to the concept of ‘impermanent losses’. Curious about what they are? Let’s explore that next.

The Uniswap Advantage: What Makes it Stand Out?

Hey there! Are you curious about why Uniswap has been making waves in the crypto community? It’s because Uniswap has a myriad of standout features that set it apart from its traditional crypto exchange counterparts. Let’s break it down into its key ingredients:

No Need to Play Hide and Seek

Uniswap stands for freedom and privacy. Thanks to its permissionless Automated Market Maker (AMM) operations, you can engage in token trading while keeping your identity under wraps.

Your direct peer-to-peer transactions are tied only to your public wallet address, no names are required.

A Safeguard for your Assets

Uniswap boasts robust security measures. Given that it’s a non-custodial protocol, it doesn’t hold onto any of your cash.

Plus, its smart contracts have been thoroughly inspected by multiple teams, ensuring your peace of mind when trading.

No Middleman, More Power to You!

The “non-custodial” tag is worth highlighting again. On Uniswap, no third parties get in the way of your trades.

Wallets are where you handle your transactions. Remember, with great power comes great responsibility – you’re the guardian of your private keys and tokens.

Always First in Line

Uniswap lets you be one of the early birds when it comes to new tokens. Want to start an ERC20 token? Go ahead, pair it with ETH, and presto – you’ve provided liquidity for new pools.

Keep More of Your Money

Uniswap isn’t in it for the fees. It doesn’t levy listing fees or platform fees on its users. The only dent to your wallet is a minor 0.3% fee for each transaction, a drop in the ocean compared to other exchanges.

All Cards on the Table

Uniswap operates on an open-source philosophy. The code is out there for everyone to see and even replicate for their own decentralized trading adventures.

In a nutshell, Uniswap offers an unmatched blend of anonymity, security, efficiency, and transparency that puts the power right back in the hands of traders like you. Pretty cool, right?

The Hidden Truth of Temporary Losses

Now, we’re diving into the deep end of liquidity providing, focusing on an often misunderstood concept known as “evanescent losses.” However, let’s start with a digestible illustration to ensure we’re all on the same page.

Picture this: You’re navigating the exciting landscape of Uniswap and stumble upon a pool containing 10 ETH and 1,000 USDT. Feeling inspired, you contribute 1 ETH and 100 USDT. Since both parts of a token pair need to match in value, it naturally infers:

1 ETH equals 100 USDT Quick calculations reveal that you’ve now secured a solid 10% slice of this pool. The total liquidity at this point is 10,000. Now, suppose several trades occur, shifting the ETH/USDT balance to 5 ETH and 2,000 USDT.

This change lifts the price of 1 ETH to a striking 400 USDT. Why the change? Keep in mind our earlier point about total liquidity needing to remain fixed. That’s it! Astute arbitrage traders will continue extracting ETH and injecting USDT until equilibrium is achieved.

With this revised price, your 10% stake equates to 0.5 ETH and 200 USDT, amounting to 400 USDT in total. It may dawn on you that this sum is smaller than your initial investment (which at the current rate would total 500 USDT). This is the essence of an “evanescent” loss. But don’t worry! The loss isn’t irreversible:

- It can adjust if ETH descends back to its former value of 100 USDT.

- You can also compensate for it by collecting LP fees over the period. However, should you opt to withdraw your funds right now, your loss would solidify, leaving you with a total of 400 USDT.

However, there’s a lot more ground to cover! Up next, we’ll be guiding you on how to make your DeFi token debut on Uniswap. Stick around!

Do you dream of revolutionizing the finance world with decentralization? That’s exactly what we’re passionate about at Webisoft! We bring ideas to life, crafting tailor-made decentralized financing wallets, apps, and platforms for staking, exchange, and lending – all on self-governed blockchain platforms. Think of us as the power behind your vision, turning your dreams into reality.

The Friendly Guide to Launching Your DeFi Token on Uniswap

Are you wondering how to get your DeFi token on the Uniswap platform? If so, you’re in the right place. There are some pre-flight checks you need to complete before your token is ready for lift-off:

- Get MetaMask up and running.

- Establish your ERC20 token contract on the Ethereum mainnet.

- Transfer your ERC20 tokens to your MetaMask wallet.

Sounds simple, right? With that done, it’s time for the real action. Let’s walk you through how to make your DeFi token’s grand entrance on Uniswap.

Establishing an Exchange: The How-To Guide

The first on your to-do list is setting up an exchange so that your token and Uniswap can get acquainted. Here’s a step-by-guide to making that happen:

- Venture to Uniswap’s Exchange Page. This is what you’ll see.

- Time to link up with your MetaMask Wallet.

If you notice, there are other wallet options available too. Plus, if you’re yet to install MetaMask, the platform will kindly prompt you to do so.

- Spot the “Pool” tab? It’s hanging out on the top right of your screen. Give it a click.

- Next up, look for and select the “Create Exchange” button.

- You’ll see an option that reads “Select a Token.” Go ahead and click it.

- It’s time to introduce your token. Type your token’s address into the “Search Name or Address” bar. A dropdown list will appear. Find and select your token.

- Click again on “Create Exchange.”

- A pop-up will make an appearance. Look for and click on the “Confirm” button.

And voila! You’re done. That wasn’t too hard, was it? Happy Uniswapping!

How to Add Liquidity?

Now that you’ve successfully minted an exchange for your brand new tokens, what’s next on the agenda? Filling up your liquidity tank! You’ll need to fuel it up with a mix of ETH and your unique tokens. How the price gets determined hinges on the number of tokens you put in.

Why so? Well, as we touched on earlier, you need to deposit your tokens and ETH in pairs of equal value to maintain a constant liquidity pool. Therefore, if you contribute 1 ETH along with 1 of your tokens, the price of your token would match that of 1 ETH.

A Simple Guide to Add Liquidity

- Spot the dropdown menu on the same page and click on “Add Liquidity.”

- Next, decide how much ETH you want to commit to the cause and enter the amount.

- Choose the “Select a Token” option.

- Moving on, type your token’s address in the “Token Address” field and pick your token from the dropdown.

- Then, find the “Unlock” option. It’s located right beside your token symbol. Give it a click!

- After that, when the confirmation pop-up appears, hit “Confirm”. This will verify your transaction.

- Next up, now it’s time to decide how many of your tokens you want to put in. Make sure you double-check the calculated exchange rate.

- Lastly, click on the “Add Liquidity” option and hit “Confirm” when the confirmation pop-up shows up again.

There you go! You’ve successfully listed your token on the Uniswap exchange.

Now that we’ve covered that, let’s move on to how you can swap your shiny new tokens for ETH. Buckle up for the next steps!

Wrapping Up

Through this journey, we’ve discovered how the Uniswap exchange is revolutionizing the DeFi space. Its emphasis on privacy, security, and user empowerment sets it apart from traditional crypto exchanges.

Uniswap’s no-fee philosophy and open-source approach make it a truly democratic platform. Meanwhile, its ability to offer instant access to new tokens keeps its users ahead of the curve.

By taking the reins away from intermediaries and placing them into the hands of its users, Uniswap is not only fostering a more equitable trading environment but is also shaping the future of crypto trading. Stay tuned to this vibrant platform as it continues to transform and disrupt the crypto world.

Looking to bring your business to the forefront of the digital landscape? With Webisoft, your search ends here. Using cutting-edge technology, and our experienced team, we can transform your digital presence. Click here to get started on your digital transformation journey with Webisoft, the partner you can trust to bring your vision to life!