Cryptocurrencies are often unpredictable. Their prices change quickly, making them difficult for daily use. Types of stablecoins solve this problem by keeping their value steady. They are useful for payments, trading, and savings.

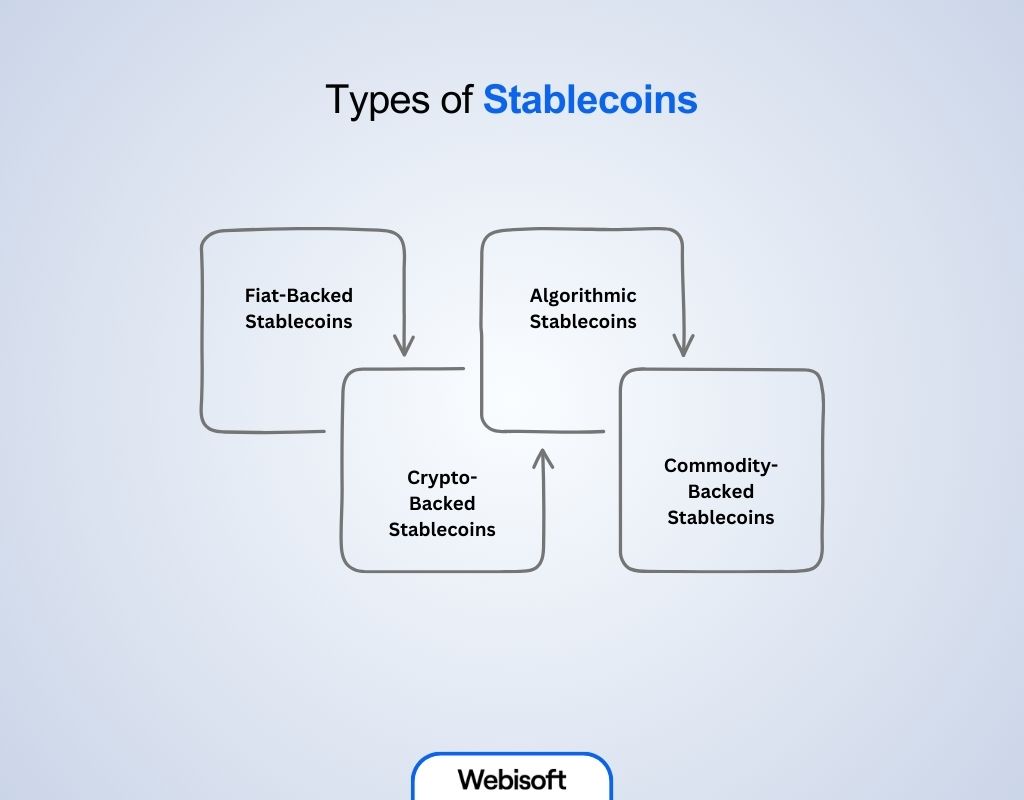

There are different stablecoin types, each designed to maintain stability in a unique way. Some are backed by money, while others rely on digital assets or algorithms. Understanding these stablecoins helps in choosing the right one.

This guide explains the four main types of stablecoins. It also covers their use cases, risks, benefits, regulation, transparency, liquidity, and security.

Contents

- 1 1. Fiat-Backed Stablecoins

- 2 2. Crypto-Backed Stablecoins

- 3 3. Algorithmic Stablecoins

- 4 4. Commodity-Backed Stablecoins

- 5 Stablecoin Liquidity: Why It Matters

- 6 Stablecoin Security: Are Your Funds Safe?

- 7 Stablecoins vs. Volatile Cryptocurrencies

- 8 Stablecoin Regulation: What You Should Know

- 9 Final Thoughts on Stablecoin Types

- 10 FAQs

- 10.1 1. What are the different types of stablecoins?

- 10.2 2. How do fiat-backed stablecoins work?

- 10.3 3. Are crypto-backed stablecoins more secure than fiat-backed stablecoins?

- 10.4 4. What are algorithmic stablecoins, and why are they risky?

- 10.5 5. Why do people use commodity-backed stablecoins?

- 10.6 6. How does stablecoin regulation affect users?

- 10.7 7. How do stablecoins compare to regular cryptocurrencies like Bitcoin?

1. Fiat-Backed Stablecoins

Fiat-backed stablecoins are tied to traditional currencies like the U.S. dollar or the euro. They hold an equal amount of money in reserve to keep their value stable.

How They Work

Each stablecoin is backed by a company that holds an equal amount of fiat currency in a bank. When users buy stablecoins, the issuer keeps the same amount in cash or financial assets.

Examples

- Tether (USDT) – Supported by a mix of cash and financial assets

- USD Coin (USDC) – Backed by reserves in regulated banks

- Binance USD (BUSD) – Issued under financial regulations

Stablecoin Benefits

- Easy to use for payments and trading

- Accepted on most crypto exchanges

- Low volatility compared to other cryptocurrencies

Stablecoin Risks

- Users must trust the company holding reserves

- Regulations may limit their availability

- Some issuers do not provide full financial reports

Are Fiat-Backed Stablecoins Centralized?

Yes. Centralized stablecoins are controlled by companies that manage their reserves. This makes them reliable but also subject to government oversight.

2. Crypto-Backed Stablecoins

Crypto-backed stablecoins use digital assets instead of fiat currency as reserves. These are often decentralized stablecoins, meaning they are not controlled by a single company.

How They Work

Users deposit cryptocurrency (such as Ethereum) into a smart contract. The smart contract then issues stablecoins based on the deposited amount. Since crypto prices can change quickly, extra collateral is required to reduce risks.

Examples

- Dai (DAI) – Uses Ethereum as collateral, managed by MakerDAO

- sUSD (Synthetix USD) – Backed by synthetic assets

Stablecoin Benefits

- No reliance on traditional banks

- Reserves are stored transparently on the blockchain

- Users have more control over funds

Stablecoin Risks

- Requires extra security due to crypto price swings

- More complex than fiat-backed stablecoins

- If crypto prices drop too fast, reserves may be liquidated

Are Crypto-Backed Stablecoins Decentralized?

Yes. Decentralized stablecoins operate through smart contracts, making them more transparent but also more complex to manage.

3. Algorithmic Stablecoins

Algorithmic stablecoins do not use traditional reserves. Instead, they rely on smart contracts to control supply and demand.

How They Work

An algorithm tracks the stablecoin’s price. If demand increases and the price rises, the system creates more stablecoins. If demand decreases, some coins are removed from circulation.

Examples

- Frax (FRAX) – Combines collateral and algorithms

- Ampleforth (AMPL) – Expands or reduces supply based on demand

Stablecoin Benefits

- Works without traditional banks or reserves

- Fully decentralized and runs on blockchain technology

- Designed for long-term stability

Stablecoin Risks

- System failures can lead to loss of value

- Harder to understand and predict

- Some projects have collapsed, causing major losses

Stablecoin Transparency: Are Algorithmic Stablecoins Safe?

Algorithmic stablecoins are transparent because they operate on blockchains. However, they rely on market confidence. If trust is lost, their value can crash.

4. Commodity-Backed Stablecoins

Commodity-backed stablecoins are tied to physical assets like gold, silver, or oil. Their value depends on the price of these commodities.

How They Work

Each stablecoin represents a fixed amount of a commodity. The issuer holds real gold, oil, or another asset in storage. Users can trade these stablecoins or redeem them for the physical asset.

Examples

- Tether Gold (XAUT) – Supported by gold reserves

- Paxos Gold (PAXG) – Each token represents one troy ounce of gold

Stablecoin Benefits

- Less affected by inflation compared to fiat currency

- Provides an easy way to invest in commodities

- More stable than cryptocurrencies based on speculation

Stablecoin Risks

- Requires trust in issuers to maintain proper reserves

- Higher costs due to storage and security

- Less liquid compared to other stablecoins

Stablecoin Liquidity: Why It Matters

Liquidity determines how easily a stablecoin can be exchanged for fiat or other cryptocurrencies.

- High-liquidity stablecoins, such as USDT and USDC, can be quickly converted into cash or traded on multiple platforms.

- Low-liquidity stablecoins may have fewer buyers and sellers, leading to price differences between exchanges.

Stablecoin liquidity affects their usefulness in trading and payments. Choosing a widely accepted stablecoin can help avoid transaction delays.

Stablecoin Security: Are Your Funds Safe?

Stablecoin security depends on how reserves are managed. Different types face different risks:

- Fiat-backed stablecoins rely on banks. They face regulatory risks and possible bank failures.

- Crypto-backed stablecoins use smart contracts. They are vulnerable to hacking and software errors.

- Algorithmic stablecoins depend on market trust. A loss of confidence can lead to failure.

- Commodity-backed stablecoins require secure storage. They have higher maintenance costs and can be harder to redeem.

Checking audits, security measures, and issuer credibility can help in choosing a safe stablecoin.

Stablecoins vs. Volatile Cryptocurrencies

| Feature | Stablecoins | Bitcoin, Ethereum |

| Price Stability | High | Low |

| Best Use | Payments, trading, savings | Investment, speculation |

| Control | Varies by type | Fully decentralized |

| Transparency | Some are audited | Public and open |

Stablecoins are designed for steady value, making them useful for payments and savings. Traditional cryptocurrencies often serve as investment tools with higher risk.

Stablecoin Regulation: What You Should Know

Governments are monitoring stablecoins to prevent financial risks. Some stablecoins, like USDC and BUSD, follow strict regulations and provide financial reports. Others, such as USDT, have faced criticism for limited transparency.

New regulations may require stablecoin issuers to follow banking rules. Some governments are also developing their own digital currencies.

Understanding stablecoin regulation is important for long-term users. Compliance with financial rules can affect availability and security.

Final Thoughts on Stablecoin Types

Stablecoins are an essential part of the digital economy. Each type has different advantages:

- Fiat-backed stablecoins offer stability and easy access.

- Crypto-backed stablecoins provide decentralization and transparency.

- Algorithmic stablecoins rely on technology but carry risks.

- Commodity-backed stablecoins connect digital money to real-world assets.

Choosing the right stablecoin depends on personal needs. Those who prefer security may use fiat-backed or commodity-backed stablecoins. People who support decentralization may use crypto-backed stablecoins. Algorithmic stablecoins bring new ideas but require caution.

Understanding how stablecoins work helps in making smarter financial choices.

FAQs

1. What are the different types of stablecoins?

There are four main types of stablecoins: Fiat-backed, Crypto-backed, Algorithmic, and Commodity-backed. Each type maintains stability in a different way. Some rely on traditional money, while others use cryptocurrencies, smart contracts, or real-world assets.

2. How do fiat-backed stablecoins work?

Fiat-backed stablecoins hold an equal amount of traditional currency, like the U.S. dollar or euro, in reserve. The company issuing the stablecoin stores the same value in a bank or financial institution. This helps keep the price stable.

3. Are crypto-backed stablecoins more secure than fiat-backed stablecoins?

Crypto-backed stablecoins are decentralized and use blockchain technology for transparency. They store cryptocurrency as collateral, making them independent of traditional banks. However, they can be risky because crypto prices change quickly.

4. What are algorithmic stablecoins, and why are they risky?

Algorithmic stablecoins use smart contracts to control supply and demand instead of holding reserves. If demand increases, more coins are created. If demand falls, coins are removed. These stablecoins depend on market confidence, which makes them less predictable.

5. Why do people use commodity-backed stablecoins?

Commodity-backed stablecoins are tied to physical assets like gold or silver. They provide a way to invest in commodities without holding them physically. Their value is linked to the price of the asset, offering a stable alternative to cryptocurrencies.

6. How does stablecoin regulation affect users?

Some stablecoins follow strict financial rules, while others do not. Regulated stablecoins, like USDC, provide regular financial reports. Governments may introduce new rules to make stablecoins safer for users.

7. How do stablecoins compare to regular cryptocurrencies like Bitcoin?

Stablecoins have steady prices, making them useful for payments, savings, and trading. Bitcoin and other cryptocurrencies have large price swings, making them better for investment. Stablecoins offer lower risk, while Bitcoin is often used for long-term gains.