Types of Stablecoins Explained: Which One Should You Trust?

- BLOG

- Crypto

- October 12, 2025

Stablecoins are designed to be the calm in crypto’s storm—the one thing that doesn’t swing wildly in value. But just how stable are they? The truth is, a stablecoin is only as strong as what backs it. Some rely on fiat, others on crypto, and some on complex algorithms. In the end, what holds them all together is trust. And like any currency, if that trust fades, so does the value. That’s why understanding the types of stablecoins isn’t just smart, it’s essential.

Not all stablecoins are built alike, and choosing the wrong one can cost you, whether in fees, trust, or functionality. If you’re navigating DeFi, handling cross-border payments, or building your own crypto solution, knowing the types of stablecoins gives you the clarity to choose what fits your needs. Let’s break them down, one type at a time.

Contents

Types of Stablecoins

This section lists the main types of stablecoin based on how they maintain price stability. That is, their mechanism. There are other ways to classify stablecoins too, and we’ll get to those after covering the mechanism-based list.

Most Common Stablecoin Types (By Mechanism)

We are only listing the types here. There is a detailed section for these three coins after this section mentions all the stablecoin types. Other types won’t have these detailed sections describing everything because they are not this popular.

- Fiat-Backed Stablecoins

Fiat-backed stablecoins are cryptocurrencies pegged to traditional currencies like the US dollar, backed by reserve assets to maintain stability.

- Crypto-Backed Stablecoins

These stablecoins are backed by other cryptocurrencies (like ETH) held in smart contracts, often overcollateralized to handle price swings.

- Algorithmic Stablecoins

These use code, not collateral to control supply and demand, adjusting the token supply automatically to keep the price stable.

Other Stablecoin Types (Also By Mechanism)

These are the stablecoins that are not that common. Most of them are Hybrid Stablecoins or a variation of the common types mentioned earlier. But they still play a very important role in bringing in interesting variations of the stablecoin trilemma.

Partially Algorithmic Stablecoins

Partially Algorithmic Stablecoins Combine on-chain collateral with algorithmic mechanisms to stabilize value. These were created to balance capital efficiency with decentralization, offering more scalable and adaptable stablecoin models for DeFi applications. Their unique mechanism lies in using a fractional reserve model that adjusts supply via algorithmic incentives.

Examples: Frax (FRAX)

Commodity-Backed Stablecoins

Commodity-backed stablecoins are backed by physical assets, such as gold or oil. These were introduced to give users a way to access the stability of traditional commodities in digital form, often used as a hedge against inflation or market volatility. Their uniqueness stems from the physical redemption of assets backing each token, thereby providing intrinsic value.

Examples: PAXG (gold), XAUT (Tether Gold)

Bank-Backed Stablecoins

Bank-Backed Stablecoins Issued by licensed banks and integrated into traditional banking systems. They were created to bridge the gap between legacy finance and blockchain by offering secure, regulated digital currency alternatives for institutional use. What sets them apart is direct issuance and backing by banking institutions under regulatory oversight.

Examples: JPM Coin (JPMorgan)

Non-Collateralized Stablecoins

Non-collateralized stablecoins lack explicit collateral and maintain peg through supply-demand dynamics alone. Designed to be fully decentralized and capital-efficient, their main use case is enabling censorship-resistant digital dollars without reliance on traditional assets. Their mechanism is distinct in relying solely on algorithmic control of token supply and user incentives.Examples: Basis (defunct), early version of Empty Set Dollar

Launch your stablecoin with Webisoft now!

Schedule a free consultation – Build a secure & scalable stablecoin today!

Key Concepts to Know Before Diving In

Before we get into the different types of stablecoins, it’s important to understand a few fundamental ideas that shape how they function. These concepts provide the foundation for grasping the mechanisms, risks, and use cases of each stablecoin type.

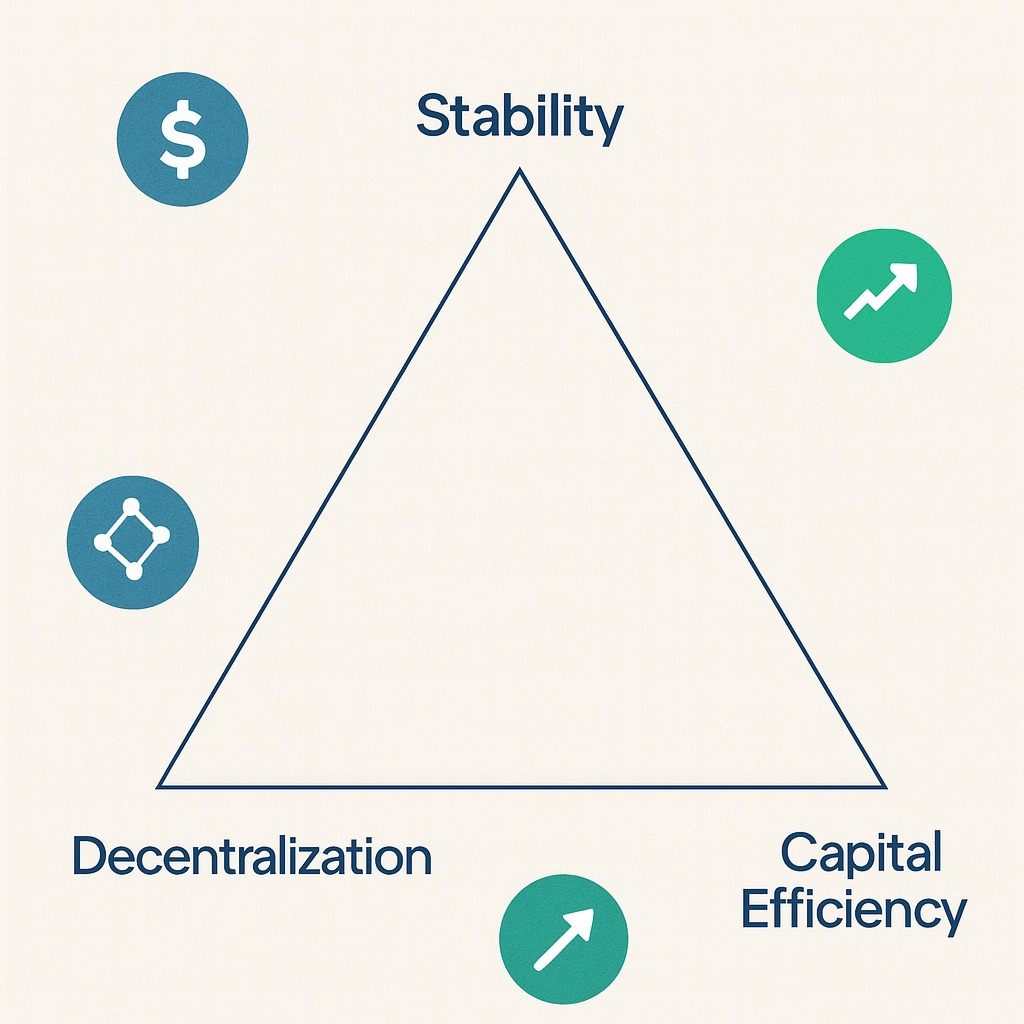

Understanding the Stablecoin Trilemma: Stability, Decentralization, and Scalability

Before diving into the design of stablecoins, it’s important to grasp a key challenge developers face: the stablecoin trilemma. Much like the blockchain trilemma, this concept highlights the difficulty in achieving all three of the following attributes at once:

- Price Stability: The coin must hold a steady value, typically pegged to a fiat currency or asset.

- Decentralization: Control should not rest with a single party or small group, allowing for censorship resistance and trustlessness.

- Scalability: The stablecoin should be efficient to use and capable of supporting large volumes without performance issues.

Most stablecoins can strongly satisfy two of these attributes, but often at the cost of the third. For example, fiat-backed stablecoins like USDT or USDC prioritize stability and scalability, but they rely on centralized entities, compromising decentralization. On the other hand, crypto-backed coins like DAI aim for decentralization and stability, but can suffer from scalability or capital inefficiency.

This trilemma shapes how stablecoins are designed,

Why Belief and Trust Define Stablecoin Value

At the core of any stablecoin’s success lies one simple truth: a currency only holds value if people trust it. That belief isn’t just about the technology or backing assets. It’s about user confidence in the system holding up under pressure. Whether the coin is pegged to dollars, crypto, or algorithms, its ability to retain value depends on how much users believe that peg will hold. Once trust breaks, even a well-designed stablecoin can spiral into collapse. This is why transparency, strong mechanisms, and real-world usability play such critical roles in building lasting value.

Main Types of Stablecoins

As we break down the main categories of stablecoins, keep one thing in mind: not all benefits, risks, or use cases are universal. Some of these traits are only relevant to specific stablecoin types.

So rather than list every possible outcome for each coin, we’ll focus only on what makes each category unique. This way, you’ll get a clear understanding of how each type works, where it stands out, and where it might fall short.

What Are Fiat-Backed Stablecoins?

Fiat-backed stablecoins are digital assets pegged to traditional government-issued currencies, like the US Dollar or Euro. Each coin is backed 1:1 by reserves held in bank accounts or custodial institutions, giving them a strong foundation of price stability.

These stablecoins act as a bridge between the crypto world and traditional finance. They’re easy to understand, quick to adopt, and widely accepted across exchanges and platforms.

Popular examples include:

- USDT (Tether)

- USDC (Circle)

- BUSD (Binance USD)

These coins are often the most liquid and most traded across centralized exchanges. However, they face regular scrutiny around reserve transparency and regulatory oversight.

Market sentiment: Fiat-backed coins dominate the stablecoin market in terms of volume and usage. Despite occasional trust issues, especially around Tether’s audit history, users generally accept them as the most practical and accessible stablecoins today.

Trilemma balance: Fiat-backed stablecoins strongly satisfy stability and scalability. However, they compromise heavily on decentralization, as centralized issuers control the reserves, supply, and redemption process.

Benefits of Fiat-Backed Stablecoins

- Simple peg mechanism makes them easy to understand

- Low volatility compared to crypto-backed or algorithmic coins

- High liquidity and adoption on exchanges

- Can be redeemed for fiat (in most cases)

Risks of Fiat-Backed Stablecoins

- Centralized control exposes them to censorship or asset freezes

- Lack of real-time, transparent audits for some issuers

- Regulatory crackdowns can halt issuance (e.g., BUSD)

- Susceptible to banking risks if reserve institutions collapse

Use Cases of Fiat-Backed Stablecoins

- Quick on-ramp/off-ramp between fiat and crypto

- Hedging against crypto market volatility

- International payments with low fees and fast settlement

- DeFi collateral, trading pairs, or yield farming

- Payroll or remittances in regions with currency instability

What Are Crypto-Backed Stablecoins?

Crypto-backed stablecoins, also known as digital asset collateral stablecoins, are backed by cryptocurrencies rather than fiat currencies. These stablecoins are typically overcollateralized to absorb market volatility and maintain their peg to a target value like $1.

They operate through smart contracts and decentralized protocols that lock up crypto assets as collateral. Users mint new stablecoins by depositing crypto (like ETH or BTC) and can redeem their collateral by returning the stablecoin to the protocol.

Popular examples include:

- DAI (MakerDAO)

- LUSD (Liquity Protocol)

- sUSD (Synthetix)

These stablecoins are a core component of decentralized finance (DeFi) and represent one of the most innovative types of stablecoins available.

Market sentiment: Crypto-backed stablecoins are widely respected in DeFi communities for their decentralized architecture. However, their adoption outside of crypto-native users is still relatively niche, mainly due to volatility risks and complexity.

Trilemma balance: This category excels in decentralization and stability (with proper overcollateralization), but often struggles with scalability due to the need for excess collateral and high gas fees on certain chains.

Benefits of Crypto-Backed Stablecoins

- Operate without centralized control or custodians

- Transparent on-chain reserves

- Resistant to censorship or regulatory shutdown

- Integrate well into DeFi applications

Risks of Crypto-Backed Stablecoins

- Require overcollateralization to remain stable

- Vulnerable to crypto market crashes

- Liquidation risk if the collateral value drops rapidly

- Technical risk due to smart contract vulnerabilities

Use Cases of Crypto-Backed Stablecoins

- Decentralized borrowing and lending

- Collateral in DeFi protocols

- Payments in ecosystems that value decentralization

- Trading without fiat exposure

- Supporting DAO treasuries and operations

Among all types of stablecoins, crypto-backed models offer the highest alignment with DeFi ideals but with trade-offs in efficiency and capital use.

What Are Algorithmic Stablecoins?

Algorithmic stablecoins are not backed by fiat or crypto reserves. Instead, they rely on smart contract algorithms to control the coin’s supply and stabilize its price. These coins aim to maintain a peg usually to the US dollar by automatically expanding or contracting supply based on market demand.

The idea is to mimic central bank monetary policy, but on-chain and without collateral. When demand rises and the price goes above the peg, the protocol increases supply. When demand falls, it burns tokens or incentivizes users to remove them from circulation.

Popular examples include:

- FRAX (initially partially algorithmic)

- Ampleforth (AMPL)

- Basis (defunct)

These models are considered experimental among the types of stablecoins, with high potential rewards and risks.

Market sentiment: Algorithmic stablecoins have seen mixed reactions. Some are intrigued by the innovation, while others remain cautious due to high-profile failures like TerraUSD (UST). Confidence in this category is generally low unless paired with partial collateral or strict governance mechanisms.

Trilemma balance: Algorithmic stablecoins aim for scalability and decentralization, but stability is their biggest weakness. Since there’s no hard collateral, price swings can become uncontrollable if the algorithm loses market trust.

Benefits of Algorithmic Stablecoins

- No need for collateral, freeing up capital

- Designed for high scalability and on-chain efficiency

- Fully autonomous and decentralized (in theory)

- Rapid innovation potential

Risks of Algorithmic Stablecoins

- Peg can break quickly if demand drops

- Prone to death spirals or hyperinflation scenarios

- Complex mechanics can confuse average users

- Low market confidence without added collateral or regulation

Use Cases of Algorithmic Stablecoins

- On-chain experimentations and protocol-native currencies

- DeFi projects testing new economic models

- Rapidly scalable payment systems in theory

- Value stabilization inside closed-loop ecosystems

How Do Stablecoins Make Money?

While stablecoins are designed to maintain a fixed value, they still generate revenue for their issuers and protocols. The most common income sources include interest earned on reserves, transaction fees, issuance and redemption fees, and DeFi integrations. Some issuers also invest portions of reserves in low-risk government securities.

To understand the full breakdown of revenue models, check out this detailed guide on how stablecoins make money.

Judging the 5 Most Popular Stablecoins

Stablecoins may share a common goal, but how they perform in the real world varies. Here’s how the top five compare on core factors that matter most.

USDT (Tether)

Among the most widely used stablecoins, USDT remains dominant due to its broad platform support and fast transaction speeds. It’s accessible worldwide but has faced criticism over its reserve transparency and lack of consistent audits. While transaction fees vary by chain, they’re typically low, especially on networks like Tron. Tether is highly centralized, and although rare, it has experienced brief moments of de-pegging under pressure.

USDC (Circle)

USDC by Circle is praised for its strong compliance and transparency, with reserves primarily in U.S. Treasuries and frequent audits. It’s quick to transact, widely accepted in DeFi and CeFi platforms, and seen as secure. Although centralized, it’s trusted more than many peers. Its brief de-pegging during the SVB banking crisis was quickly resolved, reinforcing its market reliability.

DAI (MakerDAO)

DAI, issued by MakerDAO, is a crypto-backed stablecoin that prioritizes decentralization. It’s well-integrated across DeFi platforms, although its speed depends on the Ethereum network. With transparent overcollateralization and community governance, it’s seen as secure. However, DAI’s growing exposure to centralized assets like USDC has raised concerns about creeping centralization. Despite some instability during high-volatility events, it has largely maintained its peg.

BUSD (Binance USD)

BUSD, tied to Binance, was once a strong contender thanks to fast transactions on BNB Chain and low fees within the Binance ecosystem. However, regulatory issues led to a halt in issuance by Paxos. Though its reserves were well-managed, BUSD’s utility has declined, and it’s viewed as highly centralized. The coin remained stable until regulatory challenges disrupted its future.

FRAX (Frax Finance)

FRAX, which began as algorithmic and later evolved into a hybrid model, offers efficient transactions and is integrated into several DeFi ecosystems. Its semi-collateralized nature offers flexibility, but also adds risk. Governance is semi-centralized, and although FRAX has shown volatility in the past, its hybrid mechanism has recently helped stabilize it. Still, it’s considered niche with lower global access compared to giants like USDT or USDC.

Unsure which stablecoin model aligns with your project? Talk to our team to get expert guidance tailored to your use case.

How Webisoft Helps You Build and Scale With Stablecoins

Behind every stablecoin is a web of critical infrastructure: blockchain frameworks, smart contracts, wallets, dashboards, and integrations. That’s where we come in.

At Webisoft, we specialize in full-stack blockchain development with a strong focus on stability, usability, and long-term scalability. If you’re looking to launch a stablecoin or integrate one into your ecosystem, our team brings both the technical firepower and real-world experience to guide the way.

From building smart contracts for minting and burning to designing user-friendly crypto wallets that support stablecoin payments, we handle every piece of the puzzle. We also develop stablecoin-ready blockchain infrastructures and execute secure Web3 integrations to help your token interact seamlessly with other DeFi tools.

Our approach goes beyond code—we help you think through regulatory strategy, reserve models, and the best blockchain network for your goals. If you’re serious about building something reliable, flexible, and future-proof, talk to us. Let’s bring your stablecoin project to life.

Final Thoughts on the Types of Stablecoins

The world of stablecoins is evolving fast, shaped by market trust, technology, and regulation. Whether you’re building in DeFi, trading, or just looking for a reliable store of value, understanding the different types of stablecoins and how they perform in practice gives you a real edge.

No model is perfect, but each offers unique trade-offs depending on what matters most to you: speed, stability, decentralization, or control.

FAQs About Stablecoins

Is USDT or USDC better?

It depends on your priorities. USDT offers higher liquidity and wider adoption across global exchanges. USDC, on the other hand, is generally seen as more transparent and better regulated. If trust and auditability matter more to you, USDC may be the better choice.

Which stablecoin is safer?

In terms of transparency and regulatory oversight, USDC is often considered the safer option. It’s backed by audited reserves and is fully redeemable. However, safety also depends on use case and platform security.

Who owns USDC?

USDC is issued by Circle, a U.S.-based financial technology company. It was co-developed with Coinbase under the Centre Consortium. Circle manages the reserves and oversees compliance and operations for the stablecoin.