Top Blockchain Development Frameworks in 2025

- BLOG

- Blockchain

- October 5, 2025

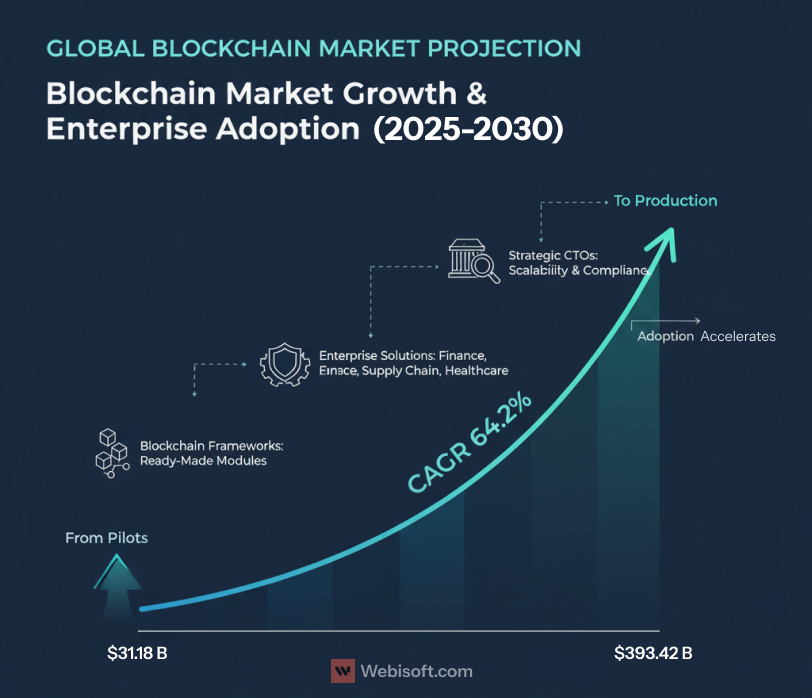

Blockchain has moved far beyond its early association with cryptocurrencies. In 2025, it is powering enterprise-grade solutions across finance, supply chain, healthcare, and government. The shift is no longer about whether organizations will explore blockchain but how quickly they can move from pilot projects to production-ready systems.

A blockchain framework plays a crucial role in this transition. Instead of building every component from scratch, developers and businesses rely on frameworks that provide ready-made modules for consensus, identity management, smart contracts, and integration with existing systems. This drastically reduces development time and lowers the risk of technical failure.

The demand is clear. According to Fortune Business Insights, the global blockchain technology market is projected to grow from $31.18 billion in 2025 to $393.42 billion by 2030, reflecting a staggering CAGR of 64.2%. This surge highlights why understanding frameworks is essential, they are the building blocks behind the adoption wave.

For CTOs, frameworks determine scalability, compliance readiness, and long-term maintainability. For non-technical decision-makers, frameworks represent a way to align business strategy with emerging technology without overcommitting resources. Choosing the right one can mean the difference between a project that scales and one that stalls.

This guide explores the leading blockchain development frameworks in 2025, their strengths, and their ideal use cases. By the end, you will have a clearer view of which frameworks align with your business or technical needs and how to make an informed choice.

Contents

- 1 What Are Blockchain Development Frameworks?

- 2 Why Choosing the Right Framework Matters

- 3 Top Blockchain Development Frameworks in 2025 (Reviewed)

- 4 Framework Trends for Enterprises in 2025

- 5 Market Outlook: Growth of Enterprise Blockchain Frameworks

- 6 How to Choose the Right Framework for Your Project

- 7 Webisoft’s Role in Helping You Navigate Frameworks

- 8 FAQs About Blockchain Development Frameworks (2025)

- 8.1 1. What is a blockchain development framework?

- 8.2 2. Which frameworks are best for enterprise use?

- 8.3 3. What programming languages do blockchain frameworks support?

- 8.4 4. Are private frameworks more secure than public ones?

- 8.5 5. How much does it cost to build on top of these frameworks?

- 8.6 6. What frameworks are best for NFTs and DeFi?

What Are Blockchain Development Frameworks?

A blockchain development framework is a set of pre-built tools, libraries, and protocols designed to make building blockchain-based applications faster and more reliable. Instead of reinventing the wheel for every new project, frameworks give developers ready-made modules for critical functions like consensus mechanisms, peer-to-peer networking, transaction validation, and smart contract execution.

For non-technical readers, you can think of a blockchain framework as the “operating system” of a blockchain application. It provides the foundation on which businesses can deploy custom apps for finance, supply chain, healthcare, or other industries. This way, companies don’t need to design every component from scratch, they can focus on business logic and user experience.

For developers and CTOs, frameworks bring technical advantages. They standardize APIs, manage nodes, handle cryptographic functions, and often include testing environments. Many frameworks are also modular, allowing teams to customize components like consensus algorithms or permission models without disrupting the rest of the system.

Some frameworks are public and open-source, like Ethereum, which powers DeFi and NFT ecosystems. Others, like Hyperledger Fabric and Corda, are permissioned and optimized for enterprise use, offering better compliance, governance, and performance guarantees. This division is one of the most important distinctions to understand when choosing the right fit for your project.

Blockchain frameworks ultimately lower costs, improve scalability, and reduce the likelihood of failed implementations. They serve as the bridge between raw blockchain protocols and fully functional applications.

Why Choosing the Right Framework Matters

Blockchain projects are notoriously risky. Many proof-of-concepts never make it to production because of technical misalignment, lack of scalability, or gaps in regulatory compliance. The framework you choose at the start can determine whether your project thrives or becomes another stalled experiment.

Frameworks aren’t interchangeable. Some are designed for high throughput and public adoption, while others emphasize privacy and regulatory oversight. Picking a framework without considering business goals often leads to costly rebuilds later. For startups, this can drain budgets. For enterprises, it can delay digital transformation roadmaps.

The data backs this up. Forrester notes that firms failing to assess technical architecture, cultural fit, and realistic MVPs are most at risk of project failure and wasted spend. In other words, choosing a framework isn’t just a technical decision, it’s a strategic one.

From a developer’s perspective, the right framework impacts developer productivity, code maintainability, and integration with existing systems. For decision-makers, it affects compliance readiness, security posture, and long-term cost efficiency.

This is where experienced blockchain partners add value. A consultative team can help you evaluate not just the technical features of each framework but also its fit with your business model, market, and compliance environment.

Top Blockchain Development Frameworks in 2025 (Reviewed)

Leading frameworks have matured into specialized ecosystems. They solve different problems, from public DeFi scale to enterprise privacy and compliance. Research frequently identifies Ethereum, Hyperledger Fabric, and Corda as the top choices for real-world enterprise applications, with Ethereum dominant on the public side and Fabric favored in regulated sectors. See the survey by ScienceDirect for a comparative view of adoption patterns and use cases (frameworks in practice).

1) Ethereum (EVM and Layer-2 Ecosystem)

Ethereum remains the most widely used framework for smart contracts and public applications. The Ethereum Virtual Machine lets teams write programmable logic in Solidity. The developer tooling is extensive, including Foundry, Hardhat, and Truffle, with mature testing and deployment pipelines.

Layer-2 networks help with scale and cost. Rollups reduce gas expenses, while preserving Ethereum security guarantees. For consumer apps, this balance of ecosystem reach and lower fees is attractive.

Common enterprise patterns include tokenization of assets, permissioned sidechains, and zero-knowledge integrations for privacy. Careful gas budgeting and contract design are still essential to avoid cost spikes.

Best for: NFTs, DeFi, DAOs, tokenization, consumer dApps

Strengths: Largest developer community, rich tooling, strong network effects

Trade-offs: Gas volatility on mainnet, security diligence required, evolving privacy patterns

2) Hyperledger Fabric

Fabric is a permissioned framework under the Linux Foundation. It offers modular components, private data collections, and channel-based privacy so that counterparties only see what they should. This aligns well with compliance needs in finance, healthcare, and supply chains.

Smart business logic runs as chaincode in languages like Go and Java. Identity and access are handled through a built-in Membership Service Provider, which simplifies enterprise onboarding and audit trails.

Performance tuning focuses on endorsement policies, ordering services, and hardware security modules. Integration with existing systems is straightforward through gRPC and REST gateways.

Best for: Regulated workflows, consortia, audit-heavy processes

Strengths: Fine-grained privacy, enterprise identity, predictable governance

Trade-offs: Steeper learning curve, more ops overhead, smaller public ecosystem

3) Corda

Corda is built for confidential business transactions. It does not broadcast all data to all participants. Instead, it shares transactions only with relevant parties. This model supports privacy and reduces data leakage.

Developers write CorDapps in Kotlin or Java. Flows coordinate transactions, while notaries prevent double spends. The architecture maps well to financial agreements, settlements, and regulated record keeping.

Enterprises appreciate the strong model for legal prose alignment and the emphasis on compliance. Connectivity with core banking, payments, and identity systems is a common deployment pattern.

Best for: Financial services, insurance, regulated B2B networks

Strengths: Point-to-point privacy, legal alignment, enterprise-grade patterns

Trade-offs: Narrower public use cases, smaller open ecosystem, vendor expertise required

4) Polkadot and Substrate

Polkadot provides a shared security relay chain with interoperable parachains. Substrate is the toolkit used to build those custom blockchains. Teams choose runtime pallets for governance, assets, staking, and more, then tailor consensus and execution for their needs.

The result is a flexible architecture. You get a chain designed for your application, with cross-chain messaging to other parachains. For projects that require sovereignty plus interoperability, this is a strong option.

Operational complexity is higher than a single-chain app, so planning for monitoring, upgrades, and relays is important. Teams with protocol-level ambitions benefit most.

Best for: Interoperable networks, custom runtimes, cross-chain DeFi

Strengths: Modularity, sovereignty with shared security, robust cross-chain messaging

Trade-offs: Higher protocol complexity, relay dependencies, specialized talent needs

5) Cosmos SDK

Cosmos positions itself as the “Internet of Blockchains.” Its SDK lets developers compose blockchains using modules, while the Tendermint consensus ensures speed and reliability. Inter-blockchain communication (IBC) makes Cosmos chains interoperable.

High-profile deployments like Binance Chain and Osmosis validate its scalability. Developers can tailor governance, fee structures, and staking parameters. The trade-off is ecosystem fragmentation, as each chain may diverge in design and security assumptions.

Best for: Custom interoperable chains, scalable DeFi platforms

Strengths: Modular SDK, proven interoperability, real-world adoption

Trade-offs: Risk of fragmented chains, more dev expertise required

6) Tezos

Tezos is known for its on-chain governance and formal verification. The governance model enables protocol upgrades without hard forks, which minimizes community splits. Smart contracts can be formally verified, reducing vulnerabilities.

Adoption has been strong in tokenized assets, art NFTs, and digital securities. Enterprises favor Tezos for its energy-efficient consensus and predictable upgrade path. Developers may face a smaller ecosystem than Ethereum but benefit from strong governance assurances.

Best for: Asset tokenization, compliance-sensitive NFT projects

Strengths: Stakeholder-driven governance, security via formal verification, eco-friendly

Trade-offs: Smaller dev community, limited mainstream adoption compared to Ethereum

7) Quorum (by ConsenSys)

Quorum started at JPMorgan and is now part of ConsenSys. It extends Ethereum with permissioned features, private transactions, and enterprise-grade governance. This makes it attractive to financial institutions that want Ethereum compatibility without the risks of a fully public chain.

It benefits from Ethereum tooling and standards while adding confidentiality layers. However, its scope is narrower: Quorum is less suitable for public-facing consumer apps, and more tuned for internal or consortium deployments.

Best for: Enterprise finance, regulated consortium networks

Strengths: Ethereum compatibility, enterprise support, private transaction handling

Trade-offs: Narrower use cases, smaller independent community

8) Stellar SDK

Stellar is optimized for cross-border payments and token issuance. Its SDK simplifies integration for fintechs and NGOs targeting financial inclusion. Transaction fees are extremely low, and settlements occur within seconds.

Adoption examples include remittance corridors, digital currency pilots, and tokenized assets. While Stellar is less flexible for general-purpose dApps, it is unmatched in lightweight financial applications.

Best for: Remittances, CBDC pilots, token issuance for fintech

Strengths: Low fees, fast payments, global partnerships

Trade-offs: Less modular, not suited for complex smart contract apps

Framework Trends for Enterprises in 2025

Enterprise adoption of blockchain frameworks is accelerating, but the priorities look different from public blockchain projects. While DeFi and NFT developers continue to favor Ethereum for its open ecosystem, enterprises often choose permissioned frameworks like Hyperledger Fabric and Corda to balance transparency with compliance.

A major driver is regulation. Financial institutions, in particular, are under pressure to meet strict anti-money laundering (AML) and know your customer (KYC) requirements. Frameworks that provide robust identity management and transaction traceability are rising in adoption. According to IDC’s Corporate Banking Predictions, by 2026, 50% of financial institutions will rely on frameworks such as Hyperledger Fabric and Corda to verify account and identity veracity.

Industries like healthcare and supply chain management are also leaning into permissioned frameworks for their ability to handle private data while still enabling secure multi-party collaboration. Meanwhile, sectors experimenting with tokenization, digital securities, and central bank digital currencies (CBDCs) are exploring both public and hybrid models.

Another trend is the emphasis on interoperability. Enterprises rarely work in isolation; they need systems that can connect across different ledgers. Frameworks like Polkadot, Cosmos, and Quorum are gaining traction for projects that require cross-chain integration without compromising compliance.

The enterprise blockchain market is clearly moving toward frameworks that combine regulatory trust, scalability, and interoperability. For businesses, this means choosing a framework is less about hype and more about aligning technology with industry standards and long-term operational resilience.

Market Outlook: Growth of Enterprise Blockchain Frameworks

Enterprise adoption of blockchain frameworks is still in its early stages, but the growth trajectory is accelerating. Organizations are moving beyond proofs-of-concept to full-scale production deployments, especially in financial services, logistics, and government-backed initiatives.

The enterprise blockchain development market was valued at $372 million in 2024 and is projected to grow to $1.229 billion by 2031, representing a CAGR of 19.3%. This steady growth reflects the increasing trust in blockchain’s ability to address compliance, data sharing, and operational inefficiencies.

Frameworks that focus on interoperability and governance are positioned to capture the most value. Hyperledger Fabric and Corda continue to gain traction for their permissioned models, while Polkadot and Cosmos are opening new possibilities for cross-chain enterprise solutions. Public blockchains like Ethereum also remain part of the mix, particularly in hybrid models where enterprises need global connectivity alongside internal privacy.

Key drivers behind this growth include:

- Regulatory clarity in regions like Hong Kong, Singapore, and the EU.

- Digital asset initiatives such as CBDCs and tokenized securities.

- Interoperability demands, ensuring different ecosystems can communicate securely.

- Cloud-native tooling, which lowers the entry barrier for enterprises exploring blockchain.

The implication is clear: blockchain frameworks are not just competing on features but on their ability to integrate seamlessly with legacy systems, meet compliance standards, and scale globally.

How to Choose the Right Framework for Your Project

Selecting the right blockchain framework is less about features on paper and more about aligning technology with business goals. Each framework excels in different areas, so the evaluation process should be structured and intentional.

1. Define Your Consensus Needs

Consensus algorithms impact scalability, security, and energy efficiency. Public chains like Ethereum rely on Proof-of-Stake, while enterprise frameworks like Fabric let you configure consensus to match transaction volume and trust models.

2. Consider Programming Language Support

Ethereum favors Solidity, while Corda supports Java and Kotlin. Fabric allows chaincode in Go and Java. Choose a framework that aligns with your team’s existing skills to reduce onboarding costs.

3. Assess Interoperability Requirements

If your project must interact with multiple ledgers, frameworks like Polkadot and Cosmos are strong candidates. For isolated applications, simpler architectures may suffice.

4. Evaluate Regulatory and Compliance Needs

Industries under strict oversight should prioritize permissioned frameworks with strong identity and audit capabilities, such as Fabric, Corda, or Quorum. These make compliance workflows easier to integrate.

5. Look at Scalability and Throughput

Different frameworks have different transaction-per-second capacities. High-volume financial applications may require Polkadot or Cosmos, while tokenization platforms may run efficiently on Tezos or Stellar.

6. Gauge Ecosystem Maturity

An active developer community and strong tooling ecosystem reduce risk. Ethereum leads in this category, while enterprise-focused frameworks rely more on vendor support.

7. Balance Cost and Long-Term Sustainability

Consider both initial setup and ongoing maintenance costs. Some frameworks demand more infrastructure investment but deliver efficiency at scale.

The decision-making process should be collaborative, involving both technical stakeholders and business leaders. Consulting with experienced development partners can help map framework capabilities against your strategic objectives, avoiding costly missteps.

Webisoft’s Role in Helping You Navigate Frameworks

Choosing the right blockchain framework is rarely straightforward. The options are diverse, and each comes with trade-offs in scalability, compliance, ecosystem support, and cost. For many businesses, the challenge is not just identifying a framework but integrating it into existing systems, aligning it with long-term goals, and ensuring it can evolve with market demands.

This is where Webisoft supports its clients. Our team has worked across leading frameworks, including Ethereum, Hyperledger Fabric, Corda, and Polkadot, helping startups and enterprises alike make informed decisions. We go beyond technical builds to provide consultative guidance, mapping framework capabilities against your business objectives.

For developers, we help set up the right tools, environments, and integration pipelines. For decision-makers, we simplify the complexity of framework selection by clarifying regulatory implications, long-term maintenance costs, and interoperability needs. Our approach combines technical depth with business strategy, ensuring that your blockchain project is designed not just to launch, but to scale.

If you are planning a new blockchain initiative or evaluating whether to migrate to a different framework, Webisoft can help reduce risks and accelerate outcomes.

FAQs About Blockchain Development Frameworks (2025)

1. What is a blockchain development framework?

It’s a toolkit that provides pre-built components like consensus algorithms, smart contract engines, and APIs to simplify blockchain application development. Frameworks reduce complexity, save time, and allow developers to focus on business logic instead of building protocols from scratch.

2. Which frameworks are best for enterprise use?

Enterprises typically favor permissioned frameworks. Hyperledger Fabric is popular in supply chain and healthcare for its modular privacy features, while Corda dominates in finance due to its transaction-level confidentiality. Quorum adds Ethereum compatibility with enterprise-grade controls.

3. What programming languages do blockchain frameworks support?

It varies: Ethereum uses Solidity; Corda uses Java and Kotlin; Fabric supports chaincode in Go and Java; Polkadot/Substrate uses Rust; Tezos contracts can be written in Michelson or higher-level languages. Language support is often a deciding factor for developer teams.

4. Are private frameworks more secure than public ones?

Not inherently. Private frameworks like Fabric and Corda restrict participation and offer tighter access control, which can reduce attack vectors. Public frameworks like Ethereum rely on decentralization for security. The right choice depends on compliance requirements and trust models.

5. How much does it cost to build on top of these frameworks?

Costs vary widely. Public frameworks may incur higher transaction fees, while private ones demand infrastructure and licensing investments. Enterprises often weigh ongoing support and compliance costs in addition to initial development.

6. What frameworks are best for NFTs and DeFi?

Ethereum remains the leader for NFTs and DeFi due to its ecosystem maturity, developer tools, and Layer-2 scalability solutions. Cosmos and Polkadot are gaining ground for projects that require cross-chain interoperability, but Ethereum dominates in liquidity and the developer community.