How Real Estate Tokenization Works: Complete Guide

- BLOG

- Blockchain

- October 12, 2025

Real estate tokenization is transforming how people invest in property by turning physical assets into digital tokens on the blockchain. This guide breaks down the concept in simple terms for both newcomers and experienced investors. You’ll learn how tokenization works, the benefits it offers, the risks involved, and how to participate safely and legally. Whether you’re a developer seeking new fundraising channels or a retail investor looking for accessible property ownership, this guide will walk you through every key aspect — from technology and compliance to real-world use cases and future trends. Let’s demystify tokenized real estate together.

Contents

- 1 What is Real Estate Tokenization?

- 2 How Does Real Estate Tokenization Work in Practice?

- 3 Tokenization Models Explained

- 4 Benefits of Real Estate Tokenization for Investors and Developers

- 5 Legal, Regulatory, and Tax Considerations

- 6 Technical Infrastructure of Real Estate Tokenization

- 7 Challenges and Risks of Tokenized Real Estate

- 8 Step-by-Step: How to Invest in Tokenized Real Estate

- 9 Real-World Examples and Case Studies

- 10 The Future of Real Estate Tokenization

- 11 FAQs About Real Estate Tokenization

- 11.1 What is the minimum investment in tokenized real estate?

- 11.2 Is tokenized real estate legal in the U.S.?

- 11.3 Can I earn rental income through tokens?

- 11.4 What happens if the platform goes out of business?

- 11.5 Are tokenized assets insured or collateralized?

- 11.6 How do I sell my real estate tokens later?

- 12 Conclusion: Is Tokenization Right for You?

What is Real Estate Tokenization?

Real estate tokenization is the process of turning a real-world property into digital shares, or “tokens,” that can be bought, sold, and traded on a blockchain. These tokens represent ownership in a specific property, development, or portfolio, and they function similarly to shares in a company. Through tokenization, investors can gain fractional access to high-value assets that were traditionally reserved for institutional players or those with significant capital.

To understand tokenization, imagine a building worth $1 million. Instead of selling the whole property to one buyer, the owner can tokenize it by creating 10,000 digital tokens, each worth $100. Investors can then purchase as many tokens as they want, owning a proportional share of the building and potentially earning returns from rent or capital appreciation.

This model shares similarities with Real Estate Investment Trusts (REITs), crowdfunding platforms, and traditional property syndications, but it also introduces key differences. While REITs are traded on stock exchanges and managed as large funds, tokenized assets can be tied directly to individual properties. Tokenization also provides greater transparency and the potential for 24/7 trading, unlike most traditional platforms that are limited to fixed operating hours and slower transaction processes.

Compared to real estate crowdfunding, tokenization relies on blockchain to automate many parts of the process — such as ownership verification, dividend payouts, and compliance checks — which reduces overhead and streamlines operations. It also offers more flexibility. For example, investors can sell their tokens on secondary markets without waiting for a full property exit, which is often the only liquidity event in traditional models.

Ultimately, real estate tokenization is opening doors for both retail and institutional investors. It combines the reliability of real estate with the flexibility and efficiency of blockchain, creating a more accessible way to participate in property markets.

How Does Real Estate Tokenization Work in Practice?

Tokenizing real estate may sound complex, but it can be broken down into a series of clearly defined steps involving legal, technical, and compliance components. The core idea is to represent ownership of a physical property through blockchain-based digital tokens, governed and enforced by smart contracts.

Legal and Technical Foundations

Every tokenized real estate deal begins with a legal entity—often a Special Purpose Vehicle (SPV) or trust—that owns the actual property. Rather than issuing traditional shares, this entity creates digital tokens that represent ownership rights or economic interests in the property. These tokens are recorded on a blockchain and can be traded or transferred under specific terms.

Smart contracts play a central role in managing how these tokens behave. Built primarily on Ethereum-compatible standards like ERC-20 or ERC-1400, smart contracts encode rules such as who can hold the tokens, how dividends are distributed, and what happens in the event of a resale. For example, ERC-1400 is specifically designed for security tokens, with features like forced transfers, lock-up periods, and identity restrictions, making it a better fit for regulatory compliance.

KYC, AML, and Regulatory Compliance

Because tokenized real estate is generally classified as a security, regulatory compliance is a core component of any offering. This starts with Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. All investors must verify their identity before purchasing tokens. This is typically handled through integrated identity verification providers, who screen buyers before granting them access to the token sale.

Jurisdiction also matters. In the United States, offerings often comply with SEC regulations through exemptions such as Regulation D or Regulation S. In the European Union, similar frameworks like MiFID II and the Prospectus Regulation apply. These legal wrappers dictate who can invest (e.g., accredited vs. retail investors), how much they can invest, and how the asset must be reported.

Custody and Investor Onboarding

Tokens can be stored in two ways: non-custodial (where the investor holds their own private keys) or custodial (where a third-party service holds the tokens on behalf of investors). While non-custodial solutions offer more control, they also pose risks related to lost keys or poor user management. Custodial solutions are more user-friendly and may be required in jurisdictions that treat tokenized securities as regulated assets.

Investor onboarding platforms often bundle wallet setup, KYC, and token purchasing into one streamlined interface. This reduces friction and helps ensure compliance across multiple jurisdictions. Once onboarded, investors can view their holdings, receive automated payouts, and track performance—often without needing deep blockchain expertise.

The rise of token marketplaces is also expanding post-sale liquidity. These platforms allow token holders to trade their real estate-backed tokens with other verified users, bringing a level of flexibility that was rarely possible with traditional property ownership.

Tokenization Models Explained

Real estate tokenization is not one-size-fits-all. Depending on the investment strategy, asset type, and expected return structure, developers and platforms can choose from a variety of token models. Each serves a different purpose and attracts different kinds of investors. Here’s a closer look at the most common models used today.

Fractional Ownership Tokens

This is the most widely used model. Each token represents a fractional share of ownership in a property or a legal entity that holds the asset. Investors benefit from property appreciation and may receive a proportional share of rental income.

- Best suited for: Residential and commercial properties

- Ideal for: Long-term investors seeking capital appreciation and occasional income

- Risk level: Moderate (tied to property value and rental market)

Cash Flow Tokens

Instead of ownership, these tokens entitle holders to a share of the revenue generated by the asset—such as rental income or lease payments. Ownership may stay with the sponsor or another legal entity, while investors receive income distributions via smart contracts.

- Best suited for: Income-generating assets like rental apartments or commercial leases

- Ideal for: Investors seeking consistent passive income

- Risk level: Low to moderate (linked to occupancy rates and tenant quality)

Project Development Tokens

These tokens represent a stake in a real estate development project. Investors receive returns from the sale of units or long-term leasing once the project is completed. This model is common in tokenized real estate crowdfunding.

- Best suited for: New construction, redevelopment, or large-scale renovation projects

- Ideal for: Investors with higher risk appetite and longer investment horizons

- Risk level: High (depends on project completion, permits, market shifts)

RE Baskets / Real Estate Fund Tokens

These tokens represent shares in a diversified portfolio of real estate assets. Think of it as a real estate ETF that’s tokenized and accessible to a wider investor base. Investors benefit from diversification across regions and property types.

- Best suited for: Asset managers, tokenized REITs, or multi-property funds

- Ideal for: Passive investors seeking stable exposure across real estate

- Risk level: Low to moderate (depends on portfolio strategy)

You might also like: What Is Asset Tokenization? Key Use Cases and Value

Benefits of Real Estate Tokenization for Investors and Developers

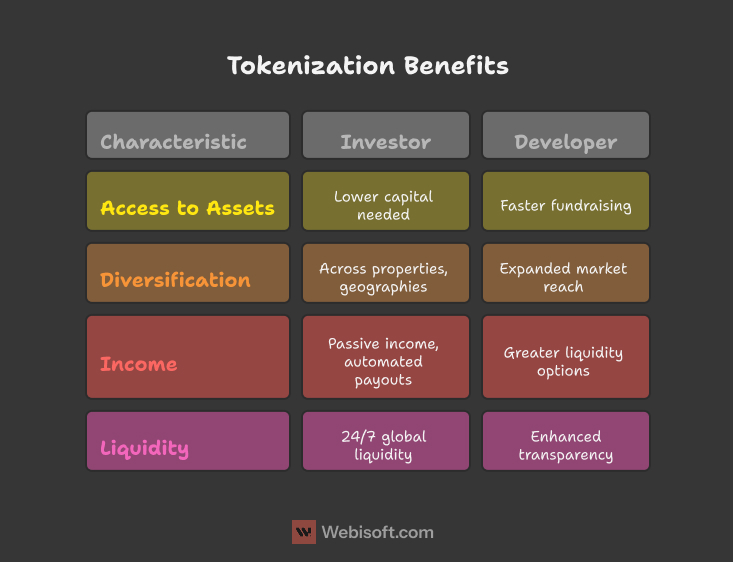

Real estate tokenization isn’t just a buzzword — it brings tangible benefits for both investors and property owners. By leveraging blockchain technology, tokenization removes many of the traditional friction points in property investing and capital raising. Here’s a breakdown of how each side stands to gain.

For Investors

1. Access to Premium Assets with Lower Capital

Tokenization breaks down large, premium properties into smaller units that anyone can invest in. Instead of needing hundreds of thousands to enter a real estate deal, investors can now get exposure with much smaller amounts. According to EY, minimum investments through tokenized platforms can be as low as $1,000, opening up opportunities that were once limited to institutional players.

2. Diversification Across Properties and Geographies

Instead of putting all capital into a single location or property, investors can now spread their funds across multiple assets — from luxury resorts in the U.S. to residential apartments in Europe. This kind of diversification was often cost-prohibitive with traditional real estate investing.

3. Passive Income with Automated Payouts

Smart contracts enable automatic distribution of rental income or dividends. Investors don’t need to chase landlords or deal with complex accounting. Payouts are scheduled and transparent, providing a seamless passive income experience.

4. 24/7 Global Liquidity on Digital Marketplaces

Unlike traditional real estate, which can take months to buy or sell, tokenized assets can be traded peer-to-peer or on secondary marketplaces. This opens up liquidity that was previously unthinkable in the real estate space, giving investors more flexibility to enter or exit when needed.

For Developers and Asset Owners

1. Faster Fundraising and Capital Deployment

Raising capital through traditional methods — bank loans, private equity, or institutional funds — is often slow and restrictive. Tokenization allows asset owners to tap into a wider pool of retail and accredited investors, often with quicker turnaround times.

2. Expanded Market Reach Through Fractionalization

A developer selling a $10 million property traditionally needs to find one or two buyers. With tokenization, that same property can be sold to thousands of micro-investors around the world. This increases demand and can potentially raise funds more efficiently.

3. Greater Liquidity Options

Asset owners can sell fractional stakes instead of the entire property, enabling partial exits or refinancing without disrupting full ownership. It also allows them to monetize parts of an asset while continuing to manage or develop it.

4. Enhanced Transparency and Trust

Blockchain records offer immutable ownership logs and real-time transaction visibility. This builds trust with investors, reduces disputes, and simplifies recordkeeping for both parties.

Legal, Regulatory, and Tax Considerations

While real estate tokenization opens exciting new pathways for investment and fundraising, it also introduces complex legal and tax challenges. These must be addressed from the start to ensure full compliance and long-term viability. Regulators across the globe are catching up to the technology, and staying on the right side of the law is critical for both issuers and investors.

Security vs. Utility Tokens

In most cases, real estate tokens are classified as securities rather than utility tokens. This means they fall under the same regulatory scrutiny as traditional financial instruments.

The U.S. Securities and Exchange Commission (SEC) applies the Howey Test to determine whether a token qualifies as a security. If the token offers profit expectations based on the work of others — such as rental income or asset appreciation — it’s considered a security and must comply with securities laws.

This has important implications:

- Token issuers must register with the SEC or qualify for exemptions (such as Reg D or Reg S).

- Marketing language must avoid suggesting guaranteed returns.

- Secondary trading may be restricted to accredited investors or specific platforms.

Europe follows similar frameworks under the MiFID II directive, while countries like Switzerland and Singapore have created clearer guidelines for security token offerings.

KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) laws require identity verification of every investor. These procedures are essential for:

- Preventing fraud and illicit finance.

- Ensuring the legitimacy of transactions.

- Meeting jurisdictional regulatory obligations.

Many tokenized platforms partner with third-party KYC providers to automate onboarding while maintaining security standards. Investors typically upload government-issued ID, proof of address, and undergo screening.

Failing to implement these measures can lead to penalties, platform bans, or complete shutdowns in some regions.

Tax Reporting

Real estate token holders are still subject to tax obligations, which vary by jurisdiction and token type. Some important considerations include:

- Capital gains taxes when selling tokens at a profit.

- Rental income taxes on distributed returns.

- Withholding taxes for cross-border investors.

- Valuation reporting for annual tax filings.

Because blockchain transactions can be opaque to traditional tax systems, investors must keep detailed records of purchases, sales, and income. Some token platforms provide downloadable tax reports, but it’s still advisable to consult a tax professional — especially when investing across borders.

As the global real estate tokenization market pushes toward a projected $3 trillion by 2030, regulatory clarity will become more important than ever. Compliance is no longer optional — it’s the foundation for sustainable, scalable growth.

Technical Infrastructure of Real Estate Tokenization

Behind every tokenized property deal lies a foundation of technical systems that enable secure, transparent, and scalable transactions. While investors and asset owners don’t need to become developers, understanding how the infrastructure works helps build trust and confidence in the process. Tokenization doesn’t rely on a single technology — it combines multiple components working together.

On-Chain vs. Off-Chain Records

One of the most common misunderstandings about tokenization is what data actually lives on the blockchain. In practice, only certain information is stored on-chain for efficiency and privacy reasons.

On-chain records typically include:

- Token issuance details

- Ownership records

- Smart contract logic (e.g., vesting, transfer restrictions)

- Transaction histories

Off-chain records include:

- Legal documents (e.g., title deeds, offering memorandums)

- Identity verification data (from KYC/AML processes)

- Physical property details like inspections or appraisals

These off-chain records are often linked to their on-chain counterparts via cryptographic hashes. This allows verification without storing sensitive data publicly, helping projects meet privacy and regulatory standards.

Wallet and Identity Management

Investors in tokenized real estate need wallets to store and manage their tokens. But unlike typical crypto wallets, real estate tokens often require additional safeguards and identity verification.

Challenges include:

- Key management: Losing access to a private key could mean losing token ownership. Many platforms offer wallet recovery features or use custodial wallets to reduce risk.

- Whitelisting: Only verified investors (per KYC rules) are allowed to receive or trade tokens. This is managed through smart contracts and wallet whitelisting.

- Multi-signature approvals: Used for added security, especially in institutional settings.

To ease user onboarding, some platforms integrate with identity tools that connect a real-world identity to a wallet address in a secure, privacy-preserving way.

Scalability and Platform Integration

Most tokenization projects use blockchain networks that balance scalability, cost, and compliance. Ethereum remains popular due to its wide adoption and smart contract standards (e.g., ERC-20, ERC-1400). However, its gas fees and congestion have led many platforms to adopt faster or cheaper alternatives.

Common choices include:

- Polygon: Ethereum-compatible with lower transaction costs.

- Avalanche: High throughput, with a growing ecosystem of tokenization tools.

- Private or permissioned blockchains: Ideal for enterprise-level deals requiring more control over network participation.

Beyond blockchain choice, tokenization platforms must integrate with:

- Payment processors

- KYC/AML services

- Custodians

- Reporting and tax tools

This ecosystem ensures the process runs smoothly from investor onboarding to dividend distribution.

This guide might help you choose the right blockchain for tokenization

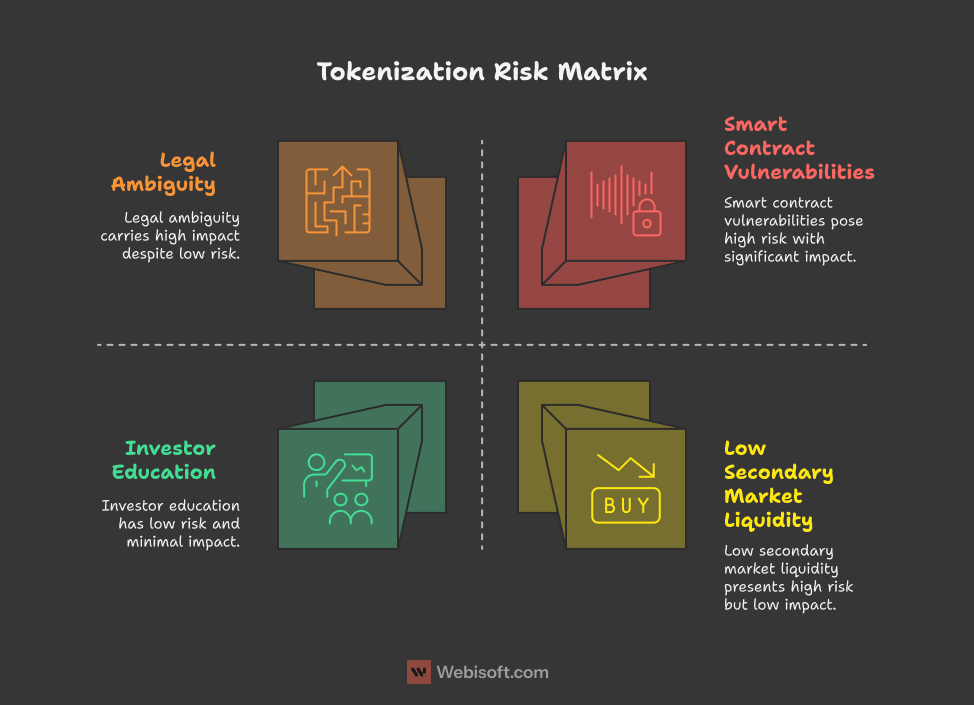

Challenges and Risks of Tokenized Real Estate

While real estate tokenization offers compelling benefits, it’s not without limitations. Many platforms are still early in development, and regulatory clarity varies widely across regions. Understanding the risks is essential for both investors and property owners before jumping in.

Legal Ambiguity and Jurisdictional Risk

Real estate is a heavily regulated asset class, and the rules around tokenizing it are still evolving. What qualifies as a security in one country may not in another, and compliance frameworks can vary even within jurisdictions.

Key legal concerns include:

- Some tokens may inadvertently violate securities laws if improperly structured.

- Cross-border transactions raise additional questions around investor eligibility and tax reporting.

- Jurisdictional disputes can arise if the asset, issuer, and investors are all in different countries.

While some regions, like Switzerland and Luxembourg, are moving toward clearer frameworks, others lag behind — creating uncertainty that can delay or derail projects.

Low Secondary Market Liquidity

One of the biggest promises of tokenization is 24/7 liquidity. However, the reality is that most tokenized real estate deals still face limited trading volume.

Why liquidity is often low:

- Few established marketplaces support compliant trading of security tokens.

- Legal transfer restrictions limit who can buy and sell.

- Token holders may not be eager to exit early, reducing active listings.

This means that even though fractional ownership is possible, selling those fractions quickly is not always easy. Token holders may still face long hold periods, especially for niche or illiquid property types.

Smart Contract Security Vulnerabilities

While blockchain provides transparency and immutability, smart contracts can introduce risk if not audited and tested thoroughly.

Real-world issues include:

- Bugs in token logic that freeze funds or allow exploits.

- Poor implementation of transfer restrictions, enabling unauthorized trades.

- Hacks of connected systems like oracles, custodians, or admin interfaces.

A well-written smart contract is critical, but so is third-party auditing. Platforms that skip this step can expose investors to irreversible losses.

Investor Education and Adoption

The concept of buying real estate via blockchain-based tokens is still unfamiliar to most people. Many potential investors are hesitant simply because they don’t fully understand how it works or what they’re buying.

Common challenges include:

- Confusion around wallet setup and key management.

- Difficulty understanding token rights (e.g., income, voting, redemption).

- Fear of scams or fraudulent projects.

Investor onboarding must include strong educational content, clear documentation, and transparent communication. Without this, adoption will be slow — and limited to early tech-savvy users.

Step-by-Step: How to Invest in Tokenized Real Estate

If you’re curious about joining the tokenized real estate market, the good news is that it’s more accessible than traditional property investment. That said, there are still important steps to follow to ensure you’re participating safely, legally, and with full awareness of your responsibilities. Here’s a clear walkthrough for retail and accredited investors alike.

Step 1: Choose a Platform

Start by researching platforms that offer tokenized real estate deals. Some cater to accredited investors only, while others welcome retail participation. Key things to check:

- Is the platform regulated or licensed in your region?

- Does it support fractional investments or full property tokens?

- What types of properties are offered (residential, commercial, international, etc.)?

Popular platforms include Lofty AI, ReaIT, and SolidBlock. Each has different investor requirements, fees, and token models.

Step 2: Complete KYC and AML Verification

Before you can invest, you’ll need to pass Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. These are required by most compliant platforms to meet global financial regulations.

You’ll typically need to provide:

- A government-issued ID

- Proof of address

- Source-of-funds documentation (in some cases)

This process is usually quick, especially if the platform uses automated identity verification tools.

Step 3: Set Up a Digital Wallet

To hold real estate tokens, you’ll need a compatible crypto wallet. Some platforms offer custodial wallets (they hold the tokens for you), while others require you to connect your own.

Types of wallets:

- Custodial: Easier for beginners but relies on the platform for security.

- Non-custodial: More control but requires managing private keys safely.

Choose a wallet that supports the token standard used (usually ERC-20 or ERC-1400 for security tokens).

Step 4: Fund Your Wallet

Once your wallet is ready, you’ll need to fund it with the appropriate currency — usually a stablecoin like USDC, or sometimes fiat via direct bank transfer. Some platforms accept credit cards for smaller purchases, but crypto transfers are more common for international deals.

Double-check:

- Accepted currencies

- On-chain transaction fees (gas costs)

- Minimum investment amount (often $1,000 or less)

According to EY, tokenization enables fractional ownership with minimum investments starting as low as $1,000 — making it significantly more accessible than traditional real estate.

Step 5: Select a Property and Review the Details

Don’t just buy a token — study the asset. Legitimate platforms provide detailed offering documents that outline:

- Property type and location

- Expected cash flows or appreciation

- Governance structure and investor rights

- Exit options or holding period expectations

This is your chance to evaluate whether the investment matches your risk tolerance and goals.

Step 6: Make the Purchase

Once you’ve selected a property, simply input the number of tokens you’d like to buy and complete the transaction. Your tokens will be issued to your wallet address and recorded on the blockchain, giving you verified ownership.

For most platforms, this step takes just a few minutes.

Step 7: Monitor Performance and Plan Your Exit

After investing, you can monitor your portfolio through the platform dashboard or blockchain explorer. Depending on the token type, you may receive rental income, dividends, or other distributions.

Before selling or exiting:

- Check whether there’s a secondary marketplace available.

- Review transfer restrictions or holding period limitations.

- Track token appreciation and liquidity.

Platforms like tZERO or INX may offer secondary trading options for tokenized real estate, but liquidity can vary.

Real-World Examples and Case Studies

Tokenized real estate isn’t a future concept — it’s already delivering measurable results around the world. Below are three standout examples where real-world properties were successfully tokenized, giving both investors and developers tangible benefits. These stories show how different tokenization models can work across property types and regions.

Aspen Digital (Luxury Hotel in Colorado)

In one of the most widely cited cases, the St. Regis Aspen Resort in Colorado was partially tokenized through a company called Elevated Returns. In 2024, the firm raised $18 million by selling digital equity shares in the resort to accredited investors via blockchain. — Source

- Platform used: Securitize and tZERO

- Token type: Equity-backed security token

- Investor access: Accredited investors only

- Outcome: The token’s value increased by 30% over 18 months and was actively traded on secondary markets

This example is often referenced to demonstrate that tokenized real estate can offer real liquidity and price appreciation — not just theoretical potential.

Lofty AI (U.S. Residential Income Properties)

Lofty AI focuses on single-family rental properties in the United States and allows retail investors to purchase fractional ownership starting at just $50. Each property is tokenized individually, with rental income distributed daily through smart contracts.

- Platform: Lofty.ai

- Token type: Cash-flow-backed fractional ownership tokens

- Investor access: Open to global retail investors

- Outcome: Strong user adoption, with some properties fully sold within hours of listing

Lofty AI showcases how tokenization can open access to everyday investors, offering income-generating assets without the usual barriers of property ownership.

ReaIT (Europe-Based Tokenized RE Platform)

ReaIT is a platform based in the Netherlands that focuses on commercial and residential real estate in Europe. Investors can buy tokens that represent shares in real properties, including office buildings and apartment complexes.

- Platform: ReaIT.io

- Token type: Security tokens representing shares in a legal entity that owns the property

- Investor access: Both retail and institutional

- Outcome: Transparent reporting and token transfer via secondary platforms compliant with European law

This project shows that tokenized real estate can function within strict regulatory frameworks like the EU’s MiFID II, appealing to a broad spectrum of investors.

The Future of Real Estate Tokenization

Real estate tokenization is moving from niche to mainstream. As the technology matures and regulations become clearer, more institutional and retail investors are paying attention. The next few years will shape whether tokenization remains a specialized tool — or becomes a standard way to buy, sell, and manage property.

One major trend is the shift from pilot projects to scalable platforms. Early adopters showed that tokenization works. Now, global asset managers, property funds, and even governments are exploring how blockchain-based real estate systems can reduce costs, improve transparency, and attract broader participation.

In parallel, decentralized finance (DeFi) is beginning to intersect with tokenized real estate. Some protocols are experimenting with using real estate tokens as collateral for on-chain lending. Others are integrating with automated yield strategies. While these are still early-stage innovations, they point toward a future where real estate becomes a more fluid asset class — not locked up in paperwork or hard-to-sell formats.

Artificial intelligence (AI) is also starting to enhance how tokenized real estate is managed. From automating compliance checks to optimizing portfolio performance and rental pricing, AI can pair with tokenization to streamline operations and improve decision-making. This is especially promising for platforms offering tokenized REIT alternatives or global property baskets.

DAO-governed real estate is another emerging model. In this setup, token holders vote on key decisions — like maintenance, rental pricing, or asset liquidation — through a decentralized governance system. While not yet widely adopted, it reflects a broader push toward democratizing real estate management.

Market Insight: The global real estate tokenization market is projected to reach $3 trillion by 2030, representing approximately 15% of all real estate assets under management. — Source: ScienceSoft

Whether through faster fundraising, globalized investing, or more inclusive ownership models, tokenization is likely to become a fixture in how real estate is funded and traded. The tools are already here — what’s evolving now is the infrastructure, regulation, and market confidence to support long-term growth.

FAQs About Real Estate Tokenization

For many investors and property owners, tokenization still feels unfamiliar. These frequently asked questions address the most common concerns and misconceptions, especially for those exploring this space for the first time.

What is the minimum investment in tokenized real estate?

One of the most significant advantages of tokenization is the low barrier to entry. Depending on the platform, minimum investments can be as low as $1,000. This enables a broader range of investors to access assets that would otherwise require hundreds of thousands of dollars in capital.

Insight: Tokenization enables fractional ownership, allowing investors to buy and sell shares in real estate assets far more easily than through traditional methods. This increased liquidity is changing the accessibility of the market.

Is tokenized real estate legal in the U.S.?

Yes, but it depends on how the token is structured and offered. In most cases, tokenized real estate is classified as a security and must comply with SEC regulations. Platforms typically use exemptions like Regulation D or Regulation S to remain compliant. Investors may need to be accredited, and all transactions must pass KYC/AML screening.

Can I earn rental income through tokens?

Yes. Many tokenized properties are structured to distribute income, such as rental revenue, to token holders on a regular basis. These payments are typically automated via smart contracts. The income may be fixed or variable, depending on the property’s performance and the terms of the token offering.

What happens if the platform goes out of business?

Ownership of the property itself is typically recorded off-chain through legal agreements and custodianship. In a well-structured setup, the tokens represent a legal claim to the underlying asset, independent of the platform. However, platform failure could still impact secondary market access, data records, and payment processing — so due diligence is critical.

Are tokenized assets insured or collateralized?

The real estate asset itself may be insured, just like traditional property, but the token is not always backed by separate insurance. Some platforms work with custodians or escrow services to reduce risk. It’s important to review each project’s documentation to understand what protections are in place.

How do I sell my real estate tokens later?

Tokens can be sold on secondary marketplaces, but liquidity varies. Some platforms offer built-in trading environments, while others rely on third-party exchanges. Restrictions may apply based on investor eligibility, holding periods, or jurisdiction. Always check whether the token is transferable and whether there’s an active market.

Conclusion: Is Tokenization Right for You?

Real estate tokenization offers something rare in the investment world — the ability to unlock high-value assets and make them more accessible, liquid, and transparent. Whether you’re an investor looking to diversify your portfolio or a property owner seeking faster and broader capital access, tokenization represents a new path forward. But it’s not one-size-fits-all.

This guide has shown how the process works, its benefits, risks, and what to consider before getting involved. From smart contracts and compliance requirements to real-world case studies, the opportunity is real — and growing. The global real estate tokenization market is projected to reach $3 trillion by 2030, signaling strong momentum ahead for this emerging sector.

Still, this is a space that requires caution, research, and the right partners. Regulatory frameworks are evolving, technical implementations vary, and investor education remains essential. Tokenization is not about chasing trends; it’s about transforming a historically illiquid and exclusive market into one that’s more flexible, inclusive, and efficient.

If you’re curious, start small. Explore reputable platforms, consult legal and financial professionals, and experiment within your risk tolerance. Like any innovation, the winners will be those who move early but move wisely.