Machine Learning in Stock Trading: Applications and Limits

- BLOG

- Artificial Intelligence

- February 15, 2026

Stock prices jump, crash, and stall every second, yet patterns still hide inside the chaos. Machine learning in stock trading exists because humans cannot process thousands of signals, correlations, and market reactions fast enough without help.

Still, machine learning is not a cheat code for beating the market. Some models quietly improve consistency, while others fail the moment volatility changes or assumptions break. The difference usually comes down to data, design, and discipline.

As a result, this article shows how ML in stock trading works, covering predictions, data, models, risks, and failures, so you can judge fit.

Contents

- 1 What is Machine Learning in Stock Trading?

- 2 Problems in Stock Trading that Machine Learning Can Solve

- 3 Deploy machine learning systems designed for stock trading.

- 4 Types of Stock Market Predictions Made Using Machine Learning

- 5 What Data Machine Learning Models Use in Stock Trading

- 6 How Machine Learning Models are Built and Used for Stock Trading

- 6.1 Step 1: Collect and align raw market data

- 6.2 Step 2: Transform raw data into features

- 6.3 Step 3: Define prediction targets or labels

- 6.4 Step 4: Split data for training and testing

- 6.5 Step 5: Train the machine learning model

- 6.6 Step 6: Validate and backtest predictions

- 6.7 Step 7: Convert model outputs into trading signals

- 6.8 Step 8: Integrate risk controls and execution rules

- 6.9 Step 9: Deploy and monitor in live or paper trading

- 7 Machine Learning Models Commonly Used in Stock Trading

- 8 Risk Controls That Belong Inside ML Trading Systems

- 9 Common Failure Modes in ML Stock Trading

- 10 Working with Webisoft on Machine Learning Solutions for Stock Trading

- 10.1 Data readiness and signal roadmap

- 10.2 Trading-grade data pipelines and feature foundations

- 10.3 Custom ML models built around your trading objective

- 10.4 Risk-aware decision logic and anomaly detection

- 10.5 Production deployment, monitoring, and retraining loops

- 10.6 A delivery model that fits your team

- 11 Deploy machine learning systems designed for stock trading.

- 12 Conclusion

- 13 Frequently Asked Question

What is Machine Learning in Stock Trading?

Machine learning in stock trading refers to using models that learn patterns from historical market data to support trading decisions. Instead of relying on fixed rules or manual judgment, these models adjust their behavior based on past price movements, volume, fundamentals, and other market signals.

In practical terms, machine learning helps traders and firms analyze large datasets and identify relationships that are difficult to detect through traditional analysis. The models do not predict the future with certainty. They estimate probabilities, rankings, or risk measures that guide how and when trades are placed.

Within stock trading systems, machine learning acts as a decision support layer. It helps make trading more systematic, repeatable, and data driven, while reducing reliance on intuition or emotion.

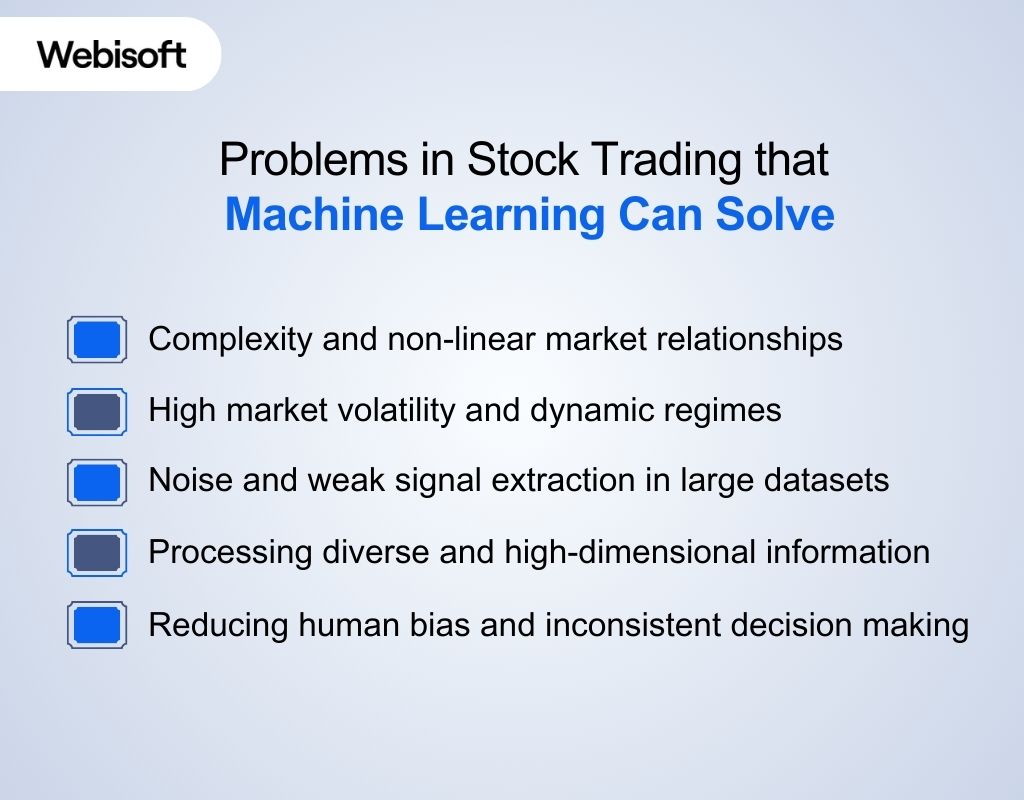

Problems in Stock Trading that Machine Learning Can Solve

Stock trading involves uncertainty, rapid information flow, and constantly shifting market behavior. Traditional methods struggle to process this complexity at scale.

Stock trading involves uncertainty, rapid information flow, and constantly shifting market behavior. Traditional methods struggle to process this complexity at scale.

Machine learning helps address structural problems that arise from noisy data, human limitations, and changing market conditions.

Complexity and non-linear market relationships

Stock prices are driven by intricate, non-linear relationships among economic indicators, company performance, and investor sentiment.

Traditional linear models often fail to capture these dynamics, whereas machine learning techniques uncover subtle patterns that improve prediction quality.

High market volatility and dynamic regimes

Financial markets regularly shift between calm and turbulent states, making it difficult for static models to adapt. Machine learning models can learn different volatility regimes and adjust forecasts accordingly, helping traders better anticipate risk and price changes.

Noise and weak signal extraction in large datasets

Market data is noisy, with random fluctuations that obscure meaningful signals. Machine learning excels at filtering noise from huge volumes of historical data to reveal persistent patterns that human analysis and simple statistical models often miss.

Processing diverse and high-dimensional information

Modern trading isn’t limited to price data. News articles, social sentiment, macroeconomic indicators, and alternative data sources all matter.

Machine learning handles this high-dimensional data efficiently, enabling integrated insights that traditional methods overlook.

Reducing human bias and inconsistent decision making

Emotions, cognitive biases, and inconsistent judgment can lead to poor trading decisions. Machine learning systems apply systematic logic based on data patterns, reducing subjective biases and improving consistency in trade execution and risk assessment.

Deploy machine learning systems designed for stock trading.

Partner with Webisoft to design, validate, and deploy stock trading solutions.

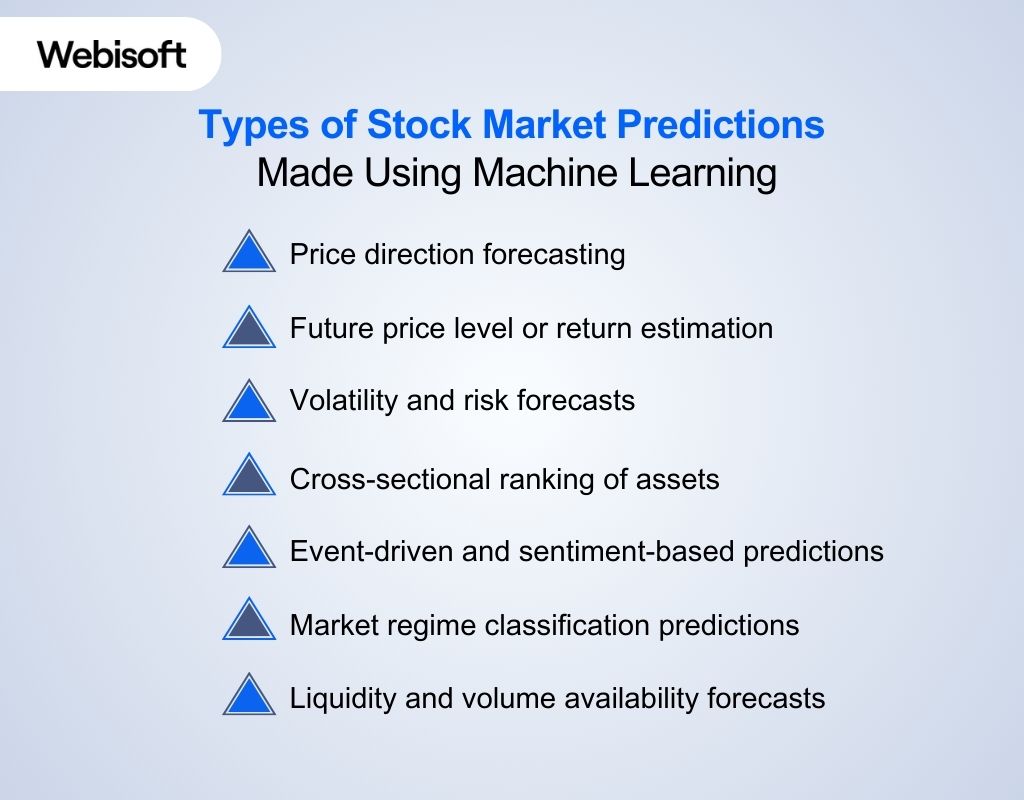

Types of Stock Market Predictions Made Using Machine Learning

Machine learning supports multiple prediction tasks in stock trading that extend beyond basic price forecasts. In machine learning stock prediction, models analyze market data and external signals to estimate direction, risk, and relative performance. These insights help traders adapt decisions to changing market conditions.

Machine learning supports multiple prediction tasks in stock trading that extend beyond basic price forecasts. In machine learning stock prediction, models analyze market data and external signals to estimate direction, risk, and relative performance. These insights help traders adapt decisions to changing market conditions.

Price direction forecasting

This is one of the most common prediction types. ML models estimate whether the price of a stock or index will rise or fall over a defined time horizon. It is often treated as a binary classification task where prices move up or down, which helps inform entry and exit decisions.

Future price level or return estimation

Beyond direction, models may forecast how much a price might change, estimating expected returns or specific price levels.

These forecasts can guide position sizing and anticipated profit targets, offering a more granular signal than simple directional predictions.

Volatility and risk forecasts

Predicting future volatility helps in risk management and strategy calibration. Machine learning models can learn volatility regimes and estimate the intensity of price movement. This is essential for setting stop-loss thresholds, risk limits, and dynamic position sizes.

Cross-sectional ranking of assets

In portfolio contexts, ML models rank multiple stocks based on expected performance or risk-adjusted return. This enables traders to allocate capital more efficiently across a basket of assets rather than focusing on a single instrument.

Event-driven and sentiment-based predictions

Some machine learning models incorporate news, earnings reports, or social sentiment to predict market reactions to specific events. By quantifying textual or alternative data, these predictions capture information flows that traditional pricing data alone may miss.

Market regime classification predictions

Instead of predicting prices directly, some models classify the current market regime, such as trending, mean-reverting, high volatility, or low liquidity environments. These predictions help decide which strategy should be active, rather than forcing one model to work everywhere.

Liquidity and volume availability forecasts

Machine learning models are used to estimate future liquidity and trading volume for specific stocks or sessions. This helps traders avoid placing large orders during thin markets and reduces execution risk, especially for institutional or high-frequency strategies.

What Data Machine Learning Models Use in Stock Trading

Stock market trading in machine learning relies on data that reflects what the market looked like at the moment a decision was made.

The usefulness of any model depends less on complexity and more on whether the data is accurate, timely, and properly aligned.

- Price and volume data: Open, high, low, close, and volume series capture how prices move and how actively stocks trade. These time series are used across almost every trading horizon, from intraday strategies to long-term models.

- Corporate actions and adjustments: Stock splits, dividends, mergers, and delistings change how historical prices should be interpreted. If these are handled incorrectly, models may learn patterns that never existed in real trading.

- Company fundamentals and financial disclosures: Balance sheets, income statements, and valuation ratios help models understand business performance rather than short-term price noise. They are often used to filter stocks or define investment universes.

- Macroeconomic and interest rate data: Inflation trends, policy rates, and economic indicators help models interpret price behavior under different conditions. The same stock movement can mean very different things in different economic environments.

- News and event data: Earnings releases, guidance updates, and major announcements often trigger sharp price moves. Models that use this data must respect timing, since delayed information can distort results.

- Sentiment and alternative data: Social media signals, analyst opinions, and web activity are sometimes used to estimate market mood. These datasets can add value, but only when filtered carefully and aligned to trading time.

- Liquidity and market activity data: Trading volume, spreads, and order flow help models understand whether trades can be executed efficiently. This is especially important for larger positions or faster trading strategies.

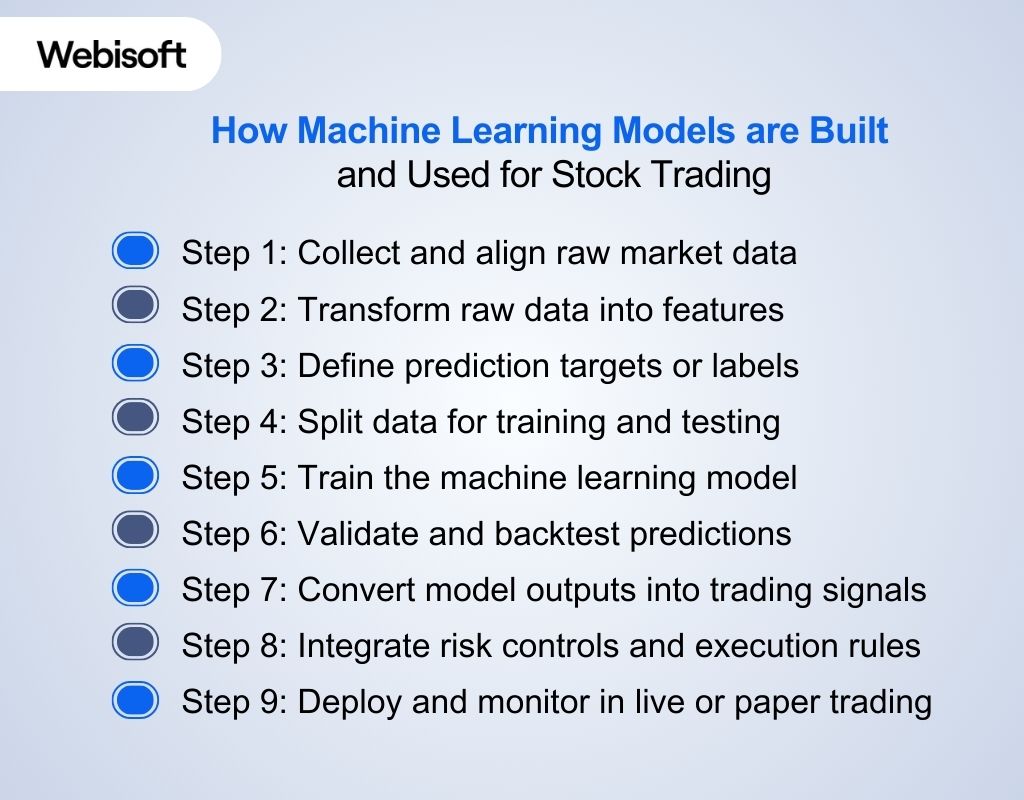

How Machine Learning Models are Built and Used for Stock Trading

Building and using machine learning in stock trading follows a structured pipeline. Each step moves from raw data to tested predictions and then to executable trading decisions. This process helps ensure models remain reliable in real market conditions.

Building and using machine learning in stock trading follows a structured pipeline. Each step moves from raw data to tested predictions and then to executable trading decisions. This process helps ensure models remain reliable in real market conditions.

Step 1: Collect and align raw market data

Gather price, volume, corporate actions, macro data, event data, and any alternative sources needed for your trading goals. Ensure timestamps are synchronized and data is cleaned so the model sees information as it would have existed at the time of decision-making.

Step 2: Transform raw data into features

Convert prices and raw inputs into engineered features such as moving averages, volatility measures, sector spreads, and event indicators. Feature engineering helps the model detect patterns that raw numbers alone might not reveal.

Step 3: Define prediction targets or labels

Decide what the model should predict, such as price direction, return range, volatility level, or cross-sectional rank. Clear labels help the model focus on the exact outcome that drives your trading logic.

Step 4: Split data for training and testing

Use time-based splits that reflect market chronology. Avoid random sampling; instead, segment data into train, validation, and test sets that simulate how unseen data would behave.

Step 5: Train the machine learning model

Fit the model on historical features and labeled outcomes. Try baseline algorithms first, then more complex ones, while monitoring overfitting and generalization performance.

Step 6: Validate and backtest predictions

Evaluate the model on held-out data and in backtests that include simulated transaction costs. Check not just accuracy but also profit/loss measures, drawdowns, and risk-adjusted returns to see if predictions would translate into real performance.

Step 7: Convert model outputs into trading signals

Translate predictions into actionable rules. For example, set thresholds for buy or sell signals, determine position sizes, and define holding periods based on prediction confidence.

Step 8: Integrate risk controls and execution rules

Layer risk management logic around signals, such as stops, exposure caps, and volatility limits to protect capital. Tie signals into execution systems that consider liquidity and slippage.

Step 9: Deploy and monitor in live or paper trading

Put the model into a trading environment for live or paper execution. Continuously monitor performance, drift in data patterns, and model reliability to decide when retraining or revision is needed.

If you are evaluating how this pipeline fits your trading strategy, Webisoft helps teams apply AI and machine learning expertise to production trading systems. See how our engineers translate modeling workflows into scalable, live-ready ML solutions.

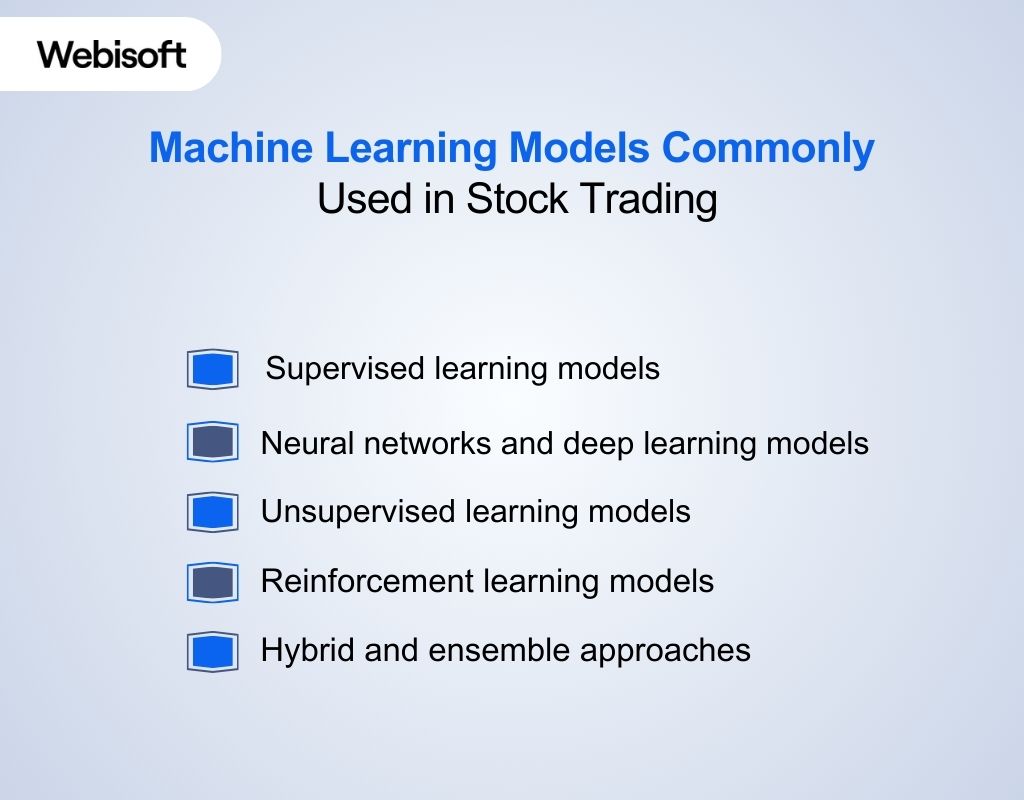

Machine Learning Models Commonly Used in Stock Trading

Stock trading places practical constraints on machine learning models, including noisy price data, non-stationary behavior, and execution risk. In any real machine learning in stock trading example, traders choose models based on how well they handle time dependence, cross-sectional comparisons, and risk-aware decision making.

Stock trading places practical constraints on machine learning models, including noisy price data, non-stationary behavior, and execution risk. In any real machine learning in stock trading example, traders choose models based on how well they handle time dependence, cross-sectional comparisons, and risk-aware decision making.

Supervised learning models

These models learn from labeled historical data to make future predictions. Supervised approaches are widely used for direction forecasting, return estimates, and risk predictions.

- Linear and logistic regression estimate expected returns or classify short-term price direction, often serving as baseline trading models.

- Decision trees and random forests combine technical indicators and fundamentals into unified signals while capturing non-linear market behavior.

- Gradient boosting models (LightGBM, XGBoost) identify small but persistent alpha signals, commonly used in cross-sectional stock selection.

- Support Vector Machines (SVM) classify price movements over defined horizons to support entry and exit timing.

Neural networks and deep learning models

These models capture complex relationships in market data where interactions between inputs are difficult to model explicitly.

- Multilayer Perceptron (MLP) combines multiple trading features for return prediction or factor scoring.

- Recurrent Neural Networks (RNNs) model short-term dependencies in price and volume sequences.

- LSTM and GRU models capture longer-term temporal effects such as trend persistence or delayed reactions to events.

- Convolutional Neural Networks (CNNs) detect structured patterns in transformed price data that indicators may miss.

Unsupervised learning models

Unsupervised models support stock trading by identifying structure rather than predicting prices directly.

- K-Means clustering groups stocks or periods with similar trading behavior.

- Principal Component Analysis (PCA) compresses large feature sets into stable, interpretable factors.

- Autoencoders flag abnormal price or volume behavior linked to regime shifts or event risk.

Reinforcement learning models

These models focus on learning sequences of trading actions instead of single-step predictions.

- Deep Q-Networks (DQN) manages evolving trading decisions such as position adjustments over time.

- Policy gradient methods optimize trading policies using rewards tied to risk-adjusted performance.

Reinforcement learning remains experimental in live stock trading but is useful for controlled strategy optimization.

Hybrid and ensemble approaches

Most professional trading systems rely on multiple models working together.

- Stacked models combine different model outputs to capture diverse market signals.

- Blended deep learning models integrate time-based and pattern-based signals for regime stability.

- Ensembles with sentiment or alternative data layers add external context to price-driven predictions.

Risk Controls That Belong Inside ML Trading Systems

Once you turn predictions into trades, risk controls become part of the model, not an add on. They protect capital from bad signals, bad fills, and bad market days. In machine learning in stock trading, these controls also limit model error and drift.

- Position sizing from confidence: Use the model’s probability or score to scale positions, so weak signals take smaller risk than high-conviction signals.

- Exposure caps: Set hard limits on single-name, sector, and gross exposure so one theme or correlated basket cannot dominate portfolio risk.

- Max drawdown guardrails: Pause trading or reduce size after a defined equity drawdown, since losing streaks often cluster during regime shifts.

- Volatility targeting: Adjust position sizes as volatility changes, so the same strategy does not take outsized risk in fast markets.

- Liquidity-aware sizing: Tie order size to volume, spread, or depth so the system does not “become the market” and move price against itself.

- Transaction cost and slippage modeling: Bake commissions, spreads, slippage, and market impact into backtests and live expectations, because costs can flip results from positive to negative.

- Kill switch and circuit breakers: Add a fast stop that cancels orders and blocks new ones when abnormal behavior appears, such as runaway order rates or repeated rejects.

- Drift and performance monitoring: Track live feature drift, hit rate, and PnL attribution so you can downshift risk or retrain when the data distribution changes.

Common Failure Modes in ML Stock Trading

Once you add risk controls, the next step is knowing what can still break machine learning in stock trading system. Most failures come from hidden bias in data and testing, plus market behavior that shifts over time. These issues can make backtests look strong but fail live.

- Data leakage: The model learns information that would not be available at trade time, often through misaligned timestamps, feature construction, or overlapping labels. Results look great in testing, then collapse in live trading.

- Look-ahead bias: Future data slips into the training or backtest process, such as using revised fundamentals, future-index membership, or indicators that peek ahead. It inflates performance without adding a real tradable edge.

- Survivorship bias: Datasets exclude delisted stocks or failed companies, so the model trains on a “winner-only” history. The strategy then underestimates risk and overstates real-world returns.

- Backtest overfitting and multiple testing: Repeated tuning across many features, models, and parameters can fit noise rather than signal. You end up selecting what worked historically by chance, not what persists.

- Non-stationarity and regime change: Markets change as participants adapt, volatility shifts, and macro conditions rotate. A model trained in one regime can become unreliable when the price-generation process changes.

- Ignoring real execution and costs: Strategies that appear profitable before costs turn negative after spreads, slippage, and market impact, as highlighted by research on trading costs and execution practices. This is a common reason paper performance fails to match live results.

- Label and horizon mismatch: The target the model learns, such as next-day direction, does not match the way trades are held or executed. The model can be “right” on paper but useless for the actual holding period.

- Data quality and corporate action errors: Bad adjustments for splits, dividends, tickers, or missing events can create fake patterns. The model learns artifacts, not market behavior, and performance degrades when data is corrected.

Working with Webisoft on Machine Learning Solutions for Stock Trading

After you choose the right models and controls, the real work is getting a trading-ready system into production without fragile assumptions. That is where we come in. At Webisoft, we build ML trading solutions as end-to-end systems, not isolated models.

After you choose the right models and controls, the real work is getting a trading-ready system into production without fragile assumptions. That is where we come in. At Webisoft, we build ML trading solutions as end-to-end systems, not isolated models.

Data readiness and signal roadmap

We start by mapping your trading goal to the data you can trust, the horizon you can execute, and the constraints you must respect. Our process helps you avoid building models that look good in backtests but cannot survive real execution.

Trading-grade data pipelines and feature foundations

Our engineers design pipelines that keep timestamps, corporate actions, and data lineage clean so your model learns what was actually knowable at decision time. This is where most ML trading projects quietly fail, and we treat it as first priority.

Custom ML models built around your trading objective

We develop models that match your prediction type, universe, and cadence, whether you need ranking, volatility estimation, or event-aware signals. Our focus is practical performance under real constraints, not academic metrics in isolation.

Risk-aware decision logic and anomaly detection

In trading, the model output is only useful if it is paired with guardrails. We integrate risk logic and real-time anomaly detection so the system can reduce exposure when conditions shift and flag behavior that does not match historical patterns.

Production deployment, monitoring, and retraining loops

We support the full lifecycle, including deployment, performance tracking, and automated retraining triggers as data drifts. This helps your system stay stable as the market changes, instead of decaying silently over time.

A delivery model that fits your team

You can engage us to augment your quant and engineering team or let us own delivery end to end. Either way, we align the build to your compliance, security, and scalability needs, especially for financial systems.

If you are serious about taking a machine learning stock trading idea beyond research and into live markets, we can guide that transition. Connect with our team at Webisoft to discuss your strategy, constraints, and how we would design a production-ready system around them.

Deploy machine learning systems designed for stock trading.

Partner with Webisoft to design, validate, and deploy stock trading solutions.

Conclusion

So where does this leave machine learning in stock trading? It is neither a shortcut nor a guarantee. When used correctly, it sharpens decisions, exposes hidden risk, and enforces discipline. When used carelessly, it magnifies errors faster than manual trading ever could.

If your goal is to apply ML in stock trading beyond research, Webisoft helps teams build systems that operate under real market pressure. We focus on data integrity, execution reality, and risk controls, so models perform where theory meets live trading.

Frequently Asked Question

Is machine learning better than traditional trading strategies?

Yes. Machine learning can outperform trading strategies in certain market conditions where patterns persist. However, it also fails during regime shifts or poor data environments. Success depends on data quality, validation discipline, execution realism, and alignment with the trading horizon.

Can machine learning predict stock prices accurately?

No. Machine learning cannot predict stock prices with certainty or consistency. Instead, it estimates probabilities, trends, or relative rankings from historical data. These outputs support decision making, but they cannot eliminate uncertainty, randomness, or unexpected market events.

Is machine learning trading profitable?

Yes. Machine learning trading can be profitable under specific conditions and disciplined execution. Models must be validated on realistic data, include transaction costs, and operate with risk controls. Many strategies appear profitable in testing but fail after slippage and fees.