KYC processes are vital for financial institutions’ anti-money laundering efforts, with global spending estimated to reach $1.2 billion in 2020. However, traditional KYC processes are often inefficient, costly, and time-consuming. To address these challenges, the integration of blockchain technology has emerged as a promising solution. By leveraging blockchain’s inherent features, KYC processes can be made more secure, efficient, and cost-effective, revolutionizing regulatory compliance.

Traditional KYC processes are time-consuming and costly due to manual verification and data entry. Blockchain streamlines this by offering a tamper-proof and auditable system for customer identity verification. Its decentralized nature ensures secure information sharing while preserving data privacy and consent.

Smart contracts automate parts of KYC and reduce errors and verification time. Blockchain’s immutability guarantees trustworthy KYC data, preventing tampering. Adopting blockchain-based KYC solutions improves efficiency, cuts costs, and enhances the customer experience.

Addressing scalability, interoperability, and regulatory compliance challenges is crucial for the widespread adoption of blockchain-based KYC systems. As blockchain technology matures and regulatory frameworks evolve, integration of these systems is expected to increase. Enhanced security, efficiency, and cost-effectiveness make blockchain an appealing solution for financial institutions looking to streamline their KYC processes.

In the upcoming sections, we will delve into the essential characteristics and advantages of blockchain-based KYC systems, while also addressing the challenges and considerations involved in their implementation. By leveraging the capabilities of blockchain technology, financial institutions can enhance their KYC processes, mitigate risks, and uphold regulatory compliance in an ever-growing digital and interconnected landscape. The future of KYC relies on the innovative adoption of blockchain, paving the path toward a more secure and efficient financial ecosystem.

Contents

- 1 The Drawbacks of Centralized KYC Systems

- 2 Revolutionizing KYC with Blockchain Technology

- 3 Blockchain’s advantages in the KYCAML procedure

- 4 Can Blockchain Development Solutions Solve KYC Challenges?

- 5 Exploring the Potential of Blockchain Development Solutions in KYC: A Paradigm Shift in Identity Verification

- 6 Conclusion

The Drawbacks of Centralized KYC Systems

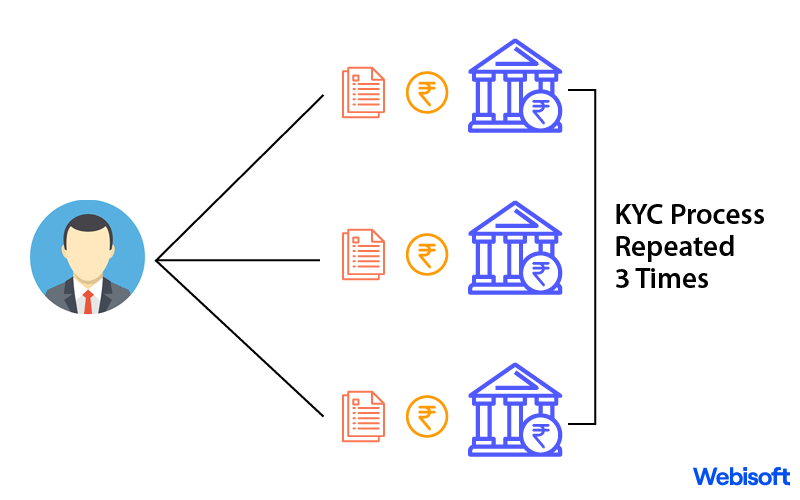

Centralized KYC systems, despite their widespread use, come with several drawbacks that hinder their effectiveness. One significant drawback is the lack of efficiency and delays in the verification process.

With a centralized approach, multiple parties involved in the KYC process often rely on manual verification, leading to time-consuming procedures and potential bottlenecks.

- Lack of efficiency and delays in the verification process

- Data redundancies and duplications

- Increased vulnerability to data breaches and security risks

- Challenges in scalability and interoperability

- Blockchain-based KYC systems offer solutions to these drawbacks

- The decentralized nature of blockchain reduces delays and enhances efficiency

- The immutability of blockchain ensures data integrity and protection against tampering

- Users have greater control over their personal data

- Embracing decentralized KYC systems can lead to a more streamlined and secure verification process.

In summary, centralized KYC systems suffer from inefficiencies, data redundancies, security risks, and scalability issues. Decentralized KYC systems powered by blockchain offer potential solutions by providing efficiency, data integrity, security, and user control over personal data. Embracing decentralized KYC systems can address the drawbacks of centralized approaches and lead to a more streamlined and secure verification process.

Revolutionizing KYC with Blockchain Technology

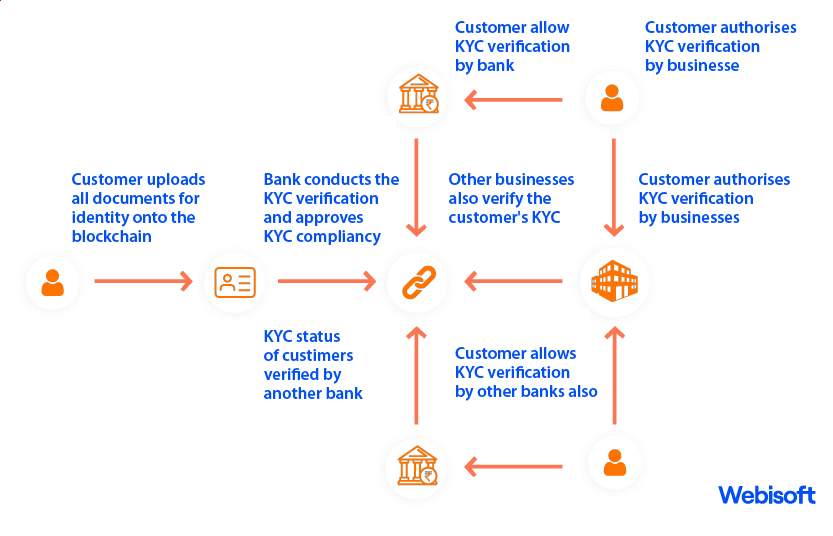

The utilization of blockchain technology in the KYC (Know Your Customer) process brings numerous benefits, transforming how customer identification and verification are conducted. Here is a step-by-step explanation of how blockchain can enhance the KYC process:

1. Data Collection

In a traditional KYC process, customers are required to submit their personal information and supporting documents to financial institutions. With blockchain, customers can securely store their KYC data in a decentralized manner, eliminating the need for repetitive data submissions.

2. Data Verification

Blockchain enables the creation of a tamper-proof, immutable ledger where customer information is recorded. This distributed ledger ensures data integrity and makes verification more efficient. Institutions can validate customer information by accessing the blockchain network, reducing the time-consuming manual verification process.

3. Decentralized Identity

Blockchain facilitates the creation of decentralized identities, allowing customers to maintain control over their personal information. Customers can grant permission to institutions or authorities to access specific KYC data, ensuring privacy and consent management.

4. Secure Sharing

Blockchain enables the secure sharing of KYC data between different institutions and stakeholders. Instead of relying on manual data exchanges and the risk of data breaches, blockchain allows for encrypted and permission sharing, enhancing data security and reducing the risk of unauthorized access.

5. Streamlined Compliance

Blockchain technology simplifies regulatory compliance by providing auditable and transparent records of KYC activities. Regulators can access the blockchain to verify compliance with KYC regulations, streamlining the auditing process and reducing the administrative burden on financial institutions.

6. Automation through Smart Contracts

Smart contracts, self-executing agreements on the blockchain, can automate KYC processes. These contracts can programmatically verify customer information, trigger notifications, and even enforce compliance rules, minimizing human error and speeding up the KYC process.

7. Enhanced Customer Experience

With blockchain adoption in banking, customers experience improved efficiency and reduced duplication of efforts. They can securely share their KYC data with multiple institutions, eliminating the need for repetitive document submissions and enhancing the overall customer experience.

8. Cost Savings

By leveraging blockchain technology, financial institutions can reduce costs associated with manual data entry, verification, and document storage. The streamlined KYC process and reduced administrative burden result in significant cost savings for both customers and institutions.

9. Future Potential

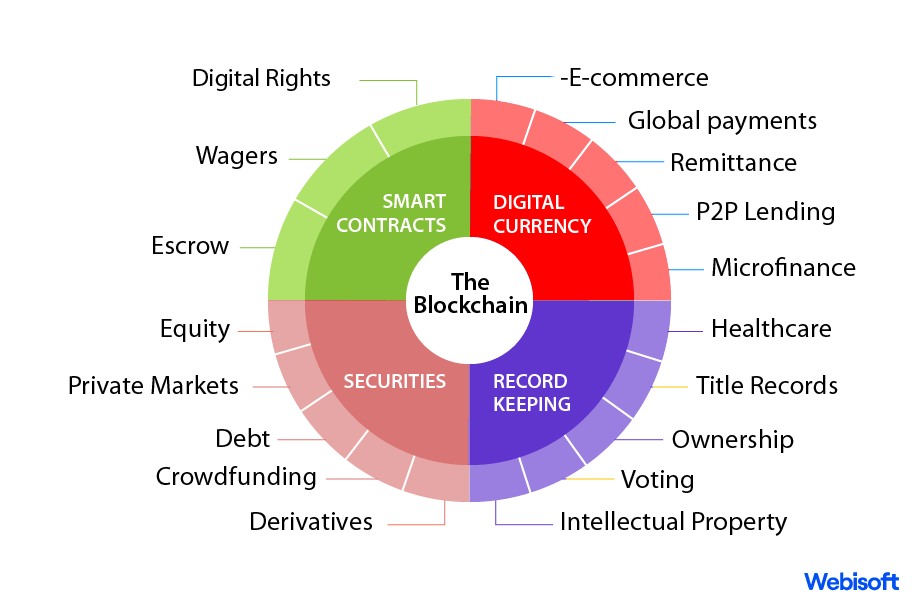

As blockchain technology continues to evolve, further advancements in KYC processes are expected. Integrations with other emerging technologies such as artificial intelligence (AI) and machine learning can enhance risk assessment and fraud detection capabilities, making the KYC process even more robust and efficient.

Utilizing blockchain technology in the KYC process offers significant advantages, including enhanced security, streamlined compliance, automation, improved customer experience, and cost savings. As this technology continues to mature, financial institutions are increasingly adopting blockchain-based solutions to revolutionize their KYC processes and embrace the benefits of a decentralized and efficient approach.

Blockchain’s advantages in the KYCAML procedure

Blockchain technology offers numerous benefits when applied to the KYC (Know Your Customer) and AML (Anti-Money Laundering) processes. Here are the key advantages:

Faster Onboarding

Blockchain-based KYC/AML processes can expedite customer onboarding by automating verification and reducing manual paperwork. This results in faster account opening and access to financial services for customers.

Improved Due Diligence

Blockchain’s transparent and auditable nature enables better due diligence processes. Financial institutions can trace the origin and history of transactions, making it easier to identify suspicious activities and comply with AML regulations.

Reduced Redundancy

By eliminating the need for duplicate KYC checks across multiple institutions, blockchain reduces redundancy and saves time for both customers and financial institutions.

Trust and Transparency

The decentralized and transparent nature of blockchain technology promotes trust between institutions, customers, and regulators. It provides a shared source of truth, reducing disputes and improving transparency in the KYC/AML process.

Enhanced Risk Management

Blockchain’s real-time visibility into customer information and transaction history enables better risk assessment and management. It allows institutions to identify high-risk customers more efficiently and implement appropriate risk mitigation measures.

Regulatory Advantages

Blockchain-based KYC/AML processes can help institutions meet evolving regulatory requirements more effectively. The immutability of blockchain records and transparent compliance reporting simplify regulatory audits and demonstrate compliance to authorities.

Blockchain brings enhanced security, improved efficiency, cost savings, and better customer experiences to the KYC/AML process. With its transparent, secure, and decentralized nature, blockchain technology holds immense potential for transforming and revolutionizing the way financial institutions approach KYC and AML compliance.

Can Blockchain Development Solutions Solve KYC Challenges?

Blockchain development solutions have emerged as a potential answer to the challenges faced by traditional KYC (Know Your Customer) processes. By leveraging the decentralized and immutable nature of blockchain technology, KYC issues can be effectively addressed. Blockchain offers a secure and transparent platform for managing and verifying customer identities, mitigating risks associated with identity theft and fraud.

Through smart contracts, KYC processes can be automated, reducing the reliance on manual verification and minimizing human error. Additionally, blockchain enables secure data sharing among trusted parties, ensuring privacy and consent management. The integration of blockchain in KYC processes not only enhances security and efficiency but also streamlines compliance efforts by providing auditable and tamper-proof records.

While there are still challenges to overcome, such as scalability and regulatory considerations, blockchain development solutions hold great promise in revolutionizing the KYC landscape and improving customer experiences in the financial sector. By leveraging the decentralized and transparent nature of blockchain, financial institutions can enhance the security and efficiency of their KYC processes, while also ensuring compliance with regulatory requirements. With further advancements and widespread adoption, blockchain technology has the potential to transform the way KYC is conducted, making it more streamlined, secure, and customer-centric.

Exploring the Potential of Blockchain Development Solutions in KYC: A Paradigm Shift in Identity Verification

Identity verification is a crucial process for businesses in various industries, especially in the financial sector where compliance with Know Your Customer (KYC) regulations is mandatory. The advent of blockchain technology has introduced a transformative approach to KYC, offering a paradigm shift in identity verification.

Blockchain development solutions provide a decentralized and secure platform that addresses the limitations of traditional KYC methods. By leveraging the immutability and transparency of blockchain, customer identities can be stored and verified in a tamper-proof manner, reducing the risk of fraud and identity theft.

One of the key advantages of blockchain-based KYC is the automation of verification processes through smart contracts. These self-executing agreements streamline identity verification, eliminating manual errors and reducing the time-consuming nature of traditional methods. The use of smart contracts also enables real-time updates and notifications, ensuring that KYC information remains up-to-date and relevant.

Furthermore, blockchain facilitates secure data sharing between trusted parties. Through encrypted transactions and access controls, customers can share their KYC information securely, granting permission only to authorized entities. This empowers individuals to maintain control over their personal data, enhancing privacy and consent management.

The adoption of blockchain in KYC also brings benefits to businesses. The integration of auditable and tamper-proof records simplifies compliance efforts, making regulatory audits more efficient and reducing the administrative burden on financial institutions. Moreover, the cost savings achieved through streamlined processes and reduced reliance on intermediaries can significantly impact the bottom line.

Conclusion

Blockchain development solutions have the potential to revolutionize KYC processes by offering decentralized, secure, and automated identity verification. embracing the power of blockchain technology, along with the integration of innovative solutions like Webisoft, holds the key to revolutionizing KYC processes. By leveraging the immutability and transparency of blockchain, businesses can enhance security, streamline compliance, and improve customer experiences.

Embracing this transformative technology is key to staying ahead in the evolving digital landscape and unlocking the full potential of efficient and trustworthy KYC processes.