How To Mine Solana: The Real Ways To Earn SOL Fast

- BLOG

- Blockchain

- November 24, 2025

The question how to mine solana pops up everywhere, usually from people expecting a new version of Bitcoin-style mining. After all, Solana moves fast, scales well, and feels like the kind of network that should reward hardware power.

The surprise comes quickly: Solana can’t be mined at all. Instead, it offers earning paths that are faster, cleaner, and far more interesting than traditional mining rigs and electricity battles.

This guide uncovers those methods in a way that’s easy to follow, practical to apply, and aligned with how Solana actually works. If you want to earn SOL, you’re exactly where you need to be.

Contents

- 1 Why People Search for “How to Mine Solana”

- 2 Why Solana Cannot Be Mined Like Bitcoin

- 3 Real Ways to Earn Solana: The Practical “Mining” Alternatives

- 4 On-Chain Activity and Participation Rewards

- 5 How You Can Start Earning SOL Now: Step-by-Step Guide

- 5.1 Step 1. Set up a compatible Solana wallet

- 5.2 Step 2. Acquire SOL and transfer it to your wallet

- 5.3 Step 3. Select a high-performing validator

- 5.4 Step 4. Delegate your SOL to the selected validator

- 5.5 Step 5. Begin receiving staking rewards

- 5.6 Step 6. Optional: Run a validator for higher involvement

- 5.7 Step 7. Optional: Explore Solana DeFi for additional yield

- 6 Build stronger Solana solutions with Webisoft’s expert guidance!

- 7 What Can Go Wrong When Earning Solana

- 7.1 Selecting a validator with poor performance

- 7.2 Unstaking delays and temporary loss of rewards

- 7.3 Slashing and penalty risks on validator-operated stakes

- 7.4 Exposure to SOL price volatility

- 7.5 DeFi-related risks from smart contracts and liquidity pools

- 7.6 Misleading offers and “mining” scams

- 7.7 Errors with liquid staking or derivative tokens

- 7.8 Overreliance on low-quality wallets or platforms

- 8 Is It Worth Mining Solana? ROI and Earnings Explained

- 9 How Webisoft Can Help You in the Solana Ecosystem

- 10 Build stronger Solana solutions with Webisoft’s expert guidance!

- 11 Wrap up

- 12 Frequently Asked Questions

Why People Search for “How to Mine Solana”

The keyword how to mine Solana appears often because many people assume Solana can be mined in the same way as Bitcoin or other proof-of-work cryptocurrencies. Mining is a familiar process for beginners and for individuals who have operated GPU or ASIC hardware. So it becomes the default term for anyone seeking ways to earn a new token. Even leading some to search how to mine Solana online using browser-based tools. Search interest typically comes from a few groups:

- Existing miners looking to redirect their hardware toward a popular, high-performing blockchain.

- New crypto users who are unaware of the differences between proof-of-work and proof-of-stake networks.

- Investors researching ways to generate yield from SOL holdings.

- Developers and founders exploring how network participation works within the Solana ecosystem.

The core issue is that Solana cannot be mined. Solana operates on a Proof-of-Stake and Proof-of-History model, which does not rely on mining equipment or computational work. The presence of this keyword reflects a misunderstanding of how Solana generates rewards. Thus making it necessary to clarify the actual earning methods such as staking or validator participation.

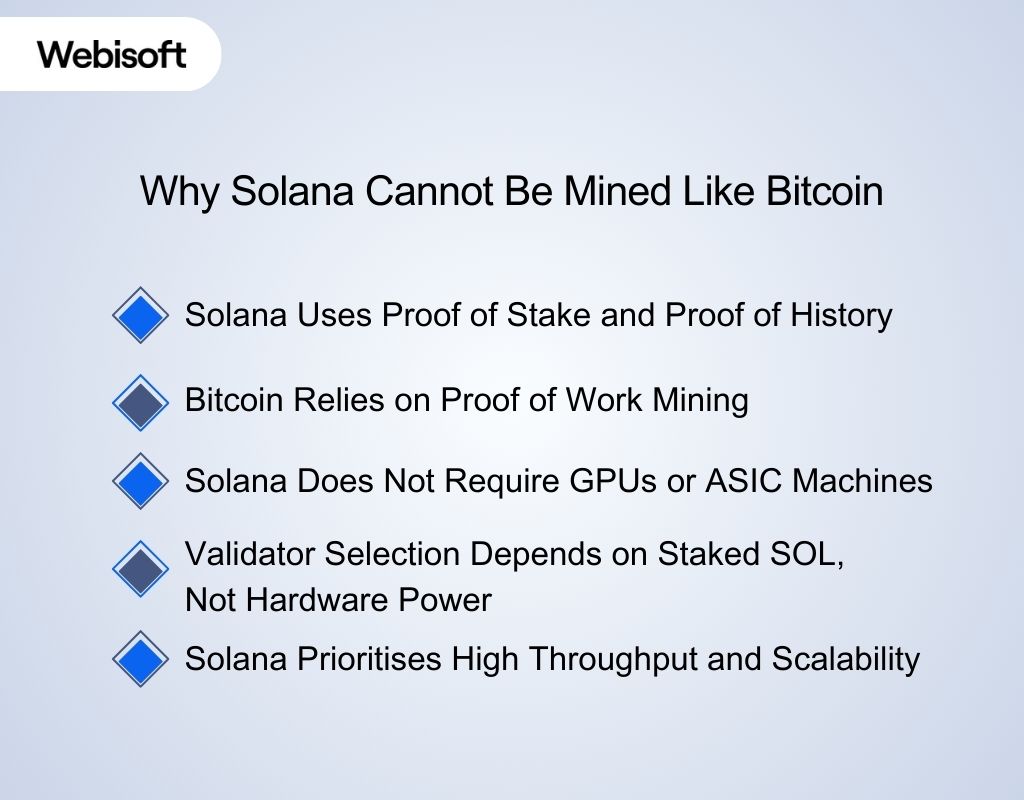

Why Solana Cannot Be Mined Like Bitcoin

Solana does not rely on mining because it operates on a fundamentally different consensus model from Bitcoin. Instead of solving computational puzzles, Solana depends on stake-based validation and time verification, removing the need for hardware-driven mining entirely.

Solana does not rely on mining because it operates on a fundamentally different consensus model from Bitcoin. Instead of solving computational puzzles, Solana depends on stake-based validation and time verification, removing the need for hardware-driven mining entirely.

Solana Uses Proof of Stake and Proof of History

Solana’s network is built on a combination of Proof of Stake (PoS) and Proof of History (PoH). PoS assigns validation rights based on staked SOL, while PoH provides a verifiable time structure that keeps the network efficient and synchronised.

Bitcoin Relies on Proof of Work Mining

Bitcoin uses a Proof of Work (PoW) model that requires miners to solve complex mathematical problems with specialised hardware. This process consumes significant computational power and electricity, making mining central to Bitcoin’s security model.

Solana Does Not Require GPUs or ASIC Machines

Solana’s network does not depend on GPU rigs, ASIC machines or hardware competition. Validation is based on staked SOL rather than hash power, which eliminates the entire concept of traditional mining equipment.

Validator Selection Depends on Staked SOL, Not Hardware Power

Validators on Solana are chosen based on the amount of SOL they stake and their operational performance. Unlike Bitcoin miners, they do not compete through energy consumption or hardware speed to create the next block.

Solana Prioritises High Throughput and Scalability

Solana’s architecture supports high transaction throughput, reaching approximately 50,000 transactions per second according to Webisoft’s analysis in its Solana blockchain development overview. This focus on speed and scalability aligns with stake-based validation rather than mining-based competition.

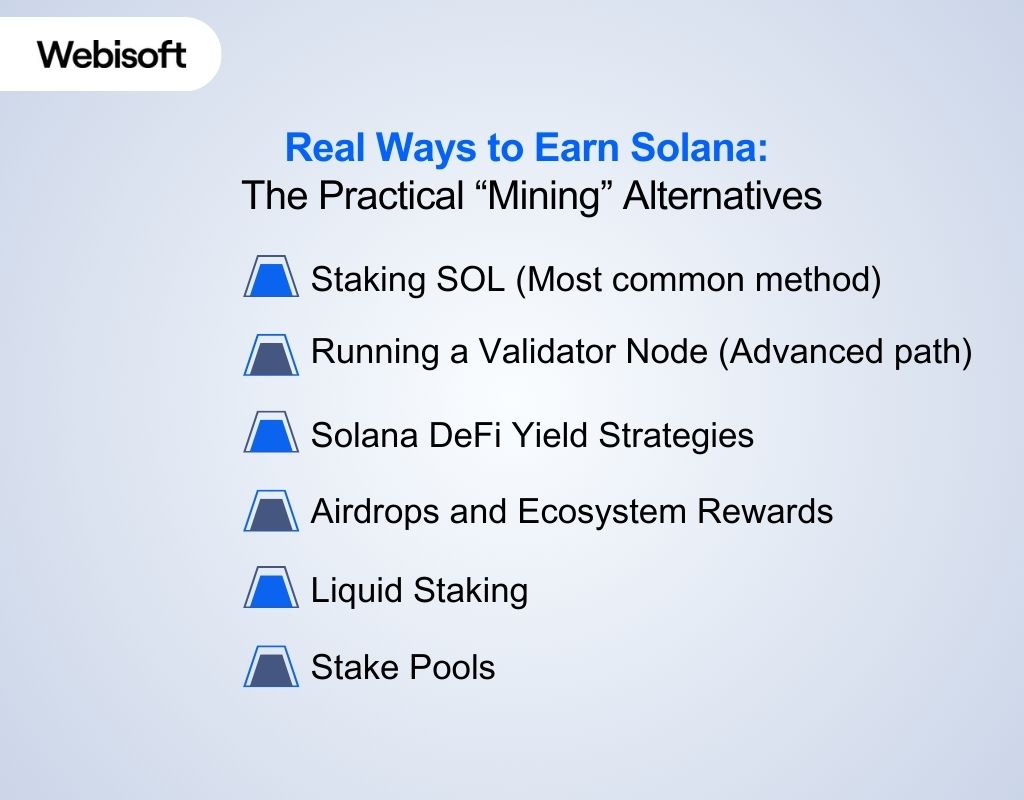

Real Ways to Earn Solana: The Practical “Mining” Alternatives

Traditional mining doesn’t work on Solana, but you still have several effective ways to earn SOL through participation, staking, validation, and on-chain activity. These methods match how Solana’s proof-of-stake network distributes rewards and answer a broader search intent related to how to earn Solana reliably.

Traditional mining doesn’t work on Solana, but you still have several effective ways to earn SOL through participation, staking, validation, and on-chain activity. These methods match how Solana’s proof-of-stake network distributes rewards and answer a broader search intent related to how to earn Solana reliably.

Staking SOL (Most common method)

Staking involves delegating your SOL to a validator so the network can verify transactions securely. You earn regular rewards for this contribution, and returns often fall in the 5–7% APY range depending on the validator’s performance and commission rate.

Running a Validator Node (Advanced path)

Running a validator means operating your own node with dedicated hardware and maintaining high uptime. This approach allows you to earn block rewards and commissions from delegators, but it requires technical knowledge, consistent maintenance, and a significant amount of staked SOL.

Solana DeFi Yield Strategies

DeFi on Solana gives you ways to earn through liquidity provision, yield farming, and incentive programs. If you’re building within this space, Webisoft’s Solana dApp development service covers full-cycle decentralized app architecture and deployment.

These methods can generate higher returns than staking, yet they also involve greater risks due to market volatility and smart-contract exposure.

Airdrops and Ecosystem Rewards

Airdrops reward early or active participation within the Solana ecosystem. You may receive tokens for staking, trading, testing protocols, or completing specific tasks. The value of these rewards varies based on each project’s activity and growth.

Liquid Staking

Liquid staking allows you to stake SOL and receive a liquid token such as mSOL or jSOL in return. This token continues to generate staking rewards while remaining usable across DeFi platforms, giving you flexibility without the typical unstaking delay.

Stake Pools

Stake pools combine SOL from many participants and spread it across multiple validators. You receive a share of the pooled rewards, benefit from broader validator coverage, and avoid depending on a single validator’s performance.

On-Chain Activity and Participation Rewards

Some Solana protocols reward active usage with points, tokens, or eligibility for future airdrops. Using apps, completing quests, or trading NFTs can earn rewards depending on each protocol’s rules.

To explore real-world implementations, check out Webisoft’s Solana DApps insights for examples of ecosystem utilities. If Solana participation feels complex and you want expert support with staking, validators, or custom development, Webisoft can guide your setup from start to scale. Connect with the team now.

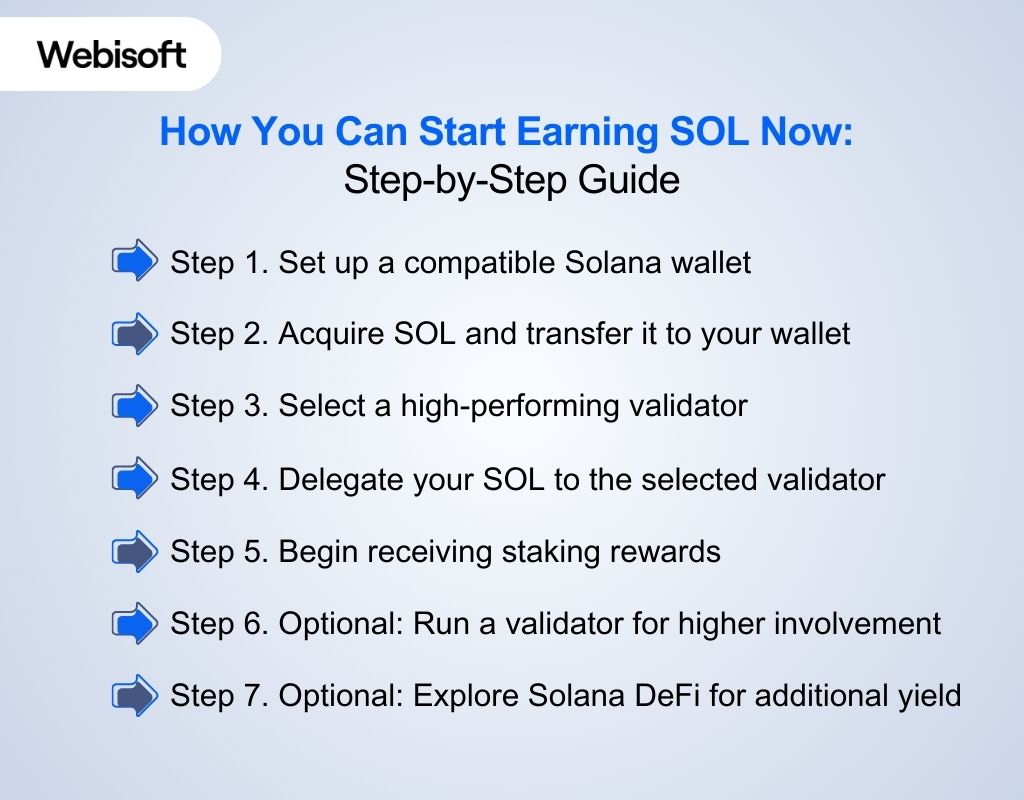

How You Can Start Earning SOL Now: Step-by-Step Guide

Earning SOL begins with a simple setup process. These steps focus on staking, the most beginner-friendly option, and can be expanded later into validator operations or DeFi strategies once you build confidence.

Earning SOL begins with a simple setup process. These steps focus on staking, the most beginner-friendly option, and can be expanded later into validator operations or DeFi strategies once you build confidence.

Step 1. Set up a compatible Solana wallet

To begin, install a Solana-supported wallet such as Phantom, Solflare, or Ledger. These wallets give you access to the Solana network, allow you to hold SOL securely, and provide built-in tools for staking. After installation, create a new wallet, save your recovery phrase, and enable security options to protect your account.

Step 2. Acquire SOL and transfer it to your wallet

You need SOL to cover transaction fees and to stake. Purchase SOL from a reputable exchange and withdraw it to your Solana wallet address. Transfers are usually completed within seconds due to Solana’s high throughput, allowing you to proceed without long confirmation delays.

Step 3. Select a high-performing validator

Before staking, review available validators inside your wallet’s staking interface. Focus on validators with high uptime, stable performance, transparent commission rates, and a positive track record within the ecosystem. This choice affects your earnings, because consistent validators distribute rewards more reliably.

Step 4. Delegate your SOL to the selected validator

Once you choose a validator, use your wallet to start the delegation process. Enter the amount of SOL you want to stake and confirm the transaction. Delegated SOL remains under your ownership, but it becomes assigned to the validator to support network security. After delegation, no further action is required unless you decide to unstake or change validators.

Step 5. Begin receiving staking rewards

After your stake becomes active, you will start earning rewards automatically. Solana distributes staking rewards every epoch, which lasts about two to three days. Your rewards depend on validator performance, network conditions, and the amount of SOL you delegated. You can monitor your rewards directly through your wallet.

Step 6. Optional: Run a validator for higher involvement

If you want deeper participation, you can operate a validator node. This requires dedicated hardware, stable uptime, and ongoing maintenance. You must stake SOL to activate your validator and maintain node health to stay eligible for rewards. Running a validator is more complex than staking, but it offers both block-production rewards and commissions from delegators.

Step 7. Optional: Explore Solana DeFi for additional yield

You can use your SOL or liquid staking tokens in DeFi platforms to earn additional rewards. Before participating, review audits, check protocol history, understand liquidity risks, and examine how rewards are structured. DeFi strategies can increase your earnings but require careful evaluation to manage exposure.

Build stronger Solana solutions with Webisoft’s expert guidance!

Get customized support to design, deploy, and scale your Solana strategy effectively.

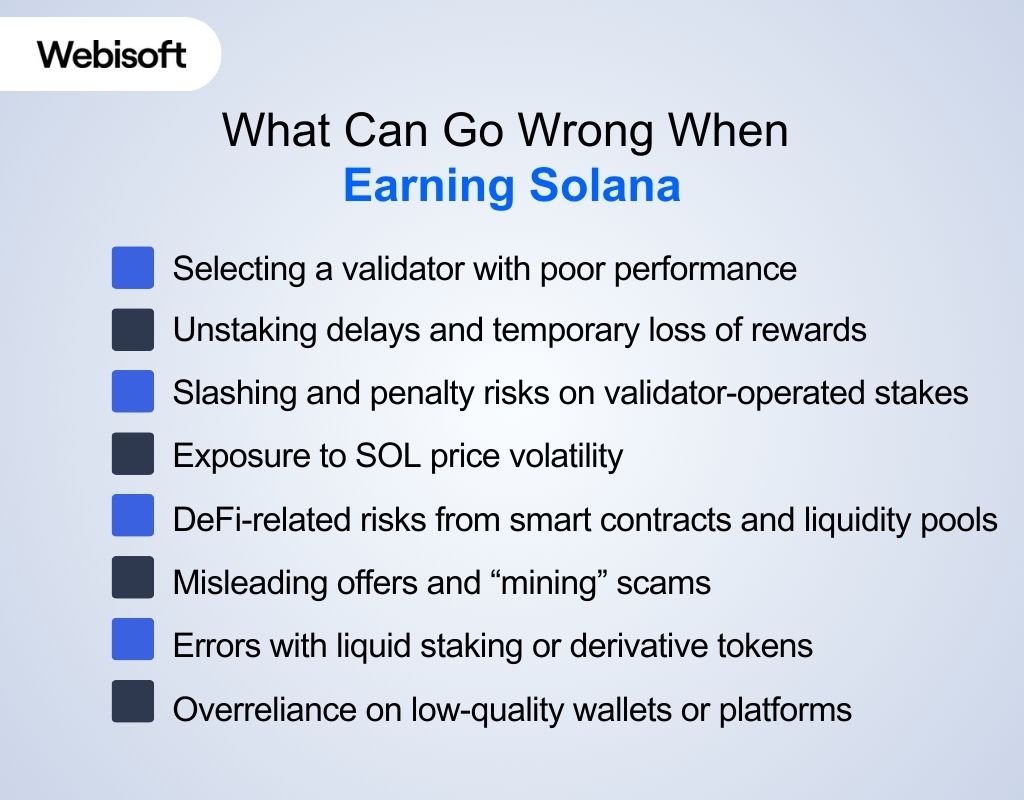

What Can Go Wrong When Earning Solana

Earning SOL is more accessible than mining Bitcoin, but it still involves several risks tied to staking, validation, DeFi activity, and general market conditions. Understanding these risks helps you choose safer earning paths and avoid common mistakes.

Earning SOL is more accessible than mining Bitcoin, but it still involves several risks tied to staking, validation, DeFi activity, and general market conditions. Understanding these risks helps you choose safer earning paths and avoid common mistakes.

Selecting a validator with poor performance

Your staking rewards depend heavily on validator uptime and reliability. If the validator you choose experiences frequent downtime or inconsistent performance, your rewards decrease.

High commission rates also reduce your earnings over time. A poor validator choice doesn’t result in losing your staked SOL, but it noticeably weakens your earning potential.

Unstaking delays and temporary loss of rewards

When you decide to unstake your SOL, the tokens go through a deactivation period that can last several days. During this time, your SOL does not earn any rewards. If you plan to move funds quickly, especially during market fluctuations this delay becomes a limitation you must account for.

Slashing and penalty risks on validator-operated stakes

Although Solana’s slashing is less severe than on some other proof-of-stake chains, validators can still be penalized for specific types of misconduct or extended downtime. If you operate your own validator, mistakes in configuration, network reliability, or security can reduce rewards and affect your validator’s reputation.

Exposure to SOL price volatility

Staking rewards are paid in SOL, so your returns fluctuate with the market. Even if you earn consistent APY, the dollar value of your rewards varies. A price drop in SOL can diminish the overall value of your earned tokens, especially if your strategy depends on short-term gains.

For up-to-date market data, you can check Solana’s price on CoinMarketCap to monitor value changes over time.

DeFi-related risks from smart contracts and liquidity pools

DeFi platforms offer attractive yields, but they introduce higher risk. Vulnerabilities in smart contracts can lead to exploits, and liquidity pools expose you to impermanent loss when token prices shift. Projects without audits or transparent development practices add additional layers of uncertainty.

Misleading offers and “mining” scams

Because Solana cannot be mined, any tool claiming how to mine solana for free through GPU, cloud, or “online mining” is likely misleading. Many of these offers are structured to appear legitimate while providing no real earning mechanism, making them a common source of user losses.

Errors with liquid staking or derivative tokens

Liquid staking platforms issue derivative tokens that represent your staked SOL. While convenient, this introduces smart-contract risk and price divergence risk. If the derivative token loses peg or faces a liquidity shortage, it can affect your ability to exit positions smoothly.

Overreliance on low-quality wallets or platforms

Choosing wallets or platforms without strong security or proper support can lead to operational issues. Poorly maintained software increases the chance of failed transactions, mismanagement of assets, or security vulnerabilities.

Is It Worth Mining Solana? ROI and Earnings Explained

Let’s address the big question: is it actually worth participating on Solana in place of “mining”? If you stake SOL at an annualised ~5-7% yield and you have 1,000 SOL, you might earn ~50-70 SOL per year (subject to network conditions).

Using the information from Solana’s official site. For validator operators the ROI depends on initial hardware cost, stake size, operational expenses and uptime, so the break-even point may take months. DeFi strategies may offer higher yields (say 10-20%+) but with increased risk. In summary:

- If you already hold SOL and seek passive income, staking is a sensible path.

- If you expect mining-style returns (large hardware investment, high returns), it may not match those expectations.

- If you cannot withstand risk or volatility, simpler holding or staking might suffice rather than operating a validator or doing DeFi.

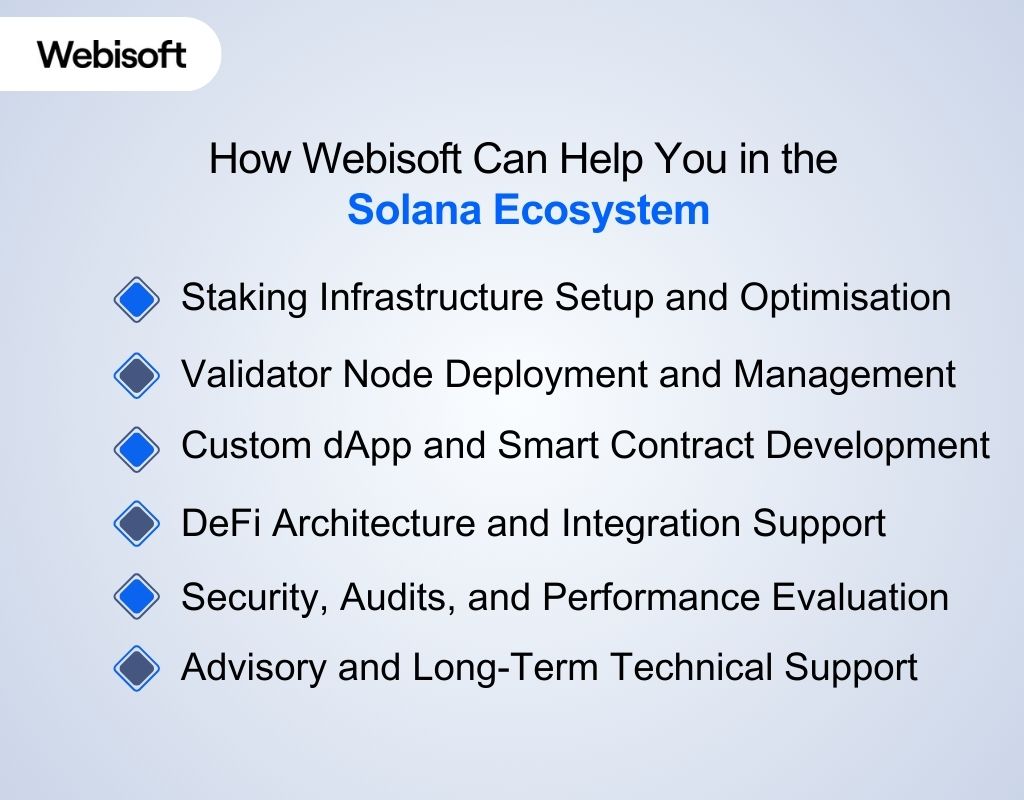

How Webisoft Can Help You in the Solana Ecosystem

After understanding the different earning methods and the risks involved, the next step is choosing the right technical support to participate safely and effectively. Webisoft provides structured guidance, technical expertise, and reliable infrastructure solutions that help you operate confidently within the Solana ecosystem.

After understanding the different earning methods and the risks involved, the next step is choosing the right technical support to participate safely and effectively. Webisoft provides structured guidance, technical expertise, and reliable infrastructure solutions that help you operate confidently within the Solana ecosystem.

Staking Infrastructure Setup and Optimisation

Webisoft helps you build secure and efficient staking setups aligned with Solana’s Proof of Stake model. This includes validator selection support, stake distribution planning, infrastructure optimisation, and guidance on reducing commission-related inefficiencies.

Validator Node Deployment and Management

If you want to run a validator, Webisoft assists with server provisioning, configuration, uptime management, monitoring tools, and long-term maintenance. This ensures your validator remains stable, performs consistently, and meets the operational standards required to stay competitive within the network.

Custom dApp and Smart Contract Development

Webisoft’s development capabilities cover Solana-based dApps, smart contracts, and integrations. The team designs scalable architectures, builds performance-focused applications, and ensures compatibility with Solana’s high throughput.

DeFi Architecture and Integration Support

Webisoft supports teams building or integrating DeFi products, including liquidity pools, yield mechanisms, staking dashboards, and governance systems. The focus remains on secure smart-contract development, efficient routing, and user-friendly interfaces that operate smoothly within Solana’s fast network.

Security, Audits, and Performance Evaluation

Webisoft provides ecosystem and validator performance evaluations, staking configuration reviews, and security-focused guidance. This includes assessing uptime stability, identifying operational risks, and improving resilience across your staking or application infrastructure.

Advisory and Long-Term Technical Support

Beyond deployment, Webisoft offers continued advisory support, helping you choose reliable ecosystem partners, adapt to network changes, and plan for long-term scalability. This gives businesses, investors, and developers a stable foundation for ongoing participation in the Solana network.

Build stronger Solana solutions with Webisoft’s expert guidance!

Get customized support to design, deploy, and scale your Solana strategy effectively.

Wrap up

In the end, the idea of how to mine solana becomes far clearer: Solana isn’t mineable. But it offers meaningful ways to earn through staking, validation, and ecosystem participation. These methods give you practical earning power without the complexity of traditional mining, closing the gap between expectation and reality.

As you move forward, choosing the right structure matters. With Webisoft’s technical experience and support, you can build a stable, efficient presence in the Solana ecosystem and grow with confidence.

Frequently Asked Questions

How to get Solana for free?

You can get Solana for free through airdrops, ecosystem reward programs, on-chain quests, or promotional campaigns run by new Solana projects. Some platforms also offer small SOL rewards for completing tasks, testing features, or participating in community activities.

Can Solana reach $10,000?

Solana reaching $10,000 would require unprecedented market growth and a multi-trillion-dollar valuation. While Solana has strong technology and ecosystem activity, such a price target is extremely speculative and depends on future adoption, regulation, and broader market conditions.

How hard is it to mine Solana?

Solana is not hard to mine because it cannot be mined at all. The network uses Proof of Stake and Proof of History, meaning SOL is earned through staking, validation, or ecosystem participation rather than traditional mining with hardware.

How fast can you mine Solana?

You cannot mine Solana at any speed because Solana is not mineable. The network uses Proof of Stake and Proof of History, so SOL is earned through staking instead of mining. Staking typically yields about 6 to 8 percent per year, depending on the validator and network conditions.