Traditional finance limits access, delivers minimal returns, and relies on centralized intermediaries. For many, this results in missed opportunities and reduced control over personal wealth.

That’s where DeFi comes in, offering borderless, permissionless tools for anyone looking to grow their crypto assets.

You can easily earn through staking, lending, yield farming, governance tokens, and more, often with greater flexibility and transparency than traditional systems.

In this guide, you’ll explore practical, secure, and proven ways to generate income with DeFi—step-by-step and backed by real-world examples.

Contents

- 1 What is DeFi?

- 2 What Are The Best Ways To Make Money With Defi?

- 3 Advantages and Limitations of Earning Passive Income in Defi

- 4 Tax Implications of Passive Income from Defi

- 5 How to Start Earning Passive Income with DeFi?

- 6 In Closing

- 7 Frequently Asked Questions

What is DeFi?

DeFi, or Decentralized Finance, is a financial ecosystem built on blockchain networks that replicates and extends traditional financial services.

It uses smart contracts, which are self-running programs, to automate activities like lending, borrowing, trading, and managing assets without needing middlemen.

In DeFi, protocols operate on public ledgers, with all transactions recorded transparently.

Governance is often handled by token holders who vote on protocol changes, rather than by a corporate entity. This decentralization reduces single points of failure and censorship risk.

Core features of DeFi include non-custodial asset control, composability between protocols, and 24/7 market access. These properties make DeFi structurally different from centralized finance, offering programmable and permissionless alternatives to legacy systems.

What Are The Best Ways To Make Money With Defi?

1. Delegated staking

Delegated staking is a method that allows token holders to earn rewards by participating in network validation without running a node themselves.

Instead of transferring ownership, users delegate their tokens to a validator. This helps secure the network while keeping the delegator’s assets in their own wallet.

It’s a widely used approach in proof-of-stake blockchains and forms a key part of DeFi passive income strategies.

How it works:

- You select a validator from the network’s list.

- Tokens are delegated via a wallet interface, not transferred.

- The validator adds your stake to their pool and validates transactions.

- Rewards are automatically distributed to you based on your share.

- Some networks may slash rewards if the validator behaves maliciously.

Returns are typically in the range of 5–12% annually, depending on the blockchain’s inflation model, validator performance, and network conditions.

Unlike more volatile earning methods, rewards from staking platforms are relatively predictable.

For instance, the Tezos network offers delegation with no minimum stake and pays out rewards every cycle, typically every three days, making it efficient and accessible for smaller holders.

Its design illustrates well-structured staking protocol mechanics, balancing reward distribution with network security.

2. Yield Farming

Yield farming is a strategy that allows users to earn rewards by providing liquidity to decentralized finance protocols.

Instead of passively holding crypto, you can move assets between pools to maximize returns. It’s more active than staking and often involves higher risk, but it can offer competitive yields when managed strategically.

How it works:

- You deposit tokens into a liquidity pool on a DeFi platform.

- The pool facilitates trading, lending, or borrowing activities.

- In return, you receive a share of transaction fees or platform tokens.

- Some platforms also offer governance tokens as extra incentives.

- Yields may vary and often require monitoring market shifts.

Yields are typically expressed as Annual Percentage Yields (APY) and can fluctuate daily. While top pools may offer double-digit returns, they come with risks like impermanent loss and smart contract vulnerabilities.

Still, many investors use yield farming as a way to diversify DeFi income strategies beyond staking. Platforms like Curve Finance have optimized structures for stablecoin farming.

It minimizes volatility and maximizes capital efficiency through well-tested liquidity allocation mechanisms.

3. DeFi Lending Platforms

DeFi lending platforms allow you to lend your crypto assets to others and earn interest. Unlike traditional lending, there are no middlemen involved.

Smart contracts handle everything automatically—from connecting lenders and borrowers to calculating interest and managing collateral.

This is a key part of the DeFi earn model and is widely used across major blockchain networks.

How it works:

- Users lock their digital assets into a smart contract on the lending platform.

- Borrowers access these assets by providing overcollateralized loans.

- Interest is paid by borrowers based on protocol-defined rates.

- The smart contract distributes earned interest to lenders.

- Collateral is automatically liquidated if loan terms are violated.

Interest rates change based on market demand, token volatility, and the platform’s mechanics. Platforms like Aave use algorithms to adjust rates in real-time.

As a lender, you can earn predictable returns, usually between 2% and 10% annually, depending on the asset.

These platforms are built on clear, automated lending systems that remove the need for credit checks and allow anyone globally to access capital.

4. Interest-Bearing Crypto Accounts

Interest-bearing crypto accounts let you earn passive income by depositing digital assets into DeFi platforms. These accounts work like savings accounts but are managed by smart contracts instead of banks.

You earn interest through lending activities or by providing liquidity, depending on how the platform handles the deposited funds.

How it works:

- Users deposit supported crypto assets into a DeFi interest account.

- The platform deploys those assets into lending pools or yield strategies.

- Interest is generated through borrower repayments or market-making fees.

- Earnings are distributed back to users at fixed or variable rates.

- Withdrawals are permitted anytime, subject to liquidity availability.

Returns typically range from 3% to 10% annually, depending on the asset, platform structure, and market conditions.

Unlike custodial interest accounts, DeFi options offer more transparency but require users to evaluate smart contract risk.

Platforms like Compound provide dynamic rates based on supply-demand mechanics. It tracks all activity through on-chain interest models, ensuring visibility into fund allocation and returns.

5. Content Monetization Platforms

Content monetization platforms in DeFi allow creators to earn income directly from their audience using blockchain-based tools.

These platforms remove intermediaries like streaming services or publishers, and replace them with smart contracts that automate payments and ownership rights.

It’s a growing vertical in DeFi passive income, especially for digital artists, writers, and video creators.

How it works:

- Creators upload content to decentralized platforms powered by smart contracts.

- Users pay for access with cryptocurrencies, often through microtransactions.

- Payments are instantly and transparently transferred to the creator’s wallet.

- Some platforms offer tipping, subscriptions, or pay-per-access options.

- Smart contracts manage royalties and any secondary sales, if applicable.

Earnings vary based on engagement, pricing structure, and platform tokenomics.

Unlike ad-based revenue models, this approach allows creators to retain full ownership and control.

A good example is Mirror.xyz, which enables writers to tokenize articles and earn from auctions or reader contributions. These systems rely on decentralized creator economy protocols, offering transparent monetization without relying on traditional platforms.

6. Decentralized Autonomous Organizations

Decentralized Autonomous Organizations (DAOs) are governance systems powered by smart contracts, enabling communities to manage protocols, assets, or projects without central control.

Members hold governance tokens, which give them the right to vote on proposals, funding choices, and system updates.

Being part of DAOs has become a unique way to earn DeFi passive income by contributing time, capital, or technical skills.

How it works:

- Users acquire governance tokens of a DAO.

- Token holders propose or vote on key decisions, including treasury allocations.

- Contributions, such as development, marketing, or research, can be compensated.

- DAOs may distribute profits or token incentives to active members.

- All decisions and transactions are executed by smart contracts.

Income depends on the DAO’s model, some offer token rewards, others pay stablecoins, or share revenue. This structure incentivizes long-term engagement and gives contributors a stake in the protocol’s success.

A prominent example is MakerDAO, which governs the DAI stablecoin system and uses formal voting systems and financial modeling via on-chain governance frameworks.

7. Affiliate Programs

Affiliate programs in DeFi offer users a way to earn income by promoting decentralized platforms and services.

Participants share referral links that track user sign-ups or activity.

When someone joins a protocol through that link and performs an action, like staking, trading, or lending, the referrer earns a reward.

It’s a performance-based income model that aligns well with how to make money in DeFi without deploying capital directly.

How it works:

- Users register for a DeFi platform’s affiliate or referral program.

- A unique link is generated and shared through websites, social media, or communities.

- When someone signs up and meets the criteria (e.g., deposits funds), the referrer earns a commission.

- Rewards are typically paid in the platform’s native tokens or stablecoins.

- Some programs offer tiered structures with higher rewards for volume.

Returns depend on audience size, platform reputation, and user retention. While it doesn’t involve direct asset locking, top programs may require passing KYC or maintaining minimum balances.

For example, protocols like GMX have adopted advanced decentralized referral tracking systems, ensuring transparency, fraud prevention, and direct on-chain reward distribution.

8. Farming Governance Tokens

Farming governance tokens involve earning tokens that grant voting rights in a protocol. These tokens are often distributed as rewards for providing liquidity or staking assets.

Unlike passive holding, this method actively contributes to protocol growth while building a stake in its decision-making process.

It’s a common strategy among users exploring the best DeFi projects for passive income.

How it works:

- Users deposit tokens into eligible liquidity pools or staking contracts.

- In return, they earn governance tokens as part of the reward system.

- These tokens can be used to vote or traded in the open market.

- Some protocols reward early participants with higher token allocations.

- Rewards may reduce over time as the supply schedule adjusts.

Returns vary depending on market value and protocol activity. Governance tokens may not offer direct yield, but can appreciate if the protocol gains adoption.

For example, Uniswap rewarded early users with UNI tokens through a retroactive airdrop.

Today, its model relies on token distribution governance, balancing incentives with long-term control over protocol rules.

9. Token Rewards and Airdrops

Token rewards and airdrops are methods used by DeFi projects to distribute tokens to users. Rewards are typically earned through participation, such as staking or governance, while airdrops are often given for free based on eligibility.

Both serve as user acquisition tools and offer early supporters a way to benefit from protocol growth.

These methods remain key for users exploring how to make money in DeFi without active investment.

How it works:

- Users interact with a DeFi protocol or meet specific criteria.

- The platform allocates tokens to qualifying wallets.

- Airdrops are often based on historical activity or token holdings.

- Some rewards require claims via smart contracts.

- Tokens may be immediately tradable or locked for a set period.

While not guaranteed, airdrops can be surprisingly valuable. In 2020, early Uniswap users received 400 UNI tokens worth over $1,000 at the time.

These distribution models are typically structured around network participation incentives, encouraging user engagement and decentralized ownership.

Advantages and Limitations of Earning Passive Income in Defi

Earning passive income through DeFi offers unique benefits, but it’s not without risks.

Here’s a clear breakdown of the key advantages and limitations to help you evaluate before getting involved.

| Advantages | Limitations |

| Non-custodial control over assets | Smart contract vulnerabilities |

| Higher yield potential than traditional finance | Market volatility and asset devaluation |

| Global access without credit checks or KYC | Regulatory uncertainty in many jurisdictions |

| Transparent performance and protocol data | Impermanent loss in liquidity pools |

| Programmable income through smart contracts | Technical barrier for non-expert users |

| Diversified income options (staking, lending, etc.) | Reward structures may change or decline over time |

| Participatory governance in some protocols | Risk of governance manipulation or low voter participation |

Tax Implications of Passive Income from Defi

Passive income from DeFi isn’t tax-free. In most jurisdictions, activities like staking, lending, and yield farming are taxable events.

- Rewards you earn through staking or interest are usually taxed when you receive them, based on the token’s market value at that time.

- Yield farming can create multiple taxable actions, including swaps and reinvestments, each of which requires individual reporting.

- Tokens you receive through airdrops can be taxed immediately, even if you don’t sell or use them.

- Entering and exiting liquidity pools might result in capital gains or losses, depending on the price changes of the assets.

- If a token increases in value after you earn it and you sell it later, capital gains taxes may apply based on how long you held it.

- You need to keep accurate records of your wallet activity, including time, value, and transaction type, for proper reporting and audit protection.

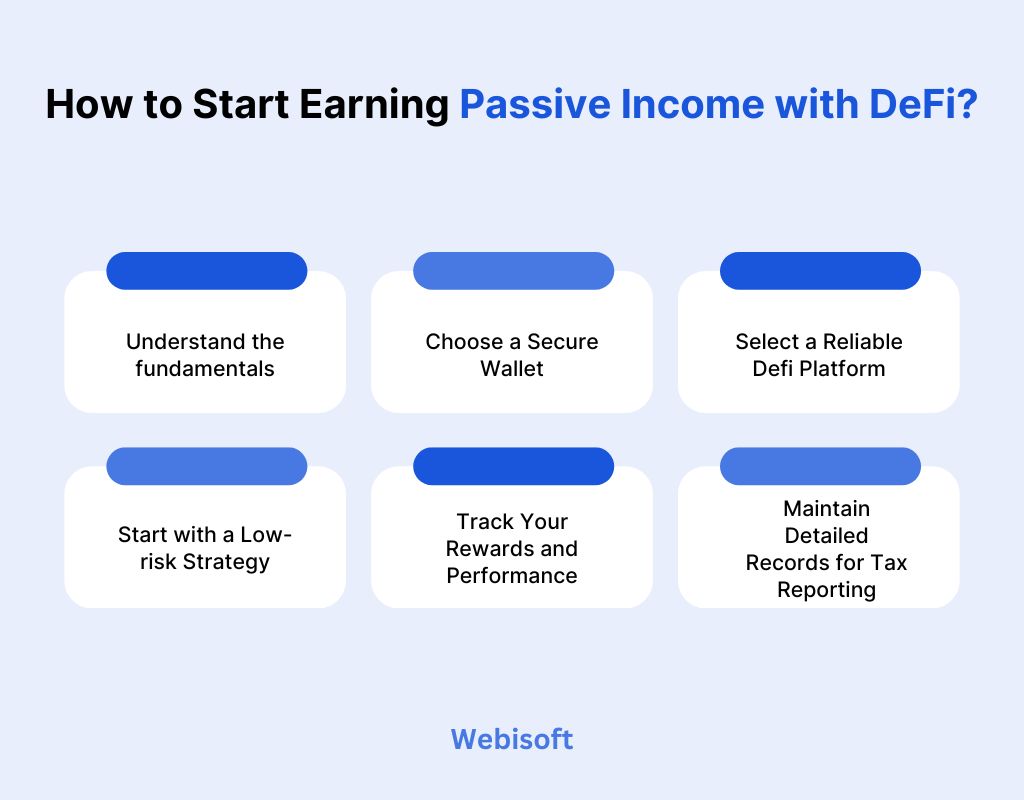

How to Start Earning Passive Income with DeFi?

Starting with DeFi doesn’t require deep technical skills, but it does demand careful planning.

Here’s a clear roadmap to help you begin earning passive income safely and strategically.

Understand the fundamentals

Before investing, study how DeFi protocols function—especially staking, lending, and yield farming.

Knowing the mechanics behind smart contracts and token flows will help you assess both risk and return.

Choose a Secure Wallet

Use a non-custodial wallet like MetaMask, Trust Wallet, or Ledger. These wallets give you full control over your keys and are compatible with most DeFi platforms. Contact with the best DeFi wallet developers here.

Select a Reliable Defi Platform

Evaluate platforms based on audits, community trust, protocol maturity, and transparency. Avoid unaudited or recently launched platforms unless you’re prepared for higher risk.

Start with a Low-risk Strategy

Consider staking or lending stablecoins to minimize exposure to market volatility. These options typically offer steady yields and are ideal for learning the system.

Track Your Rewards and Performance

Use analytics tools like DeFiLlama or Zapper to monitor your investments. These tools help visualize your yield, wallet balances, and protocol health in real time.

Maintain Detailed Records for Tax Reporting

Every transaction for staking, lending, and swaps can have tax implications. Keep logs with date, amount, and value to stay compliant and avoid legal issues later.

In Closing

DeFi is reshaping how you and businesses interact with financial systems, offering new income models that are transparent, decentralized, and accessible worldwide.

As the ecosystem matures, opportunities will grow for those who understand how to navigate it securely and strategically.

Whether you’re a crypto investor or a business exploring DeFi lending platform development, taking action today can position you ahead of the curve.

If you’re looking to build or scale blockchain-based solutions, Webisoft can help. Their team specializes in smart contracts, DeFi platforms, and custom blockchain development tailored to your goals.

Frequently Asked Questions

Is DeFi safe for beginners?

DeFi offers powerful tools but carries risk. Beginners should start with trusted, audited platforms, use secure wallets, and avoid complex yield strategies until they understand the mechanics.

Do I need a lot of money to start earning with DeFi?

No. Many platforms allow you to start with small amounts. Even $50–$100 can be used to stake, lend, or provide liquidity on beginner-friendly staking DeFi protocols.

How do I avoid scams or rug pulls in DeFi?

Always research the team, audits, and community reputation before using any protocol. Stick to well-known platforms and never interact with unknown links or DApps.

Can DeFi income be earned in stablecoins?

Yes. Many DeFi platforms offer interest or rewards in stablecoins like USDC or DAI, helping you earn without exposure to crypto price volatility.

What tools help track DeFi investments?

Dashboards like Zapper, DeFiLlama, and Zerion offer real-time tracking for yields, wallet balances, and portfolio health across the best DeFi staking platform options.