How to Invest in Tokenization the Right Way in 2025

- BLOG

- Blockchain

- September 20, 2025

Investing is no longer limited to traditional assets or large amounts of money. Today, anyone can access new opportunities through smaller, more flexible options. One of the most exciting shifts in this space is the rise of tokenization, which is changing how people invest and own assets. So, how to invest in tokenization? You start by choosing what type of asset you want to invest in. Then, use a trusted platform that turns those assets into digital tokens. After verifying your identity and funding your account, you can buy and hold these tokens, just like any other investment. Throughout this guide, you’ll get a clear breakdown of the entire tokenization process, from asset selection to platform choice. You’ll find real examples, risks to avoid, and simple tips to help you start investing in tokenized funds with confidence.

Contents

- 1 What Is Tokenization?

- 2 Understanding the Process of Tokenization

- 3 How to Invest in Tokenization: Step-by-Step

- 4 Simplify Tokenized Investing with Webisoft!

- 5 Top Tokenization Platforms to Use in 2025

- 6 Cost of Tokenization: What to Expect

- 7 Tokenization Investing: Core Benefits and Common Mistakes

- 8 Partnering with Webisoft for Successful Tokenization

- 9 Conclusion

- 10 Frequently Asked Question

What Is Tokenization?

Tokenization is the process of turning real-world things, like property, art, or even shares into digital tokens on a blockchain. These tokens represent ownership or rights to that asset. Instead of handling physical paperwork, everything is stored securely and transparently on a digital ledger. Tokenization allows you to own a small share of a high-value asset, rather than buying the whole thing. A common example of tokenization is real estate, where you can invest in a fraction of a property instead of purchasing the entire building. This makes investing easier and more accessible for everyone. Moreover, buying, selling, or transferring these tokens is fast and easy. With fewer middlemen and smart contracts, you get better security, lower fees, and smoother transactions. This also highlights the benefits of tokenization, such as fractional ownership, enhanced liquidity, and 24/7 global access.

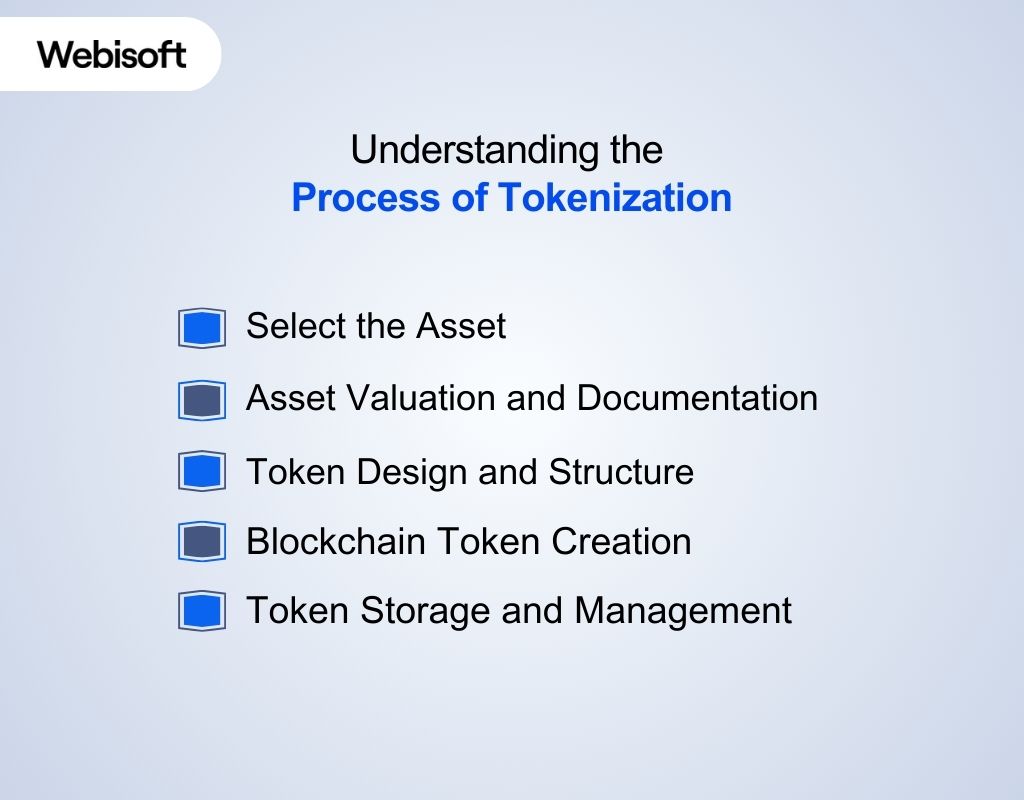

Understanding the Process of Tokenization

Tokenization might seem complicated at first, but it’s actually a simple and clear process. If you’re asking what is token investment and how does it works, this guide breaks it down. Here’s a step-by-step look at how assets are turned into tokens you can buy, hold, or trade online:

Tokenization might seem complicated at first, but it’s actually a simple and clear process. If you’re asking what is token investment and how does it works, this guide breaks it down. Here’s a step-by-step look at how assets are turned into tokens you can buy, hold, or trade online:

Select the Asset

The process begins by identifying a suitable asset to tokenize, this could be real estate, commodities, artwork, or even digital content. The asset must be clearly defined and verifiable so it can be accurately represented by tokens later in the process. It’s important that the asset holds value and can be legally owned or transferred. If you’re focusing on physical assets, Real‑World Assets (RWA) Tokenization by Webisoft offers a helpful overview.

Asset Valuation and Documentation

The asset is appraised and documented. This includes determining its market value, ownership details, and any legal paperwork. Accurate documentation ensures the digital tokens reflect real-world value. Without this step, trust in the token would be weak. This is what ties the digital token to its real-world equivalent in a meaningful, legal way.

Token Design and Structure

Here, the asset is divided into units, called tokens. You define how many tokens to issue, their value, and rights associated with them. For example, one token could equal 1% of a property. This structure helps standardize how the tokens behave, what rights they carry, and how they can be used or transferred later.

Blockchain Token Creation

Now the digital tokens are created on a blockchain. Each token is generated as a smart contract or part of one, ensuring security, traceability, and transparency. These tokens act as digital certificates of ownership. Once recorded on the blockchain, they can’t be altered, which prevents fraud and builds trust in the system.

Token Storage and Management

Finally, the tokens are stored in digital wallets and managed on the blockchain. The blockchain acts as a permanent ledger that tracks every transaction. Token holders can transfer, track, or use their tokens as needed. This makes ownership seamless, fast, and borderless, without relying on middlemen or traditional infrastructure. These features reinforce the benefits of asset tokenization, where everything from ownership verification to transaction history is automated and transparent.

How to Invest in Tokenization: Step-by-Step

Tokenization can seem new, but the process is simple once you understand it. Follow these steps to learn how to invest in tokenization wisely, and with the right support when needed.

Tokenization can seem new, but the process is simple once you understand it. Follow these steps to learn how to invest in tokenization wisely, and with the right support when needed.

Understand What You’re Investing In

Start by learning what tokenization really means and how it works. Focus on assets you’re familiar with, like property or company shares, and always understand what each token represents. A little research goes a long way in building your confidence as a new investor.

Choose the Right Asset

Think about your goals, are you looking for steady income, long-term growth, or portfolio variety? Different assets offer different benefits. Real estate might offer income, while equity tokens may offer growth. Choose assets that align with your risk tolerance and interest. If unsure, getting expert insights early on can help clarify your path.

Select a Secure Platform

Look for a platform that is easy to use, secure, and follows local regulations. It should clearly explain what you’re investing in and how your tokens are stored. Take your time to compare options. Webisoft can assist you in choosing a trusted platform if you’re navigating this space for the first time.

Complete Setup and Verification

Once you choose a platform, create your account and complete any identity checks. This keeps the process safe and protects both you and the platform. Verification usually takes just a few minutes. After this, you’re ready to invest. Keep your account information safe and make sure you follow any platform guidelines carefully.

Make Your Investment

With your setup complete, you can now buy tokens. You don’t need to start big, tokenization lets you invest small amounts in valuable assets. Choose carefully, review the terms, and double-check the asset details. This is your first step into a growing market that offers more flexibility than traditional investing ever did.

Track and Adjust

After investing, use your platform dashboard to track how your assets perform. Markets change, and so should your strategy. You might want to diversify, hold, or sell depending on your goals. If you need help reviewing performance, Webisoft offers support and insights to help you stay aligned with your investment strategy.

Simplify Tokenized Investing with Webisoft!

Turn your tokenization ideas into action with expert guidance today.

Top Tokenization Platforms to Use in 2025

If you’re thinking about entering the world of tokenized assets, choosing the right platform is key. The platform you choose directly affects how smooth and secure your experience is, especially if you’re new and learning how to invest in tokenization effectively. Here are five trusted platforms:

If you’re thinking about entering the world of tokenized assets, choosing the right platform is key. The platform you choose directly affects how smooth and secure your experience is, especially if you’re new and learning how to invest in tokenization effectively. Here are five trusted platforms:

Securitize

Securitize helps you tokenize real-world assets like real estate or company shares while staying fully compliant with regulations. It offers tools for investor onboarding, digital securities issuance, and automated management. Whether you’re a startup or an enterprise, Securitize makes the tokenization process smooth and investor-friendly from start to finish.

Tokeny

Tokeny makes it easy to tokenize assets in a secure and legally compliant way. Based in Europe, it helps you issue, manage, and transfer digital securities with ease. Their tools ensure every step, from onboarding to token delivery runs smoothly, even if you’re new to blockchain technology.

Polymesh

Polymesh is a blockchain built specifically for security tokens. It focuses on identity verification, compliance, and privacy, giving you full confidence in the assets you tokenize. If you’re dealing with regulated financial products, Polymesh helps you stay secure while keeping everything transparent and efficient.

RealT

RealT lets you invest in tokenized real estate properties, mainly in the U.S. You can buy fractional shares of rental homes and earn income directly in your digital wallet. It’s a great choice if you want to get started in real estate without needing huge capital or complicated paperwork.

tZERO

tZERO is a regulated exchange for trading digital securities and fund tokenization. It supports both initial offerings and secondary market trades, so you can buy, sell, and manage your tokens in one place. tZERO is ideal for investors looking for liquidity and a trusted environment to handle tokenized assets.

Cost of Tokenization: What to Expect

The cost of tokenizing an asset can vary widely depending on the complexity, asset type, compliance needs, and technical infrastructure. If you’re exploring how to invest in tokenization, understanding these cost factors is a key part of planning. Below is a general breakdown to help you estimate:

| Component | Estimated Cost Range (USD) | Description |

| Asset Valuation & Legal Structuring | $2,000 – $15,000 | Includes legal setup, compliance checks, KYC/AML, and asset documentation. |

| Smart Contract & Token Development | $5,000 – $25,000+ | Covers token logic, ownership structure, utility features, and blockchain deployment. |

| Platform or Marketplace Listing | $1,000 – $10,000+ | List your fund token on a platform like RealT. |

| Ongoing Maintenance & Updates | $500 – $5,000/month | Includes platform support, wallet integration, and token lifecycle updates. |

| Marketing & Investor Onboarding | $3,000 – $20,000+ | Optional but important—covers branding, pitch decks, and investor education. |

Tokenization Investing: Core Benefits and Common Mistakes

Investing through tokenization opens exciting opportunities, but like any financial decision, it comes with pros and pitfalls. Here’s a clear breakdown to help you invest smarter and avoid common errors.

| Core Benefits | Common Mistakes |

| Fractional Ownership – Invest in assets like real estate or art with less capital. | Ignoring Asset Quality – Choosing poorly managed or low-value assets. |

| Increased Liquidity – Trade tokens easily on secondary markets. | Overlooking Liquidity – Not all tokens are easily tradable. |

| Global Access – Invest in assets from anywhere via blockchain. | Untrusted Platforms – Using insecure or unregulated platforms. |

| Transparency & Security – Blockchain reduces fraud with clear records. | Skipping Research – Not reviewing the asset or legal details. |

| Low Entry Barriers – Start small and scale as needed. | No Diversification – Putting all funds into one token or asset. |

Partnering with Webisoft for Successful Tokenization

Partnering with the right team can make or break your tokenization project. Webisoft brings deep technical expertise, flexibility, and a full-service approach to help you build with confidence and clarity.

- Expert Blockchain Development: Webisoft brings hands-on experience with Ethereum, Polygon, Solana, and more. Their developers follow proven methods to build scalable and secure token systems customized to your asset type and project goals.

- Flexible Engagement Models: You can work with Webisoft in a way that fits your needs, whether it’s full project delivery, team extension, or ongoing support. Their approach adapts to your resources, budget, and timeline.

- DeFi Tokenization Service: Webisoft simplifies real-world asset tokenization by combining DeFi logic with smart contract automation. Their solutions increase liquidity, reduce manual steps, and help you bring assets like real estate or equity onto the blockchain.

- Compliance and Security First: With Webisoft, your tokenization project is built to meet regulatory standards. They implement secure code, integrate KYC/AML, and prepare your smart contracts for audits.

- End-to-End Technical Support: From idea to launch, Webisoft covers every step, asset evaluation, token creation, smart contracts, and platform integration. Their broader Blockchain Development Services ensure long-term success.

Conclusion

Tokenization is opening up new ways to invest, making it easier for you to access a wider range of assets with smaller amounts. By following the right steps, you can invest with more confidence and less risk. Now that you understand how to invest in tokenization, you’re better prepared to choose assets, pick a secure platform, and avoid common mistakes. If you’re ready to start, Webisoft is here to help. We offer expert support to guide you through the process and make your investment token journey simple, clear, and effective from day one.

Frequently Asked Question

How do I evaluate the value of a tokenized asset?

You can evaluate a tokenized asset by assessing the underlying asset’s market value, token supply, ownership rights, platform credibility, and liquidity. Always review legal documentation, smart contract terms, and third-party audits before making an investment.

Can I trade tokenized assets on regular exchanges?

Some tokenized assets can be traded on regulated digital asset exchanges or secondary markets, but not all. It depends on the asset type, jurisdiction, and platform. Always verify if the token is listed on a compliant, accessible exchange.

Do I need crypto to invest in tokenized assets?

Not always. Many platforms now accept fiat currency alongside crypto. However, some decentralized tokenization platforms require crypto wallets for transactions. Choose based on your preferred investment token method and platform.