How to Choose the Right Blockchain for Real-World Asset Tokenization

- BLOG

- Blockchain

- October 20, 2025

How to Choose the Right Blockchain for Real-World Asset Tokenization

Real-World Asset (RWA) tokenization is the process of digitally representing tangible or financial assets, like real estate, gold, invoices, or treasury bonds on a blockchain. These blockchain-based tokens reflect ownership rights and can be bought, sold, or transferred in a programmable and secure way.

Tokenization solves major inefficiencies in legacy systems:

- Illiquidity of assets like real estate or collectibles

- Manual and costly settlement processes

- Limited investor access due to geographic or capital barriers

The market is gaining traction fast. As institutions explore tokenized assets, forecasts suggest the global RWA tokenization market could unlock multi-trillion-dollar value by the early 2030s.

But here’s the catch: the blockchain platform you build on determines your success. With so many options like Ethereum, Polygon, Tezos, Polymesh, and more; each with unique trade-offs in cost, compliance, and performance, the decision is far from simple.

The global asset tokenization market size was valued at $5.60 billion in 2024 and is projected to grow to $30.21 billion by 2034, highlighting the industry’s explosive growth and long-term potential. — Polaris Market Research

This guide will help you choose the right blockchain based on real-world needs like security, regulatory fit, and future-proofing.

Contents

- 1 Why Choosing the Right Blockchain Matters

- 2 Key Criteria for Evaluating Blockchain Platforms for Tokenization

- 2.1 1. Regulatory Compliance and Jurisdiction

- 2.2 2. Smart Contract Capabilities and Flexibility

- 2.3 3. Interoperability and Standards

- 2.4 4. Scalability and Transaction Costs

- 2.5 5. Security and Network Maturity

- 2.6 6. Asset Custody and Off-Chain Integration

- 2.7 7. Ecosystem and Institutional Adoption

- 2.8 Public Blockchains (e.g., Ethereum, Solana)

- 2.9 Private Blockchains (e.g., Hyperledger Fabric)

- 2.10 Consortium Blockchains (e.g., Corda, Quorum)

- 3 Top Blockchain Platforms for Real-World Asset Tokenization in 2025

- 4 Common Mistakes to Avoid When Selecting a Blockchain

- 5 FAQs About Blockchain Selection for Tokenized Assets

- 5.1 What is the best blockchain for tokenizing real estate?

- 5.2 Can I switch blockchains after launching a tokenized asset?

- 5.3 Do I need a permissioned blockchain for asset tokenization?

- 5.4 Which blockchain is best for regulatory compliance?

- 5.5 How do I evaluate blockchain transaction costs for my use case?

- 6 Final Checklist for Selecting a Blockchain for RWA Projects

- 7 Bonus: How to Future-Proof Your Tokenized Asset Strategy

Why Choosing the Right Blockchain Matters

The blockchain layer is not just a backend choice, it’s the backbone of your tokenized asset business. Every function, from how investors interact with your tokens to how regulators view your offering, depends on it.

Choosing the wrong blockchain can lead to:

- Compliance gaps in jurisdictions with strict regulations

- Liquidity problems due to limited exchange or wallet support

- Security vulnerabilities from unproven or poorly audited platforms

- High costs and congestion if the network lacks scalability

On the other hand, a well-chosen blockchain helps you:

- Integrate smart contracts easily for automated lifecycle management

- Ensure auditability and transparency for regulators and stakeholders

- Support interoperability for cross-chain asset movement

- Optimize transaction costs and scale efficiently

These aren’t minor technical choices, they directly influence your investor trust, adoption curve, and regulatory standing.

In the next section, we’ll break down the 7 critical criteria that every RWA-focused organization should assess before selecting a blockchain.

Major institutions are driving adoption: BlackRock’s USD Institutional Digital Liquidity Fund attracted over $550 million within months of launch, and JPMorgan’s Kinexys network processed $1.5 trillion in tokenized transactions by the end of 2024. — Mordor Intelligence

Key Criteria for Evaluating Blockchain Platforms for Tokenization

Selecting the right blockchain for tokenizing real-world assets isn’t about picking the most popular name. It’s about matching your regulatory, technical, and operational needs to what a blockchain network can reliably support. Here’s how to evaluate platforms with precision:

1. Regulatory Compliance and Jurisdiction

Compliance is a non-negotiable requirement for RWA projects. The blockchain you choose must support frameworks like KYC, AML, and region-specific laws (e.g., SEC in the U.S., MiCA in the EU). Permissioned blockchains such as Polymesh or Corda often come with built-in identity layers and access controls, making them more suited for regulated markets. Public chains, while decentralized, may require custom layers or third-party compliance integrations.

2. Smart Contract Capabilities and Flexibility

Tokenized assets go through events like minting, freezing, redemption, and transfer restrictions, all of which need to be managed by smart contracts. Look for platforms that:

- Support token standards like ERC-3643 or ERC-1400

- Offer upgradable contracts, modular design patterns, and language options like Solidity or Rust

More flexibility means better control over how your token behaves across its lifecycle.

3. Interoperability and Standards

Tokenized assets don’t live in isolation. Choose a blockchain that supports:

- Cross-chain bridges (e.g., LayerZero, Wormhole)

- Interoperability protocols like Cosmos IBC or Polkadot’s parachains

- Widely adopted token standards (ERC, SPL, etc.)

This ensures your assets can move freely between ecosystems which is critical for liquidity and utility.

4. Scalability and Transaction Costs

Blockchain performance impacts both user experience and operating costs. Key considerations include:

- Transactions per second (TPS): Solana (~65,000 TPS) vs Ethereum (~30 TPS on L1)

- Gas or transaction fees: Ethereum is costlier unless paired with Layer 2s like Arbitrum or Optimism

- Congestion resilience: Some blockchains degrade under load; others handle spikes more gracefully

Choose a chain that can scale with your volume needs without pricing you out.

5. Security and Network Maturity

Security isn’t just about smart contracts, it’s about the entire network architecture. Prioritize blockchains with:

- A clean audit history and minimal downtime

- A large, decentralized validator or node base

- Ongoing bug bounty programs and a responsive core team

Mature ecosystems with active governance tend to be more resilient and trustworthy.

6. Asset Custody and Off-Chain Integration

Bridging real-world ownership with blockchain requires more than tokenization. Look for platforms that integrate well with:

- Off-chain oracles like Chainlink for price feeds and compliance events

- Custody providers such as Fireblocks or Anchorage for institutional-grade asset protection

- Off-chain asset representation mechanisms like tokenized deeds or data registries

This ensures your token truly reflects the asset it represents.

7. Ecosystem and Institutional Adoption

Adoption signals trust. Evaluate whether the blockchain is already being used by:

- Banks, asset managers, or governments

- Recognized projects with proven deployment at scale

- VCs and enterprise partners who are actively building in the ecosystem

With institutional investors holding nearly 70% of deployed capital and real estate comprising 30.5% of the tokenized market in 2024, the blockchain you choose must meet the demands of large-scale, regulated asset classes. – Mordor Intelligence

A well-supported chain often means faster integration, better tooling, and more collaboration opportunities.

Public vs Private vs Consortium Blockchains: What’s Better for RWAs?

Not all blockchains are created equal, especially when it comes to trust models, compliance, and governance control. The best fit depends on the nature of your asset, your jurisdiction, and who needs access to what.

Public Blockchains (e.g., Ethereum, Solana)

These are permissionless networks where anyone can deploy contracts and view transactions.

Pros:

- Maximum transparency and decentralization

- Rich ecosystem of DeFi, wallets, and dev tools

Cons: - Limited regulatory controls

- Potentially high gas fees and slower speeds

Best for: Open RWA markets, fractional ownership, and cross-border participation.

Private Blockchains (e.g., Hyperledger Fabric)

Run by a single organization or tightly controlled group.

Pros:

- High privacy, full control over access and operations

- Easier integration with enterprise back-end systems

Cons: - Low decentralization, limited trust beyond stakeholders

Best for: Internal asset registries, enterprise compliance, and audits.

Consortium Blockchains (e.g., Corda, Quorum)

Governed by a group of known participants, combining decentralization with permissioned controls.

Pros:

- Shared governance with trusted validators

- More compatible with financial regulatory environments

Cons: - Requires formal consortium setup

Best for: Securities issuance, syndicated loans, and cross-institutional collaboration.

Top Blockchain Platforms for Real-World Asset Tokenization in 2025

Not all blockchains are equally suited for real-world asset (RWA) tokenization. Below are the most promising platforms in 2025, each offering distinct features for compliance, scalability, and institutional adoption.

Ethereum / L2s (e.g., Polygon, Arbitrum)

As the most mature and widely adopted smart contract platform, Ethereum is often the default choice. It supports key standards like ERC-3643 and has robust tooling, security audits, and developer support.

Layer 2 networks such as Polygon and Arbitrum offer scalable, lower-cost alternatives while preserving Ethereum’s security guarantees. These L2s are increasingly used in regulated tokenization pilots and institutional use cases.

Stellar

Stellar is optimized for cross-border asset transfers and stablecoin issuance. It’s fast, low-cost, and supports compliance tools through regulated anchors and KYC-enabling features. Financial institutions looking for simplicity and fiat connectivity often choose Stellar for tokenizing fiat equivalents or real-world currencies.

Polymesh

Purpose-built for regulated securities, Polymesh includes identity, compliance, and confidentiality features at the protocol level. It supports restricted transfers, integrates with custody providers, and helps ensure regulatory alignment, making it ideal for tokenizing equity, debt, or funds.

Tezos

Tezos offers formal verification of smart contracts, which boosts security for asset issuers. With low fees and support from major institutions (e.g., Société Générale), it has proven itself in pilot tokenization projects involving real estate and bonds.

Other Emerging Platforms

- Avalanche: Supports custom subnets for jurisdiction-specific compliance; used in tokenized securities and institutional pilots.

- Algorand: Fast, eco-friendly, and increasingly adopted in government and asset tokenization initiatives.

- Centrifuge: Focused solely on RWA tokenization, bridging DeFi liquidity to asset-backed tokens like invoices and real estate.

Each of these platforms brings a unique blend of performance, compliance, and developer readiness; the right one depends on your specific business model and legal environment.

Common Mistakes to Avoid When Selecting a Blockchain

Many RWA projects stumble due to avoidable missteps. Here are the most frequent mistakes and how to steer clear of them:

- Ignoring jurisdictional compliance

Choosing a blockchain with no built-in support for legal requirements can block institutional adoption. - Picking based on hype or popularity

A popular chain may lack the features or support you actually need, especially for regulated assets. - Underestimating transaction costs

Low fees today don’t guarantee affordability tomorrow, always model cost at scale. - Lack of interoperability planning

Without bridge support or token standards, your assets could remain siloed. - Not validating ecosystem maturity

Platforms with weak documentation or developer activity may struggle to support complex use cases. - Selecting technology before defining requirements

Define your compliance, asset, and integration needs first, then map them to the right chain.

Avoiding these pitfalls can mean the difference between long-term scalability and costly rework.

FAQs About Blockchain Selection for Tokenized Assets

What is the best blockchain for tokenizing real estate?

Ethereum (especially via Layer 2s like Polygon) is a top choice due to its ecosystem maturity and support for standardized token contracts. However, platforms like Tezos and Polymesh are gaining traction for real estate due to lower costs and compliance features.

Can I switch blockchains after launching a tokenized asset?

Technically, yes, through token migration tools or wrapped tokens. But it’s often complex, especially if tied to real-world ownership records. It’s better to choose the right blockchain upfront rather than plan for migration later.

Do I need a permissioned blockchain for asset tokenization?

Not necessarily. Public blockchains can work if layered with compliance mechanisms (e.g., ERC-3643). However, permissioned or consortium chains may be preferred for institutions prioritizing privacy, governance control, and compliance enforcement.

Which blockchain is best for regulatory compliance?

Polymesh, Corda, and Quorum are purpose-built for compliance, offering built-in KYC/AML features. Ethereum, with frameworks like ERC-1400, is also viable if supported by external compliance tools.

How do I evaluate blockchain transaction costs for my use case?

Consider average gas fees, network congestion, and transaction volume. Also factor in the asset’s lifecycle events — e.g., minting, transfers, redemptions; and simulate long-term costs on platforms like Ethereum vs Solana vs Polygon.

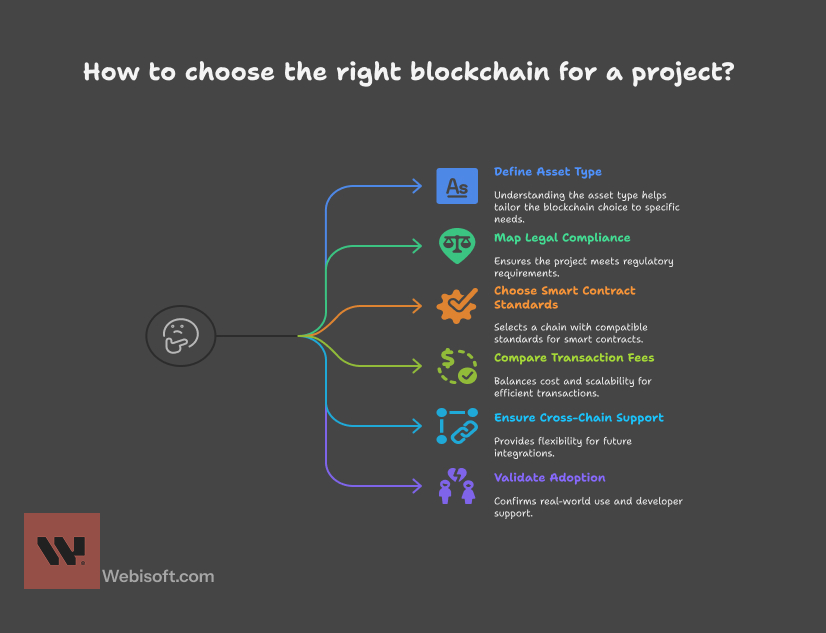

Final Checklist for Selecting a Blockchain for RWA Projects

Use this shortlist to align your blockchain decision with your asset and business needs:

✅ Define your asset type, jurisdiction, and investor profile

✅ Map out legal and KYC/AML compliance needs

✅ Choose a chain with suitable smart contract standards (e.g., ERC-3643)

✅ Compare transaction fees and scalability trade-offs

✅ Ensure cross-chain support if future flexibility is important

✅ Validate the chain’s real-world adoption and developer ecosystem

Bonus: How to Future-Proof Your Tokenized Asset Strategy

To ensure your RWA project stays relevant and adaptable as the blockchain space evolves:

- Build with modularity in mind – use flexible token standards and upgradable smart contracts

- Prioritize cross-chain compatibility to avoid lock-in and reach wider markets

- Track evolving regulations like MiCA (EU) or SEC guidelines and design compliance workflows accordingly

- Choose partners who are blockchain-agnostic and can pivot as tech landscapes shift

Staying agile ensures your tokenized assets remain secure, scalable, and compliant – no matter how the market moves.