Google Cloud Universal Ledger (GCUL) Explained: A Guide for Enterprises

- BLOG

- Blockchain

- October 10, 2025

Google Cloud Universal Ledger, or GCUL, is Google’s newly announced Layer-1 blockchain, built with the goal of supporting payments and capital market infrastructure. Unlike most public chains that start in the retail crypto space, GCUL is designed as a cloud-delivered service that enterprises can access via a single API.

The platform is permissioned at launch, meaning only verified entities can operate within it. Google emphasizes compliance-first design, with KYC-verified accounts, stable transaction fees billed monthly, and robust security and privacy leveraging Google Cloud’s existing infrastructure.

GCUL is also built with scalability and atomic settlement in mind. Atomic settlement allows assets to be exchanged instantly and irreversibly, reducing counterparty risk which is a major improvement for traditional financial systems that still rely on delayed clearing processes.

Contents

How GCUL Differs From Other Blockchains

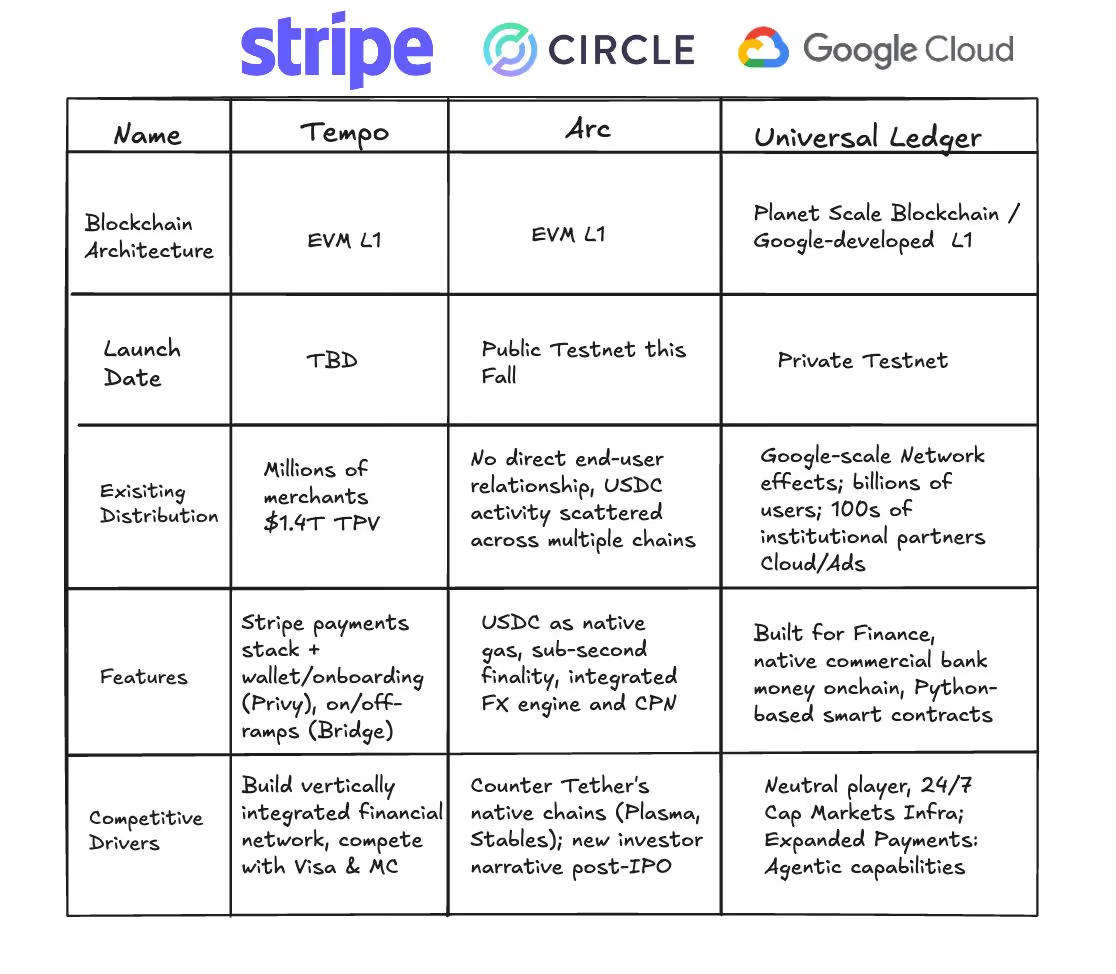

The blockchain ecosystem is already crowded with high-performance networks like Ethereum, Solana, and Aptos, along with financial infrastructure initiatives such as Stripe’s Tempo and Circle’s Arc. GCUL sets itself apart by combining the neutrality of a public ledger with the compliance and reliability of enterprise cloud infrastructure.

Unlike Ethereum or Solana, which are permissionless and open to anyone, GCUL is permissioned at launch. This means only verified participants with KYC-compliant accounts can transact or build on the network. While this may sound restrictive to crypto-native developers, it offers a higher level of assurance for banks, asset managers, and payment providers that need strict regulatory oversight.

GCUL is also designed as a service inside Google Cloud, which means enterprises interact with it through a single API and pay transparent, stable monthly fees. This model contrasts with gas fee volatility on networks like Ethereum. For institutions budgeting at scale, predictable costs are a major advantage.

Another difference is Google’s stated positioning of GCUL as “credibly neutral” infrastructure. While Stripe’s Tempo and Circle’s Arc are tied to their respective businesses, Google is framing GCUL as a shared foundation for multiple players in finance. This neutrality could help attract adoption from competing financial institutions who might hesitate to build on platforms controlled by direct rivals.

Image Credits: Coindesk

GCUL’s First Use Cases: Tokenization and Wholesale Payments

Google has made it clear that GCUL, or Google Cloud Universal Ledger, is designed for enterprise-grade finance. Two major pilots confirm its focus on tokenization of assets and wholesale payments infrastructure.

Enterprise Tokenization of Financial Assets

GCUL enables the digital transformation of traditional assets like commercial bank money, bonds, and securities into programmable tokens. This allows efficient issuance, management, and settlement on a secure ledger. Importantly, GCUL supports atomic settlement, meaning that asset transfers settle instantly and irreversibly in a single transaction, which significantly reduces counterparty and settlement risk.

Wholesale Payments and 24/7 Settlement

CME Group, the world’s largest derivatives marketplace, has already validated GCUL in a pilot phase. On March 25, 2025, both organizations announced they had completed the first phase of integration and testing. The goal is to use GCUL to streamline payments related to collateral, margin, settlement, and fees, enabling 24/7 global trading infrastructure. Services built on GCUL are anticipated to begin rolling out in 2026.

As Rohit Bhat, General Manager of Financial Services at Google Cloud, explained, this collaboration showcases “how Google Cloud helps partners transform their businesses through strategic collaborations and modern infrastructure” ready for global market demands.

A Service Built for Institutional Workflows

Rather than aiming for consumer-grade access, GCUL is proposed as a cloud-native service tailored for financial institutions. It offers secure digital processing of asset transfers and account management on a private, permissioned ledger. This design suits existing regulatory and operational demands in capital markets, reducing the need for firms to build and manage custom blockchain infrastructure.

Smart Contract Development on GCUL with Python

One of the distinctive features of GCUL is its reported support for Python-based smart contracts. This approach is significant because most existing blockchains rely on niche programming languages such as Solidity on Ethereum, Rust on Solana, or Move on Aptos. By enabling developers to build in Python, Google is lowering the entry barrier for institutions and software teams that already work extensively in this language.

Python is widely used in industries that are central to GCUL’s target audience, including finance, machine learning, and enterprise software development. Quantitative analysts, financial engineers, and data scientists already rely on Python for modeling, simulation, and analytics. Bringing that same language into a blockchain environment allows enterprises to reuse existing skill sets, tools, and workflows rather than hiring specialized blockchain developers.

For smart contract development, Python offers three clear advantages:

- Readability and ease of adoption: Teams without prior blockchain experience can start building faster.

- Rapid prototyping: Enterprises can design, test, and iterate smart contracts in less time.

- Integration with analytics and AI pipelines: Python connects seamlessly with data processing and machine learning libraries, which could enhance blockchain-based financial applications.

It is important to note that Python support has been confirmed through industry reporting and executive commentary, but Google has not yet published detailed technical documentation. Until that becomes available, Python integration should be treated as a reported feature rather than a formally documented one.

What This Means for Developers and Businesses

GCUL represents a different kind of blockchain opportunity compared to most public networks. For developers, it means access to a ledger that is delivered as a managed cloud service rather than an open system that requires setting up nodes or infrastructure. By offering predictable transaction costs and enterprise-grade compliance, GCUL reduces the operational complexity that has historically slowed blockchain adoption in large organizations.

For businesses, the implications are equally important. Financial institutions can experiment with tokenization and settlement workflows in a secure environment that meets regulatory standards. Companies already using Google Cloud for data and application hosting will be able to integrate blockchain functionality through a single API, which can simplify both deployment and scaling. This could make blockchain adoption less about reinventing technology stacks and more about extending existing enterprise systems.

Enterprises outside of finance also stand to benefit. Supply chain managers, healthcare networks, and multinational corporates may find that a permissioned, compliant ledger provides a safer pathway to pilot blockchain-based applications compared to building on public chains with uncertain regulatory status.

For developers, the reported Python smart contract capability lowers the barrier to entry. Teams with Python skills in analytics, AI, or financial engineering can now explore blockchain solutions without needing to re-skill in Solidity or Rust. This could accelerate adoption in industries where Python is already dominant.

How Webisoft Can Help You Build on GCUL

At Webisoft, we specialize in guiding enterprises and startups through the adoption of emerging blockchain technologies. With Google Cloud Universal Ledger now entering its pilot phase, our team is preparing to help businesses explore the opportunities this new infrastructure presents.

For companies interested in tokenization, we can design and implement solutions that map real-world assets to secure digital representations. For those looking at wholesale payment or settlement systems, we can assist in building workflows that align with GCUL’s compliance-first architecture. Our experience across ecosystems such as Ethereum, NEAR, and custom private chains equips us to bridge the gap between your existing infrastructure and the new capabilities offered by GCUL.

We also recognize that GCUL’s reported Python-based smart contract environment creates unique opportunities. Since many organizations already rely on Python for analytics and machine learning, Webisoft can help teams transition those skills into blockchain application development, accelerating time-to-market.

Most importantly, our approach is strategic and collaborative. We do not only deliver code but also provide advisory, security auditing, and long-term scaling support. As GCUL evolves toward public availability, we aim to position your business at the front of the adoption curve.

Frequently Asked Questions About GCUL

When will Google’s blockchain launch?

GCUL is currently in a private testnet phase. The first phase of integration has already been completed with CME Group, and early services are expected to begin rolling out in 2026. Exact public launch dates have not yet been announced.

What is GCUL?

GCUL, or Google Cloud Universal Ledger, is a new enterprise-focused layer-1 blockchain provided as a managed cloud service. It is designed for tokenization, wholesale payments, and financial market infrastructure with built-in compliance, security, and predictable fees.

Does GCUL compete with Ethereum or Solana?

GCUL serves a different audience than Ethereum or Solana. While those blockchains are open, public networks for developers and consumers, GCUL is a permissioned ledger built for financial institutions that require strict compliance, regulatory oversight, and predictable costs.

Can anyone build on GCUL?

At launch, GCUL is permissioned. Only verified participants with KYC-compliant accounts will be able to build and transact. Reports suggest that support for Python-based smart contracts could make development more accessible, but wider public access may depend on regulatory evolution.