The digital era is revolutionizing the banking sector, bringing about significant changes to traditional banking practices.

With advancements in technologies such as AI, Blockchain, Augmented, and Virtual Reality, banks now have opportunities to provide enhanced customer experience and streamline their operations.

However, digital transformation in banking isn’t without challenges, especially in security and customer preference.

Here, we’ll look at these opportunities and challenges and how banks can navigate the transformation successfully.

Contents

- 1 What is Digital Transformation in Banking?

- 2 Which Factors Drive The Digital Transformation in Banking?

- 3 Which Technologies can Help the Banking Industry Achieve Digital Transformation?

- 4 Challenges to Achieving Digital Transformation in the Banking Sector

- 5 Final Words

What is Digital Transformation in Banking?

Picture this – our world, rapidly shaped and molded by technology, pushing the boundaries of what we once considered possible. Industries, businesses, and even our daily lives are evolving in sync with technological trends.

Whether it’s streamlining work tasks, transforming customer services, enabling virtual meetups, or turning homes smarter, technology has grown to be an inseparable part of our existence.

Among all sectors, the financial industry is at the forefront of this tech-powered revolution, leveraging technology to transform traditional methods.

It’s fascinating to witness the shift as more and more people ditch traditional banking methods for digital alternatives.

It’s arguably one of the most impactful digital shake-ups we’ve seen in the finance world.

When we talk about digital transformation in banking, we’re referring to the crucial pivot that helps banks and financial institutions better comprehend, connect with, and cater to their customers.

In essence, successful digital transformation means having a deep understanding of digital customers. And that includes their preferences, habits, likes, dislikes, and both spoken and unspoken needs.

Banking Operations: Risk and Analysis

A robust fraud detection system and multi-tier transaction validation help avoid errors from customers and bank employees.

Reducing Transaction Times

The integration of Big Data processing systems, bolstered by a microservice architecture, allows for quick and secure transaction processing.

Data Management: Security is Key

Data encryption tools shield banks from fraudulent activities, preventing internal and external information leaks to cybercriminals, ensuring each transaction is securely processed.

Predicting the Future

A head start on identifying potential future problems can be the secret to financial prosperity. Before transitioning your business to a more promising and financially rewarding industry, you need reliable information about potential global economic crises.

Which Factors Drive The Digital Transformation in Banking?

It’s all about tapping into the power of smart devices, getting everyone connected, and crafting top-notch experiences that customers can enjoy right from their homes.

Banks are going through a whirlwind of change to expand the possibilities of digital transformation across various functions. Let’s dive into the main elements that are fuelling this digital change in banking.

Harnessing the Data Power

Banks can unlock the wonders of data and use tools related to it to spur their growth. Data analytics practices can be used to understand how customers think. This understanding aids banks in creating products that tick all the right boxes for their customers.

In other words, they can use insights to tailor products and experiences that strengthen their bond with customers.

Upgrading the Foundations

Beyond bringing cutting-edge digital tech on board, the nuts and bolts of a bank’s infrastructure also impact digital transformation. Up-to-date infrastructure is key to ensuring smooth information flow for digital operations.

Things like APIs, DevOps, and microservice architecture can bring the core systems up to speed for continuous integration and delivery, paving the way for quicker release cycles.

Keep Getting Better

As customer expectations skyrocket, banks need to keep up. To do this, they need a well-oiled machine that keeps an eye on market trends, trials new products, and listens to customer feedback.

This leads to ongoing improvements that turbocharge service delivery, cut down time-to-market, and boost customer engagement.

Empowering Employees

According to the World Economic Forum, over half of the finance sector workers will need to brush up their skills to meet the evolving demands of their roles. So, investment in refreshing the operational approach, thought patterns, and training is paramount.

Streamlining the Customer Journey

Today’s customers crave smooth digital experiences every step of the way. Creating a digital journey for customers means integrating everything onto a single online platform.

This makes it easier for banks to consistently meet customer needs. For instance, a customer could click on an ad, sign up online, get app-based tutorials and information, receive automated loan decisions, and handle their finances online.

For banks to succeed in this high-stakes landscape, a customer-centric approach is key. Delivering services seamlessly, crafting delightful user experiences, offering personalized products, maintaining transparency, and ensuring top-tier security are all vital for keeping customers happy in this fast-paced market.

Which Technologies can Help the Banking Industry Achieve Digital Transformation?

The journey towards digital transformation in banking calls for a sweeping shift towards digital services, combined with an overhaul of backend processes to accommodate digitization and automation.

To keep pace with digital-savvy competitors, banks must deliver an immersive digital experience for customers by harnessing the right technologies.

These tech advancements enable instant financial transactions on a global scale, upping the efficiency game for the finance sector.

Let’s dive into the technologies shaping digital transformation in the banking industry.

1. Artificial Intelligence (AI)

AI is the poster child of tech adoption in banking, shaking up the sector from the inside out. With AI, banks have an opportunity to increase revenue through diverse channels while cutting costs.

AI tools, with their speed, precision, cost-effectiveness, and efficiency, can use vast historical data to support decision-making, boost customer experience, and refine overall banking procedures.

The impact of AI is far-reaching, touching upon back-office operations, compliance, customer experience, product delivery, risk management, marketing, and beyond.

AI, particularly when teamed with other technologies such as RPA, big data analytics, and voice interface, can streamline banking processes, make lending decisions more effective, and enhance risk management.

Let’s look at how the banking sector is using AI to drive positive outcomes. The potential applications of AI can be grouped into three major areas, showcasing opportunities in banking.

| Opportunity Arenas in Banking | How AI Steps in |

| Enhancing customer experiences | Chatbots, Voice-assisted banking, Robo-guidance, Uplifting customer service, Biometric verification and permissions, Segmenting customers |

| Amplifying the effectiveness of banking procedures | Automating processes and optimizing IT maintenance predictions, Classifying documents, Handling complaints, Extracting data automatically, Processing KYC documents, Assigning credit scores |

| Fortifying safety and managing risks | Amplifying risk control, Supervising compliance, Detecting anomalies, Identifying and monitoring Anti-Money Laundering, Predicting system capacity limits, Assuring data quality, Preventing fraud, Monitoring payment transactions, Avoiding cyber risks |

Banks are utilizing AI to streamline customer identification and authentication, connecting with live representatives through chatbots and voice assistants, deepening customer relationships, and offering personalized insights and suggestions. These are just a few ways AI is reinventing banking operations.

Robo Advisors

You know those platforms that dole out financial advice on autopilot? They’re called Robo Advisors. Using smart tech, they collect details and offer investment recommendations that align with what the client wants.

It’s perfect for folks who love going digital or prefer a hands-on approach. They get personalized products, financial pointers, and save some cash along the way!

Credit Scoring

For banks, knowing if a client can be trusted with credit involves sifting through piles of data, running the numbers, and assessing the risks. With AI, this process is fine-tuned, improving credit access, and helping banks tailor debt plans for their customers.

It’s a vital tool for banks to control credit risk and keep their financial health in check.

Fraud detection

The fight against fraud is another area where AI is making a big splash in banking. It’s a crucial tool in stopping dodgy activities linked to financial crime.

A Fraud Detection System (FDS) keeps a lookout for threats like bank attacks, identity theft, and inside jobs.

It uses multiple stages of data gathering, learning, and transactional data analysis to sniff out fraudulent actions. Besides keeping bank coffers safe, AI can also help tackle money laundering and other financial crimes.

Virtual assistants and Chatbots

AI is changing the game when it comes to customer service and business chat. Virtual assistants are there to field a ton of customer questions and help with banking tasks in real-time.

People don’t want to hang around waiting for answers. They want fast, effective solutions. In banks, chatbots are stepping up to provide financial tips, assist with sign-ups, and save time and manpower for communication through channels like email and phone calls.

They’re getting smarter and better at chatting with countless customers, strengthening the connection with banks.

Productivity gains

Here’s a fun fact: about 20% of back-office tasks gobble up around 85% of the cost. Jobs like compliance reporting, welcoming new customers, and paperwork can be streamlined with AI, boosting accuracy and efficiency. It’s all about working smarter, not harder!

2. Blockchain

Picture a decentralized network acting as a digital ledger, safeguarding financial data during real-time transactions. That’s what blockchain does. As the name implies, it’s a tamper-proof chain of info-carrying blocks.

Blockchain’s unalterable and decentralized characteristics guarantee information security and integrity, making it a powerful tool against fraud and cyber threats.

Plus, it takes third parties out of the lending and credit picture, which can make borrowing safer and decrease interest rates. It also brings transparency to payments and currency exchange in banking.

Blockchain can simplify banking operations and automate processes using smart contracts. Banks are implementing blockchain for functions such as inter-bank transfers, cross-border payments, KYC processes, lending, fraud reduction, and more.

Employing blockchain technology allows banks to quickly improve their payments, remittances, and traceability objectives.

Webisoft is a tech-driven team, specializing in blockchain solutions using Python, Rust, and Terraform. We’re dedicated to helping startups and big enterprises conquer digital challenges.

The Perks of Blockchain in Banking —

Tick-Tock Timing

Blockchain facilitates the instant settlement of recorded transactions, lowers risk, and improves the customer experience.

Say Bye to Manual Processing

Blockchain provides an automated audit trail of transactions, cutting back on manual work for data validation and reconciliations.

Transparency and Stability

Record pointers on the blockchain are stable and irreversible, making data alteration impossible and negating the risk of fraud.

Automated Validation

Smart contracts facilitate business validation and automated records for transaction processing.

Cut Out the Middleman

As a distributed ledger tech, blockchain eliminates intermediaries, thereby reducing costs and minimizing latency.

Distributed Data

Blockchain’s distributed ledger and consensus mechanism ensures data consistency across multiple participants.

Beyond the benefits, blockchain opens up a wealth of opportunities in banking. Here are some key applications:

Payments and Clearance

Cross-border payments become quicker and more cost-effective with blockchain in banking. Blockchain-based remittances cost just 2-3% of the total sum, a significant reduction compared to the 5-20% typically taken by third parties.

It also removes the need for intermediary authorization, speeding up cross-border payments. In fact, Accenture estimates that investment banks could save $10 billion by using blockchain to boost clearing and settlement system efficiency.

KYC

Blockchain can automate KYC processes. As a secure, distributed ledger, it can store and share KYC data. Banks spend significant time verifying customer financial histories and business interests. An automatic update system for KYC data could streamline this process, making blockchain an appealing solution.

Trade Finance

In trade finance, financial institutions guarantee payment between seller and buyer, which can involve multiple intermediaries — banks, financiers, insurers, export credit agencies — each adding to the cost.

Blockchain-based solutions could cut record-keeping costs and remove intermediaries, saving time and money.

Syndicated Lending

This involves loans provided by a group of lenders, typically banks. The participation of multiple entities can slow down processing in traditional banking.

Blockchain solutions can speed things up, ensure transparency, and allow banks to distribute compliance or KYC tasks, attaching them to a single customer block.

3. Cloud Computing

Cloud computing in banking? Yes, it’s a thing and it’s helping financial institutions perform better and ramp up their services faster. The best part is, it’s like a buffet where you only pay for what you consume.

Cloud computing is revolutionizing banking by ensuring safe digital payments and transfers, not to mention digital wallets.

By going cloud, banks can cut down on data storage costs while keeping customer data safe and sound.

A notable example is LiveBank. They’re using cloud solutions to deliver virtual banking services. In fact, they’ve teamed up with Microsoft to give global banks access to a suite of cloud services.

The Reserve Bank of India, too, is harnessing cloud solutions to improve communication, collaboration, and customer services.

Cloud services bring a host of benefits to the banking sector.

On-demand scalability

Cloud services are nimble and can deliver extra tech resources when needed, helping banks that have their own data centers save costs.

Security and availability

Cloud vendors offer restrictions on data tampering in the cloud environment. These security and audit controls simplify audits and reduce the chance of attacks, all without requiring huge investments as with an on-premise setup.

4. Internet of Things (IoT)

The Internet of Things, or IoT, connects devices and sensors in a network to deliver cutting-edge, data-driven insights.

It’s making waves in banking services, particularly in retail banks that invest heavily in infrastructure and customer-facing features. IoT spans a range of banking solutions.

Here are a couple of examples:

Smart Collaterals

Banks can use IoT to manage a customer’s collateral, like cars or machinery, without physically taking possession.

They can issue a loan instantly and monitor the collateral’s status in real time. The bank can remotely control the machine or vehicle based on set business rules.

For example, if loan repayments aren’t made, the engine could be turned off. Plus, the bank can monitor the quality of the collateral in real time.

Wearable Payments

Wearable techs like smart watches, rings, and clothes are set to transform the retail banking experience. Smart watches are not just fashionable but also a convenient way to transfer money and make payments.

Some banks have even tried giving their own branded wearables to customers as a primary payment device.

Smart glasses are the latest wearable adopted by some financial institutions to help employees process customer information.

The impact of IoT on banking is growing, with the potential to change how banks enable bill payments, speed up transactions, and enhance their quality and security. Here are some potential applications for wearable tech in banking:

- When a customer enters the bank, the IoT system sends financial announcements and notifications to their wearable device. This helps banks build meaningful relationships with customers and boost brand visibility.

- Wearables could take over from Google or Apple transaction apps to simplify transactions.

- Contactless wallets allow customers to check their account balance or loan status instantly.

Wealth Management and Automated Transactions

Imagine this – algorithms processing data to offer you insights into wealth management. Sounds cool, right? Well, that’s where IoT technology steps in, boosting accuracy and providing insights to make smart wealth management decisions.

Plus, with IoT in play, your payment transactions can be managed in real-time, ensuring a secure, monitored trading environment. All payment procedures run smoothly with smart sensors and connected apps.

Proactive Customer Services

IoT technology isn’t just a cool buzzword; it’s transforming banking by predicting customers’ needs based on data collected during their bank visits. From gathering data to delivering services, IoT enhances the customer experience in several ways. For instance:

- Customers can be guided to an available counter or informed about their waiting time, which helps manage tasks efficiently.

- Need to find the nearest bank branch in a different city or country? A beacon-based system’s got you covered.

- Branches can instantly share user data to provide a speedy and personalized experience, no matter where you are.

- Banks can function with zero human intervention.

5. Robotic Process Automation (RPA)

The banking industry is leaning toward smart automation to boost efficiency, get rid of repetitive tasks, and provide quicker customer service. The tech behind this automation? It’s known as robotic process automation or RPA.

Using RPA, banks can automate customer service functions like checking account balances and payments, allowing them to free up human agents for more urgent tasks.

This approach not only increases productivity but also reduces operational costs and the chance of errors. Imagine getting a speedy decision on your credit card application with RPA, no humans needed!

Here are some major benefits of RPA in banking:

Cost savings

Robot software costs about one-ninth of a full-time employee in an onshore location. So, you’re looking at significant employee-related savings.

Accuracy

Robots follow instructions with pinpoint accuracy, boosting precision and productivity. In fact, accuracy levels could hit 99.5% with a robot, way higher than humans.

Performance Efficiency

Robots are speed demons at completing tasks. That’s why RPA is great for automating standard banking tasks like customer on-boarding, account opening, and loan processing.

Compliance

RPA can elevate compliance levels for monitoring and testing. It’s excellent at collecting and retrieving data from multiple sources, boosting the efficiency of regulatory, non-financial, and risk reporting tasks.

Augmented and Virtual Reality (AR/VR)

Think about tech advancements like Augmented and Virtual Reality – they’re totally revamping the customer experience in banking. These technologies are giving customers the freedom to carry out transactions from the comfort of their homes.

For instance, the Commonwealth Bank of Australia rolled out an augmented reality app for customers looking to buy or sell a house, providing them with details on current listings, recent sales, and price ranges to make informed decisions.

The concept of virtual banks is also on the rise, offering a unique environment to interact with customers from afar.

This digital feature allows banks to offer a full-fledged banking experience, including interactions and transactions, without the need for a physical location, saving both space and operational costs.

Implementing digital transformation in banking can come with a hefty price tag, especially when it comes to customer management, business process automation, and introducing new payment methods, among other things.

This is something the banking industry needs to be prepared for in order to effectively utilize these emerging technologies.

With a plethora of competitors out there, staying on top of the latest trends and implementing them smartly can make all the difference. By doing this, you can reap immense benefits and enhance business outcomes.

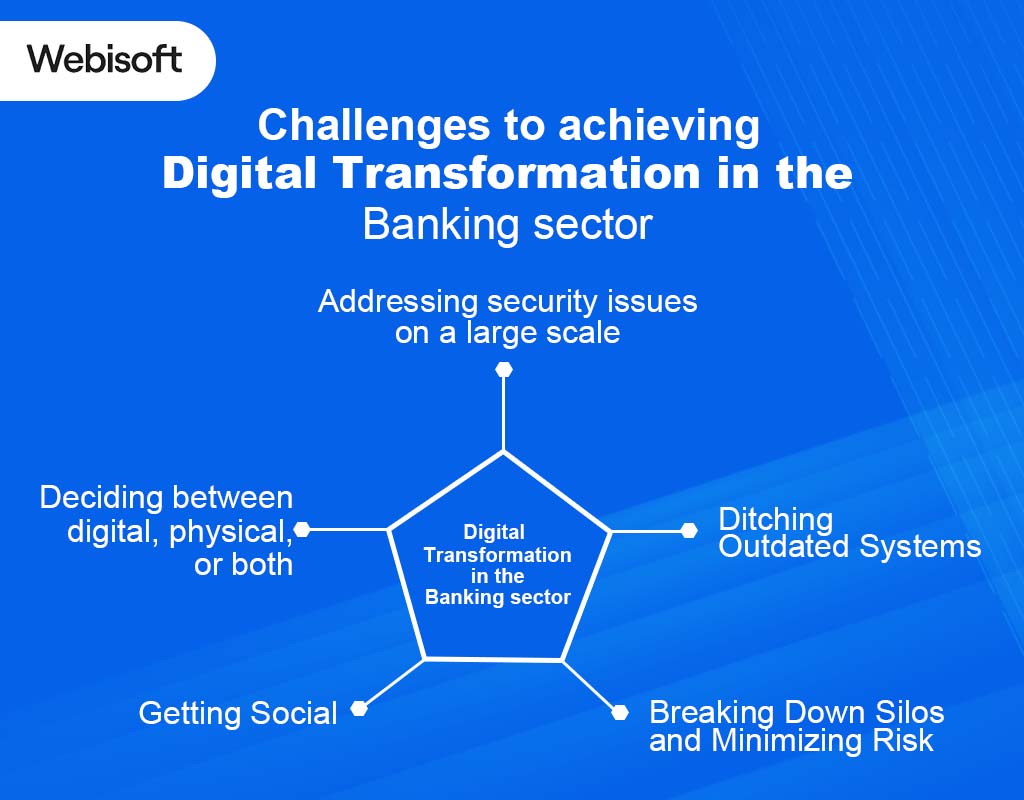

Challenges to Achieving Digital Transformation in the Banking Sector

The digital metamorphosis of the banking world has been particularly tough for retail banks. With the ever-evolving demands of today’s customers and the disruptive potential of fintech startups, conventional banks are feeling the heat to innovate and adapt.

Looking closely at these hurdles helps ensure that you and your team are doing everything to make this transformation a successful one. Here are some key areas to focus on:

Addressing Security Issues on a Large Scale

Keeping IT infrastructure secure is a major challenge banks face in their digital transition. In the past, securing IT was simpler – you just needed a good firewall. But in today’s digital world, that’s not enough.

Consider these major incidents from 2022:

- Credit Suisse Data Leak – Data from 18,000 accounts at Credit Suisse ended up with a German publication, exposing that the Swiss firm had “several high-profile criminals” as clients.

- Cash App Data Breach – Over 8.2 million users of the Cash App had their data breached, as confirmed by Cash App’s parent company, Block.

- Flagstar Bank Breach – A potential breach affected around 1.5 million customers of Flagstar Bank. The company discovered it in June 2022, but it’s still unknown if any customer info was accessed or misused.

Addressing security issues on a large scale helps banks protect not just their customer’s data, but their own reputation, and it’s critical in avoiding lawsuits and revenue loss.

Deciding Between Digital, Physical, or Both

Despite the popularity of digital tech, many clients still enjoy conducting business at physical branches. This trend is something that players in the banking sector need to see as both a challenge and an opportunity: meeting the needs of all customers while also pushing forward with digital transformation.

Some folks might use their phones for checking account balances but switch to a desktop when making payments.

Others may find online questionnaires for loan applications convenient. But having a local branch nearby is still essential for many customers.

In discussions around digital banking transformation, there’s a misconception that physical bank branches are becoming extinct.

This isn’t entirely true, as many customers still value face-to-face chats for crucial financial decisions, like personal loans and mortgages.

Digital tech can’t entirely replace these traditional interactions – instead, it can boost and work alongside them.

Ditching Outdated Systems

Banks relying on antiquated software are raising eyebrows. Today’s tech-savvy customers are craving experiences that go beyond old-school banking.

Some big-shot banks still run on the COBOL programming language, a 60-year-old relic! A Forbes survey even found that around 60% of banks are working with 5-10-year-old legacy mainframes.

A surprising 27% said they had 11-to-20-year-old mainframes, and 9% were operating on machinery that’s a whopping 21 to 30 years old! Existing systems are struggling to keep up with the surge and variety of traffic that comes with our digital age, making it clear that an upgrade is crucial.

Transitioning from a traditional, isolated banking system to a sleek, connected digital one isn’t a walk in the park. It’s a time-intensive task that requires significant upfront investment in apt applications, security measures, custom processes, and external system integrations.

But don’t forget about your employees! They’ll need training and regular updates to maximize the return on your investment.

Centralized security and compliance platforms simplify safety monitoring and adherence to regulations. Proving your commitment to data privacy goes a long way in boosting customer trust.

Getting Social

Banks need to meet their clients where they are, and nowadays, that’s on social media and web chat. With the staggering reach of Facebook and other social media platforms, it’s a no-brainer that investments here will keep growing.

Banks must ensure their social channels are safe from harmful intrusions and inadvertent employee slip-ups. The power to respond to client communication instantly on social media is a double-edged sword if banks don’t enforce proper security and compliance procedures.

Trust is the bedrock of banking, so controlling social communications is critical. Businesses should prioritize securing their social media channels and use a centralized monitoring system to nip potential policy breaches in the bud before they harm the company’s reputation.

Breaking Down Silos and Minimizing Risk

Banks are often split into different departments, each with unique objectives, which can hinder the organization’s growth. For instance, when clients apply for new services or seek assistance, they often get tossed from one department to another without finding a solution.

This lack of scalability and customer satisfaction has tarnished the banking sector’s image in recent years. Digital transformation in banking brings a unified platform to the table, eradicating silo issues by centralizing data and connecting various departments and systems.

It’s vital to note that information silos can also pose security and compliance threats due to insufficient collaboration during corporate policy-making.

As marketing becomes the brand’s first line of defense, Chief Marketing Officers (CMOs) and Chief Information Security Officers (CISOs) must join forces to devise effective solutions.

If banks don’t want to fade into oblivion, embracing digital transformation is non-negotiable. Many flourishing financial organizations are already adopting digital transformation to heighten customer-centricity or broaden their user base with digital wallets.

Plus, they’re reaping the benefits of “security through transparency,” a win-win for both them and their clients.

Final Words

In conclusion, digital transformation in the banking sector is not a choice, but a necessity in the modern world. Yes, the path towards digitalization presents hurdles, particularly in IT security and managing customer preferences.

But understanding these challenges can equip banks to tackle them effectively. By embracing new technologies and balancing the needs for both digital and physical banking experiences, banks can not only survive but thrive in the digital age.

Interested in capitalizing on the benefits of digital transformation? Get in touch with our expert team. At Webisoft, we’ll guide you on integrating digital tech into your financial solutions.

Our experts know the ropes of this industry and possess the skill set, knowledge, and experience to deliver top-notch banking solutions with perfect results.