Blockchain Implementation Strategy: A Step-by-Step Guide

- BLOG

- Blockchain

- October 4, 2025

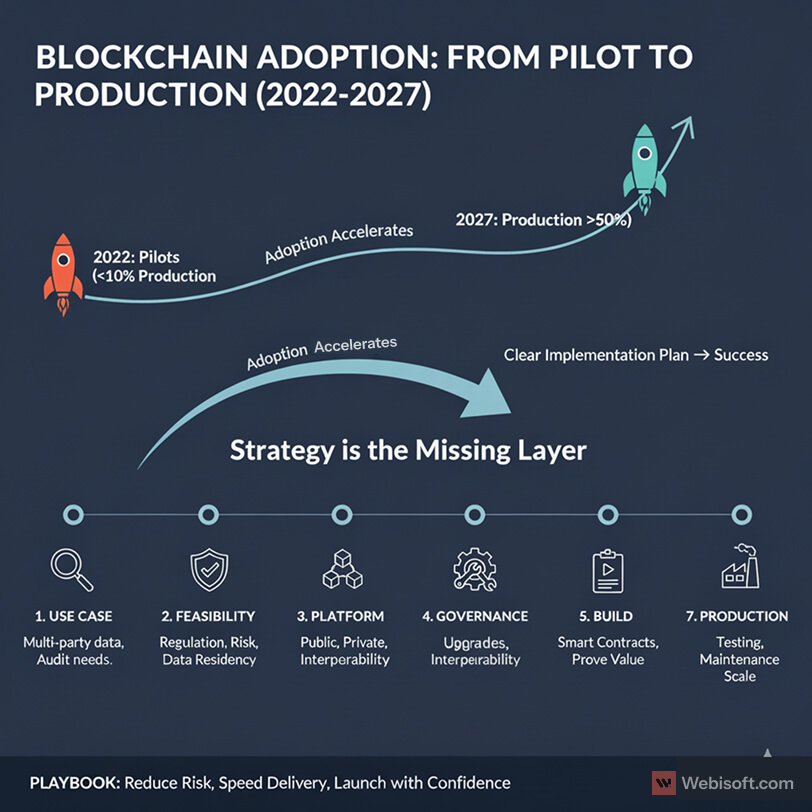

Blockchain is moving from pilots to production.

Enterprises are using it for settlement, identity, and supply chain traceability. Startups are testing tokenization and data-sharing networks.

The shift is real, but success is not guaranteed.

Many teams still jump straight to coding. They pick a chain, deploy a contract, and hope adoption follows. It rarely does.

Strategy is the missing layer.

According to Gartner’s blockchain insights, more than half of organizations will run at least one blockchain platform in production by 2027. That is up from less than 10 percent in 2022. Adoption is accelerating, which means competition and scrutiny are increasing as well.

A clear implementation plan keeps projects on track.

You need a business case with measurable outcomes. You need the right platform for your trust model. You need a governance plan that explains who can read, write, and upgrade the system.

Without that, pilots stall. Integrations break. Compliance slows go-live.

This guide gives you a step-by-step path from idea to production.

We start with use case selection. Not every workflow needs a ledger. The right candidate has multi-party data, audit needs, and a reason to reduce intermediaries.

Then we look at feasibility and regulation. Data residency, KYC, and cross-border transfer rules can change the architecture. Planning for them early avoids costly redesigns later.

Platform choice comes next. Public, private, or consortium. Ethereum for open networks. Hyperledger Fabric or Corda for regulated workflows. Interoperability options if you need to connect systems.

You will define governance and roles. Who operates nodes. How upgrades roll out. How disputes are resolved. Governance is the difference between a working network and a stalled committee.

Build comes after that. Smart contracts, integrations, and tests. Security reviews are mandatory. Most vulnerabilities show up long before launch, so you want audits and automated checks in your pipeline.

Finally, you pilot, iterate, and scale. Measure outcomes. Prove value. Move to production with a plan for monitoring and maintenance.

Use this playbook to reduce risk, speed up delivery, and launch with confidence.

Contents

- 1 Step 1 – Identify the Right Use Case

- 2 Step 2 – Assess Technical Feasibility and Compliance

- 3 Step 3 – Choose the Right Blockchain Platform

- 4 Step 4 – Define Governance and Architecture

- 5 Step 5 – Build Smart Contracts and dApps

- 6 Step 6 – Test, Pilot, and Iterate

- 7 Step 7 – Deployment and Integration

- 8 Step 8 – Establish Maintenance, Monitoring, and Scaling

- 9 Business Benefits of Blockchain Implementation

- 10 Common Challenges and How to Overcome Them

- 11 Case Studies – Blockchain Implementation in Action

- 12 How Webisoft Can Help You Implement Blockchain

- 13 FAQs About Blockchain Implementation Strategy

- 13.1 1. How long does blockchain implementation take?

- 13.2 2. What industries benefit most from blockchain?

- 13.3 3. How much does blockchain implementation typically cost?

- 13.4 4. What are the main security concerns?

- 13.5 5. How do you integrate blockchain with existing systems?

- 13.6 6. Is blockchain compliant with regulations?

- 13.7 7. Can blockchain scale for large enterprises?

- 13.8 8. What makes blockchain projects fail?

- 14 Conclusion – Moving From Strategy to Execution

Step 1 – Identify the Right Use Case

Not every business process needs blockchain.

That’s where most projects go wrong. Teams try to “add blockchain” to problems that don’t require distributed ledgers. The result is wasted time, budget, and credibility.

The starting point should always be use case validation. Ask:

- Does the workflow involve multiple parties who need a shared source of truth?

- Is transparency or auditability a priority?

- Are intermediaries adding friction, cost, or risk?

If the answer is yes, blockchain could be the right tool. If the process is internal, single-party, or doesn’t need immutability, a traditional database might be a better fit.

Take supply chain management as an example. Global manufacturers struggle with delays, counterfeit goods, and limited visibility. Blockchain enables all participants to share updates in real time, with an immutable record of provenance. The business value is clear: faster verification, fewer disputes, and lower fraud risk.

Contrast that with a local accounting system for a small business. Storing invoices on a blockchain adds complexity without real benefit. This is a case where a centralized ERP is simpler and more cost-effective.

Validation also means considering ROI and scalability. Early enthusiasm can cloud judgment, so leadership teams should model out the potential efficiency gains or revenue growth compared to costs. According to McKinsey, successful blockchain initiatives begin with “pain points that require trust, transparency, or automation across organizational boundaries.”

The Gartner data adds urgency. With over half of organizations projected to adopt blockchain by 2027, waiting too long to identify relevant use cases could leave businesses at a competitive disadvantage. But moving ahead without clear justification can be equally damaging.

The key is to find the balance: one use case that is ambitious enough to show value but practical enough to implement. Many organizations start with a pilot in supply chain, payments, or compliance reporting because these areas have measurable outcomes and visible impact.

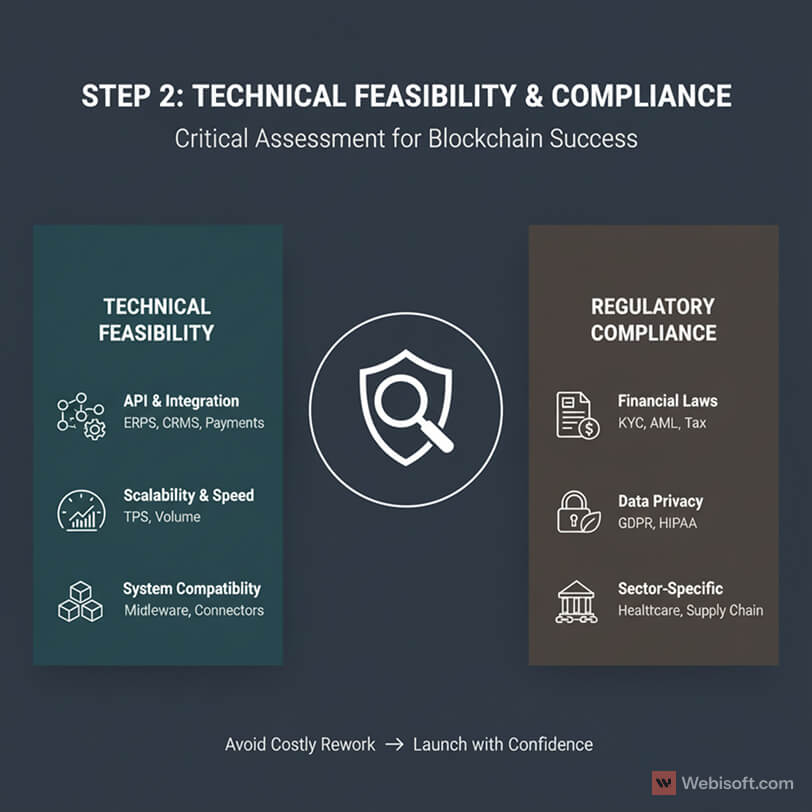

Step 2 – Assess Technical Feasibility and Compliance

Once you’ve validated the use case, the next step is testing its technical and regulatory feasibility. Many blockchain pilots stumble here because teams underestimate integration complexity or compliance requirements.

According to Deloitte’s 2025 Blockchain Survey, 61% of enterprises cite integration complexity as their top challenge. Right behind it: regulatory uncertainty (58%) and scalability concerns (52%). These numbers show that building the solution is often easier than aligning it with existing systems and legal frameworks.

Start with the technical side. Ask:

- Can the blockchain system integrate with your ERP, CRM, or payment systems?

- Do you need API layers, middleware, or custom connectors?

- What transaction speed and volume will your application require?

A supply chain solution, for example, may need to handle thousands of updates per second. An internal compliance ledger might have lower throughput needs but higher audit and reporting standards. Technical feasibility means aligning business needs with the network’s performance characteristics.

Then, look at compliance. Blockchain operates across borders, and so do regulations. If you’re in finance, expect KYC, AML, and data residency requirements. In healthcare, HIPAA or GDPR rules may dictate how data is stored and who can access it.

A good approach is to map out regulatory checkpoints early. That could mean engaging legal experts or building an internal compliance playbook before development begins. Skipping this step is one of the main reasons projects stall at pilot stage.

Security is also part of feasibility. Consider access controls, encryption methods, and disaster recovery protocols. Many enterprises underestimate how governance overlaps with security—who holds the keys, who approves upgrades, and who audits smart contracts all matter.

The bottom line: technical feasibility and compliance aren’t afterthoughts—they’re deal breakers. By testing integration, scalability, and regulatory fit early, you save time and avoid costly rework later.

Step 3 – Choose the Right Blockchain Platform

Once you’ve confirmed feasibility, the next big decision is which blockchain platform to use. This choice will shape your project’s scalability, security, and long-term flexibility.

Here’s the first distinction: public vs private vs consortium networks.

- Public blockchains (like Ethereum or Polygon) are open, decentralized, and great for transparency. They work best for dApps, tokenization, and NFT marketplaces.

- Private blockchains (like Hyperledger Fabric) are permissioned. Only approved participants can join, which is ideal for regulated industries like banking or healthcare.

- Consortium blockchains strike a middle ground. They’re operated by a group of organizations, making them well-suited for supply chain or interbank settlement networks.

The choice isn’t just about technology, it’s about trust. Who controls the network? Who approves new members? How much transparency is acceptable?

According to ScienceDirect, three frameworks consistently dominate enterprise adoption: Ethereum, Hyperledger Fabric, and Corda. Fabric is favored for regulated industries, while Ethereum dominates in public dApps. Corda is often chosen by financial institutions for identity and settlement use cases.

Cost and scalability also play a role. Ethereum gas fees are unpredictable, which is why many enterprises explore Layer 2 solutions like Optimism or Polygon. Hyperledger Fabric offers more predictable performance but requires governance overhead.

Another factor is ecosystem maturity. Ethereum has the largest developer base and tooling support. Hyperledger offers enterprise-grade modules and integrations. Corda focuses on financial use cases but has limited adoption outside banking.

IDC predicts that by 2026, half of financial institutions will rely on frameworks like Fabric and Corda for compliance and identity verification. This highlights how industry-specific needs often drive the platform decision.

So, how should you choose? Start with three questions:

- Is your use case open to the public or restricted to known partners?

- What regulatory requirements apply?

- What are your performance and cost constraints?

The answers will quickly narrow down your options.

Step 4 – Define Governance and Architecture

Choosing the right platform is just the start. To make it work, you need governance and architecture that define how the network operates day-to-day.

Governance answers the “who” questions:

- Who can join the network?

- Who approves transactions?

- Who manages upgrades and fixes?

Without governance, blockchain networks stall. Decisions take too long, or worse, disputes bring the system to a halt. A well-defined governance model keeps things moving and builds trust among participants.

Architecture answers the “how.” It covers node design, consensus mechanisms, and integration with external systems. This is where scalability and resilience get locked in.

For example, a consortium supply chain network may assign different roles: manufacturers as validators, logistics providers as endorsers, and retailers as readers. Architecture enforces these permissions and ensures each participant can contribute without overstepping.

Centralized governance may sound easier, but it reduces trust. Decentralized governance increases transparency but can slow down decision-making. The right choice depends on your industry and regulatory environment.

Consider also how governance ties into compliance. Financial networks often require audit trails, role-based permissions, and automated reporting. Healthcare networks may need strict data privacy rules baked into the architecture.

The architecture stage is also where you decide on redundancy, disaster recovery, and interoperability. Will your system connect to other chains? Can it integrate with payment rails or identity solutions?

A poorly designed governance or architecture layer leads to costly redesigns later. Getting this right early ensures your blockchain doesn’t just work technically, it works socially and legally too.

Step 5 – Build Smart Contracts and dApps

Once governance and architecture are in place, it’s time to move into the build phase. This is where your blockchain project becomes more than a concept.

At the core of most implementations are smart contracts. These are self-executing pieces of code that enforce rules automatically. Whether it’s transferring tokens, logging supply chain updates, or executing payments, smart contracts ensure trust without intermediaries.

Developing them requires technical expertise in languages like Solidity (Ethereum), Rust (Solana/NEAR), or Go (Hyperledger). The language depends on the platform you selected earlier.

But writing code isn’t enough. Security is critical. According to CertiK’s 2025 Security Report, more than 70% of blockchain projects face vulnerabilities during development. This is why audits, code reviews, and automated security tools must be part of the build lifecycle.

Alongside smart contracts, you’ll likely need a decentralized application (dApp). This is the interface end-users interact with. Think dashboards for supply chain partners or wallets for consumers. dApps connect to smart contracts via APIs or SDKs, making usability just as important as security.

Testing is not optional. Use testnets before mainnet deployment. Run stress tests, simulate attacks, and validate edge cases. Many successful teams also use bug bounties to uncover issues before launch.

Beyond functionality, consider integration. Your smart contracts and dApps must work with ERP systems, payment rails, or customer apps. Without this, blockchain risks becoming a siloed tool instead of a value driver.

The build stage is also iterative. Teams often develop a minimum viable product (MVP) to validate assumptions before scaling. This reduces risk and creates quick wins for stakeholders.

The goal is not just to ship code—it’s to ship secure, usable, and integrated blockchain solutions that support your business case.

Step 6 – Test, Pilot, and Iterate

Even after building your smart contracts and dApps, the work isn’t over. The testing and pilot phase is where theory meets reality.

Start with functional testing. Verify that every smart contract executes as intended under normal conditions. Then expand into edge cases—invalid inputs, stress loads, and transaction spikes. Blockchain systems must be resilient under pressure.

Next comes security testing. This is where penetration tests, formal audits, and bug bounty programs become invaluable. Since more than 70% of blockchain projects experience vulnerabilities during development (CertiK, 2025), skipping this step is not an option.

After testing, you’ll need to launch a pilot program. This usually means deploying your project in a limited scope: one business unit, a single product line, or a controlled set of partners. Pilots help you identify gaps without exposing the entire organization to risk.

Pilots are also a way to validate ROI early. For example, a logistics company might test blockchain to track shipments between two warehouses before scaling to a global network. This controlled approach allows teams to measure performance, cost savings, and adoption before committing further resources.

Iteration is critical. Gather feedback from both technical users and business stakeholders. Did the system integrate smoothly with existing ERP or CRM software? Were employees comfortable with the new workflows? Were there latency or cost concerns?

Use this input to refine smart contracts, optimize performance, or even pivot your platform choice if necessary. Many blockchain projects fail because teams rush into full deployment without this iterative feedback loop.

The pilot stage also prepares you for scaling. By resolving issues in a contained environment, you reduce the risk of costly failures when rolling out company-wide. This is why organizations engaging in structured pilots see higher project success rates.

The mantra here is: test thoroughly, pilot cautiously, iterate continuously. This ensures your blockchain solution is secure, functional, and aligned with business needs before scaling to full production.

Step 7 – Deployment and Integration

Once pilots are complete, the next major milestone is deployment. This step is where your blockchain project moves from controlled environments to production use, and where integration decisions can make or break the long-term value of the system.

Mainnet vs Enterprise Deployment

For public blockchain projects, mainnet deployment is the natural path. It enables access to liquidity, interoperability, and a broad ecosystem of wallets and applications. Launching on a mainnet also signals maturity, but it comes with added requirements for gas cost optimization, scalability testing, and security audits.

Enterprise use cases often take a different approach. Private or consortium chains may be deployed to ensure tighter access control, faster transaction finality, and compliance with regulatory frameworks. For example, financial institutions using Hyperledger Fabric or Corda may restrict validator nodes to authorized members.

Choosing between mainnet and enterprise deployment is not binary. Hybrid approaches are emerging, where core settlement layers run on public chains, while sensitive business logic stays within private frameworks. This layered deployment model provides both trust and confidentiality.

Integration With Core Business Systems

Deployment doesn’t stop at launching smart contracts. To create real enterprise value, blockchain must connect with existing systems such as:

- ERP (Enterprise Resource Planning): Linking blockchain to ERP ensures that supply chain data, invoicing, and procurement records flow seamlessly. For instance, a logistics firm could have blockchain-verified shipment records automatically update SAP.

- CRM (Customer Relationship Management): Integration with CRM platforms like Salesforce enables organizations to tie blockchain-verified transactions to customer profiles, improving trust in loyalty programs or digital asset ownership.

- Payment Systems: Bridging blockchain with fiat rails, card processors, or stablecoin gateways ensures smooth settlement. This is particularly important for marketplaces or cross-border trade platforms.

Without these integrations, blockchain risks becoming a siloed solution that duplicates data rather than improving workflows.

Avoiding Siloed Implementations

One of the most common pitfalls in blockchain deployment is creating a standalone system that doesn’t interact with the wider IT stack. This not only undermines adoption but also reduces ROI.

To avoid this, enterprises need to focus on:

- API-first architecture: Expose blockchain data and services through APIs so they can be consumed by ERP, CRM, and analytics systems.

- Middleware and adapters: Tools like Oracle Blockchain Platform or custom middleware help bridge on-chain and off-chain systems.

- Data consistency: Ensure blockchain entries map correctly to enterprise databases. Poor synchronization can create trust issues instead of solving them.

- Cross-chain interoperability: As multi-chain ecosystems grow, deployment strategies should plan for connecting multiple blockchains, not just one.

Example of Integration Done Right

Consider a global trade finance platform. On-chain smart contracts validate documents like letters of credit. Meanwhile, APIs push verified records into ERP systems for financial reconciliation, while CRM integrations update client dashboards in real time. Payments settle through stablecoins on the public mainnet, reducing delays.

This creates a unified digital workflow rather than fragmented systems.

Step 8 – Establish Maintenance, Monitoring, and Scaling

Deployment is not the end of the journey. Blockchain projects require constant maintenance and oversight to remain secure, compliant, and aligned with business goals. Neglecting this stage is one of the fastest ways to see early wins unravel into technical debt or security incidents.

Continuous Audits, Patching, and Upgrades

Smart contracts and blockchain nodes must be regularly audited. Even well-written code can harbor vulnerabilities that attackers exploit months after launch. Independent audits, penetration testing, and bug bounty programs provide early warnings before issues escalate.

Upgrades are another critical piece. Protocols evolve, governance frameworks change, and security patches need to be applied. Enterprises should adopt a planned upgrade cycle, similar to how ERP or CRM systems are patched, rather than a reactive “fix it when it breaks” approach.

Monitoring Tools and Dashboards

Monitoring blockchain systems is different from monitoring traditional IT. Beyond server uptime, you need visibility into on-chain metrics, node health, transaction throughput, and gas cost trends.

Dashboards powered by tools like Prometheus, Grafana, or custom APIs can surface this data in real time. For example, a dashboard may show how many contracts are active, the average block confirmation time, and whether nodes are falling out of sync.

Monitoring also includes compliance tracking. Enterprises operating in regulated industries should log AML/KYC checks, transaction approvals, and governance actions to ensure auditors can verify activity without compromising privacy.

Governance Updates and Stakeholder Alignment

Blockchain is rarely static. Over time, stakeholders need to agree on protocol adjustments, validator policies, and transaction rules. Without active governance, networks risk fragmentation or loss of trust.

Regular governance updates should be scheduled, just like board meetings or quarterly reviews. This ensures that business priorities, technical realities, and regulatory requirements remain aligned.

A good practice is to maintain a stakeholder steering committee that includes business leaders, technical architects, and compliance officers. This prevents the project from being run solely by developers or executives, keeping balance between strategy and execution.

Scaling Considerations

As usage grows, scaling becomes critical. Enterprises should plan for node expansion, load balancing, and integration of Layer-2 solutions for performance improvements. In some cases, multi-chain deployments or sidechains may be necessary to handle spikes in demand.

Scaling isn’t only technical. Teams need documentation, training, and support processes so new developers and users can onboard without disrupting operations.

Business Benefits of Blockchain Implementation

When companies invest in blockchain, they are looking for clear, measurable benefits. Unlike hype-driven experiments of the past, today’s blockchain deployments are tied directly to efficiency, transparency, and cost savings.

Efficiency Gains

One of the strongest arguments for blockchain is the way it streamlines processes that used to be manual and time-consuming.

For example, settlement and reconciliation between financial institutions often take days and involve multiple middlemen. A blockchain ledger can reduce this to near real-time updates, cutting out redundant approvals and manual data entry.

According to PwC’s Global Blockchain Survey, organizations that implemented blockchain reported a 30–40% reduction in reconciliation time and a 20–30% decrease in transaction costs within the first year. Those numbers speak directly to operational efficiency and bottom-line results.

Transparency and Trust

Blockchain creates a shared, tamper-resistant record of transactions. That means all stakeholders – whether banks, suppliers, or patients in a healthcare system are looking at the same data.

In supply chains, this level of transparency allows retailers and consumers to verify the origin of goods. In healthcare, it means patient records are updated securely across providers without data silos. For finance, it means auditors and regulators have access to trustworthy transaction histories, reducing disputes and compliance risks.

This transparency also builds trust. Businesses that adopt blockchain can reassure partners and customers that their data handling is both secure and verifiable.

Cost Reduction

Cost reduction is a natural outcome of fewer intermediaries and less manual work. For banks, that might mean lower fees paid to clearinghouses. For logistics firms, fewer losses from fraud or errors. For healthcare providers, less duplication of testing and administration.

By moving data and transactions into a shared blockchain framework, companies spend less on verification, reconciliation, and dispute resolution. These savings add up quickly, especially for high-volume industries like payments and global trade.

Real-World Examples

- Finance: JPMorgan’s Onyx blockchain platform has shown how tokenized payments can settle faster and cheaper, with fewer risks of failed transactions.

- Supply Chain: Walmart uses blockchain to trace food products back to their source in seconds, reducing waste and improving safety recalls.

- Healthcare: Projects like MediLedger are exploring blockchain to track pharmaceuticals, reducing counterfeit risks and ensuring compliance with regulatory requirements.

These examples highlight that blockchain is not theoretical anymore, it’s delivering practical business value today.

Common Challenges and How to Overcome Them

Implementing blockchain is rarely smooth sailing. While the technology has matured, companies still face technical, regulatory, and organizational hurdles.

Integration Complexity

Blockchain doesn’t live in isolation. It has to connect with ERP systems, CRMs, payment processors, and external APIs. Deloitte’s 2025 Global Blockchain Survey found that 61% of enterprises cite integration complexity as their biggest challenge.

The solution? Start with a phased rollout. Instead of attempting to blockchain-enable your entire organization at once, pilot integration with one system — such as supply chain tracking or payment settlements. This controlled approach reduces risk and reveals gaps before scaling.

Scalability and Performance

Public blockchains often face throughput limits, while private ones may struggle to balance speed with decentralization. For companies processing thousands of daily transactions, this becomes a bottleneck.

To overcome it, enterprises should test performance in sandbox environments and explore scaling techniques like sharding, sidechains, or hybrid blockchain models. Choosing the right framework upfront is critical.

Regulatory Hurdles

58% of enterprises report regulatory uncertainty as a top barrier (Deloitte). With rules evolving across jurisdictions, compliance is no small task.

The best strategy is to involve compliance experts early. A blockchain consultant can align your architecture with AML, KYC, and data privacy requirements, while also flagging potential red zones before you launch.

Cultural and Organizational Barriers

Even when the tech is ready, people may resist. Employees may distrust blockchain or fear job displacement. Leadership may struggle to allocate resources to something unfamiliar.

Addressing this requires change management. Educate teams with workshops, highlight quick wins from pilots, and secure leadership buy-in by presenting blockchain as a growth enabler, not just an IT experiment.

Risk Mitigation Strategies

The safest route combines consultant guidance with phased implementation. Consultants help de-risk technical and regulatory decisions, while phased rollouts prevent costly all-at-once failures. Together, these approaches turn blockchain from a risky experiment into a controlled digital transformation.

Case Studies – Blockchain Implementation in Action

Blockchain isn’t just a concept anymore. Enterprises across industries are deploying it to solve real business problems — with varying degrees of success.

Finance: Faster Settlements and Reduced Costs

JPMorgan’s Onyx platform is one of the most visible examples of blockchain in finance. It enables tokenized payments and intraday repo transactions that settle within minutes instead of days. The result is reduced liquidity risk and lower operational costs.

The key lesson here: when blockchain aligns with a clear business need like faster settlements, adoption succeeds.

Supply Chain: Traceability and Compliance

Walmart partnered with IBM to use blockchain for food traceability. Before blockchain, tracing the origin of mangoes in U.S. stores could take up to 7 days. With blockchain, the same task now takes 2.2 seconds.

This isn’t just faster, it’s critical for safety recalls, compliance, and consumer trust. The project worked because blockchain delivered clear, measurable value.

When Projects Struggle

Not all implementations succeed. Gartner reports that up to 92% of blockchain pilot projects fail before reaching production. Reasons often include:

- Choosing blockchain for problems that don’t require decentralization.

- Ignoring integration complexity with legacy systems.

- Lack of internal alignment and leadership buy-in.

For example, several early trade finance blockchain consortia shut down after struggling to onboard enough participants to make the network useful.

The lesson: blockchain can’t succeed in isolation; it needs ecosystem adoption and organizational commitment.

Adoption Insights from Deloitte

Deloitte’s 2025 Global Blockchain Survey highlights the most common hurdles: 61% cite integration complexity, 58% cite regulatory uncertainty, and 52% cite scalability concerns.

The positive takeaway? Enterprises that engaged consultants early and rolled out blockchain in phases were far more likely to reach production. Deloitte notes these organizations achieved better risk management and smoother compliance.

Key Takeaways

- Finance and supply chain lead in successful enterprise use cases.

- Failures often stem from poor fit or weak execution.

- Strategic alignment and phased implementation significantly improve success rates.

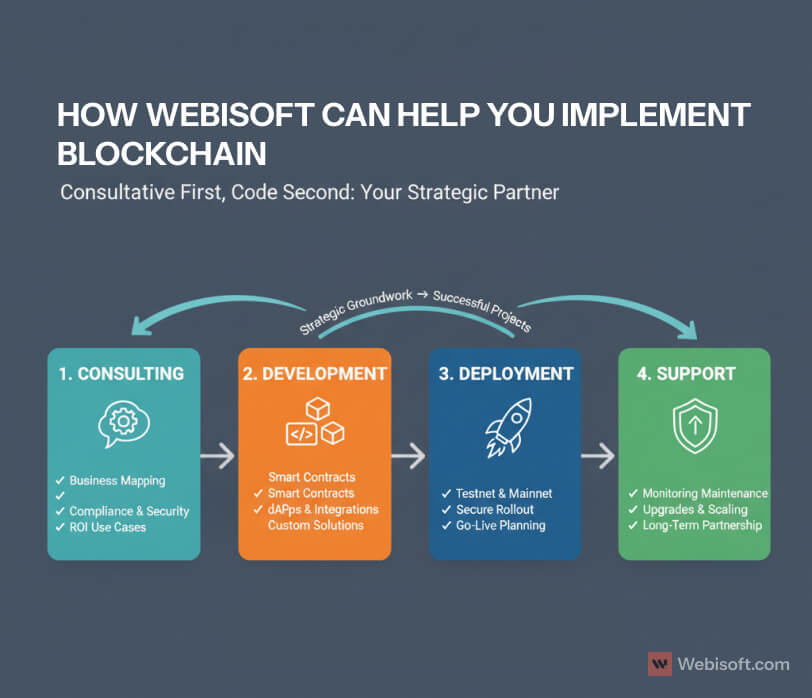

How Webisoft Can Help You Implement Blockchain

At Webisoft, we approach blockchain not just as developers, but as strategic partners. Our team works with you from the earliest stages of planning to ensure that the technology aligns with your business goals, not the other way around.

Consultative First, Code Second

Many blockchain projects fail because companies jump straight into development. We start with a consultative phase, where we:

- Map business objectives to blockchain capabilities.

- Identify compliance or security requirements early.

- Define use cases that deliver measurable ROI.

This strategic groundwork is what sets successful projects apart from stalled pilots.

Experience Across the Lifecycle

Webisoft has delivered end-to-end blockchain projects across industries, covering:

- Consulting: Identifying the right framework and roadmap.

- Development: Building smart contracts, dApps, and integrations.

- Deployment: Ensuring secure, scalable rollout on testnets and mainnets.

- Support: Providing long-term monitoring, maintenance, and upgrades.

This holistic approach means you get a partner that doesn’t stop at delivery — we stay with you to keep the system running and evolving.

Why Early Strategic Alignment Matters

Gartner research shows that most blockchain failures stem from poor partner fit and lack of early alignment. By working with Webisoft from day one, you avoid those pitfalls. We focus on phased rollouts, compliance alignment, and security-by-design so you can scale without costly rework.

FAQs About Blockchain Implementation Strategy

1. How long does blockchain implementation take?

Timelines vary by scope. A simple proof of concept can take 3–6 months, while enterprise-wide deployment may take 12–18 months. Factors include integration needs, regulatory review, and the size of the development team. A phased rollout is often the most effective approach.

2. What industries benefit most from blockchain?

Finance and supply chain remain the leading adopters due to clear ROI in settlements and traceability. Healthcare, real estate, and energy are also exploring blockchain for compliance and transparency. Any industry facing inefficiency, fraud, or data silos can benefit from blockchain-based solutions.

3. How much does blockchain implementation typically cost?

Budgets depend on complexity. A small pilot may start around $50,000, while full-scale custom platforms can exceed $500,000. Costs come from development, integration, compliance, and ongoing maintenance. Working with consultants early helps organizations avoid overspending and focus on high-value use cases.

4. What are the main security concerns?

Smart contract bugs, private key management, and insufficient audits top the list. More than 70% of projects report vulnerabilities during development. Using formal code reviews, penetration testing, and continuous monitoring reduces risks significantly and protects both users and business data.

5. How do you integrate blockchain with existing systems?

Blockchain rarely runs in isolation. Integration with ERP, CRM, and payment systems is common. APIs, middleware, and dedicated integration layers make this possible. Testing in sandbox environments before full rollout helps ensure compatibility and avoids disruption to critical business operations.

6. Is blockchain compliant with regulations?

Compliance varies by jurisdiction. Enterprises need to align with AML, KYC, and data privacy laws early in the design process. Partnering with compliance experts ensures projects meet evolving legal requirements and reduces the risk of fines or forced shutdowns later.

7. Can blockchain scale for large enterprises?

Yes, but scalability must be designed upfront. Techniques like sharding, sidechains, or hybrid blockchain models improve throughput. Choosing a framework aligned with your transaction volume and governance model is critical. Without planning for scale, systems risk becoming bottlenecks as adoption grows.

8. What makes blockchain projects fail?

Gartner reports up to 92% of blockchain pilots fail before reaching production. Common reasons include unclear objectives, poor partner fit, and lack of leadership buy-in. Success requires aligning technology with real business needs, phased rollouts, and early stakeholder engagement.

Conclusion – Moving From Strategy to Execution

A blockchain project is never just about technology. The most successful initiatives follow a phased strategy: start small, prove value, then scale with governance and security in place.

From defining business goals to deploying on mainnet, each step demands both strategic planning and disciplined technical execution. Skipping either piece often leads to stalled pilots or wasted budgets.

At Webisoft, we help organizations avoid those pitfalls. Our consultative-first approach ensures blockchain is tied to measurable business outcomes, while our development expertise turns ideas into working solutions.

If you’re ready to move from planning to production, contact the Webisoft team. We’ll help you design, build, and scale blockchain systems that deliver lasting impact.