Best Blockchain for NFT: Top 11 Platforms Review

- BLOG

- Blockchain, NFT

- December 27, 2025

NFT minting costs can drain your budget before you even launch. You need a blockchain that balances speed, security, and affordability without forcing compromises.

The network determines whether you pay $100 or $0.01 per mint. It affects how fast collectors receive their purchases and whether your smart contracts stay secure long-term. Different blockchains excel at different things. Like, Ethereum dominates marketplaces while Solana offers lightning speed.

We’ve researched transaction costs, validator structures, marketplace integrations, and real trading volumes. Check our list of the best blockchain for NFTs below to find which blockchain actually fits your NFT project goals.

Contents

- 1 What is the Best Blockchain for NFT: [Quick Comparison Table]

- 2 Start Your NFT Journey Today!

- 3 Key Considerations For Choosing The Best Blockchain For NFT Marketplace Development

- 4 How Webisoft Helps Build Your NFT Marketplace on the Right Blockchain

- 5 Start Your NFT Journey Today!

- 6 To Conclude

- 7 Frequently Asked Questions

- 7.1 Q1: Can I migrate my NFT collection from one blockchain to another after launch?

- 7.2 Q2: Do I need to run my own blockchain node to launch an NFT marketplace?

- 7.3 Q3: How do royalty payments work differently across blockchains?

- 7.4 Q4: What happens to my NFTs if the blockchain experiences a hard fork?

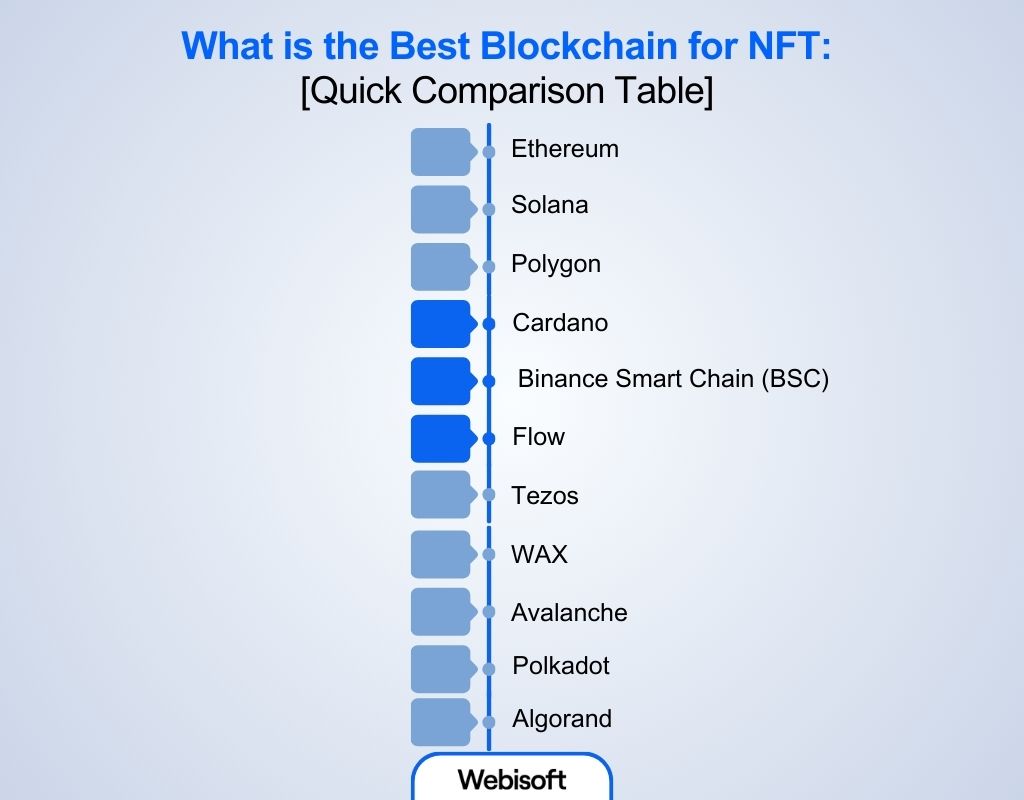

What is the Best Blockchain for NFT: [Quick Comparison Table]

| Blockchain | Transaction Speed | Transaction Fee | Best For |

| Ethereum (ETH) | Slow (~10–20 TPS) | High ($0.40–$15) | Perfect for artists, collectors, and platforms looking for maximum exposure and liquidity. |

| Solana (SOL) | Fast (~1k-2k TPS) | Very Low (<$0.01) | High-volume NFT platforms or projects with fast minting and trading needs. |

| Polygon (MATIC) | Fast (~100-1k TPS) | Low (<$0.01) | Creators who need low-cost minting while staying within the Ethereum ecosystem. |

| Cardano (ADA) | Fast (~250-1k TPS) | Very Low (<$0.01) | Those who are looking for sustainable, energy-efficient NFT projects. |

| BSC (Binance Smart Chain) | Fast (~150-200 TPS) | Very Low (<$0.01) | Perfect for low-cost, fast transactions and Binance ecosystem integration. |

| Flow | Fast (~135 TPS) | Low (<$0.01) | Optimized for NFT gaming projects and large-scale digital collectibles. |

| Tezos | Moderate (~40 TPS) | Very Low (<$0.01) | Best for independent artists and eco-conscious NFT projects. |

| WAX | Very Fast (~8k TPS) | Very Low (<$0.01) | Gaming NFTs and digital collectible projects with low minting costs. |

| Avalanche (AVAX) | Very Fast (~4.5k TPS) | Low (<$0.01) | Enterprise-level NFT projects that need high scalability and low fees. |

| Polkadot | Fast (~1k TPS) | Low (<$0.01) | Projects that need interoperability between multiple blockchains. |

| Algorand | Very Fast (~10k TPS) | Low (<$0.01) | Best for projects needing scalable, sustainable NFT solutions. |

1. Ethereum

Ethereum operates on a proof-of-stake system where validators secure your NFT transactions. Validators lock up 32 ETH as collateral to process and verify every transaction on the network. This staking mechanism keeps your NFTs safe from tampering or unauthorized changes.

Ethereum operates on a proof-of-stake system where validators secure your NFT transactions. Validators lock up 32 ETH as collateral to process and verify every transaction on the network. This staking mechanism keeps your NFTs safe from tampering or unauthorized changes.

The blockchain introduced ERC-721 and ERC-1155 token standards that power every NFT you create. ERC-721 generates unique, one-of-a-kind tokens perfect for individual collectibles.

ERC-1155 lets you batch multiple tokens together, slashing your gas costs up to 90% compared to single transfers using older standards.. Major marketplaces like OpenSea and Blur built their entire infrastructure around these Ethereum standards.

Why Ethereum is the Best Blockchain for NFTs:

Ethereum gives you the infrastructure that has been built and continues to dominate the NFT industry.

- Largest Developer Community: Ethereum has over 31,000 active developers and has attracted 16,181 new developers in the past nine months. You access constant innovation and rapid bug fixes unavailable on smaller blockchains.

- Built-In Royalty Mechanisms: ERC-2981 embeds automatic royalty payments directly into your smart contracts. You receive passive income every time collectors resell your work across compatible marketplaces.

- IPFS Metadata Integration: Ethereum supports IPFS for decentralized metadata storage, preventing centralized server failures from destroying your NFTs. Your NFT metadata and images stay accessible permanently across distributed nodes.

- Universal Marketplace Recognition: OpenSea, Blur, Rarible, and Foundation all prioritize Ethereum listings. You reach millions of active buyers instantly without custom integration work.

- Layer 2 Cost Solutions: Arbitrum and Optimism reduce your minting costs to $0.01-$0.50 per transaction. You maintain Ethereum’s mainnet security without paying expensive gas fees.

Key Challenges to Consider:

Ethereum’s technical structure creates specific obstacles you must navigate when building NFT projects.

- You’ll pay $50-$100 per mint during popular drops because thousands of buyers compete for limited block space simultaneously.

- Transactions process slowly at 13-15 per second, creating longer wait times during busy periods compared to faster blockchains.

- You need months to master Solidity and Web3.js libraries before you can deploy secure NFT contracts.

Webisoft’s senior blockchain engineers eliminate this learning curve entirely. We deploy production-ready Ethereum NFT contracts with gas optimization, security audits, and Layer-2 integration from day one.

2. Solana

Solana runs on a unique Proof of History mechanism combined with Proof of Stake. Proof of History creates a cryptographic clock that timestamps each transaction without requiring nodes to communicate constantly.

Solana runs on a unique Proof of History mechanism combined with Proof of Stake. Proof of History creates a cryptographic clock that timestamps each transaction without requiring nodes to communicate constantly.

This lets validators process transactions immediately instead of waiting for network-wide agreement. The system processes over 65,000 transactions per second, making it one of the fastest blockchains available.

Transaction fees average just $0.00025 per mint, dramatically cheaper than Ethereum’s costs. Solana hosted over 33 million NFT mints with more than $3 billion in total sales volume. The network powers Magic Eden, the second-largest NFT marketplace across all blockchains.

Why Solana is the Best Blockchain for NFTs:

Solana is the best choice if you want speed and savings in your NFT project.

- Ultra‑low fees: Transactions often cost less than a cent. You won’t be worrying about gas fees eating into your profits.

- Very fast transactions: With over 65,000 TPS, minting and trading on Solana happen nearly instantaneously, which keeps things moving.

- Scalable for big projects: Whether you’re launching a small collection or a massive marketplace, Solana’s speed doesn’t slow down as your project grows.

- Access for all creators: Solana’s low costs make it easy for everyone, from indie artists to big platforms, to join in on the NFT boom.

- Expanding ecosystem: Solana’s NFT space is growing fast with new marketplaces and projects, offering you more exposure and opportunities.

Key Challenges to Consider

Despite its strengths, Solana does have a few things you should keep in mind.

- Solana’s network has faced downtime during high traffic, causing delays and interruptions.

- For some, Ethereum and other older chains may still carry more prestige for high‑value NFTs.

3. Polygon

Polygon operates as an Ethereum sidechain using a proof-of-stake consensus mechanism. The sidechain runs parallel to Ethereum and doesn’t derive security directly from the Ethereum mainnet. Instead, validators stake MATIC tokens to process transactions independently.

Polygon operates as an Ethereum sidechain using a proof-of-stake consensus mechanism. The sidechain runs parallel to Ethereum and doesn’t derive security directly from the Ethereum mainnet. Instead, validators stake MATIC tokens to process transactions independently.

These validators aggregate transaction blocks and publish periodic checkpoints to Ethereum’s mainnet. This architecture lets Polygon handle high transaction volumes without congesting Ethereum.

Transaction costs average under $0.01 compared to Ethereum’s $1.72 in the same period. Over 45,000 dApps now operate on Polygon, up from 30,000 at the start of 2024

Why Polygon is the Best Blockchain for NFTs:

You should consider Polygon when you want a blockchain that makes NFT minting, trading, and ownership smooth, cheap, and accessible.

- Fast and smooth transactions: Polygon processes transactions quickly, often finalizing in seconds. That makes minting or resale snappy rather than slow or delayed.

- Full compatibility with Ethereum ecosystem: Polygon is built to work with Ethereum standards (ERC‑721, ERC‑1155, etc.). So NFTs created on Ethereum can easily work on Polygon too.

- Scalable for both small artists and big platforms: As fees are low and speed is high, Polygon works equally well for a solo artist launching a few pieces or a large marketplace handling many transactions.

- Large and growing NFT & Web3 ecosystem: Many NFT marketplaces, DeFi and gaming‑related dApps already run on Polygon, giving you a wide audience and interoperable tools.

Key Challenges to Consider

But Polygon isn’t perfect. Here are some drawbacks you must weigh.

- As the main NFT market still favors Ethereum, you may find fewer buyers or lower resale value on Polygon.

- Premium or high‑value NFT collectors often prefer Ethereum, so high‑end NFTs may get more attention there.

- If you want to move assets between Ethereum and Polygon, bridging can add complexity and a small delay.

4. Cardano

The Cardono network operates on Ouroboros, the first proof-of-stake protocol validated through peer-reviewed academic papers. Users delegate their ADA to validators, who stake their own and the delegated stake.

The Cardono network operates on Ouroboros, the first proof-of-stake protocol validated through peer-reviewed academic papers. Users delegate their ADA to validators, who stake their own and the delegated stake.

Cardano selects block producers using verifiable random functions, preventing attackers from predicting the next validator. You pay 0.155381 ADA base fee plus 0.000043946 ADA per byte, giving you exact cost calculations upfront.

Cardano NFT sales surged 102% in July 2025, proving collectors are actively buying here. JPG Store runs as the main marketplace where you launch and trade your NFTs.

Why Cardano Is the Best Blockchain for NFTs:

If you’re thinking about NFTs and sustainability, Cardano offers real strengths:

- Low energy, eco‑friendly protocol: Because it uses proof‑of‑stake instead of power‑hungry mining, Cardano keeps energy use minimal.

- Structured and secure smart‑contract design: Its dual‑layer design (settlement + computation) gives smart contracts a stable, clearly organised base.

- Predictable, reasonable fees: Transactions and contract interactions don’t carry the steep gas fees often seen on older blockchains, which helps especially smaller creators.

- Long‑term reliability and research‑driven updates: Every upgrade or change is peer‑reviewed and planned, helping avoid rushed fixes or bugs.

Key Challenges to Consider:

Before you commit to Cardano for NFTs, here are some realistic drawbacks:

- Its smart‑contract languages (e.g. Plutus) demand more technical skill than some popular alternatives, which may be a barrier for beginners.

- Because the ecosystem is smaller and less mature, NFTs on Cardano may get less attention if you aim for high‑end art or high‑value sales.

That’s where expert Cardano blockchain development becomes essential. Webisoft’s specialized team handles complex Plutus programming, native asset minting, and policy ID implementation. We build secure batch-minting systems with predictable fee structures tailored to your collection requirements.

5. Binance Smart Chain (BSC)

BSC built its architecture around speed and affordability for creators like you. The network uses 21 validators who stake BNB tokens to process transactions. This smaller validator set lets BSC move faster than networks with thousands of validators.

BSC built its architecture around speed and affordability for creators like you. The network uses 21 validators who stake BNB tokens to process transactions. This smaller validator set lets BSC move faster than networks with thousands of validators.

You get transaction confirmations in 3 seconds because validators don’t need extensive coordination. This speed comes with $0.10 average fees, letting you mint thousands of NFTs without spending a fortune. BSC runs Ethereum Virtual Machine natively, so your Solidity contracts deploy immediately.

Why BSC is the Best Blockchain for NFTs:

You might like BSC when you want fast, cheap, and widely accessible NFT operations.

- EVM‑compatibility: Developers used to Ethereum tools and smart contracts can build on BSC with minimal adjustments. That lowers the learning curve and increases flexibility.

- Mature and diverse NFT & dApp ecosystem: BSC supports multiple active NFT marketplaces, games, and decentralized applications. That gives creators and buyers many options.

- High transaction capacity (scalable for volume): BSC handles many transactions daily, which makes it suitable if your NFT project expects lots of users or frequent trades.

Key Challenges to Consider:

But BSC also comes with some trade‑offs you should know.

- BSC uses a smaller set of validators, which lowers decentralization compared to older blockchains.

- For premium or high‑value NFTs, collectors may still trust older, more established blockchains more.

6. Flow

Flow solves blockchain congestion by dividing the work among specialized validators. Instead of one node handling everything, different nodes focus on Consensus, Execution, Verification, and Collection. This setup allows Flow to handle high volumes of users without slowing down.

Flow solves blockchain congestion by dividing the work among specialized validators. Instead of one node handling everything, different nodes focus on Consensus, Execution, Verification, and Collection. This setup allows Flow to handle high volumes of users without slowing down.

Flow was created by Dapper Labs, the team behind CryptoKitties, after Ethereum’s congestion caused issues with their project in 2017. To ensure digital ownership, Flow uses Cadence, a custom programming language that protects NFTs from being lost or duplicated.

Flow powers popular platforms like NBA Top Shot and NFL All Day, with the network’s value growing 91.6% in Q4 2024. Plus, Flow offers low and predictable fees, no matter how busy the network gets.

Why Flow is the Best Blockchain for NFTs:

Choose Flow when you want a blockchain that’s optimized for digital collectibles and large‑scale NFT use.

- High scalability with low congestion: Its multi‑node architecture handles many transactions without network slowdowns, ideal for big drops or popular collections.

- Low transaction and minting fees: Costs stay low compared with older blockchains, making minting affordable for creators at any scale.

- Fast finality & user‑friendly flow: Transactions finalize quickly, giving buyers and sellers smooth NFT experiences without delay.

- Strong backing & real‑world traction: Flow hosts major NFT and collectibles projects seen across arts, sports, and entertainment, making adoption and visibility easier

Key Challenges to Consider

Although Flow shines for many NFT use cases, some trade‑offs exist

- Some wallets or tools built for older blockchains may not support Flow, creators need to check compatibility.

- Projects on Flow work best when there’s an active user base; new or niche drops may face visibility limits.

7. Tezos

Tezos uses a Proof‑of‑Stake design that leads to very low energy use: its yearly network footprint equals roughly that of 17 average people. Because of this design, transaction and minting costs are low and remain stable compared with many older blockchains.

Tezos uses a Proof‑of‑Stake design that leads to very low energy use: its yearly network footprint equals roughly that of 17 average people. Because of this design, transaction and minting costs are low and remain stable compared with many older blockchains.

In 2025, one of the largest Tezos NFT platforms, Objkt, recorded about 1,800 weekly active users. You can imagine its real, ongoing demand and activity. Moreover, recent protocol upgrades reduced block time to as low as 8‑10 seconds and improved finality, helping NFT projects run fast and smoothly.

This means you can mint or trade NFTs on Tezos with low, predictable costs, lower environmental impact, and a reasonably active community.

Why Tezos is the Best Blockchain for NFTs:

Tezos offers specific advantages that make it an excellent choice for creators, especially those looking for sustainability, security, and low-cost operations:

- Formal verification for smart contracts: Tezos supports formal verification on its smart contracts, which means higher reliability and fewer bugs.

- Stable, predictable fees: Minting on Tezos is extremely affordable, typically ranging from $0.01 to $0.05 per transaction. This stability helps creators avoid unpredictable gas fees.

- High scalability without congestion: Tezos handles 5-10 transactions per second (TPS) with no slowdowns, even during large NFT drops or popular trading times.

- Active and growing NFT ecosystem: Tezos continues to grow its NFT community, with strong activity on marketplaces such as objkt.com and fxhash.

Key Challenges to Consider:

Despite its strengths, Tezos does have a few challenges you should keep in mind Some NFT marketplaces and tools are not fully integrated with Tezos yet, which may limit creative flexibility for developers or creators looking for more resources. Note: If you’re exploring Tezos development for decentralized applications, Webisoft bridges these integration gaps. Our team builds custom NFT marketplaces, implements SmartPy contracts, and develops tailored tooling that expands your creative possibilities on Tezos.

8.WAX

WAX is a blockchain built specifically for NFTs, digital assets, and gaming. It’s optimized for high-volume transactions, which is crucial for handling large NFT collections, digital items, and massive drops.

WAX is a blockchain built specifically for NFTs, digital assets, and gaming. It’s optimized for high-volume transactions, which is crucial for handling large NFT collections, digital items, and massive drops.

With over 450 million NFTs minted and 15 million active wallets, WAX has proven itself as a go-to platform for creators and collectors who want speed, low fees, and a huge market.

Because of its Delegated Proof-of-Stake (DPoS) model, WAX allows for instant transactions and near-zero gas fees, making it affordable for creators of all sizes.

Why WAX is the Best Blockchain for NFTs:

Here’s why WAX is the ideal choice for your next NFT project:

- Optimized for digital collectibles and gaming: WAX is designed for virtual goods, making it a top pick for games or projects based around collectible items.

- Fast and scalable: WAX can handle up to 3,000 transactions per second, making it ideal for projects that need fast transaction finality without delays. Whether you’re launching high‑frequency trades or large collections, WAX keeps things moving.

- High activity and user engagement: With millions of wallets and billions of dollars in NFT sales, WAX has a large and active user base. This means more visibility for your NFTs and a built-in audience for your digital assets.

- Easy-to-use platform: WAX makes NFT creation simple and user-friendly, with tools that help even beginners easily create, mint, and list NFTs on the marketplace.

Key Challenges to Consider

While WAX offers a lot of benefits, there are some challenges to keep in mind before committing to it for your NFT project:

- WAX uses RAM storage for NFTs, and high demand for this limited resource can drive up minting costs.

- WAX’s small set of block producers could lead to centralization and limited competition, impacting decentralization ideals.

- While fast, WAX’s throughput could be strained under massive traffic or high‑volume NFT drops.

9. Avalanche

Avalanche is one of the fastest blockchains, offering sub-second transaction finality and over 4,500 transactions per second (TPS). This makes it an excellent choice for NFT projects that need to handle high-volume trades without slowing down.

Avalanche is one of the fastest blockchains, offering sub-second transaction finality and over 4,500 transactions per second (TPS). This makes it an excellent choice for NFT projects that need to handle high-volume trades without slowing down.

Transactions are completed in less than 2 seconds, meaning no delays when minting, buying, or selling NFTs. The low fees, often under $0.01 per transaction, make it a cost-effective platform for creators and traders alike.

In 2024, Avalanche saw a 72% increase in TVL (Total Value Locked), reaching $7 billion across various applications, including NFT platforms. This is a strong indicator of its growing use in the NFT and decentralized finance (DeFi) spaces.

Why Avalanche is the Best Blockchain for NFTs:

Here’s why Avalanche stands out for NFTs:

- Extremely low transaction costs: The cost to mint, transfer, or sell NFTs on Avalanche is typically under $0.01, providing affordable solutions for creators and buyers alike.

- Customizable subnets: Avalanche allows developers to create customized subnets, making it easier for NFT platforms to adjust blockchain performance to meet growing needs

- Ethereum compatibility: With Ethereum Virtual Machine (EVM) support, developers can easily migrate existing Ethereum NFTs and dApps to Avalanche without rewriting code

Key Challenges to Consider

Despite its benefits, Avalanche does have some limitations you should keep in mind:

- Avalanche’s delegated Proof of Stake (dPoS) system leads to concerns about centralized control with fewer validators.

- Fewer mainstream NFT marketplaces on Avalanche, limiting visibility and liquidity for NFTs.

- Avalanche’s multi-chain architecture and custom subnets make it more complex for new developers to use.

10. Polkadot

Polkadot connects independent blockchains through its relay chain architecture. This connection lets your NFTs move across different chains without third-party bridges.

Polkadot connects independent blockchains through its relay chain architecture. This connection lets your NFTs move across different chains without third-party bridges.

You’ll pay approximately 0.1-0.17 DOT for minting compared to Ethereum’s $10-150 range. Even more impressive, the network achieved 4,930 NFTs minted per minute through Unique Network.

Parachains process these transactions in parallel using shared validator security. As a result, you access multiple ecosystems simultaneously with trustless interoperability.

Why Polkadot is the Best Blockchain for NFTs:

Polkadot brings certain technical strengths that suit NFT projects, especially if you think longer‑term or cross‑chain.

- Blockchain interoperability & cross‑chain transfers: Polkadot lets different parachains and connected chains exchange data and assets securely. That could enable NFTs to move between chains, expanding reach

- Flexible, custom blockchain logic/architecture: With Polkadot’s framework developers can build a custom parachain optimized for NFTs. such as custom rules, custom token standards, or specialized marketplace logic.

- XCM Cross-Chain NFT Transfers: Your NFTs move between parachains using Polkadot’s native messaging protocol. This eliminates third-party bridges and centralization risks.

Real Challenges & Considerations

Building or using a parachain introduces more complexity than a single-chain setup, which may increase development time or cost.

If you need affordable yet efficient NFT development on Polkadot, our blockchain engineers simplify parachain integration. Webisoft handles XCM protocol implementation, cross-chain asset transfers, and Substrate development so you avoid costly technical overhead.

11. Algorand

Algorand creates NFTs in seconds through Algorand Standard Assets without smart contract code. This simplicity means you pay approximately $0.10 for minting compared to Ethereum’s $50-800 range. The blockchain processes 10,000 transactions per second with 3.3-second finality.

Algorand creates NFTs in seconds through Algorand Standard Assets without smart contract code. This simplicity means you pay approximately $0.10 for minting compared to Ethereum’s $50-800 range. The blockchain processes 10,000 transactions per second with 3.3-second finality.

Its Pure Proof of Stake consensus requires only one ALGO to participate as a validator. Consequently, network security spreads across 1,769 validators democratically. Your NFT transfers cost roughly $0.0002 per transaction. Since launching in June 2019, the platform has maintained perfect uptime with zero downtime incidents.

Why Algorand is The Best Blockchain for NFTs:

- Scalable & can handle large volume: Algorand’s design supports high throughput, which helps if your NFT project gets lots of traffic or many trades.

- Energy‑efficient and eco‑friendly: PPoS consensus keeps energy use low; good if you (or your audience) care about sustainability.

- Strong smart‑contract support & robust infrastructure: Algorand supports smart contracts and asset standards, letting you build NFT marketplaces, custom logic, or tokenized assets easily.

Key Challenges to Consider

When considering Algorand for your NFT project, be mindful of these challenges:

- Algorand’s validator node requirements are high, which may reduce decentralization and increase centralization.

- Algorand’s NFT ecosystem is still in its early stages compared to Ethereum or Solana, limiting visibility and liquidity for NFTs.

- There are concerns about low rewards for validators, which could impact network participation and security over time.

Key Considerations For Choosing The Best Blockchain For NFT Marketplace Development

You need to evaluate these technical and operational factors before selecting your blockchain platform.

You need to evaluate these technical and operational factors before selecting your blockchain platform.

Scalability and Performance

Your blockchain must handle high transaction volumes without slowdowns. Solana processes 65,000 TPS compared to Ethereum’s 30 TPS baseline. Transaction finality matters too.

Algorand finalizes in 3.3 seconds versus Ethereum’s 12-second blocks. During peak NFT drops, networks face congestion that kills user experience. You want consistent performance even when thousands mint simultaneously

Note: Solana faced a seven-hour outage in May 2022 when NFT minting bots flooded the network with four million transactions per second. Your marketplace becomes completely unusable during such failures, driving users to competitors permanently.

Transaction Cost Structure

Minting fees directly determine whether creators can afford your marketplace. Ethereum averages $6 per transaction but spikes to $50-800 during congestion periods.

A 10,000 NFT collection costs $500,000+ on Ethereum but only $200 on Algorand. These fee differences mean small creators get priced out entirely on expensive chains while thriving on affordable alternatives.

Cross-Chain Interoperability

Your NFTs need mobility between blockchain ecosystems to reach maximum audiences. Polkadot’s XCM protocol transfers NFTs natively across parachains without centralized bridge risks.

Traditional bridges lock your NFTs to single chains. Native interoperability expands your collector base across multiple marketplaces simultaneously instead of limiting sales to one ecosystem.

Smart Contract Security and Audit Requirements

Vulnerable code destroys your marketplace reputation overnight through catastrophic hacks. Here’s how it impacts you: attackers find weak spots in your smart contract code and exploit them to steal user funds.

When your withdrawal function doesn’t verify who’s making the request, hackers drain wallets repeatedly until nothing remains. If your approval system lacks limits, one malicious transaction gives attackers full access to user portfolios.

Notes: WazirX lost $234.9 million when attackers exploited multisignature wallet vulnerabilities. PlayDapp suffered $290 million in losses after hackers gained minting rights through compromised private keys. Your unaudited contracts become ticking time bombs.

How Webisoft Helps Build Your NFT Marketplace on the Right Blockchain

Blockchain selection determines your marketplace’s entire technical foundation and long-term viability. Wrong choices for blockchain development lock you into expensive fees, slow transactions, or limited scalability. That’s the point, it is wise to take help from a professional.

Webisoft delivers North American blockchain expertise with 90%+ senior engineers who architect NFT marketplaces on optimal platforms tailored to your specific business requirements and user demographics. Our NFT Marketplace Development Expertise:

- Multi-Chain Architecture Assessment: We evaluate Ethereum, Solana, Polkadot, Algorand, and Cardano against your volume projections and budget constraints.

- Smart Contract Security Auditing: Our team conducts comprehensive vulnerability testing to prevent reentrancy attacks and unauthorized access exploits.

- Gas Optimization Strategies: We implement batching techniques and compression protocols that reduce your minting costs by up to 24,000x.

- Cross-Chain Bridge Integration: We build native interoperability using XCM and secure protocols that protect against the $2.6B in bridge exploits.

- Scalable Infrastructure Design: Our DevOps architects Layer-2 solutions and parallel processing that maintain performance during high-volume drops.

- Custom Tokenomics Development: We design royalty enforcement mechanisms and fractional ownership models directly into your blockchain architecture.

Contact Webisoft today for a technical consultation. Our senior engineers will assess your project requirements and recommend the optimal blockchain architecture for your success.

To Conclude

Selecting the best blockchain for NFT depends on your specific project goals and technical requirements. Speed matters when you’re launching high-volume drops. Cost efficiency determines creator accessibility.

Security protects your marketplace reputation long-term. Interoperability expands your collector reach across ecosystems.

Each platform excels in different areas, so align your choice with actual business priorities rather than hype. Technical complexity shouldn’t stop you from building. Partner with Webisoft’s blockchain experts to architect your NFT marketplace on the optimal platform and launch confidently.

Frequently Asked Questions

Q1: Can I migrate my NFT collection from one blockchain to another after launch?

Yes, you can migrate NFTs using cross-chain bridges or wrapped token protocols. However, migration creates new token addresses and requires community coordination.

Original NFTs remain on the source chain unless burned. Migration costs vary from $50 to thousands depending on collection size and destination blockchain fees.

Q2: Do I need to run my own blockchain node to launch an NFT marketplace?

No, you don’t need to run dedicated nodes for most NFT projects. RPC providers like Infura, Alchemy, and QuickNode offer reliable node infrastructure.

Running your own node costs $200-500 monthly in server expenses. Most marketplaces use third-party node services for faster deployment and reduced maintenance overhead.

Q3: How do royalty payments work differently across blockchains?

Ethereum enforces royalties through marketplace cooperation, not blockchain protocol. Solana and Cardano embed royalties directly into smart contracts for automatic execution.

Some marketplaces now bypass royalty mechanisms entirely. You need blockchain-level enforcement or strong marketplace partnerships to guarantee creator payments on secondary sales.

Q4: What happens to my NFTs if the blockchain experiences a hard fork?

Hard forks create two separate blockchain versions with identical transaction histories up to the fork point. Your NFTs exist on both chains post-fork. However, marketplace support determines which version holds value.

Ethereum Classic still contains pre-merge NFTs, but they’re essentially worthless without active marketplace integration.