The world of banking is on the brink of a seismic shift. As we stand on the precipice of the web3 era, the traditional banking sector is set to transform any other.

But what does this mean for banks and, more importantly, for you, the customer? Let’s dive in and explore. Web3, or the decentralized internet, is a new phase of the internet that leverages blockchain technology and decentralized networks.

This shift from centralized servers to a decentralized network could disrupt many industries. Banking is one of the most significant. Web3 is set to redefine the banking landscape.

It promises to democratize financial services, making them more accessible, transparent, and efficient. Banks will need to adapt to this new paradigm or risk becoming obsolete.

This means embracing blockchain technology, developing new skills and capabilities, and rethinking their business models.

But what does this mean for banks and, more importantly, for you, the customer? Let’s dive in and explore.

Contents

The Disruptive Potential of Web3

A new era is dawning on the internet landscape – the era of Web3. This decentralized internet, powered by blockchain technology and networks, is poised to disrupt various industries.

Among these, banking stands out as a sector ripe for significant transformation. Web3’s disruptive potential lies in its core characteristics:

- Decentralization: Unlike the traditional internet, Web3 operates on a decentralized network. This means no single entity has control, promoting a more democratic and equitable digital space.

- Blockchain Technology: At the heart of Web3 is blockchain technology. It is known for its transparency, immutability, and security. Blockchain is set to revolutionize how transactions are conducted and recorded.

- Smart Contracts: These contracts with the terms of the agreement directly written into code are a game-changer. They eliminate the need for intermediaries, reducing costs and increasing efficiency.

- Tokenization: Web3 enables the creation of digital assets or tokens. These tokens can represent anything from currencies to assets, opening up new possibilities for digital transactions.

Now, let’s delve deeper into how these characteristics can disrupt the banking industry:

- Decentralization and Banking: Traditional banking is characterized by centralization. Banks act as intermediaries, controlling transactions and the flow of money.With Web3, this could change dramatically. Decentralization could democratize banking, making it more accessible and equitable. It could eliminate the need for intermediaries, reducing costs and increasing efficiency.

- Blockchain and Banking: Blockchain could revolutionize banking transactions. Its transparency and immutability mean that transactions can be tracked and verified without a third party. This could reduce fraud and increase trust in the banking system.

- Smart Contracts and Banking: Smart contracts could automate many banking processes. Smart contracts could make banking more efficient and user-friendly, from loan approvals to fund transfers.

- Tokenization and Banking: Tokenization could open up new possibilities in banking. From tokenized assets to digital currencies, it could redefine how we view and use money.

What Does Web3 Mean for Banks?

Web3, the decentralized internet, is set to redefine the banking landscape. This new paradigm promises to democratize financial services, making them more accessible, transparent, and efficient.

Banks will need to adapt to this new paradigm or risk becoming obsolete. Web3’s impact on banking can be understood through several key areas:

1. Disintermediation

Web3 has the potential to remove intermediaries, such as traditional banks, from specific financial transactions.

Individuals and business professionals can directly engage in peer-to-peer transactions through smart contracts on blockchain platforms without intermediaries.

It could reduce the need for traditional banking services in certain areas. The areas include remittances, international transfers, and decentralized lending.

2. Financial Inclusion

Web3 technologies can enable greater financial inclusion. Through decentralized applications, individuals can access banking-like services.

The services are savings, loans, and payments using a smartphone and internet connection. It can help empower individuals in underserved regions and bridge the global financial inclusion gap.

3. Tokenization and Digital Assets

Web3 enables asset tokenization. The digital or physical assets can be represented as blockchain-based tokens.

This opens up new banking possibilities, such as tokenized securities and fractional ownership of assets. Banks could adapt their services to support digital asset issuance, trading, and custody.

4. Enhanced Security and Privacy

Web3 technologies can improve financial transactions’ security and privacy. With its decentralized and immutable nature, blockchain can make transactions more secure and transparent.

Moreover, users have greater control over their data. Also, they can choose to share only essential information for specific transactions, reducing the risk of data breaches.

5. Regulatory Challenges

As Web3 evolves, regulators and policymakers must adapt to the changing landscape.

The decentralized nature of Web3 can present challenges regarding oversight and consumer protection. And compliance with existing financial regulations.

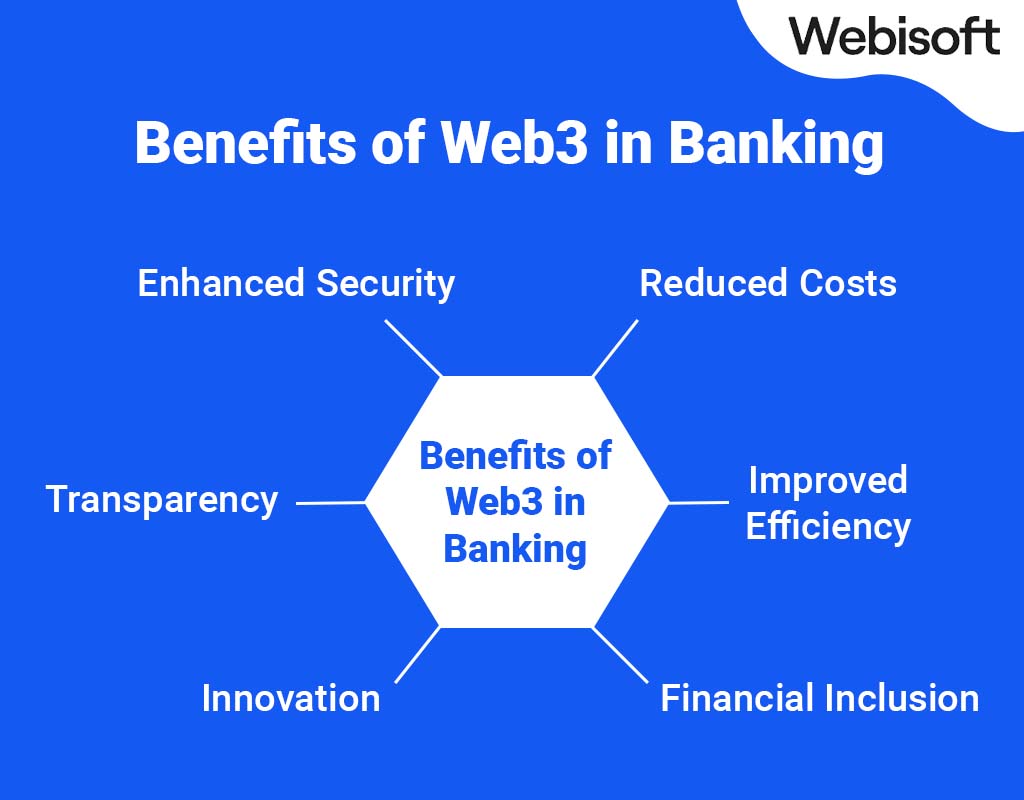

Benefits of Web3 in Banking

Web3 brings a host of benefits to the banking sector. It offers enhanced security, reduced costs, and improved efficiency. Moreover, it enables peer-to-peer transactions.

Enhanced Security

Web3’s blockchain technology offers enhanced security for financial transactions.

Blockchain’s decentralized nature makes it difficult for hackers to manipulate the data. Each transaction is recorded across multiple nodes, making unauthorized changes nearly impossible.

Reduced Costs

Traditional banking systems involve various intermediaries, each adding fees. Web3, with its peer-to-peer transactions, eliminates the need for these intermediaries.

It can significantly reduce transaction costs. Moreover, automating processes through smart contracts can further reduce operational costs.

Improved Efficiency

Web3 can streamline banking processes, making them faster and more efficient. Blockchain transactions can be processed in real-time, reducing the time taken for cross-border transfers and other banking operations.

Moreover, using smart contracts can automate various processes, reducing the need for manual intervention and further improving efficiency.

Financial Inclusion

Web3 can make banking services more accessible. Traditional banking systems often exclude a significant portion of the population due to various barriers, such as lack of documentation or access to banking infrastructure.

Web3 can overcome these barriers by providing access to financial services through a smartphone and internet connection.

Transparency

Blockchain’s public ledger provides unprecedented transparency. This can increase trust in the banking system and make it easier for customers to track their transactions.

Innovation

Web3 opens up new possibilities for innovation in banking. Moreover, the tokenization of assets can lead to new forms of investment and fundraising.

Web3 has the potential to revolutionize the banking sector. However, it also presents new challenges and risks. Banks will need to adapt to this new paradigm, developing new skills and capabilities to leverage the benefits of Web3.

How Will Web3 in Banking Benefit Daily Banking Customers?

Web3 promises a more seamless and user-friendly banking experience for daily banking customers. It offers faster transactions, lower fees, and greater control over personal financial data.

Moreover, it opens up access to a global banking system, breaking geographical barriers.

1. Quick Financial Transactions

Traditional banking often involves a time-consuming process for transactions, especially for cross-border payments. With Web3, transactions can be completed in seconds, regardless of the time and day.

This is made possible by using blockchain technology and smart contracts, which automate the transaction process, making it faster and more efficient.

2. Reduced Costs

Web3 can significantly reduce the costs associated with banking. By eliminating the need for intermediaries and automating various processes, Web3 can lower transaction and operational costs.

This can result in lower fees for customers, making banking services more affordable.

3. Enhanced Security

Security is a great concern for banking customers. Web3 offers high levels of security through the use of blockchain technology.

It makes it nearly impossible for unauthorized changes to be made. This can give customers peace of mind knowing their financial data is secure.

4. Greater Control Over Personal Financial Data

One of the critical features of Web3 is that it gives users greater control over their data. In the traditional banking system, the bank or other third parties often hold personal data.

With Web3, users can control their own data and choose who they share it with. This can enhance privacy and reduce the risk of data breaches.

5. Access to a Global Banking System

Web3 breaks down geographical barriers, giving users access to a global banking system. This means that users can transact with anyone, anywhere in the world, without a traditional bank.

This can be particularly beneficial for people in regions with limited access to banking services.

6. Tokenized Assets

Web3 enables the tokenization of assets, opening up new investment opportunities for banking customers.

For example, customers could invest in tokenized real estate, art, or other assets, offering higher returns than traditional investments.

7. Improved User Experience

Web3 can improve the user experience in banking. With its user-centric design, Web3 can make banking services more intuitive and easy to use. This can make banking more accessible, particularly for those who are less tech-savvy.

Web3 has the potential to revolutionize the banking experience for daily banking customers. However, it’s important to note that the adoption of Web3 in banking is still in its early stages, and there are challenges to overcome, including regulatory issues and the need for improved user interfaces.

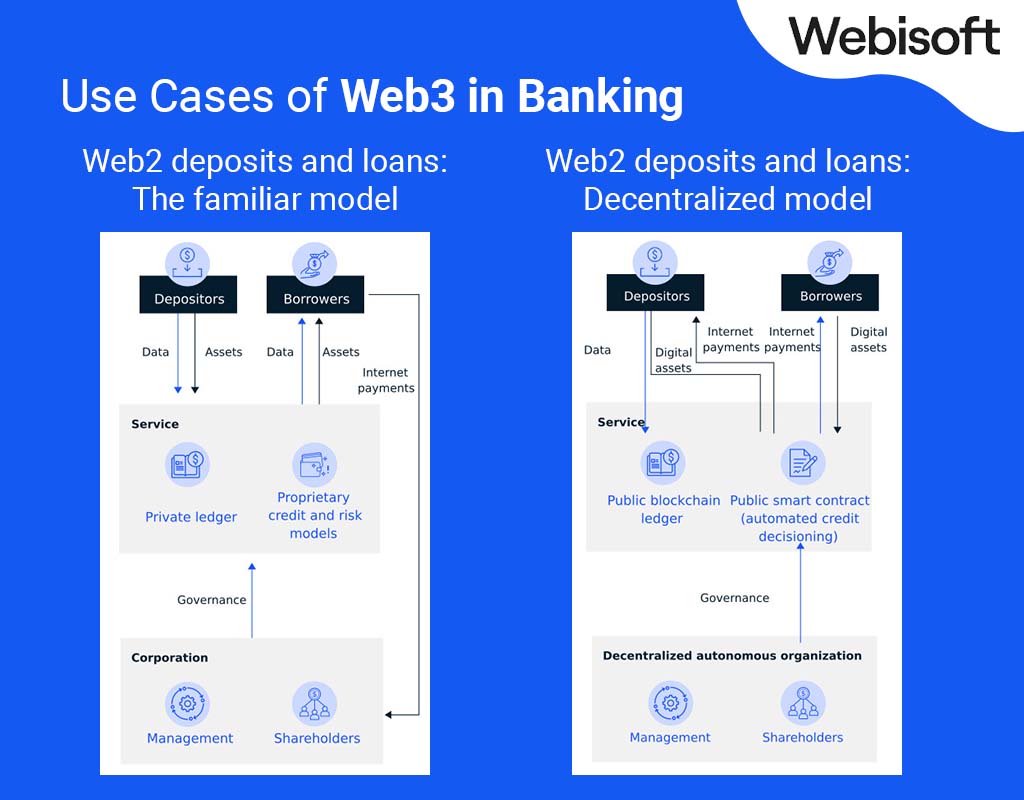

Use Cases of Web3 in Banking

There are numerous potential use cases for web3 in banking. These include decentralized finance (DeFi), peer-to-peer lending, and smart contracts.

These applications promise to revolutionize how we bank, offering more flexibility, control, and financial freedom.

Decentralized Finance (DeFi)

DeFi is one of the most promising use cases of web3 in banking. DeFi applications are built on blockchain platforms and aim to recreate traditional financial systems in a decentralized manner.

This includes services like lending, borrowing, and trading, which banks typically provide. DeFi applications can offer these services in a more transparent, efficient, and accessible way.

Peer-to-Peer Lending

Web3 enables peer-to-peer lending, where individuals can lend and borrow directly from each other without the need for a traditional bank.

This can make lending more accessible and affordable, eliminating the need for intermediaries and their associated costs. Moreover, smart contracts can automate lending, making it faster and more efficient.

Smart Contracts

Smart contracts automatically execute transactions when certain conditions are met, eliminating the need for intermediaries.

In banking, smart contracts can be used for various applications, including loan agreements, insurance policies, and derivative contracts.

Tokenization of Assets

Web3 enables the tokenization of assets, where real-world assets are represented as digital tokens on the blockchain.

This can make it easier to trade and invest in these assets. For example, real estate or art could be tokenized, allowing individuals to buy and sell fractions of these assets.

Decentralized Exchanges (DEXs)

DEXs are platforms where individuals can trade digital assets directly with each other without the need for an intermediary. It can make trading faster, cheaper, and more transparent.

Identity Verification

Web3 can also be used for identity verification in banking. Blockchain technology offers an immutable and secure record of identity information, making it easier to verify the identity of customers.

Cross-Border Payments

Web3 can make cross-border payments faster and cheaper. Traditional cross-border payments are slow and expensive due to the need for multiple intermediaries.

With web3, these payments can be made directly between parties, reducing costs and transaction times. These use cases show the transformative potential of web3 in banking.

However, it’s important to note that the adoption of web3 in banking is still in its early stages, and there are many challenges to overcome, including regulatory issues and the need for improved user interfaces.

Conclusion

As we move into the era of web3, the banking sector is set for a transformative shift. This new paradigm promises to make banking more accessible, efficient, and user-friendly. It’s time to embrace the future of banking.

Stay ahead of the curve. Embrace the web3 revolution and redefine your banking experience.